Hello,

It’s 2026. We are video-calling people across the world and talking to them with just a second or two of latency, at most. All this at almost zero marginal cost. Yet, when it comes to transferring money across firms, borders, or systems, we still face cut-off times, excessive fees, and rely on settlement windows that are shut on weekends.

Crypto promised to fix that with stablecoins, which have been around for over a decade. Yet, corporations and businesses have not fully embraced stablecoins for money transfers, despite the significant, quantifiable savings they offer.

I wrote about this and how privacy concerns, inherently embedded in public blockchains, become a deterrent here. We also flagged privacy infrastructure as a top crypto theme to watch out for in 2026.

Stablecoin issuer Circle has jumped on the opportunity to address industry demands in privacy and stablecoin infrastructure through its layer-1 blockchain, Arc.

In today’s deep dive, I will tell you why Circle is building an L1 now, what its biggest challenges are, and how the move could change the stablecoin ecosystem.

Onto the story…

Why launch an L1 now?

Currently, the stablecoin issuer business is entirely driven by interest revenue and relies heavily on distribution. This has become clearer with public reporting by the USDC issuer ever since it debuted on the stock markets in June last year.

I wrote in November last year,

In Q3, although USDC’s circulation grew over 100% YoY, reserve income rose only 66% to $711 million. The rest of it was offset by the U.S. Fed cutting interest rates. A 96-basis-point decline in average yield cut Circle’s reserve income by $122 million.

For each dollar of reserve income Circle earned in Q3, it spent over 60 cents on distribution and transaction costs, including wallet integrations, exchange listings, incentive programmes, and revenue shares.

The U.S. Federal Reserve has already started cutting rates. In December 2025, it cut the effective rate by 25 basis points to 3.50%–3.75%. The central bank has also called time on the Quantitative Tightening, effective December 1.

Lately, the U.S. economy has also been signalling to its policymakers that it’s time to soften the stance to address uninspiring data.

The Institute for Supply Management’s manufacturing PMI for December 2025 came in at 47.9 (below 50 indicates contraction), marking the 10th straight month of contraction. The December jobs report is due later today, but data from the past few months has been lacklustre.

When you put all these together, it explains why Circle is desperately pivoting to a new business model. The issuer would like to be less at the mercy of declining interest rates (at least in the short- to medium-term) and simultaneously build a second engine that can rely on a much larger and more diverse distribution.

The Arc Pivot

Arc is the pivot Circle is counting on.

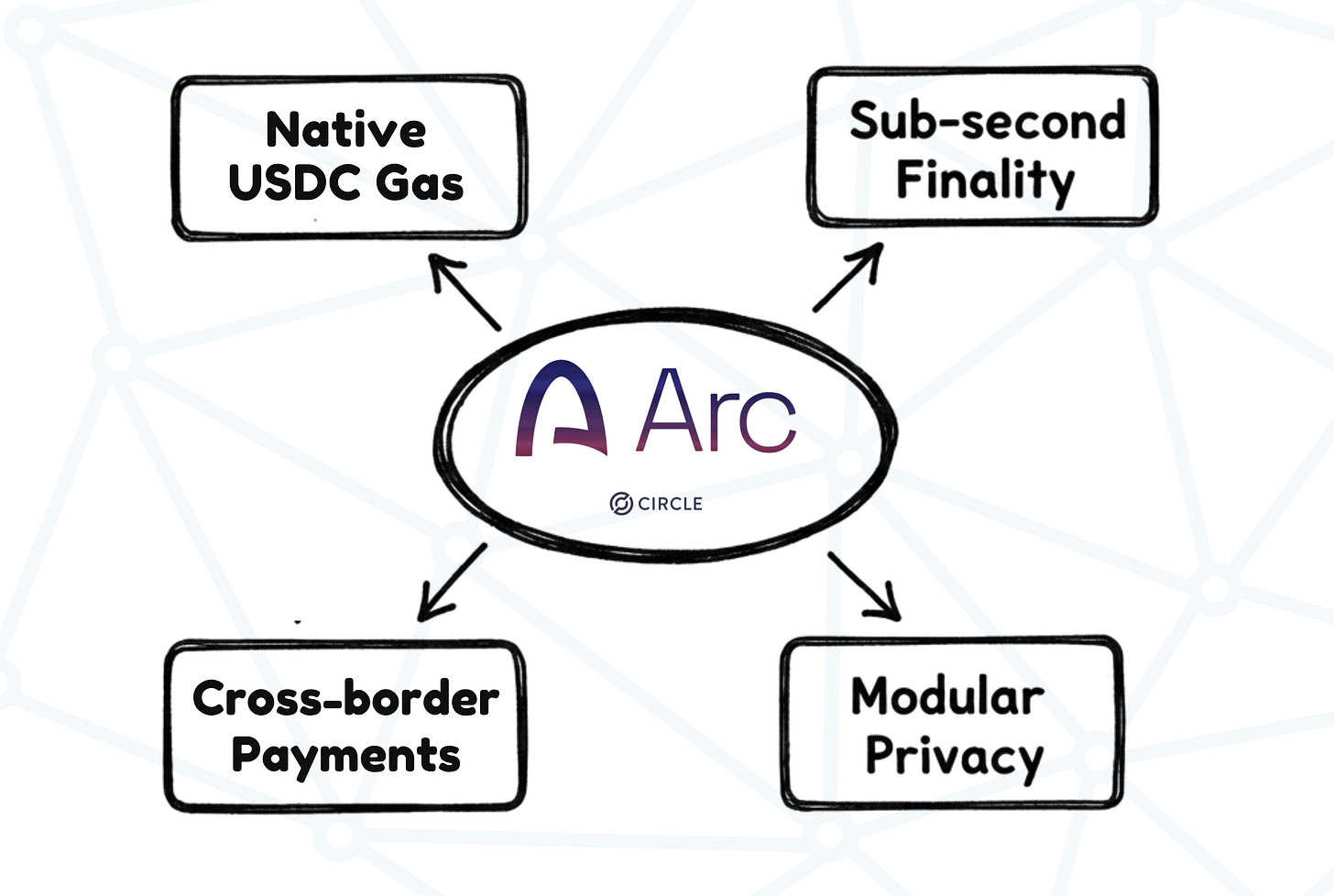

Circle built Arc as an open layer 1 (L1) blockchain, specifically designed to enable cross-border payments between enterprises via stablecoins. It’s also designed to offer sub-second finality and configurable privacy, with an opt-in option, to mask corporations’ confidential payment data.

By transitioning from a stablecoin issuer to a stablecoin settlement stack operator, Circle aims to build its business model by enabling money to move in the way enterprises care about.

In its testnet phase, Circle’s Arc has already partnered with over 100 companies, including legacy finance and tech players such as BlackRock, AWS, HSBC, Standard Chartered and Visa.

Although Arc is still in testnet and will face a barrage of challenges (which I will discuss later) before it can succeed, I find the move interesting given its timing and the problems it aims to solve.

First, collecting gas in the native token. Arc is designed to charge a low, predictable and dollar-denominated transaction fee in USDC. This eliminates the need for corporate treasury teams to hold ETH, SOL, or any other crypto just to pay transaction fees.

Second, Arc offers sub-second finality and a 24/7 open window to settle transactions. Chief financial officers will not care as much about cutting milliseconds as traders do. But they will lose sleep over payments that won’t settle when they hit ‘send’, because of running into a weekend or a cross-border chain of intermediaries.

Third, and possibly the most important, is that Arc offers configurable privacy. By explicitly providing opt-in privacy, it bridges the gap between the built-in transparency of public blockchains and corporate needs to ensure the confidentiality of sensitive information, such as B2B vendor invoices, treasury transfers, and payroll settlements.

What’s most interesting is that none of these features requires stakeholders to engage with crypto ideology. Instead, Arc strips away the aspects of crypto that enterprises dislike, such as absolute transparency, fee volatility, and uncertain settlement, and makes blockchain usable across mainstream businesses.

But couldn’t Circle build these on existing chains? Why build its own blockchain?

Circle has rented real estate all this time. On others’ chains, Circle will be forced to inherit their fee token, fight congestion from other players, follow their governance, and be at the mercy of their outages. It also loses out on an entire revenue stream via collecting fees in USDC. Circle has already been paying distribution costs to grow USDC’s presence across other platforms. By launching its own chain, it wants to own the real estate and earn ‘rent’ for offering its space to all those using its infrastructure.

However, it’s not a free win. Circle’s got competitors breathing down its neck.

On the issuer side, Tether remains the biggest threat, with the highest liquidity worldwide. It also launched USAT, a regulation-friendly stablecoin, to boost its U.S. presence.

Besides issuers, players like Stripe pose a threat by building something similar to what Circle has done with Arc.

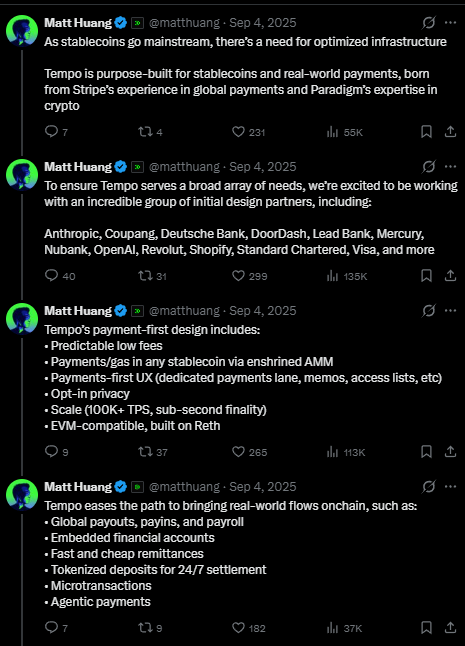

In September 2025, Stripe and Paradigm announced Tempo, a payments-first blockchain built around stablecoins. Tempo’s architecture allows gas payments in any stablecoin and also aims for sub-second finality.

Besides external threats, there’s a lot that could also go wrong with Arc itself.

It could face a cold start in attracting liquidity and developers. Enterprises will not pick Circle’s Arc just because it appears to be the best on paper. Many enterprises already use legacy payment platforms, such as PayPal, and will prefer to use those that already have counterparties and integrations.

Arc’s “configurable privacy” will be a contentious topic. The opt-in feature gives enterprises what they want, but it’s also what will attract regulators’ eyes. Arc will have to convince the market that privacy here means “commercial confidentiality with auditability,” not merely a blind spot that could create new vulnerabilities.

Despite these obstacles, I am optimistic about Circle’s chances for two reasons.

First is its distribution and reputation. Circle doesn’t need to convince the market that USDC is a real dollar token. It’s already embedded in countless exchanges, wallets, fintech flows, and increasingly, institutional pipes. Now that Circle is a publicly listed company, its initiatives appear different from those of any other crypto companies. Its public reputation lends credibility to the products it launches. That also forces Circle to build Arc in a way that can be explained to compliance and treasury teams in boardrooms.

The second is the Circle Payments Network (CPN). Together with Arc, it can enable a network of institutions and payment corridors to execute real-world transactions while operating within a compliance framework.

Arc could still fail. But what choice does it have? With the interest rate-cut era officially here and more cuts likely to follow in the new year, it’s the only reasonable option for an issuer facing fierce competition.

That’s all for this week’s deep dive. I will be back with more soon.

Until then, stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.