Can Twenty One Emulate Strategy's Play?🎮

Happy Tuesday dispatchers!

A new Bitcoin heavyweight has entered the ring.

Tether, SoftBank, Bitfinex and Cantor Fitzgerald have joined forces to create Twenty One Capital - a pure-play Bitcoin treasury vehicle launching with 42,000 BTC (~$4 billion).

The name isn't subtle. It references Bitcoin's 21 million supply cap, while positioning itself as the next evolution of corporate Bitcoin strategy.

In today's edition, we look at

The unusual alliance creating crypto's newest BTC powerhouse

Why Twenty One might outperform (or underperform) Strategy

The complex ownership structure raising red flags

How Jack Mallers fits into the picture while running Strike

What this means for corporate Bitcoin adoption

Buy Once, Earn Daily Bitcoin Forever

Infinity Hash brings the best aspects of cloud and colocation mining into a transparent and reliable system that provides long-term cash flow.

The $4 Billion Bitcoin Alliance

Three unlikely partners have formed crypto's newest juggernaut - with audacious ambitions.

Stablecoin giant Tether, Japanese investment firm SoftBank, and Wall Street stalwart Cantor Fitzgerald are bringing Twenty One Capital public through a SPAC (Special Purpose Acquisition Company) merger with Cantor Equity Partners (CEP).

Roles? Tether and its sister company Bitfinex will control 58.8% ownership and 71% voting power. Tether alone will wield a decisive 51.7% supermajority in voting power.

SoftBank isn't directly contributing Bitcoin. Instead, they're paying Tether $462 million for 24% ownership - betting the shares will trade at a premium to net asset value.

The market seems convinced.

CEP shares surged more than 130% after the announcement to about $39 a piece. The shares are currently trading at almost a 100% premium over the price before the announcement.

Block That Quote

Jack Mallers, Twenty One’s appointed CEO

"We're not here to beat the market, we're here to build a new one. A public stock, built by Bitcoiners, for Bitcoiners.”

At launch, Twenty One will hold approximately 42,000 BTC, making it the third-largest corporate Bitcoin holder behind Strategy and Marathon Digital.

Get 17% discount on our annual plans and access our weekly premium features (Mempool, Game On, News Rollups, HashedIn, Wormhole and Rabbit hole) and subscribers only posts. Also, show us some love on Twitter and Telegram.

The Double-Edged Sword

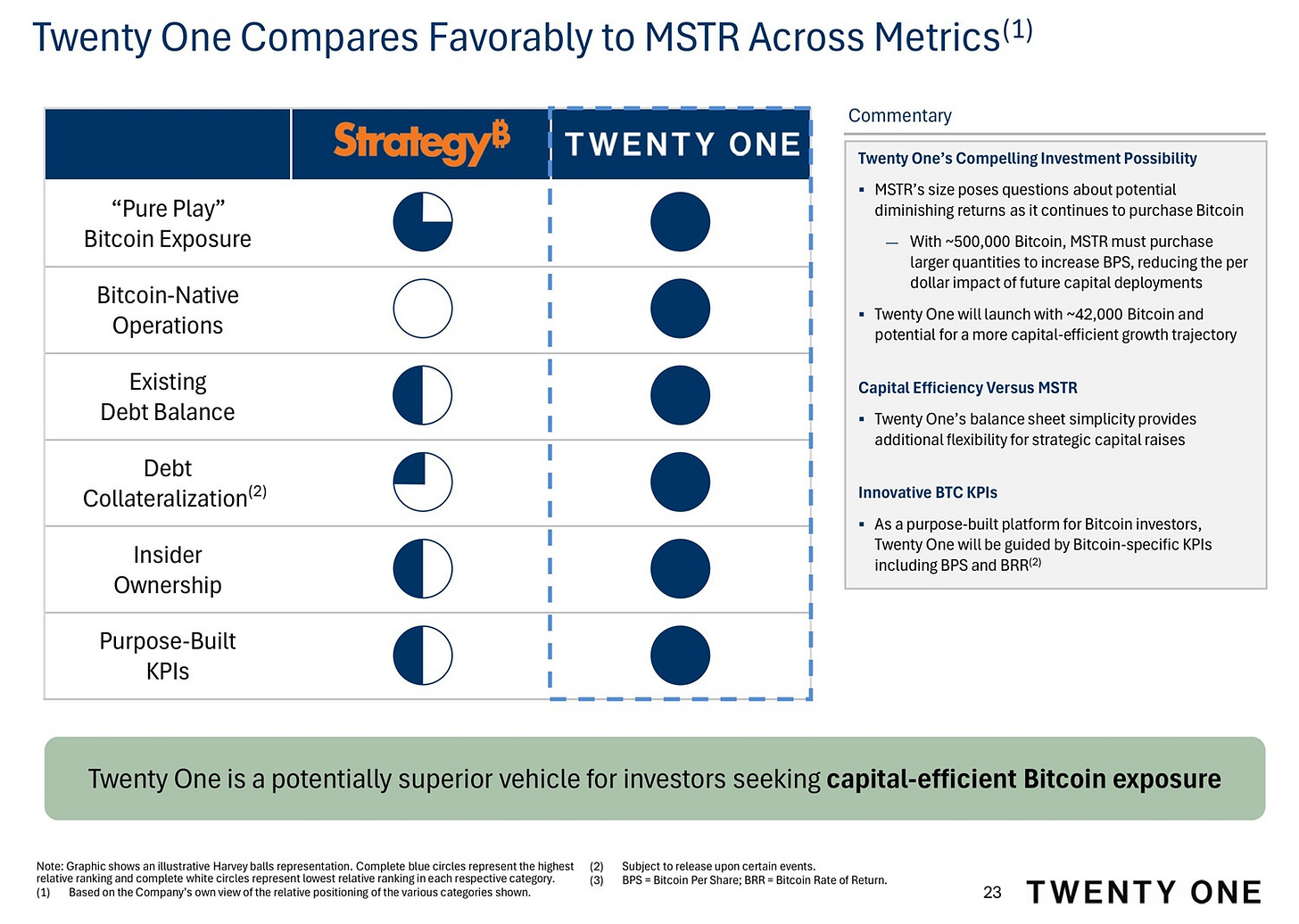

It would be an error to mistake Twenty One to be copying Strategy's playbook. In fact, it’s doubling down and going all in on Bitcoin.

Unlike Strategy, which maintains a software business alongside its Bitcoin treasury, Twenty One will be a Bitcoin-only venture.

No revenue-generating side business. No safety net. All or nothing. Heck of a risk, right?

Twenty One doesn’t feel so. Calls it an advantage over its competitor, Strategy, in its investor deck.

Mallers, the current CEO of Strike, said he would continue running the Bitcoin payment platform, while leading Twenty One.

"These are separate companies, but they share the same ethos: Bitcoin wins, we win.”

Twenty One has also introduced new metrics.

Bitcoin Per Share (BPS): Amount of Bitcoin each fully-diluted share represents

Bitcoin Return Rate (BRR): Rate at which BPS grows over time

The approach appeals to Bitcoin maximalists but introduces vulnerability.

When Bitcoin rallies, Twenty One wins big — bigger than even Strategy. And when Bitcoin drops, Twenty One has nowhere to hide. No recurring revenue to cushion the fall.

The venture plans to generate income through "Bitcoin-native financial products" and educational content - though specifics remain vague. Its investor deck hints at lending products, capital market instruments, and media initiatives.

This all-or-nothing Bitcoin approach represents both Twenty One's greatest strength and its most significant risk.

Got questions about a hot crypto topic that you want help understanding? Ask your question using the form and our crypto experts may answer it along with your name in the next Thursday’s News Rollups.

Probable Red Flags

Twenty One's funding structure raises eyebrows.

The complex arrangement heavily favours early institutional investors over retail shareholders who might buy in later.

PIPE investors (Private Investments in Public Equity) receive shares at preferential terms - purchasing at Bitcoin's net asset value while public investors must buy CEP stock at market prices (currently double NAV).

Tether appears to be the biggest winner. The stablecoin issuer stands to receive nearly $1 billion in cash while retaining majority control. It's efficiently monetising Bitcoin holdings without selling on open markets.

Twenty One’s SEC filings list 76 risks.

"Through its voting control of Twenty One, Tether is in a position to control actions that require shareholder approval and may make decisions that are adverse to other shareholders."

Another red flag: Class A Common Stock holders have zero voting rights. The company explicitly states holders "will not have any ability to influence stockholder decisions."

As a "controlled company," Twenty One plans to exempt itself from standard corporate governance requirements.

The SPAC Path to Market

Twenty One's choice of a SPAC merger over traditional IPO brings both speed and scrutiny.

The structure allows Twenty One to bypass some regulatory hurdles while providing Cantor Fitzgerald a lucrative deal. As sponsor, Cantor receives $45 million in convertible notes and 3.8 million shares along with 1.9% ownership for arranging the transaction.

The Cantor connection runs deeper. Commerce Secretary Howard Lutnick, who recently stepped away from leading Cantor Fitzgerald, must divest his interests within 90 days of confirmation.

His son, Brandon Lutnick, serves as Chairman and CEO of the SPAC vehicle. This family connection adds another layer of complexity to an already intricate arrangement.

There's also the question of how US regulators will view Tether's control of a publicly listed company. The foreign-based stablecoin issuer has historically operated outside the boundaries of typical financial oversight.

Read: (6) Too Big to Ban 🚫

Token Dispatch View 🔍

Twenty One Capital is definitely going to be more than a Bitcoin treasury vehicle. Its experiment will serve as a perfect stress test for the entire corporate Bitcoin adoption thesis.

Unlike the transparent simplicity of Bitcoin ETFs or the operational diversity of Strategy, Twenty One represents something more complex: the institutionalisation of Bitcoin maximalism.

The governance structure shows some cracks.

By securing majority voting rights while offering zero voting power to public shareholders, Tether’s position in this arrangement is interesting. It mirrors traditional finance's most problematic structures rather than embodying crypto's decentralisation ethos. All this is happening while Tether itself is seeing increasing competition from Circle and others, while the US regulators haven’t been great fans of the USDT issuer.

Twenty One emerges precisely when predictions suggest thousands of corporations might follow Strategy's lead. By establishing this vehicle now, Tether positions itself to capture massive institutional flows while traditional finance is still sorting out its Bitcoin strategy.

The 130% SPAC price surge only indicates retail investors knee-jerk reaction. If they buy into Twenty One, like they did for Strategy, they will need to prepare themselves for betting on significant premiums at the cost of governance red flags.

What stands out is a potentially dangerous dynamic of ‘high risk, higher reward’. One where Bitcoin’s appeal overrides traditional investment considerations of governance and risk-reward ratio.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Well something told me that Tuesday was going to be a big day. Thank you for these crucial insights.