Hello,

Digital payments have traditionally been slow and dull.

There were secure messaging networks (SWIFT), clearing systems (ACH, RTGS), and card schemes that moved money in batches, only on business days, using infrastructure that we rarely thought about unless something went wrong. The spreads and fees were the price users paid for not having to worry about the infrastructure.

Blockchains turned that around by bringing the infrastructure to the forefront.

Every stablecoin transfer becomes a ledger entry that is permanently recorded on the public chain. It allows anyone to watch the dollars move in real time, with finality in seconds and fees approaching zero.

On paper, this should mark the end of Wise, Remitly, Payoneer and a big chunk of the correspondent-banking stack that moves money for a not-so-insignificant processing fee. Yet, in reality, they are still around.

Stablecoins are faster and cheaper than the systems they’re “competing” with, yet the people who run payrolls and pay suppliers are sceptical of jumping onto the blockchain route.

In today’s deep dive, I will explain what’s stopping corporations from using blockchains for business use cases, such as paying salaries and making supplier payments, and what could bridge that gap.

Onto the story now,

Prathik

Polymarket: Where Your Predictions Carry Weight

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it. Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

Stablecoin numbers make it evident that the rails are scaling and gaining mass adoption.

Visa’s on-chain analytics dashboard estimates that “adjusted” (filtered to strip out bots and internal DeFi churn) stablecoin transaction volume hit $10.1 trillion in 2025, up more than 75% from the $5.7 trillion in 2024.

The gap between stablecoin transactions and those processed by Visa is shrinking with each passing quarter.

Ethereum currently sits in the middle of this story.

The Layer-1 giant, which currently hosts over half of the stablecoin supply, settled more than $7.8 trillion in “adjusted” stablecoin transactions in 2025. That’s about a third of total adjusted stablecoin transactions across all chains. In 2024, Ethereum settled over $25 trillion across DeFi, stablecoins, DAOs, and emerging categories like AI agents and on-chain identity.

Back-of-the-envelope calculations suggest that stablecoins account for over a third of all value settled on Ethereum’s network.

The chain that launched ICOs and NFTs has now become a digital dollar clearing engine.

But much of the stablecoin movement might be misleading. It could include traders moving collateral between exchanges, DeFi users rotating dollars between wallets on different chains or market makers rebalancing liquidity.

They are all still payments, by definition. Digital dollars make it easy for people around the world to participate in DeFi activities around the clock without worrying about FX spreads or time zone differences. Yet, all this is just one part of the beneficiaries.

Besides DeFi, high-inflation economies and specific remittance corridors can be among the biggest beneficiaries of stablecoin payments. US dollar-pegged stablecoins are more reliable and offer greater flexibility for moving money across the global economy, especially for countries with unstable local currencies and struggling economies.

Think of remittances made by a US company to consultants based in South Asian or South American countries. In these cases, payments made via stablecoins can be a game-changer. Consider sending $1,000 from a US business to a contractor in India.

Traditional remittance platforms charge 10x to 70x more than blockchains to transfer this amount.

If you take the SWIFT route via a traditional bank, it may incur an outgoing wire fee of $15–30. It will also include intermediary-bank handling fees and a 1.5–3% FX margin when the recipient’s bank finally converts USD to Mexican Peso or Indian Rupee.

This is not limited to emerging economies. Even businesses that want to receive payments from their foreign customers will see a credit of $950 or less posted to their bank account for a $1,000 invoice.

In contrast, a USDC or USDT transfer on Ethereum, Solana, or Tron settles the transaction in seconds or a couple of minutes, with a fee of up to 30 cents. Despite this, traditional cross-border platforms still dominate. Why?

Because there is something that matters more than the cost of payments and the speed of transfers.

Public Ledgers and Private Spreadsheets

Traditional payment systems are opaque. A payroll file is visible to HR, finance, the bank, and maybe an auditor. Everyone else just sees the money move in and out.

Public blockchains invert this model. When a US company sends remuneration to its consultants or pays its vendors in Mexico or India via USDC on Solana, anyone with a block explorer can reconstruct details such as salary bands, vendor lists, and material costs.

Addresses can be pseudonymous, but I wrote about how reconstructing patterns is not that difficult with chain-analysis firms selling tools that cluster wallets into entities.

Read: The Privacy Correction 🔐

So, when you ask treasurers why they don’t just plug stablecoins into payroll and vendor payments, you get a consistent answer: “We can’t put our entire internal economics onto a public noticeboard.”

Cheap and instant isn’t enough if the rail is too transparent.

This is why the world needs blockchains and privacy layers that can push stablecoins deeper into businesses’ account divisions.

Payment-Specific Chains

There are protocols that are already building these.

Stable.xyz, an EVM-compatible Layer-1 backed by Tether, allows peer-to-peer transfers with sub-second settlement for institutions and individuals, along with a dedicated blockspace that keeps transactions confidential.

There’s also Circle’s newest network experiment. With Circle Payments Network (CPN), the USDC issuer is looking to build a closed network that connects banks, PSPs, and fintechs through a single API, enabling them to move USDC with near-instant settlement while maintaining onboarding, compliance, and risk management standards comparable to those of traditional finance.

Read: Circle’s Token Bet 🪙

Celo, an Ethereum Layer-2, allows stablecoin transfers at sub-cent fees and roughly 1-second block times. It also offers a mobile-first UX involving phone-number-based addressing. Celo recently added Nightfall, a zero-knowledge privacy layer, enabling enterprises to make private B2B stablecoin payments with amounts and counterparties shielded yet auditable when needed.

Together, these experiments are trying to tackle the same challenge of keeping intact the good parts of public chains, such as global reach, open access and near-instant settlement, while adding confidentiality to sensitive information.

The adoption of these new payment-specific chains is still in an early, messy stage. But the change is underway and visible.

Large financial institutions are jumping on the bandwagon. During its Q3 earnings call, Circle’s top leadership mentioned that CPN has signed up big banks, including Standard Chartered, Deutsche Bank, Société Générale, and Santander, as early partners.

In February 2025, Stripe acquired stablecoin platform, Bridge, for $1.1 billion. The deal will help the financial infrastructure provider offer businesses faster, cheaper global transactions using stablecoins by integrating Bridge’s technology.

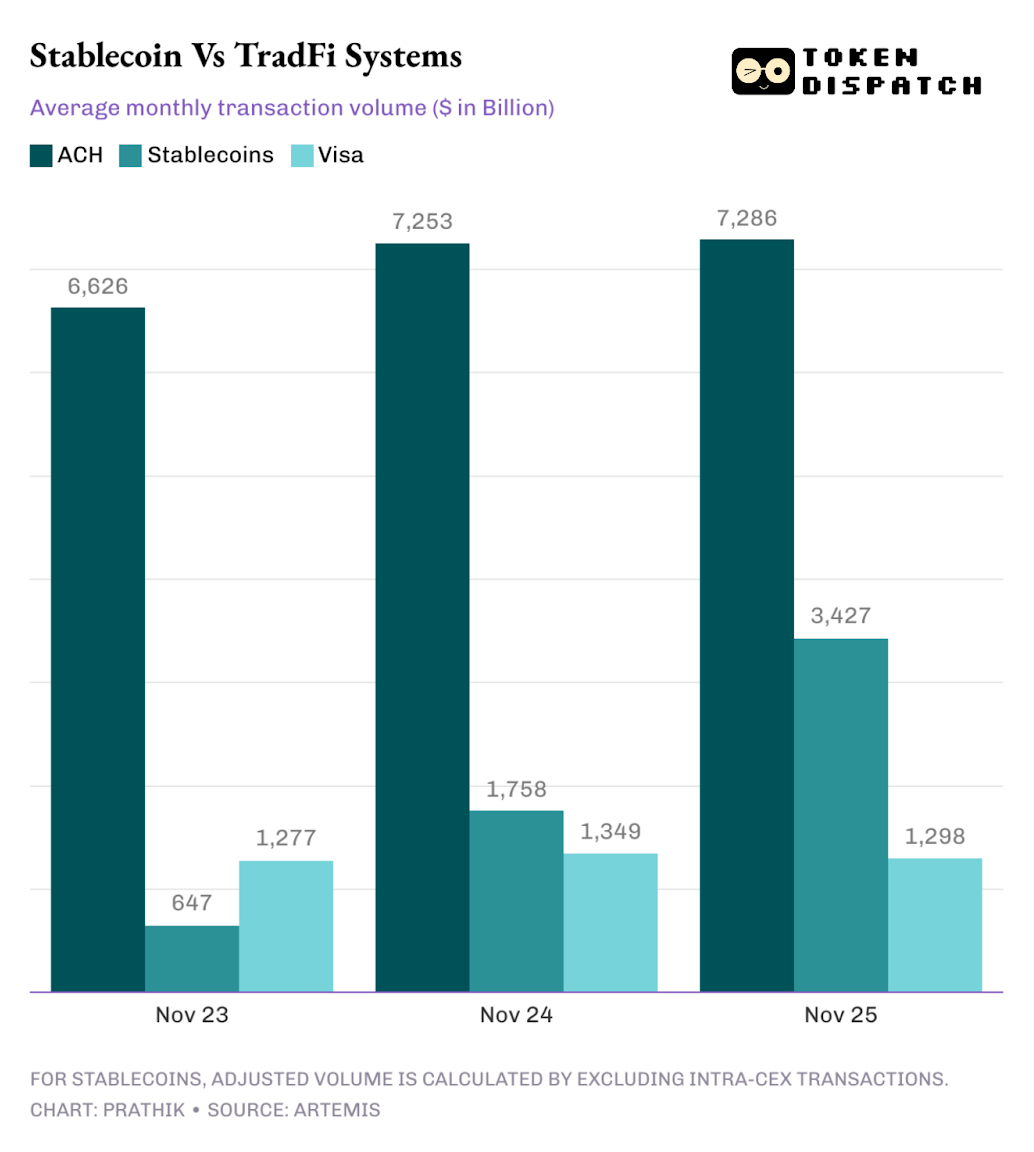

One glance at the Artemis dataset comparing on-chain stablecoin volumes with Visa, the Automated Clearing House (ACH), and other traditional financial systems shows that the gap between them is closing rapidly.

In the last three years, the adjusted stablecoin transactions have gone from trailing Visa to carrying around two-and-a-half times its volume, and from a fraction of the ACH volume to nearly half its size.

The chart clearly indicates that the flip of traditional payment systems by stablecoins will soon be a matter of when, not if.

The interesting development will be how privacy-first, payment-specific chains evolve.

They will have taken a step in the right direction if they can help clear batches of payroll in a business using a single API via stablecoin settlement. They will also have to ensure privacy while still enabling auditors to see what they need to see.

That’s it for today. I’ll see you with the next one.

Until then … stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Prathik, this is the blueprint we've needed—stablecoins hitting $10T adjusted volume in 2025 (Visa 2.5x'd!) shows the rails are ready, but yeah, public ledger transparency turning payroll into a chain-analysis exhibit is the ultimate corporate cockblock. Ethereum settling $7.8T as the stablecoin clearinghouse? Impressive, but without privacy layers like Stable.xyz's confidential txs or Celo's Nightfall ZK shielding, it's like building a Ferrari with glass walls. At 0x_Whale, I've been eyeing how Fusaka's PeerDAS could slash L2 costs to 1¢ while keeping DeFi flows private—pair that with Circle's bank partnerships and Stripe's Bridge grab, and B2B payments finally escape ACH purgatory. Spot-on on the opacity inversion; blockchains flipping the script from black-box banks to glass-box corps is hilarious until it's your vendor list.