Bulls, Bears and Bitcoin 🪙

Mt Gox delays repayments. Possible sell-off of $4B Silk Road Bitcoin. Miners log record earnings. China's uncertain stimulus a gain for Bitcoin? Saylor wants to build a trillion-dollar Bitcoin Bank.

Hello, y'all. Enjoy long-form articles trusted by the best in Web3? Get them right in your inbox 👇

Howdy! Starting your week again with Monday blues, y’all?

Losers. You, me, all of us - mortal humans.

But not Bitcoin.

It had a banger of a weekend.

And also started the week with a merry Monday.

Bitcoin hodlers are breathing easy with some early Christmas presents.

What exactly happened?

A whole lot of things are going right for Bitcoin lately. But, most recently, Mt Gox.

Yes, the Tokyo-based crypto exchange that went bust a decade ago.

And remember another not-so-similar Monday in June?

Read: Manic Monday 🫨 - The repayment chaos.

But the market’s got good news this time.

Let’s take it from the top.

Mt Gox once accounted for over 70% of global Bitcoin transactions

Lost about 850,000 Bitcoins due to a major hack

Filed for bankruptcy in February 2014; lengthy legal process followed

Creditor claims numbered over 127,000

In late 2021, creditors and the Tokyo District Court reached an agreement on the Mt Gox rehabilitation plan, closing a seven-and-a-half-year legal battle

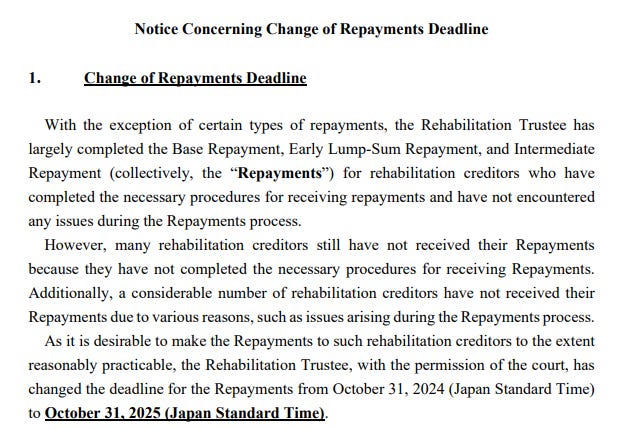

What now? On October 10, Mt Gox announced a delay in repayments to its creditors by a whole year. The original deadline was set for the end of October 2024.

And, while it repaid some of these creditors, others haven’t been.

Why? Repayment wasn’t done to those creditors who haven't completed necessary procedures and due to "issues arising during the repayments process".

How much repayment are we talking about?

Mt Gox roughly owed $9.2 billion in Bitcoin to its creditors when it started repaying in July this year.

Its wallets still have 44,900 BTC (worth $2.8 billion), per Arkham Intelligence.

About $6 billion worth of assets have already been distributed.

Why it matters?

Two words: Supply glut.

Bitcoin traders were tensed about a bearish movement due to the flood of Bitcoin that Mt Gox’s repayment could have triggered if it had stuck to its original schedule.

And the fears are not unfounded.

In July, too, Bitcoin price slumped both the times Mt Gox made repayments to its creditors.

But a delayed schedule means no immediate selling pressure due to excessive supply.

"This could assuage near-term concerns around supply overhangs, though there could (be) room for downside volatility once those on-chain funds begin moving again,” Coinbase analysts David Duong and David Han said in a report.

Result? BTC jumped more than 9% on Monday going up to $64.9k for the first time in October from the Friday low of $59,407.

The price jump comes at a time when Bitcoin is seeing increasing volatility amid uncertain macros such as CPI data, interest rate cuts and election season.

So, all well for Bitcoin?

Maybe. Just for now, perhaps.

Why? Read on…

The $4 Billion Silk Road Conundrum

Mt Gox repayment delay might have given Bitcoin traders a breather.

But another potential sell-off is just at the horizon.

US Supreme Court last Monday had declined to hear a case about 69,000 Bitcoins seized from Silk Road, the darknet marketplace.

Meaning, US government could now dump all of this Bitcoin valuing north of $4.4 bn at current price into the markets.

That could bring back bearish ghosts Bitcoin saw in July after the first Mt Gox repayments.

Says who? Brian Rudick, managing director of research of crypto market maker GSR.

“People may not be paying that much attention now, but to the extent this narrative picks up, or people actually do see the US government selling it, this could cause a decent downward draft on the markets.”

So, Mt Gox’s delay and a possible $4 billion sell-off.

Bitcoin not yet out of troubled waters?

Well, sometimes what Uncle Sam giveth, Uncle Sam taketh away.

Unlock Web3 Insights by the Web3 Builders

A weekly podcast that takes you closer and deep into things that are shaping the world of crypto and Web3. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

Do tune in for depth, insight & numbers on how the internet is evolving.

Brought to you by Joel John, Saurabh Deshpande, Shlok Khemani and Siddharth.

In The Numbers 🔢

32%

That's the increase in Bitcoin transaction fees in the week.

Bitcoin miners’ earnings touched $5 million last week, levels not seen since August.

Drivers? 50% of the Bitcoin's blockspace was dominated by Runes transactions. About 15% of all Bitcoin transactions last week were related to Runes.

What about Runes? It’s a protocol that allows users to create fungible tokens or altcoins on the Bitcoin’s network.

This was previously unique only to Ethereum and Solana.

Why it matters?

Surging network usage despite Bitcoin's price stability could mean growing user base

Runes protocol can transform Bitcoin's ecosystem and provide new use cases

Increased profitability for miners at a time when their revenues have been slumping

China’s Loss, Bitcoin’s Gain?

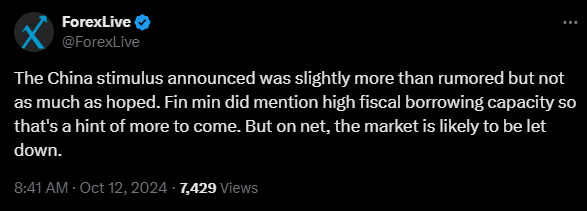

The Asian giant’s largest fiscal stimulus since Covid fell short of expectations.

Just when the world thought China might steal the crypto show.

On Saturday, Chinese Finance Minister Lan Fo'an promised more fiscal support.

But it sounded like vague promises.

Says who? Analysts at ForexLive.

Uncertain path forward for the economy might mean bad news for Chinese markets.

But Bitcoin’s not complaining one bit.

Why? When the country announced its fiscal push last week, it seemed like investors would warm up to moving funds into Chinese markets. It hit the Bitcoin price adversely.

But a weak and unclear stimulus plan reduces chances of funds flowing into Chinese equities.

Instead, investors and traders might persist with Bitcoin.

Advantage Bitcoin?

Block That Quote

Founder and Executive Chairman of MicroStrategy, Michael Saylor

"Bitcoin is going to go to millions a coin, you know, and then we create a trillion dollar company."

MicroStrategy is already the largest corporate Bitcoin holder with 252,220 BTC (about 1.2% of Bitcoin's total supply).

What lies ahead?

He laid out MicroStrategy's ambitious endgame strategy to be the leading bitcoin bank in an interview with Bernstein analysts.

How?

Saylor wants MicroStrategy to use various financial debt instruments to put $100-$150 billion in Bitcoin.

With the firm currently trading at a 50% premium to its Bitcoin holdings, he sees a path to a $300-400 billion valuation.

“It’s much more intelligent to borrow a billion dollars from the fixed income market and lend it to Bitcoin at a 50% ARR, with no counterparty risk, than to reverse that and find someone willing to pay me 12%-14%.”

The Surfer 🏄

Vitalik Buterin sold $1.6 million in memecoins, converting them into Ether (ETH) for charity. Over the past 10 days, he has donated $884,000 to various charities from the proceeds of memecoins.

Ripple co-founder Chris Larsen donated $1 million in XRP to Kamala Harris's campaign. The contribution of 1,754,815.29 XRP was made on August 14, 2024.

Donald Trump's DeFi project, World Liberty Financial, is set to launch its token sale on Tuesday, October 15. The sale is open to accredited investors who qualified through a whitelist application process that began in September. Investors must have a net worth of at least $1 million (excluding primary residence) and an annual income of at least $200,000 (or $300,000 with a spouse) for the last two years.

A Nigerian court denied bail for Binance executive Tigran Gambaryan due to health concerns. Judge Emeka Nwite ordered prison authorities to refer Gambaryan to a hospital for treatment. The bail application was rejected on October 11, as the judge ruled that health issues do not justify release from custody.

Craig Wright has filed a £911 billion lawsuit against Bitcoin Core and Square, claiming they misrepresent Bitcoin as the true version created by Satoshi Nakamoto. He has challenged Bitcoin Core to prove their adherence to Nakamoto's original vision of Bitcoin, stating he would drop the lawsuit if they can demonstrate this.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

Thank you for the information!! ♥️☀️☮️

With miners earning record revenues due to increased network activity from Runes, it’s clear Bitcoin’s utility is evolving. The fact that Bitcoin can now host fungible tokens shows it’s no longer just a store of value but an expanding ecosystem, which could draw more developers and users in the long run.