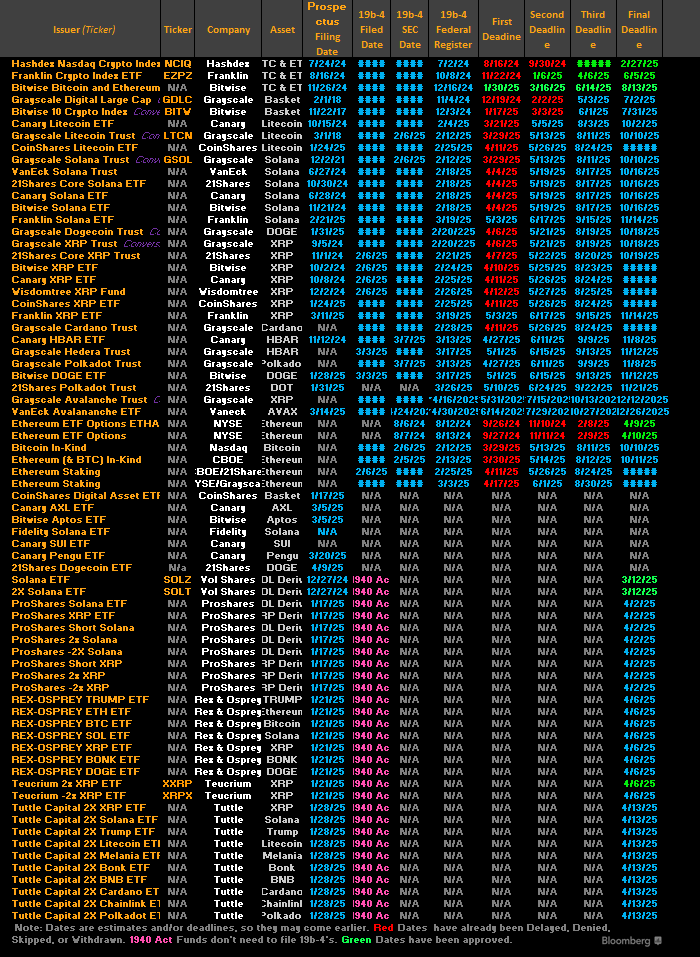

When Paul Atkins took the oath as the SEC's 34th Chair on Monday, he inherited what might be the most substantial crypto-related workload in the Commission's history: over 70 applications for cryptocurrency exchange-traded funds (ETFs) awaiting review.

Took Atkins only three days to face his first couple of major crypto decisions. Pushed rulings on multiple ETFs proposals to June.

The delays weren't unexpected. What they highlighted though is the monumental task facing the new crypto-friendly Chair.

Interestingly, this rush for altcoin ETFs comes while the funds tracking the second largest cryptocurrency — Ethereum — are bleeding capital at an alarming rate.

Fund houses are rushing in for all kinds of ETFs nevertheless. From established altcoins like Solana and XRP to memecoins like Dogecoin, PENGU, and even TRUMP, Atkins' got his job cut out.

The contrast raises an intriguing question: Why are altcoins racing for ETFs when Ethereum's experience offers such a troubling precedent?

Buy Once, Earn Daily Bitcoin Forever

Infinity Hash brings the best aspects of cloud and colocation mining into a transparent and reliable system that provides long-term cash flow.

The Great ETF Pile-Up

Asset managers have filed for ETFs based on at least 15 different cryptocurrencies beyond Bitcoin and Ethereum.

Grayscale alone has applied for funds tracking Solana, Cardano, XRP, Dogecoin, Litecoin, and Avalanche. Bitwise wants approval for ETFs based on DOGE and Aptos, while Canary Capital has been particularly aggressive with filings for Hedera, PENGU, Sui, and most recently, a staked TRX (Tron) product that would even incorporate yield-generating capabilities.

Basic question, first. Why file for ETFs?

"Having your coin get ETF-ized is like being in a band and getting your songs added to all the music streaming services. Doesn't guarantee listens but it puts your music where the vast majority of the listeners are," Bloomberg’s ETF analyst Eric Balchunas recently posted.

In simpler words, better accessibility for investors and wider adoption through fund houses.

The stakes extend beyond the crypto world, involving political complications. We are talking about complications that get US President Donald Trump involved.

Trump Media & Technology Group recently announced plans to invest up to $250 million in crypto-related ETFs.

ETH ETF Struggles

What makes the flood of applications particularly puzzling is the timing. They arrive as Ethereum ETFs are experiencing a crisis of investor confidence.

For seven consecutive weeks, until April 18, Ethereum ETFs witnessed outflows totalling more than $1.1 billion. Assets under management have cratered to $5.24 billion as of April 11, marking an all-time low since these products launched in July 2024.

These struggles stand in stark contrast to Bitcoin ETFs, which despite market volatility, logged nearly $1 billion in inflows on each of the days this week — Thursday and Friday — as Bitcoin reclaimed the $95,000 level.

For altcoin hopefuls, the Ethereum ETF experience raises an uncomfortable question: If the second-largest cryptocurrency by market cap can't sustain investor interest in an ETF wrapper, do less established tokens stand a chance?

Get 17% discount on our annual plans and access our weekly premium features (Mempool, Game On, News Rollups, HashedIn, Wormhole and Rabbit hole) and subscribers only posts. Also, show us some love on Twitter and Telegram.

Lessons from Ethereum

Beyond numbers, the ETH ETF story is also about fundamental issues that altcoin ETF aspirants must reckon with if they hope to avoid the same fate.

First is the fee structure problem, epitomised by Grayscale's ETHE. Its 2.5% annual fee proved unsustainable when competitors like BlackRock offered comparable exposure at one-tenth the cost.

This fee differential creates a mathematical inevitability — over time, high-fee products will dramatically underperform their low-fee counterparts tracking the same asset. For investors planning multi-year holds, this consideration becomes paramount.

Second is Ethereum's increasingly complex value narrative. While Bitcoin benefitted from a straightforward "digital gold" positioning, Ethereum's value proposition spans being a smart contract platform, a settlement layer for DeFi, an NFT marketplace backbone, and potentially a yield-generating asset through staking — a feature not available in current ETH ETFs.

Read: The Golden Goose of ETH ETFs 🥚

This complexity creates a marketing challenge. When financial advisors can't easily explain an investment thesis to clients in one or two sentences, adoption suffers. Bitcoin's simplicity won that battle handily.

Third is the SEC's cautious stance on staking. By preventing ETH ETFs from incorporating staking yield regulators stripped away a differentiating feature. The contrast became particularly stark when Canary Capital recently filed for a staked TRX ETF, suggesting some issuers are already trying to overcome this limitation.

Got questions about a hot crypto topic that you want help understanding? Ask your question using the form and our crypto experts may answer it along with your name in the next Thursday’s News Rollups.

Why Still Bet on ETFs Then?

Despite Ethereum ETFs' troubling performance, the rush for altcoin ETF approval isn't slowing. This apparent contradiction is driven by several powerful factors that override the immediate concerns raised by Ethereum's struggles.

The most significant catalyst is "the Atkins effect." Paul Atkins' appointment represents a dramatic shift from Gary Gensler's tenure, which was marked by what many in crypto viewed as regulatory hostility.

Atkins, with his pro-innovation reputation and history of favouring market-driven solutions, offers something issuers haven't had before: a realistic path to approval.

Read: Paul Atkins: Wall Street's Regulatory Arbiter 🏛️

The numbers support this optimism.

Bloomberg analysts estimate approval chances at 75–90% for assets like Solana, Litecoin and XRP.

Atkins' leadership has essentially opened a regulatory window that asset managers are racing to exploit before it potentially closes.

Institutional demand provides another compelling reason for this ETF frenzy. About 83% of institutional investors plan to increase their crypto allocations this year, with many targeting over 5% of assets under management, showed a March 2025 Coinbase and EY-Parthenon report.

Each altcoin also offers differentiated value propositions that might resonate more clearly than Ethereum's complex narrative.

Solana's ultra-fast transactions and growing DeFi ecosystem provide a clear efficiency story. XRP's focus on cross-border payments offers a specific use case that's easier to explain to institutional investors. Hedera's enterprise adoption gives it corporate credibility that pure retail cryptocurrencies lack.

The growth potential of smaller-cap cryptocurrencies also creates a compelling case for ETF issuers.

While Bitcoin and Ethereum may offer stability, their trillion-dollar market caps limit potential upside. Mid-cap altcoins could deliver more significant returns if they gain mainstream adoption, potentially attracting growth-focused investors who missed Bitcoin's early gains.

Potential Market Impact

The most immediate impact would be on capital flows. JPMorgan analysts project that Solana ETFs alone could attract $3-6 billion in their first year, with XRP potentially drawing $4-8 billion. These flows could dramatically affect token prices and market dynamics.

For comparison, the entire spot Ethereum ETF market currently holds about $5.27 billion in assets. If even two or three major altcoin ETFs match these projections, they could collectively surpass Ethereum ETFs in size within months of launching, creating a remarkable market realignment.

However, this fragmentation of institutional capital across multiple crypto ETFs risks dilution.

It could spread institutional interest too thin across multiple products. This proliferation might lead to a situation where none of the alt-token ETFs achieve critical mass in terms of AUM, making them less attractive for institutional portfolio allocation.

For retail investors, the impact is mixed. On one hand, ETFs offer regulated, secure exposure to cryptocurrencies without the challenges of self-custody. On the other, the growing premium that ETF investors pay (through management fees and potential tracking errors) means they might consistently underperform direct holders of the underlying assets.

If substantial portions of altcoin supplies become locked in ETFs, it could reduce circulating supply and potentially increase volatility in the underlying spot markets.

Token Dispatch View 🔍

The altcoin ETF gold rush amid Ethereum's struggles reveals that narrative power trumps performance reality. Everyone is fixated on the irony of rushing toward a model where one of the pioneers, Ethereum, is bleeding capital. What they need to focus on is not replicating ETH ETFs but rather exploiting their failures.

Smart issuers are already charting a different course.

Canary Capital's staked TRX filing is the clearest evidence of this strategic pivot. By incorporating staking yields, precisely what ETH ETFs critically lack, they're addressing the core structural flaw that's driving Ethereum's exodus in the past few weeks.

The "Atkins effect" merely provided the opportunity.

The catalyst is the recognition that ETH ETFs failed not because they're ETFs, but because they're poor substitutes for native Ethereum. When investors compare ETHE's 2.5% fee and zero staking returns against simply holding ETH, the decision becomes mathematically obvious.

The analyst projections for altcoin ETFs signal that there is more to this than blind optimism. These projections show that specific altcoins with clearer value propositions can succeed where Ethereum's complex narrative faltered.

The greatest winners may ultimately be smaller-cap tokens with the most headroom for growth. Bitcoin and Ethereum's trillion-dollar valuations limit upside potential, but precisely-targeted altcoin ETFs could deliver the growth multiples institutional investors crave.

Instead of serving as a cautionary tale, Ethereum ETFs may ironically become the sacrificial pioneer that paves the way for a more successful second wave. The failures of today’s ETH ETFs won’t be evidence of crypto ETFs not working; instead they'll be the essential market feedback that will make the next generation work better.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.