Hyperliquid processes $375 billion in volume each month. On September 5, it decided to launch its own stablecoin, sharing the announcement on Discord. Thus, USDH was born.

The foundation wouldn’t build it in-house; instead, it would build it with the community. Teams competed for the opportunity to issue it.

Stablecoins are the most traded asset in this corner of DeFi, and the stakes were high. He who controls the stablecoin controls the plumbing of liquidity, the yield on billions in deposits, and the rails of compliance.

Grab Your Exclusive Offer for TOKEN2049!

This October, the global crypto community converges at Marina Bay Sands for the world’s largest crypto event: TOKEN2049 Singapore.

Join 25,000+ attendees, 500+ exhibitors, and 300 speakers as the entire venue transforms into a festival-style pop-up city, featuring a rock-climbing wall, zipline, pickleball courts, live performances, wellness sessions, and more.

Here’s an exclusive offer for Token Dispatch readers.

The unmatchable speaker lineup includes Eric Trump and Donald Trump Jr. (World Liberty Financial), Tom Lee (Fundstrat CIO), Vlad Tenev (Robinhood Chairman & CEO), Paolo Ardoino (Tether CEO), and Arthur Hayes (CIO, Maelstrom), with many more to be announced.

Don’t miss your chance to be part of the defining crypto event of the year.

Why Launch Its Own Stablecoin?

Currently, Circle’s USDC powers over 93% of all stablecoin liquidity on Hyperliquid, amounting to approximately $5.54 billion in market cap. These balances generate interest for Circle from Treasuries and repos, with revenue in 2024 totalling $1.7 billion — around 99% of its total income.

Each time you trade on Hyperliquid, the exchange takes a trading fee, but the yield on all the USDC you deposit flows outwards to Circle.

With the 10-year Treasury yield at 4.051%, that’s millions of dollars in yield revenue lost.

A rough estimate suggests that shifting this liquidity into a native stablecoin could redirect around $220 million a year in revenue. This is money that, right now, benefits Circle’s shareholders, not Hyperliquid’s token holders. For a protocol that has always aimed to be self-sustaining, this value leakage became too significant to ignore.

Instead of taking a direct route to address this leakage, Hyperliquid turned to the community.

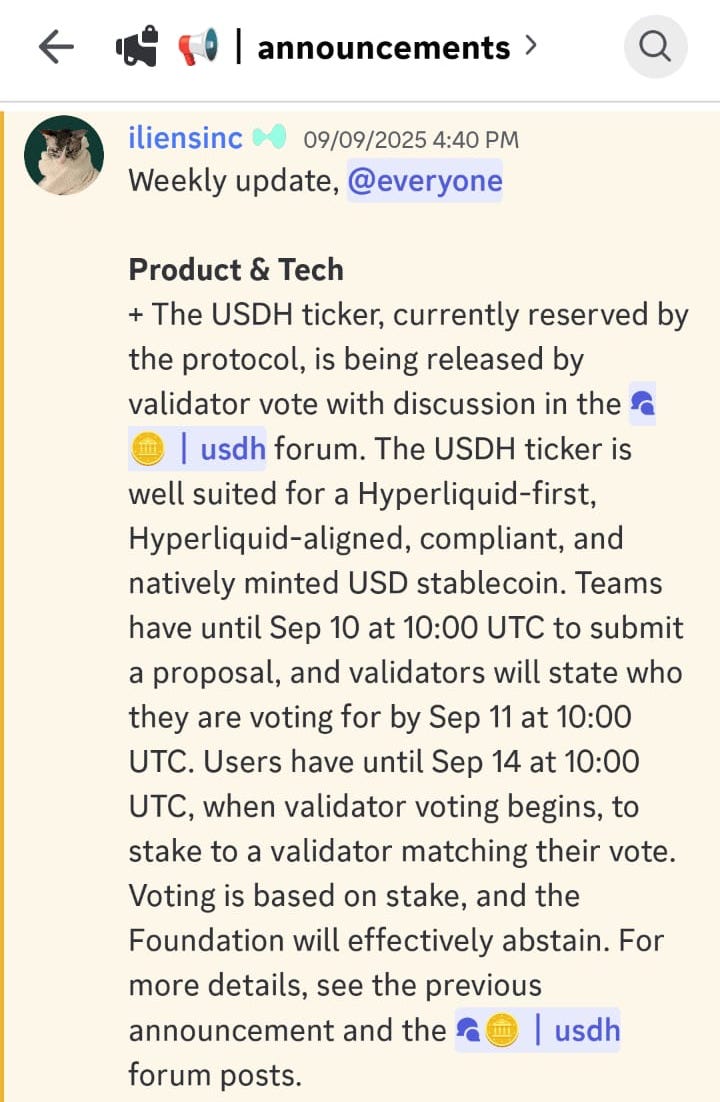

Rather than quietly signing a deal with one issuer, it has set up a process resembling an open auction. Any team can submit a proposal, and validators on the network will vote on which one they prefer. Even then, the chosen issuer must win a gas auction to deploy the contract on-chain.

Hyperliquid is cutting fees on spot stablecoin pairs by 80%, pushing traders towards the markets where USDH will operate. It is also making quote assets permissionless, meaning any stablecoin can compete, provided its backers stake and risk being slashed if the peg fails.

For an exchange known for its decentralised ethos, Hyperliquid struggled to make the process seem democratic.

The Brawl

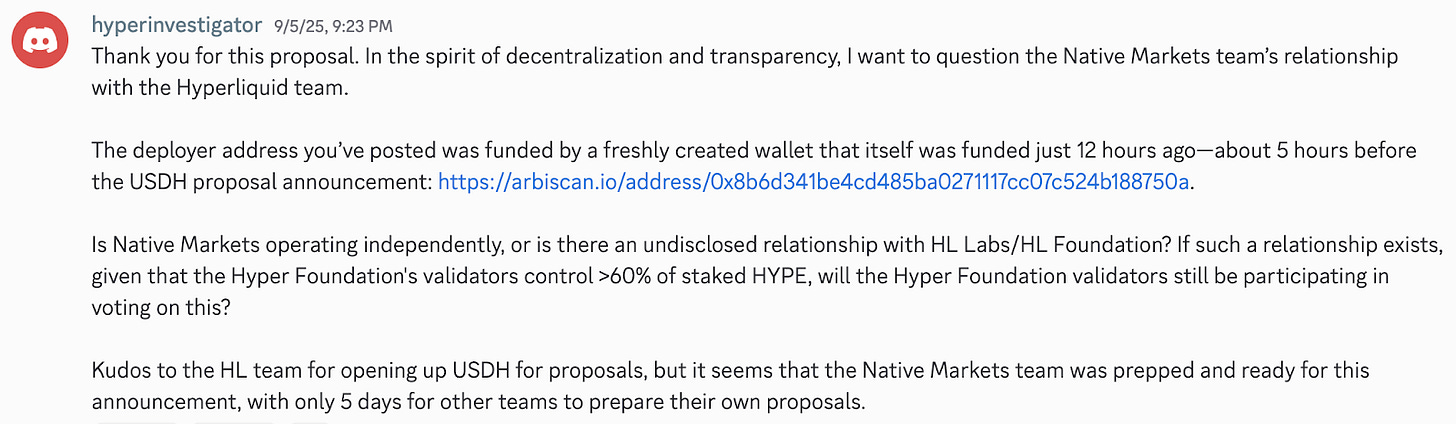

I scrolled through Hyperliquid’s Discord channel the day proposals began to roll in. Within an hour, a group called Native Markets had posted a plan. Some argued it was too fast, almost as if they knew the request was coming.

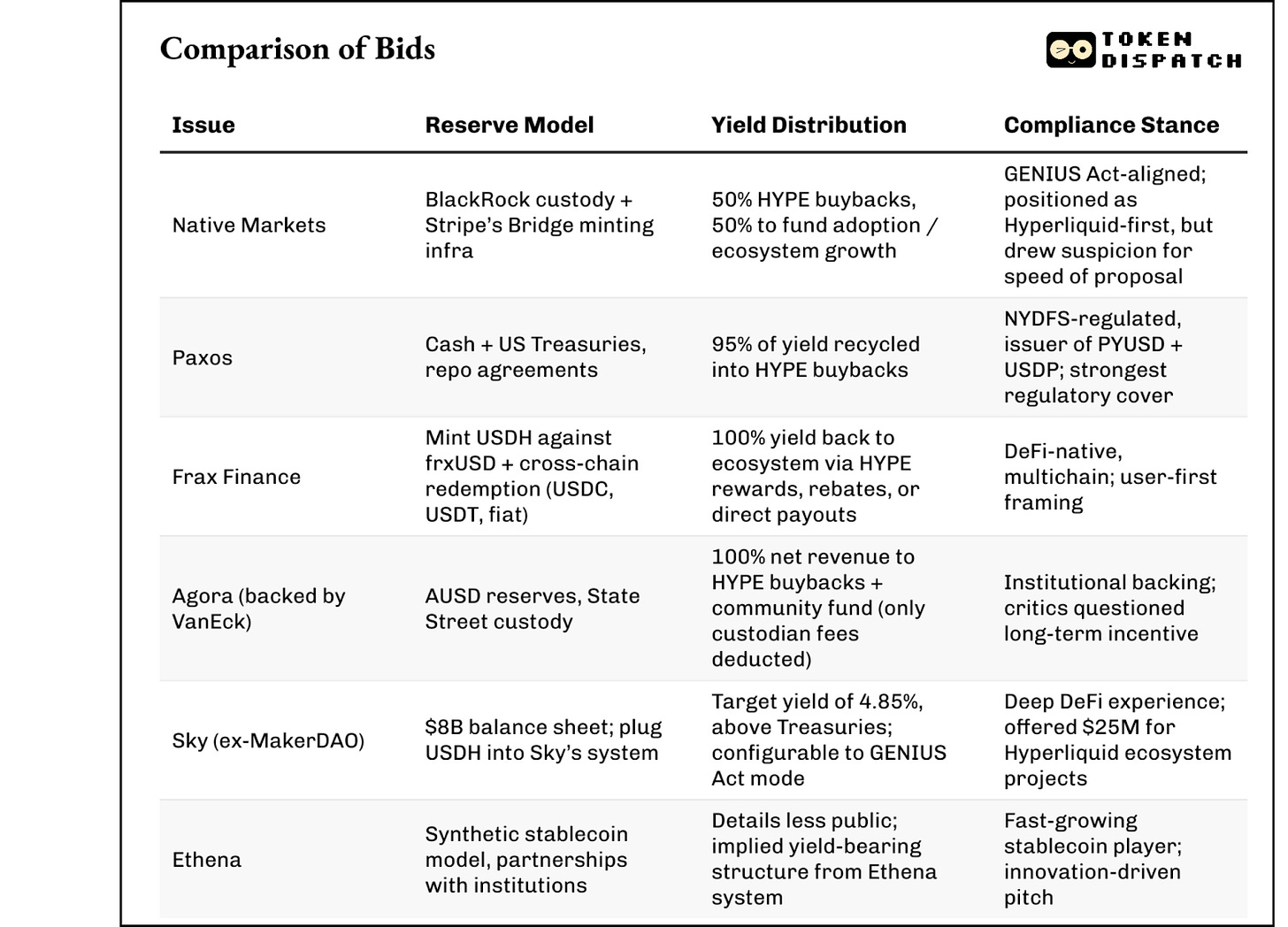

Native Markets’ pitch focused on compliance with the GENIUS Act, the stablecoin bill making its way through Washington, and promised to split reserve interest: half for buybacks of Hyperliquid’s HYPE token, and half to fund adoption.

They proposed that the reserves sit with BlackRock, with Stripe’s Bridge providing minting infrastructure. The speed of the submission made it the early favourite in terms of reactions, but also the first target of suspicion.

Soon after, Paxos entered the fray.

A name that needs no introduction in the stablecoin industry, Paxos already issues PYUSD for PayPal and USDP under New York oversight. Its bid was simple: back USDH with cash and Treasuries, recycling 95% of the yield into HYPE buybacks. The subtext was clear to the community: if Hyperliquid wants regulatory cover, Paxos is the partner they need.

Frax, the DeFi native, countered with a community-first approach: mint USDH against its frxUSD reserves, allow users to redeem across chains, and return 100% of the yield to the ecosystem, whether through HYPE rewards, rebates, or even direct payouts.

Agora, backed by VanEck, proposed sending every cent of net revenue to Hyperliquid, a promise so generous that it left people wondering what their incentive was.

Sky, the team behind DAI’s rebrand, later entered with the strength of an $8 billion balance sheet and a pledge to make USDH yield 4.85%, higher than Treasuries (4.051%), by integrating it into its own system.

Ethena joined as well, the synthetic stablecoin player that has already partnered with institutions like BlackRock, Anchorage Digital, and Securitize.

The cast of bidders was eclectic, each offering a unique route to help Hyperliquid plug the massive leakage and seize control over its liquidity.

If Paxos is the regulated face, Frax is the community’s bet. Native offers a homegrown solution, while Ethena brings an innovation that’s propelled it to become the fastest-growing stablecoin.

Read: The Ethena Speed Run

Not everyone was pleased with the process.

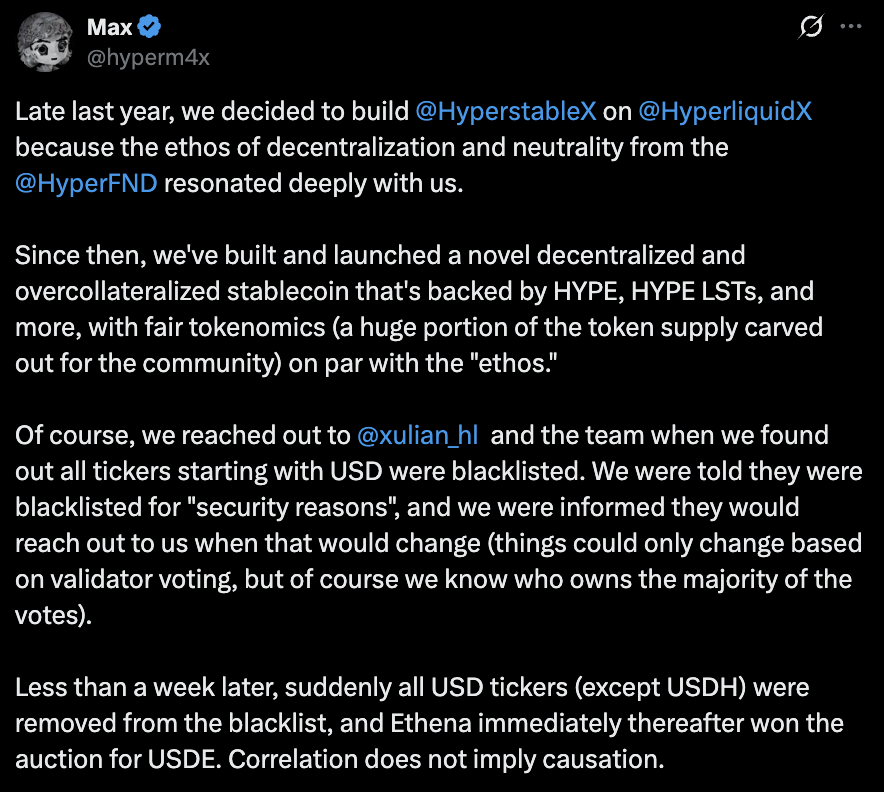

A developer, who had been building a stablecoin called Hyperstable, mentioned that he had once requested to use the USDH ticker but was blocked by the foundation. He settled for “USH” and built around it. Seeing the ticker suddenly unlocked for an official initiative felt like a betrayal.

“...the goalposts are now shifted after the game has already started months ago…,” he wrote.

Max’s dissatisfaction reflects a broader unease to me. If governance can be this ad hoc, smaller builders may hesitate to commit.

Others in the Discord have raised eyebrows at the timing of Native Markets’ proposal, calling it evidence of insider advantage. Meanwhile, Jan van Eck, whose firm backs Agora, took to X to insist they were in it for the long run and didn’t appreciate what he called “gang-tackling” of their proposal.

The Unit Economics

The economic case for a stablecoin proposal, however, is hard to ignore. If Hyperliquid manages to migrate even a majority of its USDC balances into USDH, the resulting revenue stream could rival the annual earnings of many mid-cap exchanges. For HYPE holders, this could create a new form of dividend, channelled through buybacks or rewards, depending on which issuer wins.

For Circle, it represents a loss of over 10% of its revenue.

Stablecoins have long been marketed as neutral utilities, but this episode reveals them as competitive profit centres. The battle is no longer just Tether versus USDC, with DeFi platforms now asking why they shouldn’t keep the spoils for themselves.

This also ties into a broader trend I’ve been observing.

Stripe’s Bridge has positioned itself as the infrastructure for anyone wanting to launch a compliant stablecoin, and is already backing MetaMask’s planned mUSD. PayPal launched PYUSD last year. Even wallets and payment companies are now pursuing their own branded dollars. Each is chasing the same goal: control over internal liquidity and the yields that come with it.

Hyperliquid is not an outlier in trying to reinvent the wheel. It’s following the same path many others have, realising that to own the user experience, you must also control the money that flows through it.

The regulatory dimension is substantial.

Europe’s MiCA is now live, and anyone issuing an e-money token will need licences and strict reserve management. In the US, the GENIUS Act would prohibit paying yield directly to holders, forcing creative solutions like buybacks or validator distributions.

Paxos and Agora, with their custodians and licences, represent one end of the spectrum, while Frax and Sky, more experimental in their approach, represent the other. The validator vote will, in essence, serve as a statement of how much risk Hyperliquid’s community is willing to take on regulation.

I no longer see this as merely a contest to launch a stablecoin, but as a referendum on how DeFi matures moving forward.

Beyond the incremental revenue USDH could generate, the ongoing community activity shows how a community negotiates fairness, transparency, and alignment when the prize is control of its own currency.

If Hyperliquid can pull off a launch that satisfies regulators, maintains user confidence, and rewards its token holders without alienating builders, it will set a precedent for others.

However, the cost of failure is significant. A misstep here would confirm every sceptic’s belief that decentralised governance falters when the stakes become too high.

For now, USDH remains a ticker in waiting. The proposals are live, the validators are deliberating, and the Discord debates continue as more bidders enter the race.

If USDH holds, it will be proof strong enough to establish that protocols can finally capture the value that has always slipped through their fingers.

That’s it for this week’s deep dive.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.