Too Big to Ban 🚫

Hello Dispatchers!

Making $13 billion in annual profits puts you in rarified air — the kind typically reserved for Wall Street titans and global banking giants.

So when a crypto company posted numbers that put them within striking distance of Goldman Sachs, you scribble fast and bold in your notepad.

This same company is simultaneously being shown the door in one of the world's largest markets.

Welcome to the curious case of Tether, where getting kicked out of Europe might be the best thing that ever happened to them.

FYI - Tether’s stablecoin USDT is largest stablecoin with around 64% marketshare.

How a stablecoin company became more profitable than most Wall Street banks

Why Europe's crypto crackdown might have unexpected consequences

Why the future of money might not be where anyone is looking

Driving the Next Generation of Wealth

Blockchain applications and digital assets change the fundamentals of how we invest, save, and grow our financial resources. This is the future Nexo is building.

It brings blend cutting-edge blockchain technology with time-tested financial principles, offering a platform where your assets can truly work for you 🫵

Goldman Sachs reported $14.28 billion in profits for 2024. Nobody blinked.

Tether announced $13 billion in profits just a few weeks later, the crypto world did a double take.

Tether has somehow managed to more than double its 2023 earnings of $6.2 billion, putting it in close quarters with one of Wall Street's most storied institutions.

And they did it while being systematically locked out of a major crypto market.

Major European exchanges are rushing to delist Tether's USDT stablecoin ahead of the European Union's Markets in Crypto-Assets (MiCA) regulation deadline.

Crypto.com announced it will remove USDT by January 31, Kraken plans to delist by March 31, and Coinbase has already shown Tether the door.

Yet, Tether's reserves have never looked better.

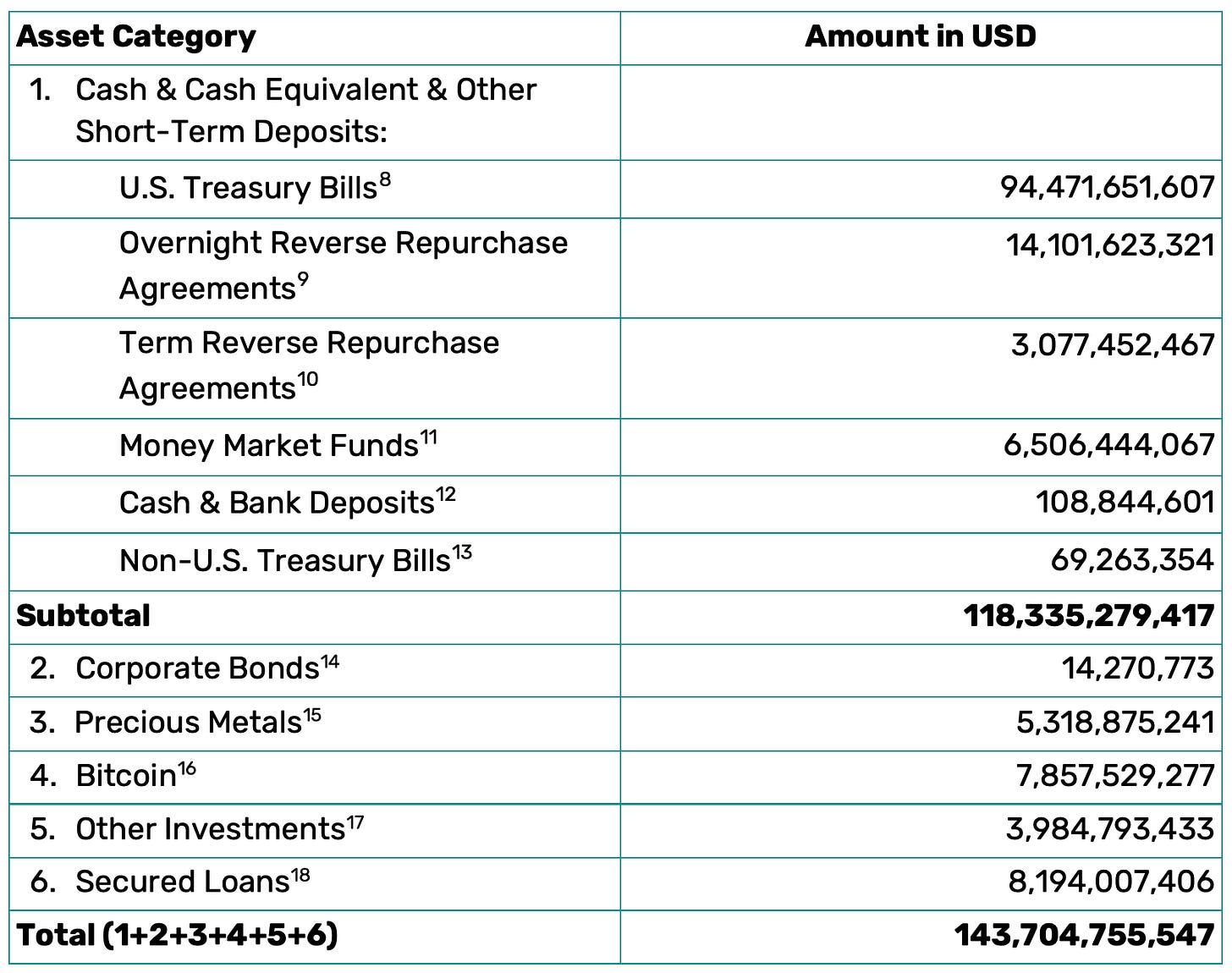

The company now holds approximately $113 billion in US Treasuries — more than the sovereign wealth funds of Germany, UAE, and Australia.

The company is sitting on 83,758 Bitcoin worth approximately $7.8 billion.

Tether's latest attestation reveals a financial fortress: $143 billion in total reserves backing $137 billion in circulating supply.

Their excess reserve buffer exceeds $7 billion.

Their consolidated equity has surged past $20 billion.

When you're holding that much in reserves, even modest yields on Treasury bills can generate astronomical profits.

Add in the appreciation of Bitcoin holdings and gold reserves, and suddenly that $13 billion starts to make sense.

Where is all this money going?

While Europe works to restrict Tether's operations, the company has been quietly building its empire elsewhere.

In a strategic pivot, Tether has established its headquarters in El Salvador, a country rapidly positioning itself as a crypto hub despite recent IMF pressures.

Tether is building a 70-floor tower in El Salvador.

Read: Crypto Exodus to El Salvador 🇸🇻

They're investing in renewable energy, Bitcoin mining, AI infrastructure, telecommunications, and education.

It's a complete reimagining of what a financial company can be. While traditional banks focus on established markets, Tether is targeting the 1.3 billion unbanked people worldwide.

Despite regulatory headwinds, USDT commands 82% market share on centralised exchanges. Their global user base has swelled to 400 million users.

"The USD stablecoin market is almost negligible in Europe. As Tether finalises its European strategy for USDt, it remains committed to ensuring compliance with evolving regulations while introducing groundbreaking technologies such as Hadron and investments in transformative projects such as Quantor, designed to be MiCA compliant” - Tether spokesperson.

While regulators in one of the world's largest economic blocs are effectively pushing it out, the company is posting record profits and expanding its influence in emerging markets.

Read on …

To get full access to our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts.

Europe's Great Stablecoin Exodus

"Sudden actions to align with MiCA could potentially lead to disorderly crypto-assets markets." — European Securities and Markets Authority

The exodus began quietly.

First, it was Coinbase in December 2024, delisting eight tokens including USDT.

Then came Crypto.com's announcement to remove ten assets by January 31.

Finally, Kraken revealed its plans for a complete USDT shutdown by March 31, 2025.

This isn't just a series of isolated decisions — it's the beginning of Europe's great stablecoin reformation, driven by the Markets in Crypto-Assets (MiCA) regulation.

MiCA regulation was supposed to bring order to crypto markets. Instead, it's triggered the largest stablecoin exodus in history.

On December 30, 2024, MiCA regulations came into effect, requiring stablecoins to be backed by liquid reserves in a strict 1:1 ratio.

By mid-January, the European Securities and Markets Authority (ESMA) was urging crypto exchanges to restrict non-compliant stablecoins.

And hence, the domino effect that we are seeing now.

It's the technical requirements that reveal why this exodus was inevitable.

MiCA demands from stablecoin issuers

Secure an e-money licence

Maintain reserves in recognised European banks

Submit to regular audits

Provide detailed transaction monitoring

Ensure immediate redemption capabilities

The regulations create a Catch-22: to operate in Europe, stablecoin issuers need banking relationships with European institutions. But those same institutions are hesitant to work with crypto companies until they're fully compliant.

For smaller stablecoins, this regulatory strangle has been devastating.

For Tether, it's created an unexpected opportunity.

As the company exits Europe, competitors like Circle's USDC are gaining ground. USDC now dominates on networks like Solana, comprising nearly 78% of stablecoin supply.

Yet even this shift hasn't dented Tether's global dominance.

In fact, the regulatory pressure appears to be pushing users toward alternative markets where USDT remains king.

It's the implementation timeline that's causing market tremors.

The European Securities and Markets Authority (ESMA) has pushed for restrictions on non-compliant stablecoins by the end of January, with a complete phase-out required by March 31, 2025.

"It is disappointing to see the rushed actions brought on by statements which do little to clarify the basis for such moves," Tether stated, expressing concern that these changes could create a "disorderly" market at a time when MiCA is still in its early stages.

They might have a point.

The regulatory pressure has already started showing cracks in the market.

Tether's market cap recently experienced its steepest drop since the FTX crash, falling over 1% to $137.24 billion.

Yet, paradoxically, this hasn't dented the company's profitability.

Instead, Tether appears to be pivoting.

While European exchanges scramble to comply with MiCA, the company is doubling down on its global strategy.

Tether's strategy seems clear: ‘If Europe wants to create barriers, we’ll simply build elsewhere.’

The company is actively investing in projects ranging from renewable energy to Bitcoin mining, from AI infrastructure to education.

They're even backing Quantoz and StablR, two firms focused on developing euro-based stablecoins that will be fully compliant with European regulations.

As one regulatory door closes, Tether seems to be kicking open several others.

For a company being pushed out of a major market, they're acting surprisingly like one that's just getting started ...

Token Dispatch View 🔍

Sometimes the most telling moves in finance aren't the headlines that grab you, but the quiet shifts that follow.

As Tether posts its record-breaking $13 billion profit while simultaneously being shown the door in Europe, we're witnessing one of those pivotal moments that could reshape the future of digital money.

Not in the way many expected. The conventional wisdom suggested that regulatory approval in major markets like Europe would be crucial for stablecoin success.

Tether's 2024 performance tells a different story.

While Circle's USDC gains ground in heavily regulated markets, Tether has discovered something more valuable: the other 1.3 billion people.

"There are 1.3 billion people in the world that don't have bank accounts," Ardoino points out. "They are not bad people, but they are just too poor of interest to banks."

This isn't just a talking point — it's becoming Tether's north star.

The numbers support this strategy.

Despite being pushed out of Europe, Tether's attestation reveals a company with unprecedented financial strength: $143 billion in reserves backing $137 billion in circulating supply, with a consolidated equity exceeding $20 billion.

These aren't the numbers of a company in retreat — they're the foundation for expansion.

Most intriguing is where Tether plans to deploy its newfound wealth.

Half of its profits are earmarked not for traditional finance, but for ventures in decentralised AI, real-world infrastructure, and emerging market development.

They're building a 70-floor tower in El Salvador not because it's the easiest place to do business, but because it's where the future growth lies.

The implications are profound.

While regulators in traditional financial centres focus on constraining stablecoin issuers, Tether is quietly building an alternative financial infrastructure in markets that traditional banks have ignored.

They're not just surviving without Europe — they're thriving by looking where others aren't.

This might be the most important lesson from Tether's 2024 performance: the future of money might not be determined in Brussels, London, or New York. Instead, it might be shaped in places where the need for financial innovation is most acute.

For those keeping score, Tether's strategy appears to be working.

Even as they face regulatory headwinds in Europe, they've maintained their position as the dominant stablecoin globally, with USDT commanding 82% market share on centralised exchanges.

Can Tether survive without Europe's blessing? They've answered that emphatically with their profit numbers.

This marks the beginning of a larger shift in financial power, away from traditional centres and towards emerging markets that embrace financial innovation.

As traditional finance and regulators grapple with how to control stablecoins, Tether seems to have discovered something more valuable: how to make them truly useful where they're needed most.

Sometimes getting pushed out of one door forces you to find better ones to walk through.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Are you guys effin joking here? Tether is likely a scam. Everybody with a brain knows Tether is a scam. Literally all Europe had to do was say "verify your reserves" and Tether ran out the door.

COINCIDENCE?

Do better.