Every week lately feels like déjà vu — one more stablecoin launch, one more attempt to reroute value. First, we saw the bidding war to issue Hyperliquid’s USDH; then we discussed the broader trend of verticalisation to capture yield on US Treasuries. Now, it is MetaMask’s native mUSD. What ties all these strategies together? Distribution.

Distribution has become a cheat code, not just in crypto but across various domains, to build a flourishing business model. If you can boast of a community in millions, why not leverage it by dropping a token directly into their hands? Well, because it hasn’t always worked. Telegram attempted that with TON, boasting half a billion messaging users, but those users never migrated on-chain. Facebook tried it with Libra, convinced that its billions of social media accounts could form the base of a new currency. Both seemed destined for success, in theory, but fell apart in practice.

That’s probably why MetaMask’s mUSD, with its fox ears and the ‘$’ symbol on top, caught my attention. At first glance, it’s like any other stablecoin — backed by short-term US Treasury bills held in regulated custody and issued through a framework developed by Bridge.xyz using the M0 protocol.

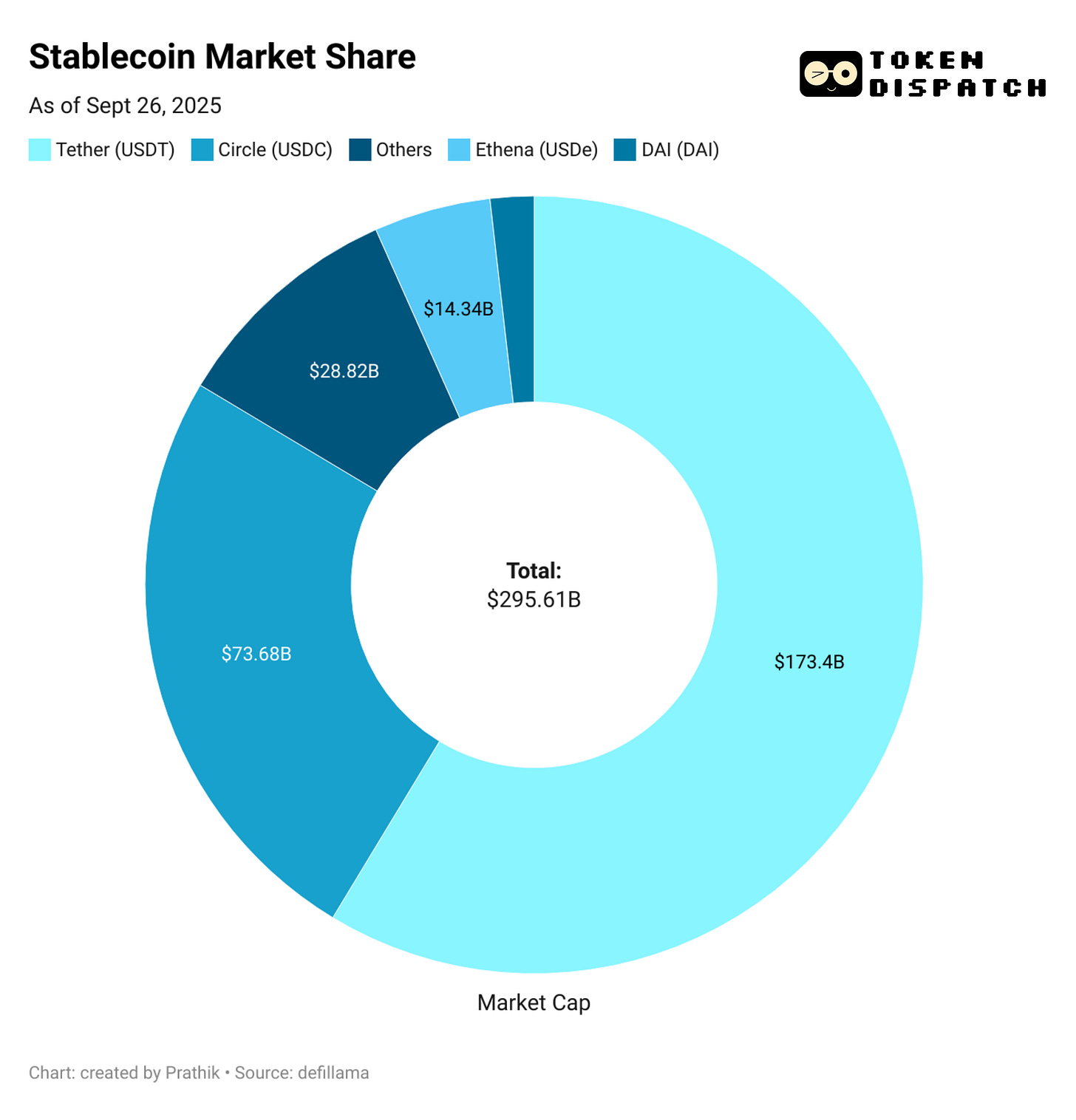

But what will differentiate Metamask’s mUSD in the $300-billion stablecoin market, currently dominated by a tight duopoly?

Is Your Crypto Sitting Idle? It Shouldn’t!

With EarnPark, put your BTC, ETH, and stables to work through battle-tested strategies and real onchain yield.

No trading. No stress. Just smart, automated earnings.

Earn yield from DeFi and institutional strategies

Transparent, onchain, and fully non-custodial

Withdraw anytime — no lock-ins

It’s like having a yield team working for you 24/7.

Try EarnPark and start earning →

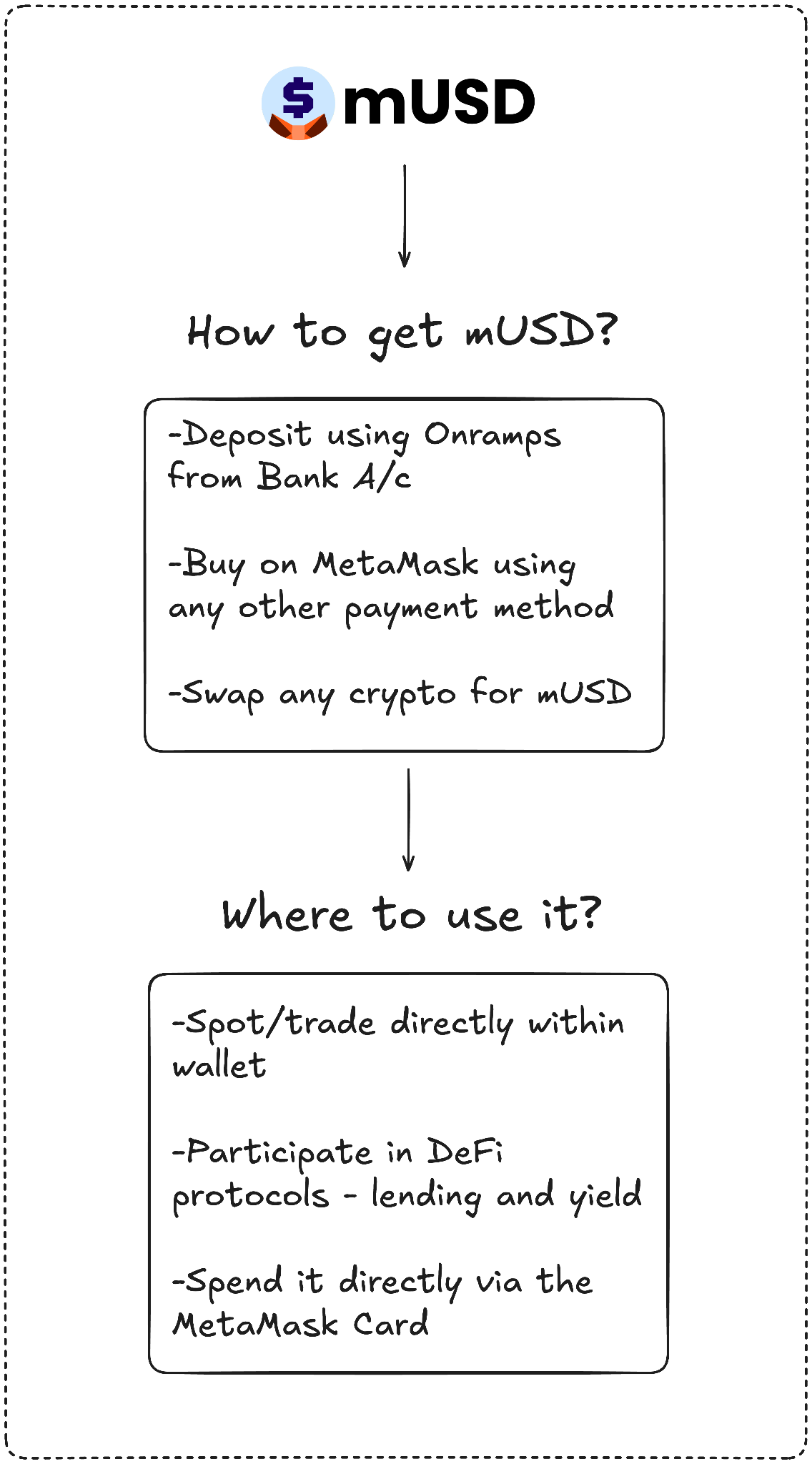

MetaMask may be entering a competitive space, but it has a unique selling point that none of its competitive can claim: distribution. With 100 million annual users worldwide, MetaMask boasts a user base few others can match. mUSD will also be the first-ever stablecoin launched natively inside a self-custodial wallet that allows on-ramp purchases using fiat currency, swaps, and even in-store spending through the MetaMask Card. Users no longer have to hunt across exchanges, bridge between chains, or deal with the hassle of adding custom tokens.

Telegram did not have this alignment between product and user behaviour. MetaMask does. Telegram aimed to move its messaging users to a blockchain for decentralised finance applications. MetaMask, on the other hand, is enhancing the user experience by integrating a native stablecoin within the app.

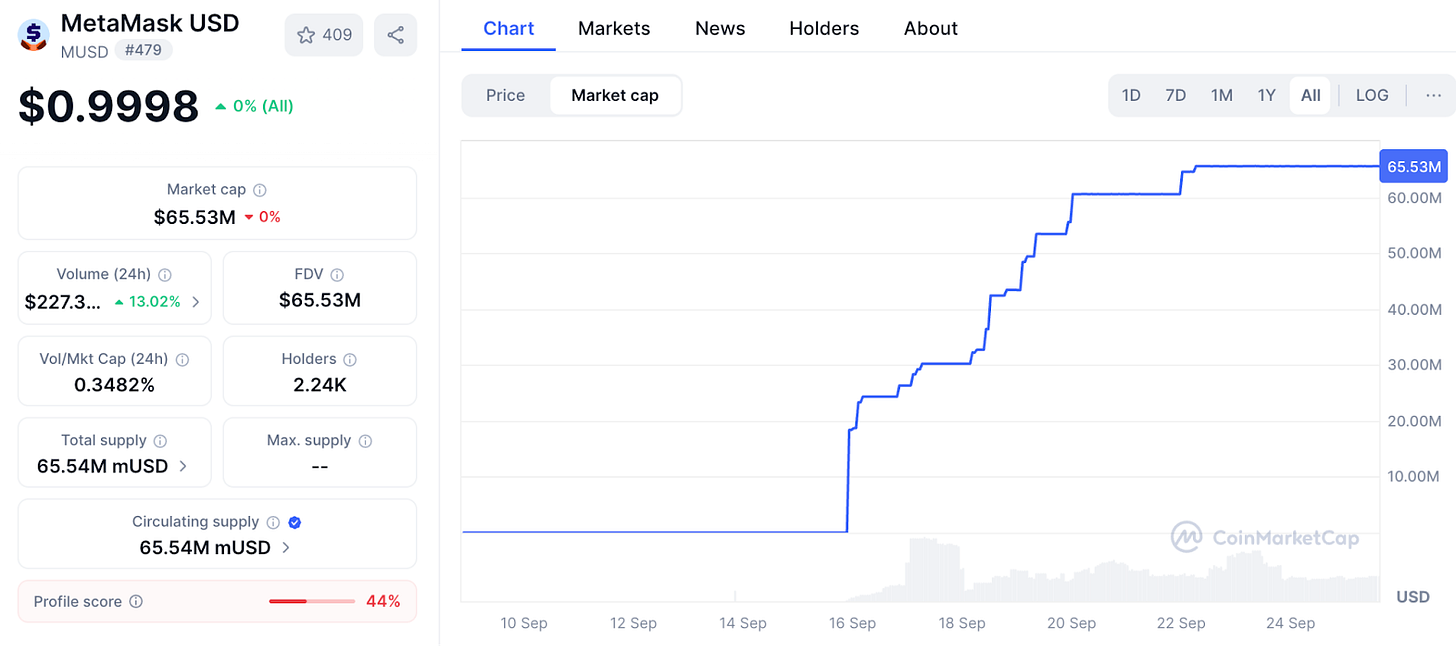

The numbers show that the adoption has been swift.

MetaMask’s mUSD market cap grew from $25 million to $65 million in under a week. Nearly 90% of it resides on Linea, ConsenSys’s in-house Layer 2, showing that MetaMask’s interface can direct liquidity effectively. This kind of leverage is similar to what exchanges have used in the past: when Binance auto-converted deposits into BUSD in 2022, circulation spiked overnight. Whoever controls the screen controls the coin. With over 30 million monthly active users, MetaMask has more screens than anyone else in the Web3 space.

This distribution is what will set MetaMask apart from the early players who tried and failed to build a sustainable stablecoin.

Telegram’s grand plan collapsed in part because of regulatory issues. MetaMask has insulated itself by partnering with Bridge, a Stripe-owned issuer, and backing each token with short-term Treasuries. This ticks the regulatory box, and the new GENIUS Act in the US gives it a legal framework from day one. Liquidity will be key as well. MetaMask is seeding Linea’s DeFi with mUSD pairs, betting that its in-house network can anchor adoption.

However, distribution doesn’t guarantee success. MetaMask’s biggest challenge will come from incumbents, especially in a market already dominated by a few giants.

Between Tether’s USDT and Circle’s USDC, nearly 85% of all stablecoins are already accounted for. A distant third is Ethena’s USDe, with $14 billion in supply, lured by yield. Hyperliquid’s USDH has just arrived, designed to plough exchange deposits back into its own ecosystem.

This brings me back to the question: What exactly does MetaMask want mUSD to be?

A direct challenger to USDT and USDC seems unlikely. Liquidity, exchange listings, and user habits all favour the incumbents. Perhaps mUSD doesn’t need to compete head-on. Just like I expected Hyperliquid’s USDH to benefit its ecosystem by routing more value to its community, mUSD will likely be a bid to capture more value from its existing users.

Read: Minting Control 🏦

Every time a new user on-ramps through Transak, every time someone swaps ETH for the new stablecoin inside MetaMask, and every time they swipe their MetaMask Card at a store, mUSD will be the first. This integrates the stablecoin as the default option within the network.

It reminds me of those times when I had to bridge USDC across Ethereum, Solana, Arbitrum, and Polygon, depending on what I needed to do with my stablecoins.

mUSD puts an end to all the tedious bridging and swapping.

Then there’s another big takeaway: the yield.

With mUSD, MetaMask will capture the yield from the US Treasuries backing the coin. Every billion dollars in circulation means tens of millions in annual interest flowing back to ConsenSys. This turns a wallet from a cost centre into a profit engine.

If just $1 billion in mUSD is backed by equivalent US Treasuries, it can earn $40 million in annual interest income from the yield. For context, MetaMask earned $67 million in revenue last year from the fees it collects.

This could unlock another passive, significant revenue stream for MetaMask.

However, there’s an element of this that makes me uneasy. For years, I thought of wallets as neutral sign-and-send utilities. mUSD blurs that line and turns the tool I once trusted as neutral infrastructure into a profit-generating business unit that profits from my deposits.

Distribution, then, becomes both the advantage and the risk. It could make mUSD sticky by default, or it could provoke questions about bias and lock-in. If MetaMask tweaks swap flows so that its own coin routes are cheaper or appear first, it could make the world of open finance less open.

There’s also the issue of fragmentation.

If every decentralised wallet starts issuing its own dollar, it could create multiple walled-gardenesque currencies rather than the interchangeable USDT/USDC duopoly that we have now.

I don’t know where this is headed. MetaMask does well to close the financial loop of buying, investing, and spending mUSD by integrating it with the card. The first week’s growth shows it can overcome the barriers that arise in the initial days of launch. Yet, the incumbents’ dominance shows how challenging it is to climb from millions to billions.

Somewhere between those realities could lie the fate of MetaMask’s mUSD.

That’s it for this week’s deep dive.

I’ll see you next week.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.