Welcome to our weekly Bitcoin macro and news analysis: Mempool.

We're looking at Week 32 of 2025 (August 04-August 10)

Trump’s 401(k) crypto nod, debanking EO spark rally

ETF inflows flip positive after outflow

$118K turns into key support to defend

Harvard’s Bitcoin bet edges out stake in Google

Your Solution to Regulated Token Finance

Vision Chain is Bitpanda’s new Ethereum-based L2, built for tokenising real-world assets like stocks, commodities, and fiat in full compliance with European regulations BitpandaThe Daily Hodl.

It’s more than another rollup. It’s the foundation for real-world finance on-chain:

Fast, low-cost Ethereum Layer-2 with institutional-grade control

On-chain KYC and token-level policies for regulated issuance

Designed for banks, FinTechs, developers, asset managers and everyday users alike Bitpanda

If you think Web3 isn’t usable without structure, Vision Chain is here to prove otherwise.

👉See what true compliance on-chain looks like

Week That Was

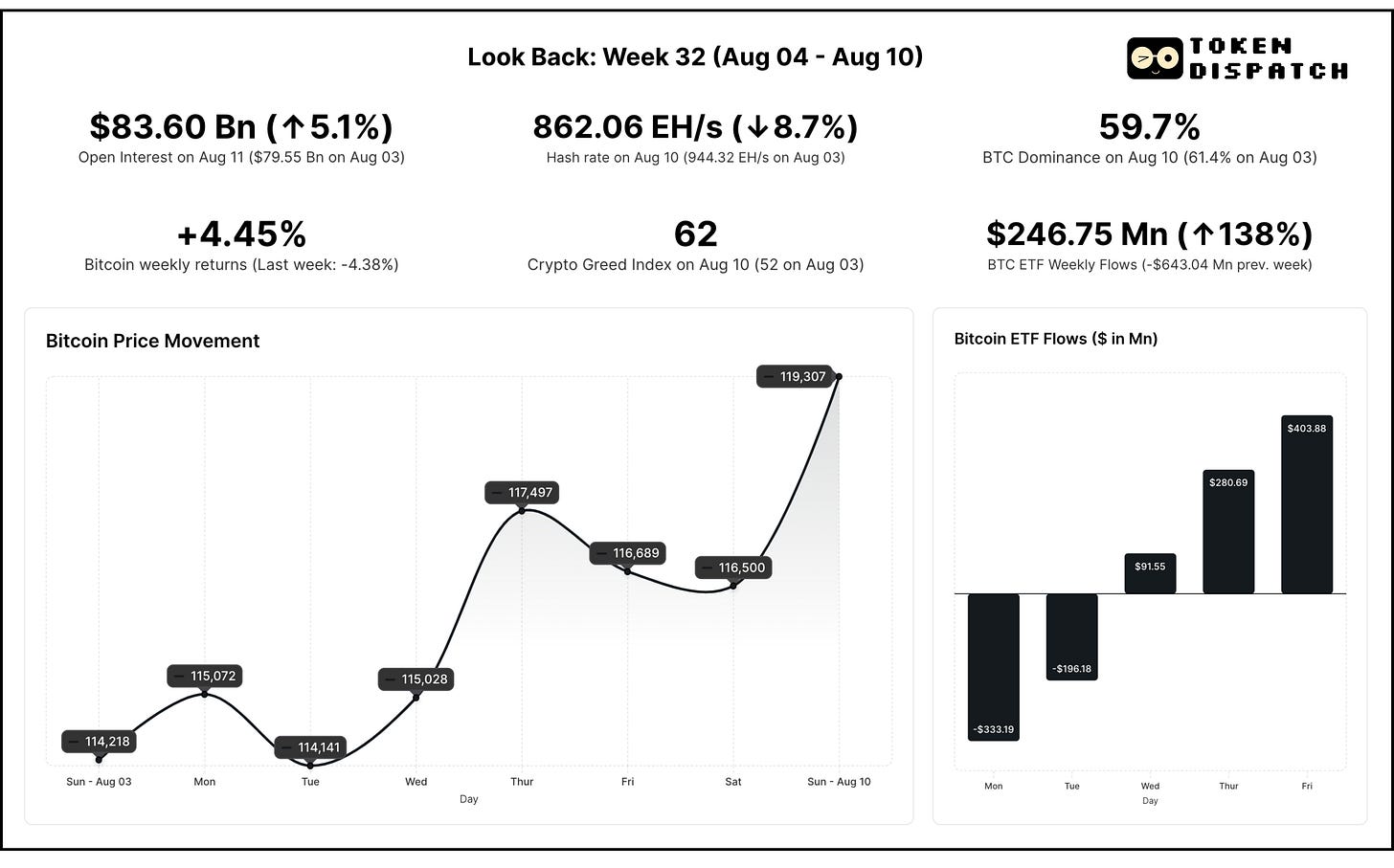

Bitcoin witnessed a see-saw journey over the previous two weeks as a week of macro-economic headwinds was followed by a week of macro tailwinds, policy headlines, and ETF inflows that put bulls back in charge.

Bitcoin shook off last week’s wobble, closing with 4.45% gains last week, just shy of the $120,000 mark. It was just a matter of time before it moved past the figure in the early hours of Monday (UTC) as it briefly charged over $122,000, reaching an all-time high of $123,092.

The first half of the week was relatively quiet as Bitcoin traded in the range of $112,700-$115-700 until the policy headlines from Washington changed the mood. On August 7, US President Donald Trump signed two executive orders — one of which directed regulators to allow crypto in 401(k) retirement accounts, while the other curbed “debanking” practices by banks against businesses based on political affiliations and beliefs.

Analysts believe that a nod to include crypto as part of 401(k) retirement accounts is bigger than even ETFs and see it as a major bullish signal.

While 401(k)s could technically invest in ETFs earlier, the Department of Labor’s (DoL) 2021 guidance discouraged non-traditional assets, effectively barring crypto access. The new EO explicitly includes digital assets as eligible “alternative assets” and directs the DoL to re-examine and potentially rescind that restrictive stance. This move could remove key legal hurdles for plan sponsors and encourage them to chase higher returns.

“In aggregate, this is ~$12T in assets with ~$50B of new capital flowing in every 2 weeks! A 1% portfolio allocation to crypto brings $120B in new flows,” said Tom Dunleavy, Head of Research at Varys Capital.

Bitcoin price caught more momentum as Trump announced the nomination of Bitcoin-friendly economist Stephen Miran to the Federal Reserve Board, signalling to crypto investors that easier policy (read: a September rate cut) could be on the table.

Despite these headwinds, Bitcoin dominance fell to 59.7% — its lowest in six months — as Ethereum captured 1.5% of market share and climbed to $4,300, its highest since December 2021. The Fear & Greed Index jumped from 52 to 62, back into the greed territory.

Futures open interest, which had cooled earlier in the month, climbed back to $83.6 billion as leveraged longs returned.

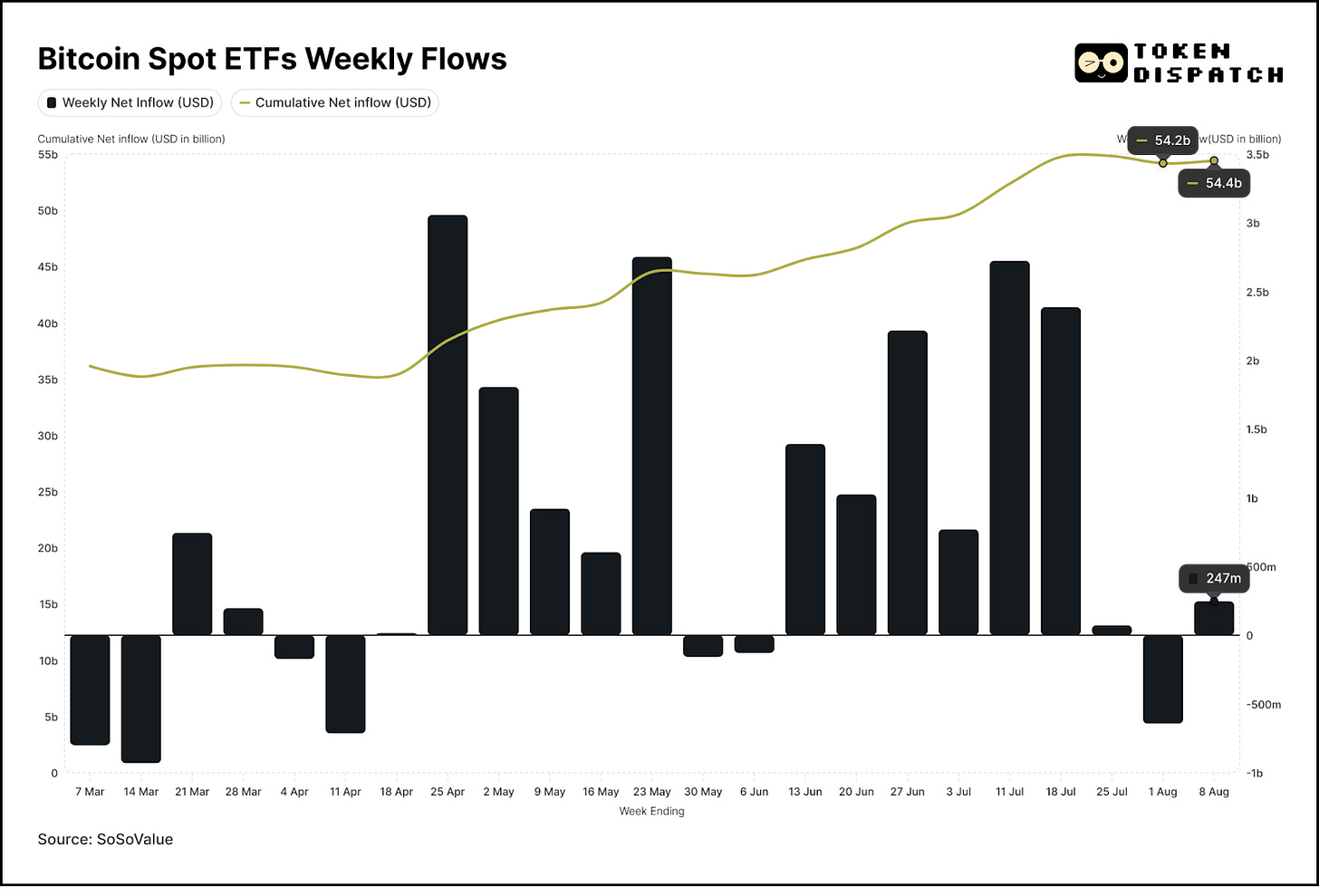

ETF flows turned positive again, reversing the previous week’s $643 million outflow with $246.75 million in net inflows.

Friday alone saw $403.86 million enter spot Bitcoin ETFs, the biggest single-day haul in over two weeks.

The rising momentum of ETF inflows in the second half of the week aligned with Bitcoin’s price rise. The cryptocurrency shot past $117,000 on Thursday and then kept steadily rising until a sudden surge on late Sunday shot it up to $120,000. As of writing this, Bitcoin has crossed the $122,000 mark intra-day, with the July all-time high of $123,000 now within striking distance.

The $118,000 level has emerged as a new support after BTC breached the level after facing resistance multiple times in the last two weeks. As long as BTC stays above that zone, the trajectory is likely to remain toward a new all-time high. However, further consolidation in the range of $118,000 and $122,000 before a further rally cannot be ruled out.

Profit realisation by long-term holders has eased in August after a torrid July, when daily realised gains ran above $1 billion, one of the heaviest profit-taking periods on record. This time, the sellers are mostly three-to-five-year holders, cashing in positions from the previous cycle.

With fewer coins being sold this month, near-term sell pressure appears lighter, giving BTC more room to rise higher if demand holds steady.

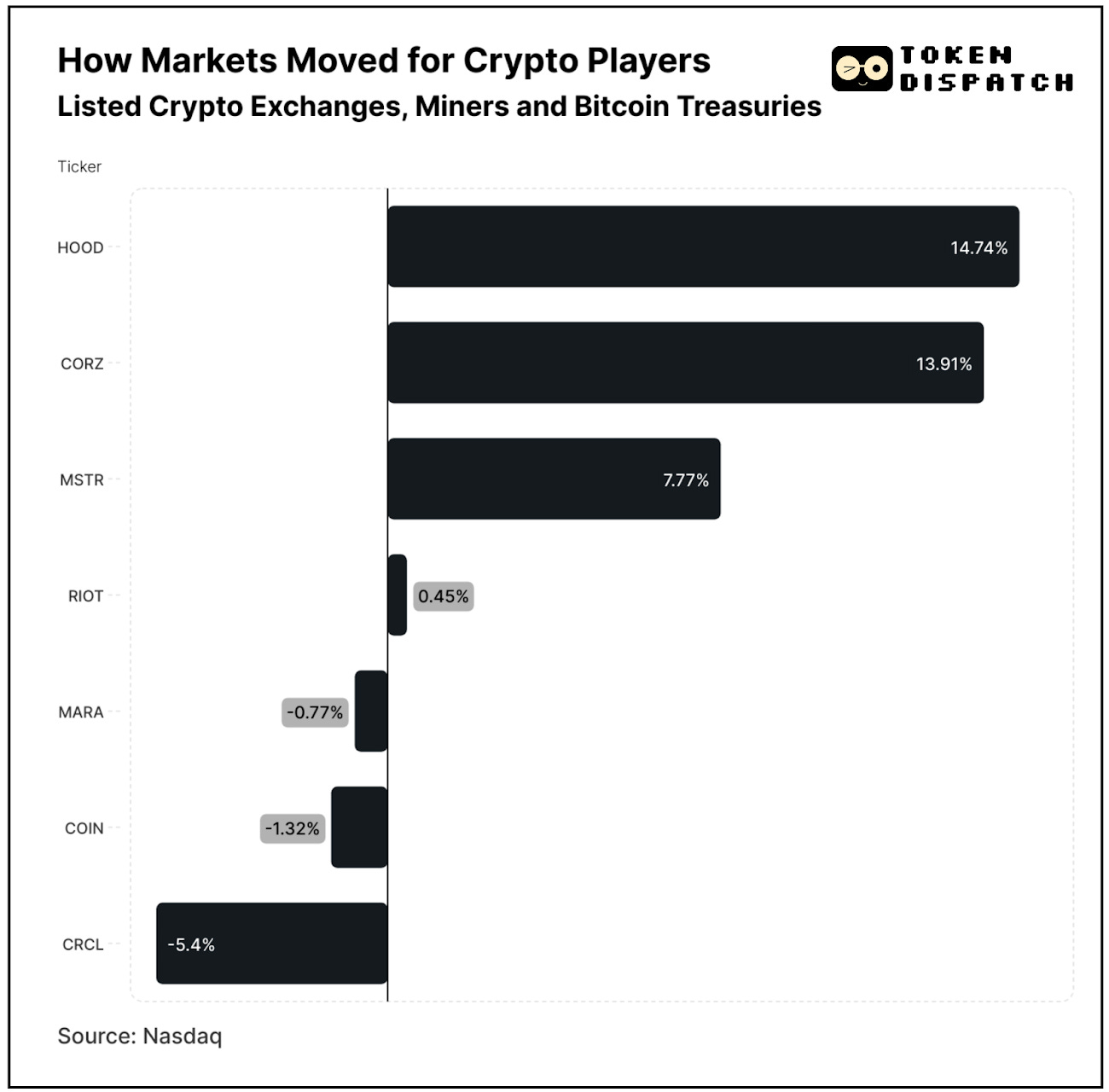

Crypto equities delivered a mixed week.

Robinhood led the pack with a 14.7% jump to a fresh all-time high, followed closely by Core Scientific’s 13.9% rise amid its ongoing merger drama.

MicroStrategy added 7.8% to close at $395.13, while Coinbase and Marathon slipped modestly to close at $310.54 and $15.38. Circle’s stock continued to unwind from its June peak, dropping another 5.4% on the week. The USDC issuer has now pared 50% gains from its peak of $298.99 in June to close at $159.03 on Friday.

Surfer 🏄🏾♂️

Billionaire Gemini founders Cameron and Tyler Winklevoss have invested in American Bitcoin, a mining firm backed by Donald Trump’s sons and formed through a merger with Hut 8 and Gryphon Digital Mining Inc. The deal comes as American Bitcoin prepares for a Nasdaq listing, after purchasing $2 billion in BTC for its treasury.

Fewer than 0.02% of people globally (about 800,000-850,000 individuals) hold at least 1 BTC, making owning a whole Bitcoin in 2025 exceptionally rare — more exclusive than the ratio of global millionaires.

Gold is leading asset returns in 2025 with a 29% gain so far, edging out Bitcoin’s 25% YTD returns. Over the long haul, Bitcoin returns since 2011 have outpaced gold by over 308,000 times. Both assets currently top global rankings, yet Bitcoin’s average annual return of 141.7% makes it the best-performing major asset of the past decade.

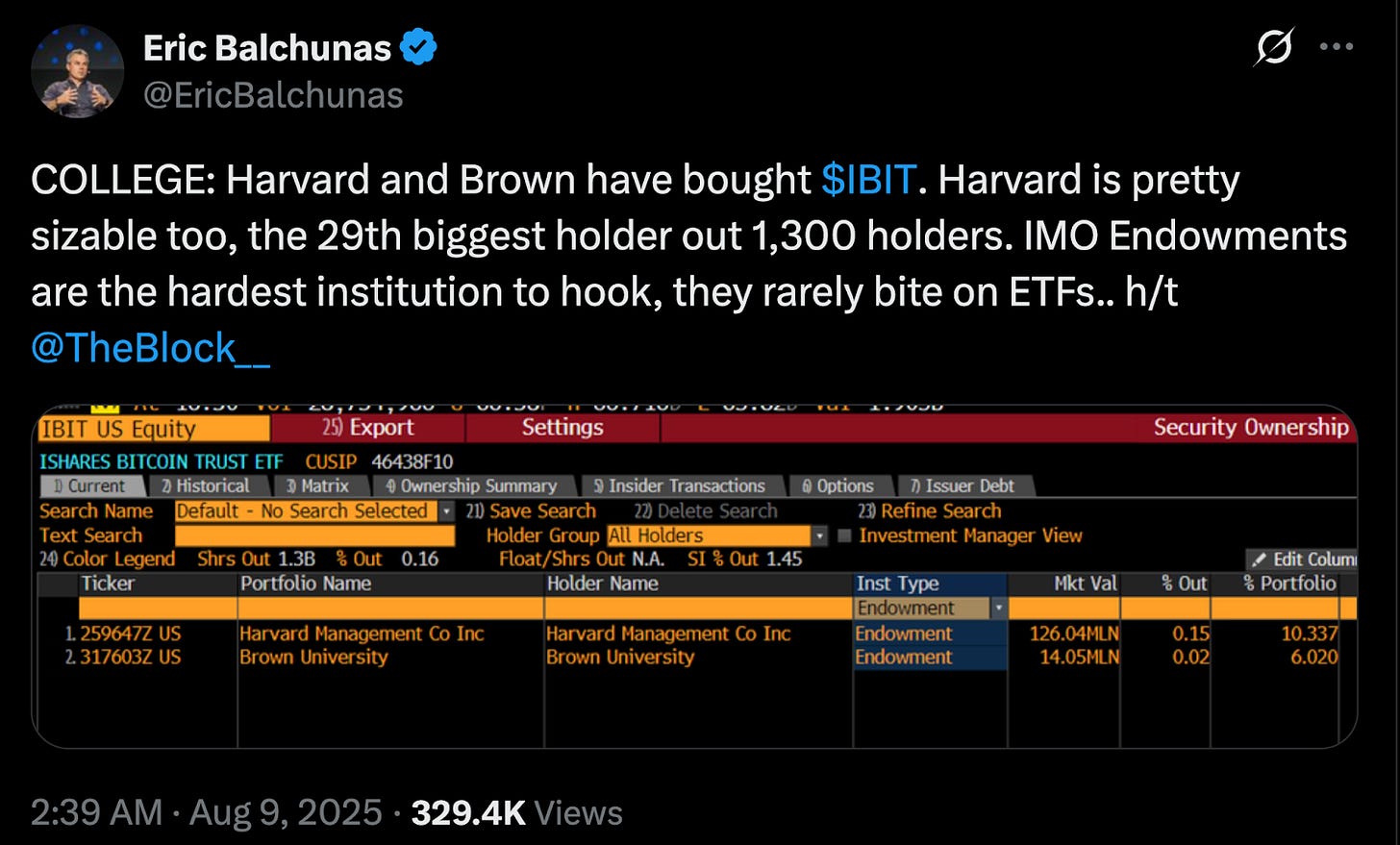

Colleges Jump Aboard BTC

Harvard’s $53.2 billion endowment, the largest of any US university, now holds more money in BlackRock’s spot Bitcoin ETF than in Google shares. As of June 30, filings show Harvard owns about 1.9 million shares of IBIT worth roughly $117 million, making it the endowment’s fifth-largest holding.

Its $114 million stake in Alphabet came in just behind, while Microsoft, Amazon, Booking Holdings, and Meta filled the top four slots. The move marks one of the most prominent university allocations into Bitcoin since ETFs launched in January 2024, with Harvard, alongside sovereign wealth funds and state pension systems, quietly building crypto exposure. Meanwhile, Brown University, another Ivy League candidate, also holds $14 million worth of IBIT shares.

For institutions long associated with the Ivy League tradition, seeing Bitcoin sit alongside Big Tech blue chips in their portfolios reflects mainstream adoption for the cryptocurrency.

That's it for this week's Mempool edition.

See ya next Monday.

Until then …stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Thanks for sharing