Three months ago, the thought of Ethereum celebrating the first anniversary of the launch of its exchange-traded funds in the US would have been laughable even to its most ardent advocates.

Yet, Ethereum ETFs are having their moment right now, as they complete one year since their first trading session on July 23, 2024.

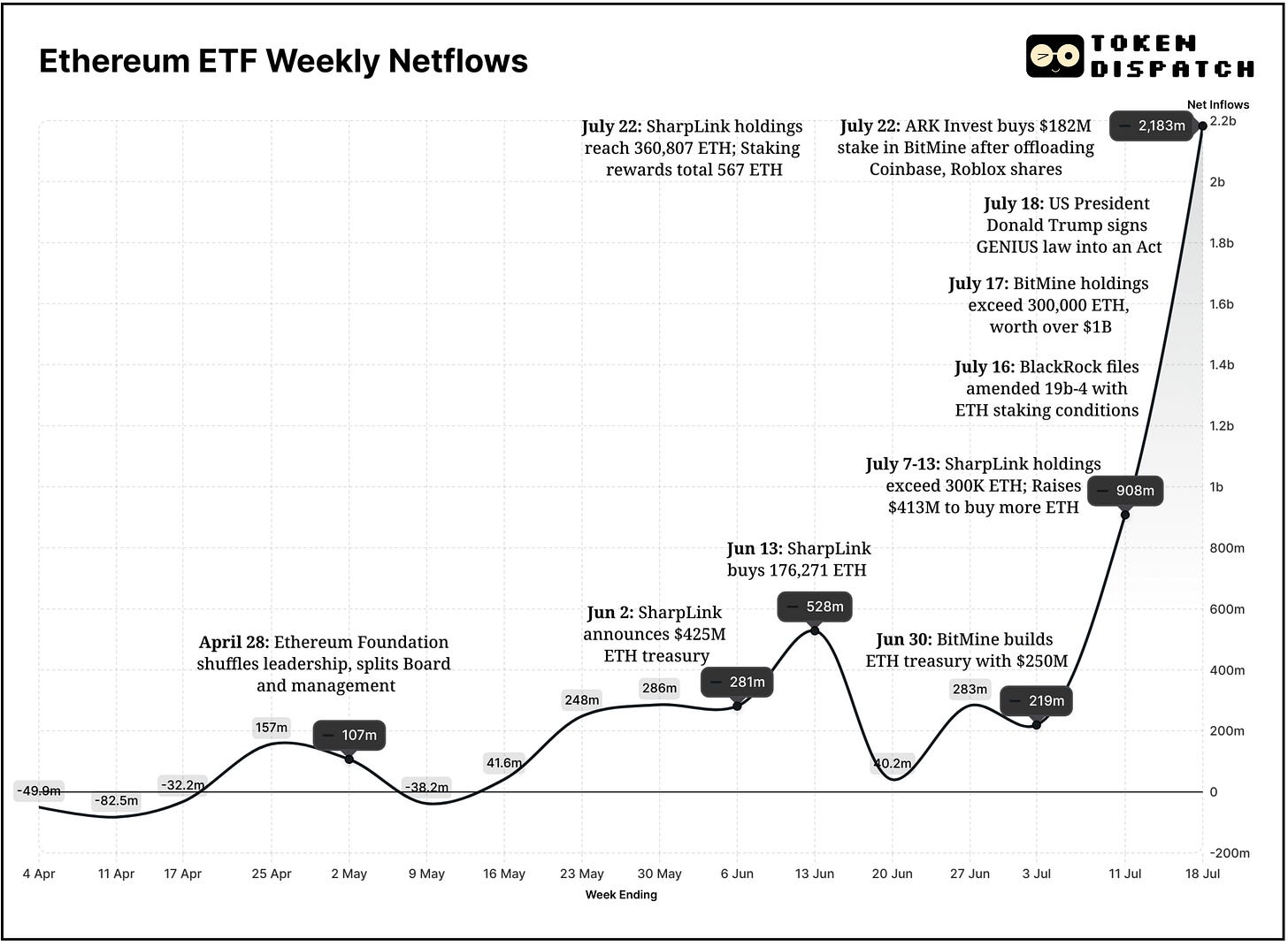

In June 2025, Ethereum ETFs recorded their best month yet, pulling in over $3.5 billion — 70% higher than their previous best in December 2024 ($2.08 billion). July is already on track to overtake June, with over $3 billion recorded so far. The last two weeks ending July 18 marked the best weeks ever in terms of net inflows. And for ten consecutive weeks now, these funds haven’t seen a single net outflow – a first in their 52-week lifespan.

The hockey-stick growth pattern in the chart below shows the story.

It wasn’t always like this.

Build the Skillset Crypto Teams Are Hiring For

Safary Certification is a 4‑week bootcamp taught by the very people behind growth at Kraken, Stargate, EigenLayer, and others.

In this bootcamp, you’ll learn:

How to position a crypto brand using narrative-first frameworks.

Funnel-building from acquisition to retention using onchain data.

Partnership strategies & token launch playbooks.

Building a personal brand that gets you hired in web3 growth.

Cohort 1 had 170 students. Cohort 2 kicks off August 1 with only 100 seats.

When US regulators greenlit Ethereum ETFs in May 2024 and trading began on July 23, the reaction was mixed. Bitcoin had already stolen the ETF spotlight earlier that year. ETH's debut was more of a shrug. Prices drifted. Attention waned. And in those very early months, the big inflows never came.

In fact, some of the initial flows were net outflows.

ETH ETFs saw positive net flows in just 15 of the first 39 weeks. Compare that with 13 out of the last 14 weeks showing net inflows, and it’s clear how much the story has shifted in the past three months.

By July 21, 2025, the total value of assets under management (AUM) across all US ETH ETFs had crossed $19 billion, more than double the ~$9.6 billion from just two months earlier.

And ETFs aren’t the only product where ETH is seeing strong demand. Institutional interest in Ethereum has also accelerated through ETH treasuries.

On June 2, SharpLink Gaming became the first US-listed firm to announce Ethereum holdings as part of its treasury strategy. When the crypto world was busy tracking a series of publicly listed companies adding Bitcoin to their balance sheet, Joe Lubin brought ETH to the treasury party.

Read: ETH's Treasury Turnaround 🏛️

Lubin, co-founder of Ethereum and founder and CEO of Consensys, had joined SharpLink Gaming's board as its chair and led their $425 million Ethereum treasury strategy.

Since the launch of its treasury programme, the company has become the largest corporate holder of Ethereum with 360,807 ETH, worth over $1.3 billion at current prices. It has also raised an additional $413 million and earned 567 ETH in cumulative rewards from staking its ETH holdings.

That’s not all. In a supplement prospectus with the SEC, SharpLink sought to increase the amount of common stock it can sell by an extra $5 billion, up from $1 billion under its initial filing.

It’s got a tight competition from a firm that’s relatively new to the ETH treasury.

BitMine Immersion, a Bitcoin miner, has also bet on Ethereum with over 300,000 ETH in holdings, worth more than $1 billion at current prices. Its chairman, Tom Lee, a Wall Street veteran, has a bigger goal.

“We are well on our way to achieving our goal of acquiring and staking 5% of the overall ETH supply," he said. Together, SharpLink and BitMine now hold more ETH than the Ethereum Foundation.

Collectively, ETH treasury companies and Ethereum ETF flows reflect institutional bets on ETH as an infrastructure layer. And this is only getting stronger.

Cathie Wood’s ARK Invest recently sold major holdings in Coinbase and Roblox to increase its stake in BitMine Immersion, investing $182 million. Previously underexposed to ETH, ARK restructured three of its flagship ETFs to allocate 1.5% to BitMine across their portfolios.

Billionaire Peter Thiel has also taken a 9.1% stake in the firm.

Ether Machine, a new company formed through a merger between existing firms, will create a publicly-traded vehicle offering institutional-grade exposure to Ethereum infrastructure and Ether yield.

The company will be led by co-founder Andrew Keys, a former board member and head of Consensys, and David Merin, former executive at Consensys and current CEO of Ether Machine. Post merger, Ether Machine plans to list on Nasdaq with over 400,000 ETH, worth more than $1.5 billion.

What changed in the past few months? The recent regime changes at Ethereum Foundation might have had a role to play.

In April end, Ethereum Foundation shuffled leadership and split the board from the management. The Foundation's new leadership outlined scaling Ethereum's base layer, improving Layer 2 rollups, and enhancing user experience as the core priorities.

Read: Can Pectra, UX and Team Shuffle Revive ETH? 🛠️

Ethereum’s utility and yield generation capability also make it an attractive proposition for investors.

Right now, no US ETF offers staking rewards. The US Securities and Exchange Commission (SEC) hasn’t yet given the green light. If ETH ETFs can eventually offer staking, ETH can become ‘digital bonds’ in institutional portfolios.

A staking-enabled ETF could offer 3–5% native yield. Even an average 4% yield on the current ETH holdings ($19.6 billion), with the ETF issuers can rake in over $750 million in staking revenue.

BlackRock is already exploring staking-inclusive structures. It submitted an amended 19b-4 filing that explicitly mentioned staking as a “potential future feature” contingent on regulatory approval. The market is waiting.

Experts predict staking will be approved for ETH ETFs by the last quarter of this year.

For many investors, staking could be the main difference between exposure and commitment. Passive income from a regulated vehicle could draw in pension funds, endowments, and sovereign wealth funds.

Market maker and trading firm Wintermute had pointed to the absence of a staking mechanism as a dampener, expecting it to diminish “Ethereum’s appeal as an ETF vehicle", in a report it had released during the ETH ETF launch last year.

If macro conditions shift — think rate cuts, inflation stability, or capital looking for higher yield — ETH becomes a compelling pick. It offers scarcity via shrinking supply, yield revenue via staking, and accessibility via ETFs and custodians.

Ethereum price is already moving in tandem with institutional activity. A further price breakout may evoke optimism and attract more inflows. Either way, retail and institutions will welcome Ethereum’s evolution after a prolonged lull.

ETH price has already shot up over 50% in just the last two weeks and recorded a yearly high for 2025. It rose 150% in the last three months.

When ETFs issue new shares, they must buy ETH. That locks up supply. Less ETH would be available in the market, resulting in more pressure on price.

Expect even Ethereum treasury companies to hold the ETH with diamond hands. Registered investment advisors (RIAs), wealth managers and public firms don’t usually look for quick gains. They rarely panic-sell.

Treasury builders are positioning ETH as programmable collateral — an asset that earns, secures, and stays put.

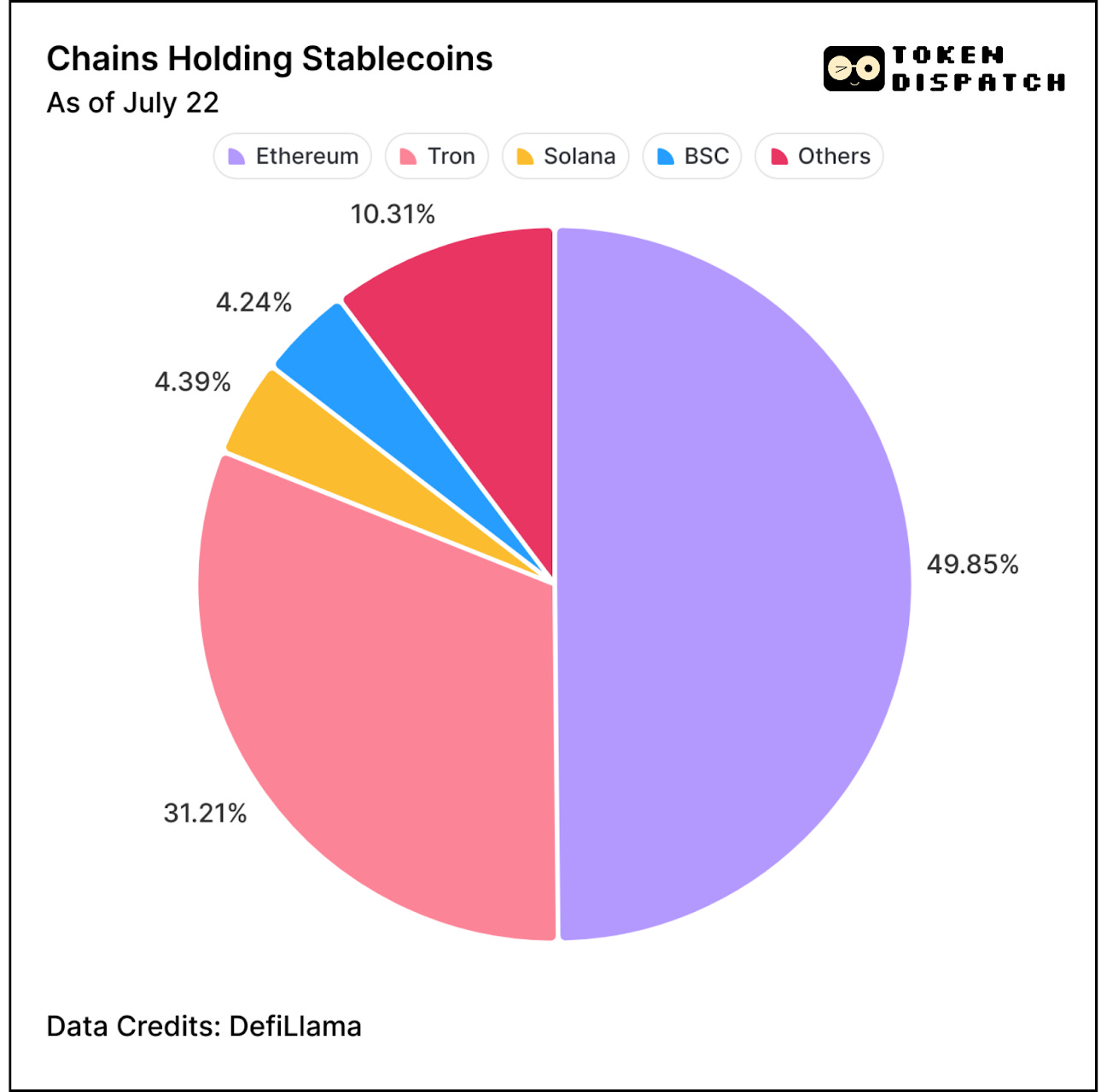

Add to this, the macro backdrop is bullish: the GENIUS Act was recently signed into law, legalising stablecoins as digital cash. Ethereum will be the biggest beneficiary, as it remains the dominant rail with 50% of the market share.

So what’s next?

Expect persistent institutional interest once staking for ETFs gets an SEC nod. More corporations are likely to build ETH treasuries because of the staking feature. More asset managers like BlackRock will continue to push ETH deeper into their portfolios.

For traditional investors, this could be the moment when they recognise that ETH now has two powerful distribution routes — ETFs and treasuries — that both lock up supply and extend Ethereum’s reach into the traditional economy.

Those comparing Bitcoin’s treasuries and ETFs to Ethereum’s are missing the point.

BTC is being held as a store of value and a digital gold for the macro playbook. ETH, on the other hand, is being put to work. Fund issuers and treasury builders are buying and backing ETH for what it enables: staking rewards, infrastructure rails, and a programmable layer for financial utility.

Bitcoin is an asset you hold. Ethereum is a network you build on.

That’s it for this week’s deep dive. See you next week.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.