On January 22nd, BitGo began trading on the New York Stock Exchange under the ticker BTGO. The company priced its Initial Public Offering (IPO) at $18 per share, exceeding its marketed range. This raised $213 million, valuing BitGo at just over $2 billion.

This is not remarkable because BitGo is particularly large. At that valuation, it sits well behind Circle’s nearly $7 billion debut and far below Coinbase’s $60 billion market cap. It is also not remarkable because the business model is especially novel. BitGo provides custody services, meaning it holds other people’s crypto in cold storage and charges fees for the service. This is foundational infrastructure, a necessary service, rather than something groundbreaking.

Traditional capital markets are now open again to crypto companies. Goldman Sachs and Citigroup led the underwriting, and the New York Stock Exchange hosted the listing. Institutional investors participated . This is Wall Street operating as usual, the same way it would for any other regulated financial services company seeking public equity.

At the same time, on-chain fundraising is accelerating. In July 2025, Pump.fun raised $1.3 billion in an ICO. Modern token launch platforms like Echo, Legion, and MetaDAO have built distribution mechanisms that look nothing like the chaotic gas wars of 2017. Projects are raising hundreds of millions of dollars in hours, without filing a single S-1.

Read: The New ICO Test 🪙 - by Prathik Desai - Token Dispatch

So, we now have two parallel capital markets. One requires audited financials, compliance infrastructure, and months of regulatory review. The other requires a smart contract and a community willing to speculate. Both are working. Neither is replacing the other.

BitGo’s IPO signals where capital is flowing and where it is splitting. The split illustrates how crypto companies approach growth, legitimacy, and the sources of their capital.

BitGo going public is a marker, not the story. The real story is that off-chain capital markets have reopened to crypto in a way that hasn’t happened since 2021.

Between 2022 and early 2024, the IPO window for crypto companies was essentially closed. FTX had collapsed. Regulatory enforcement was aggressive. The U.S. Securities and Exchange Commission (SEC) was suing exchanges and categorising most tokens as unregistered securities. Traditional underwriters were staying away. Wall Street’s message was clear: “We are not ready to trust this sector yet.”

By mid-2025, that posture reversed. Circle went public in June, raising over $1 billion. Its stock surged from $31 to as high as $233 within weeks. Figure Technologies listed on Nasdaq. Gemini completed its debut in September. Kraken confidentially filed for an IPO in November after raising $800 million at a $20 billion valuation, backed by Citadel Securities and Apollo Global Management.

These are not startups. These are companies with revenue, regulatory licenses, and institutional clients. They are also companies that could not have easily raised this kind of capital on-chain, even if they wanted to.

BitGo fits this profile exactly. It reported $10 billion in gross revenue for the first nine months of 2025, up from $1.9 billion during the same period the year before. Most of that is pass-through trading volume, but if you strip out the accounting noise, the company still generated nearly $200 million in what you might call real economic revenue: custody fees, staking services, stablecoin infrastructure, and wallet-as-a-service subscriptions.

In December 2025, BitGo received conditional approval from the Office of the Comptroller of the Currency to convert into a federally chartered national trust bank. This places it in the same regulatory category as firms like Fidelity and BNY Mellon. It also means BitGo can now operate under a single federal framework instead of navigating state-by-state licensing, which is both expensive and slow.

This regulatory legitimacy is not something you can ICO your way into. You cannot launch a token and secure a fiduciary relationship. Institutional allocators, the kind managing trillions of dollars, are legally required to custody assets with qualified custodians. This designation has specific meaning under U.S. law, and it requires audits, insurance, and federal oversight.

So, BitGo needed the IPO. Not because on-chain capital was unavailable, but because the business it runs requires a different kind of trust than tokens can currently provide.

While BitGo was filing S-1 amendments and negotiating with underwriters, a very different kind of fundraising was happening on-chain.

Initial Coin Offerings (ICOs) are back. Not in the chaotic 2017 sense, where anyone could throw up a whitepaper and raise millions with no product and no accountability. But in a more structured, engineered way that borrows some of the logic of traditional fundraising while maintaining the speed and global accessibility of crypto.

The numbers are significant. By some estimates, token sales accounted for roughly one-fifth of all crypto capital formation in 2025. Pump.fun alone raised $1.3 billion in its July 2025 ICO and went on to generate $780 million in protocol revenue by year-end, sharing a portion of that with token holders. Projects like Falcon and Plasma saw 28x and 33x oversubscriptions in their public sales.

This is happening because the infrastructure finally caught up. Platforms like Echo (which built a tool called Sonar), Legion (integrated into Kraken’s launch platform), and MetaDAO have created launch primitives that address some of the problems that plagued earlier ICO cycles.

Echo’s Sonar lets projects run self-hosted token sales with optional Know Your Customer (KYC), accredited investor checks, and geographic restrictions. It supports fixed-price sales, auctions, and treasury-backed models across multiple chains. The result is that projects can control their own distribution without relying on centralised launchpads, while still maintaining compliance options if they choose.

Legion uses an on-chain reputation score (0 to 1,000) calculated from GitHub activity, social influence, and transaction history. High-scoring participants get priority allocations in what the platform calls “merit phases.” The rest of the tokens go to KYC-verified exchange users via lottery or first-come-first-served rounds. This reduces bot dominance and rewards actual community contributors instead of whoever can run the fastest script.

MetaDAO takes a different approach, focusing on post-launch price stability. When a project raises capital through MetaDAO, the funds go into a programmatically managed treasury that is required to inject liquidity into decentralised exchanges and maintain buy-and-sell bands around a target price. The idea is to prevent the pump-and-dump dynamics that killed most 2017 ICOs by encoding price policy directly into the smart contract.

These improvements make on-chain fundraising faster, more transparent, and harder to manipulate than it used to be. They also make it accessible to anyone with an internet connection, unlike traditional private markets.

But they have not solved the fundamental problem: most tokens still fail.

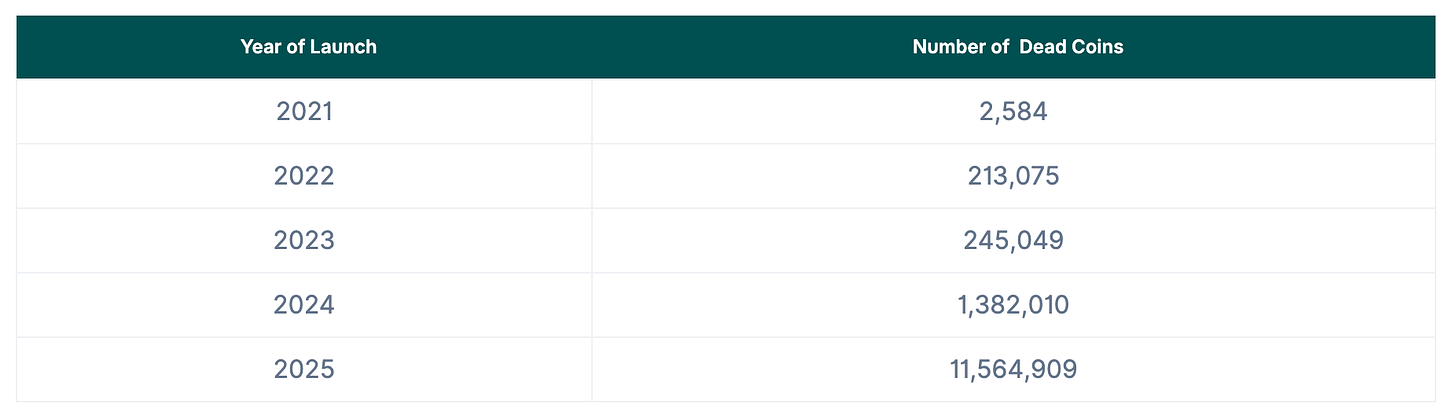

CoinGecko data shows that 86% of the 11.5 million tokens launched in 2025 went to zero. Not “performed poorly.” Went to zero. Trading volume disappeared. The projects either never had a real product or could not sustain interest after the initial hype faded.

Even Pump.fun, which built the most successful on-chain launch platform of the year, saw over 98% of the tokens launched on its platform fail within 24 hours. The platform itself made money, but in most cases, the token holders did not.

This is the tension: on-chain capital formation is incredibly efficient at moving money and distributing ownership quickly. However, it is much less efficient at filtering for quality or ensuring that the projects being funded have any durability.

So why is BitGo going public when it could have raised capital on-chain, possibly faster and with less regulatory friction?

Because custody is not a protocol. It is a fiduciary business that requires balance sheet trust, recurring auditable revenue, and legal recourse if something goes wrong.

Let me break that down.

First, audited financials. BitGo is now required to file quarterly 10-Qs and annual 10-Ks with the SEC, all of which must be audited by a PCAOB-registered firm. This creates a paper trail that institutional investors can rely on. They can see exactly how much money the company is making, where it is coming from, and what the risk exposures are.

On-chain protocols are transparent in a different way. You can see all the transactions on a blockchain, but you cannot necessarily see what is happening inside the company that built the protocol. You do not know if the team is solvent, if they are paying themselves excessive salaries, or if they have undisclosed liabilities. For the kind of institutional allocators BitGo serves, that opacity is a dealbreaker.

Second, regulatory legitimacy. BitGo’s OCC charter gives it federal bank status. That means it is subject to the same supervisory regime as traditional banks, with regular examinations, capital requirements, and consumer protection rules. It also means it can offer services that unregulated protocols cannot, such as acting as a qualified custodian for registered investment advisers.

Tokens do not confer this kind of legitimacy. Even well-designed governance tokens with clear economic rights are still treated skeptically by regulators and institutional investors. The SEC has made it clear that most tokens are securities, meaning they must be registered or sold under an exemption. Even when projects try to comply, the legal uncertainty makes it hard for large allocators to participate.

Third, legal recourse. If BitGo mismanages client funds or violates its fiduciary duty, shareholders and clients have clear legal rights. They can sue. They can demand board changes. They can seek regulatory intervention. The structure of a public company provides accountability mechanisms that go beyond code.

On-chain protocols, for all their transparency, often lack a clear legal entity to hold accountable. If a smart contract fails or a governance vote goes sideways, there is no CEO to sue, and no regulator to appeal to. The code is the law, and if the code does not protect you, you are out of luck.

BitGo could not have solved these problems with a token launch. It needed the IPO because the business it runs requires the full machinery of traditional corporate governance and financial regulation.

The dichotomy of this capital split is about what purpose it serves. The companies going public and the protocols raising on-chain are not competing for the same capital. They are serving different needs at different stages of a company’s life.

A hybrid model is emerging. Projects raise private venture rounds early to build a team, develop a product, and establish some basic governance. Then they do a public token sale to distribute ownership broadly, create liquidity, and activate a community. If the token performs well and the project matures, it might eventually transition to a liquid secondary market or even consider a traditional IPO if it needs access to deeper capital pools.

Jupiter is a good example. The project started as a decentralised exchange aggregator on Solana. It raised private capital (details are not fully public, but the team held 50% of the max supply subject to vesting). Then it did a public token sale in January 2024 using a dynamic liquidity market maker to discover prices without traditional order book volatility. By late 2025, JUP had a market cap of $721 million and was processing $700 million in daily volume. It has stayed on-chain, but used private capital to get started and a public sale to scale.

Berachain took a similar path. It raised private rounds at escalating valuations, from $50 million to $1.5 billion fully diluted. Then it launched with a dual-token model: BERA for staking and trading, BGT for governance. Private investors got tokens with long vesting schedules to prevent immediate dumping, while public participants could earn rewards by providing liquidity. The structure blends traditional venture mechanics with on-chain incentives.

Monad went even further toward compliance. It raised $225 million in a private round at a $3 billion valuation, then announced a public token sale on Coinbase that required full passport-based KYC. The sale price was $0.025 with minimum and maximum investment limits. This looked less like a permissionless ICO and more like a highly regulated public offering, just executed on-chain.

These projects are not choosing between on-chain and off-chain capital. They are using both, in sequence, to optimise for different goals at different stages.

Early private rounds give them the structure, governance, and runway they need to survive. Token sales give them speed, global distribution, and community activation. If they grow large enough, a traditional IPO or public listing might give them access to institutional capital that still will not touch tokens.

So, we are left with an open question.

BitGo’s IPO proves that traditional public markets still matter for certain kinds of businesses. Companies that need fiduciary legitimacy, audited financials, and federal regulatory approval cannot replace those things with a token, no matter how well-designed.

ICOs prove that permissionless, global capital formation is faster, cheaper, and more accessible than anything traditional finance can offer. For protocols, networks, and community-driven projects, on-chain fundraising is not just viable, it is clearly superior.

Do these two systems eventually converge? Is on-chain infrastructure mature enough to replicate the trust and accountability of traditional capital markets, making IPOs obsolete for even custodial and fiduciary businesses?

Or do they remain parallel, each serving a different kind of company and investor?

I do not think we know yet. What we do know is that both are working, and both are attracting real capital. BitGo raised $213 million in a matter of hours after pricing its IPO. Pump.fun raised $1.3 billion on-chain in roughly the same timeframe.

The capital did not choose. It split.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.