The institutional crypto playbook is fast expanding beyond the Bitcoin standard, but not all altcoins deserve a seat at the treasury table.

What started as a bold bet with Strategy (formerly known as MicroStrategy) has evolved into a $100+ billion institutional movement spanning over hundred publicly-listed companies. But as the next wave of adoption unfolds, institutions are asking a more complex question: which altcoins, if any, deserve corporate treasury allocation alongside the established Bitcoin-Ethereum-Solana trinity?

The answer lies in a fundamental assessment of whether these assets can deliver what institutional treasurers actually need: sustainable yield generation, genuine economic utility, and the infrastructure depth that makes large-scale adoption feasible.

Why Just Stake, When You Can Stake And Spend?

ETH staking doesn’t have to lock you out of DeFi.

With Kelp, you can restake ETH — earning both validator rewards and staking yields — while still spending or earning on that position using rsETH.

Staking + liquidity = ✅

Access to 40+ DeFi protocols

Built on EigenLayer and fully non-custodial

Multiply your ETH utility, don’t just stake.

Companies building crypto treasuries is no longer a novelty. Bitcoin was the first to prove that crypto could sit on a corporate balance sheet. Michael Saylor pioneered it with Strategy five years ago and its approach has now become a template for many others to follow.

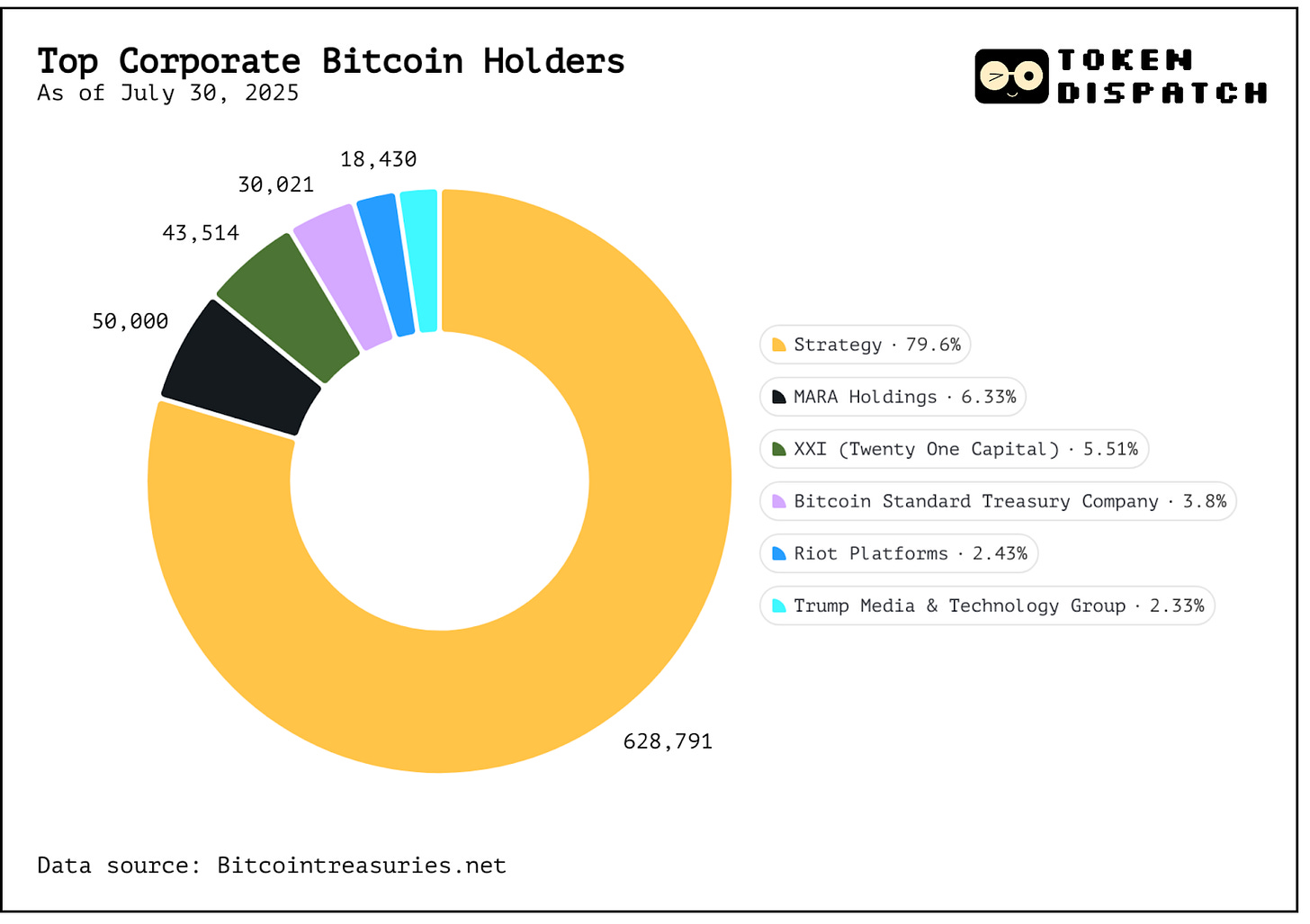

Today, 160 publicly-listed companies hold 923,327 BTC worth over $100 billion collectively on their balance sheets, accounting for 4.6% of Bitcoin’s current supply.

They are adding more as we speak.

Then came Solana, bringing low fees, high speed, and staking rewards to the table. Companies like Sol Strategies, DeFi Development Corp and Upexi hold ~3.3 million SOL worth about $600 million.

Read: Why Are Corporates Stacking SOL? 💰

Ethereum followed soon after, with similar staking rewards and decentralised finance (DeFi) use case. The second largest cryptocurrency offered more than a store of value. Together, SharpLink and BitMine now hold over 920,000 ETH (worth ~$3.5 billion), more than what the Ethereum Foundation holds.

Read: ETH ETFs, One Year On 🍾

Both Ethereum and Solana make up for the lack of asset appreciation with their yield-generating ability. Stake it, and you earn yield. With staking, you also support the network’s security and throughput for proof-of-stake chains.

All this reflects institutional adoption for altcoins that may not see as much and as fast price appreciation as Bitcoin does. Institutions are now attempting to see if these models can be extended beyond Bitcoin, Ethereum and Solana.

Do altcoins like BNB, SUI, XRP justify a place in company treasuries? Are they the next phase of institutional adoption, or are we looking at some desperate bids by institutions with misplaced hype?

BNB is the powerhouse behind Binance’s ecosystem, used for everything from claiming discounts while paying trading fees to powering DeFi applications. Its on-chain activity, user base, and staking rewards create a feedback loop that resembles the Ethereum or Solana model, albeit with greater centralisation risk.

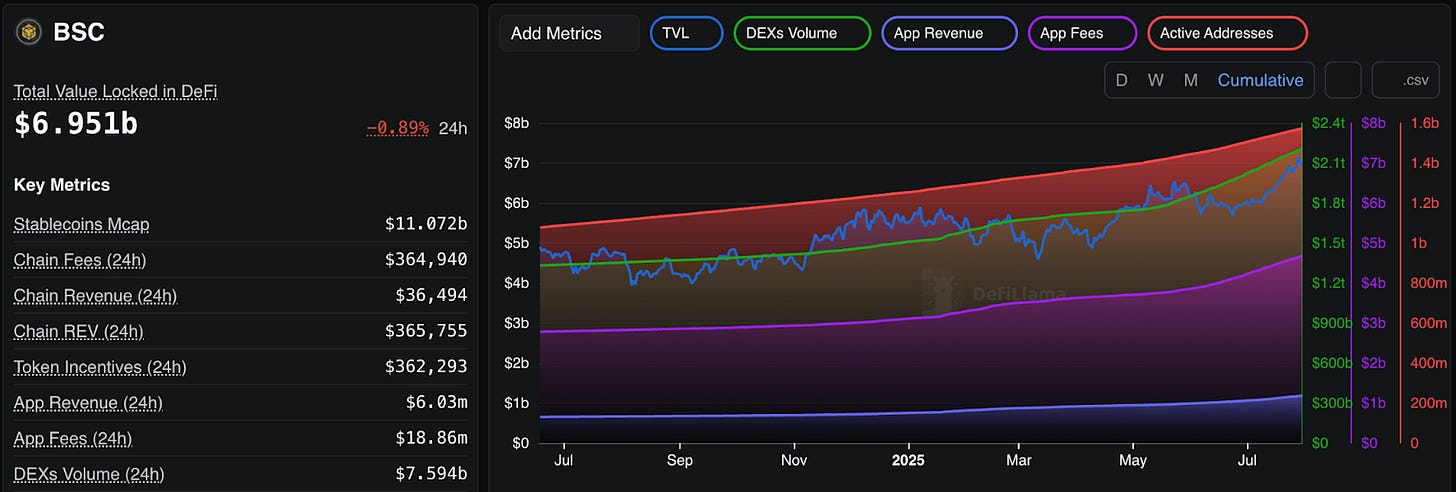

The total value locked (TVL) across all DeFi protocols on the Binance Smart Chain (BSC) stands at $6.96 billion. Meanwhile, BNB’s market cap is $111 billion, the fifth highest among all cryptocurrencies. That puts its market cap-to-DeFi TVL ratio at a steep 16.15, far higher than Ethereum’s 5.48 or even Solana’s 9.89 and the highest among the top 20 chains after Bitcoin.

It may appear that BNB’s market value is inflated relative to the actual capital locked in its DeFi ecosystem. But that’s just one part of the story. Unlike Ethereum, BNB’s value is also influenced by centralised activity on Binance exchange including fee discounts, launchpads and burns. Corporate control and quarterly burns, which are loosely tied to Binance’s revenues and not DeFi activity, also have a role to play. There’s also a large retail user base who use BNB just to transact cheaply.

BNB has nearly 2 million daily active addresses and clocks over $7.5 billion in daily DEX volume, highest among all chains — more than both Ethereum and Solana. Binance also holds assets worth $158 billion on its centralised exchange, excluding tokens issued by itself.

For institutions, this poses a dilemma.

BNB’s numbers, both daily active users and DEX volume, show its growing dominance across chains. But when viewed alongside its relatively modest DeFi footprint, the lack of depth shows up. What is clear, though, is that BNB’s value is anchored as much in Binance’s corporate engine and centralised activity as in its chain’s open ecosystem. That makes it harder to model, and perhaps harder to back, in the kind of thesis-driven way institutions have approached Ethereum and Solana.

Perhaps what institutions need is a newer metric to gauge the value they see in ecosystems like Binance.

In case of SUI, the chain is newer, with strong backers and a clear focus on gaming and developer tooling. Its growth in DEX volume and TVL over the past year has been exponential, and has moved in tandem with its market cap.

SUI’s market cap-to-DeFi TVL ratio is 6.21, much less than Solana’s and slightly more than Ethereum. For a chain launched in 2023, its current levels of DeFi activity are already outpacing where Solana was at a similar stage, with better consistency.

XRP is built not for DeFi but for payments. Its pitch to institutions has leaned on regulatory clarity and real-world use. Ripple’s recent victories in court have opened the door for XRP ETF filings and treasury consideration.

While the network handles over a million transactions daily, it generates negligible fee revenue (0.00001 XRP per transaction) and has no staking opportunity since it doesn’t work on a proof-of-stake consensus. Its market cap, now over $180 billion, dwarfs its actual economic activity. With stablecoins gaining ground in the cross-border payment space, these mismatches in valuation versus usage cast uncertainty on XRP’s real-world utility.

Its recent price market cap rise came despite stagnation in the number of active addresses and transaction fees. This raises red flags for institutions looking to bet big on the cryptocurrency.

Institutional interest comes not merely from belief in technology but stems from the want of finding newer avenues for risk-adjusted returns. ETH and SOL have shown that staking can become a yield strategy and bring in consistent revenue. This is where the comparison gets sharper. ETH offers around 4% staking yields. SOL hovers closer to 6–7%. Treasuries holding these tokens can stake them and treat the resulting returns as predictable, compounding income, even though they will have to keep worrying about drawdowns offsetting yield. Several firms now do just that. Upexi is earning millions annually on its SOL holdings.

BNB and SUI want to play the same game. Their staking yields, usage metrics, and developer growth indicate they’re getting closer to institutional-grade, if not already there. But unlike ETH and SOL, they lack the same depth of third-party tools, staking providers, and liquid staking infrastructure, the plumbing that makes institutional participation seamless.

Still, the market is preparing.

Fund issuers also await approval for ETFs filed in the US for some of these altcoins this year, including for BNB, XRP, and SUI. The assumption is that regulated wrappers will bring in more retail investors, just as Bitcoin and Ethereum ETFs did. But they will have to be wary of lessons from Ethereum ETFs, which struggled to find buyers in its early days.

If staking rewards can be passed along to ETF holders, the pitch becomes even more attractive.

Retail investors should see this moment for what it is: a sorting phase. Coins with staking, genuine activity, and developer commitment may find themselves legitimised through treasuries. Others will simply ride the wave until it crashes. The key takeaway is to read what institutional interest actually means. It’s not always an endorsement of quality. Sometimes, it’s just an experiment with liquidity.

Still, the question at the heart of this is whether institutional interest in altcoin ETFs and treasuries is justified. In a few cases, yes, especially where yield meets usage. In others, not yet. And for some, perhaps never. But if there’s anything the world has learnt from Solana, it’s that the crypto treasury landscape is no longer just for Bitcoin and Ethereum. The next cohort is already here and busy staking, scaling, and vying for a seat at the institutional table.

That’s it for this week’s deep dive. See you next week.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Super cool la pub