Hello

Not too long ago, Circle’s financial fortunes were driven less by crypto cycles and more by the U.S Federal Reserve Chair’s policy decisions. That remains partly true - but it’s starting to change. Each rate hike padded Circle’s margins, but with the caveat of uncertainty about when the Fed will begin cutting rates. The largest U.S.-regulated stablecoin issuer’s topline has been at most a yield proxy on U.S Treasuries.

Now, the inevitable has happened.

That dependence paid handsome dividends when the Fed’s benchmark rate hovered high, but each cut in the rate, as the central bank has begun doing, is pruning Circle’s revenue.

As more rate cuts loom and distribution costs tied to partners weigh heavy, Circle is confronting the limits of a stablecoin business model built on interest income. The company’s answer to this has been an architectural evolution through Arc and the Circle Payments Network (CPN), two systems designed to enable Circle to earn from usage rather than yield.

In this week’s earnings analysis, I dug into Circle’s Q3 earnings call to understand how its leadership team plans to address the challenge posed by its fluctuating income model.

On to the story now,

Prathik

Stable: The Stablecoin Chain for the Real World

If you’re done juggling volatile tokens just to move value, Stable is your platform.

Pay fees in USDT – no extra tokens, no surprises

Free peer-to-peer transfers, sub-second finality

Native USDT settlement + enterprise-grade throughput (10,000+ TPS on roadmap)

EVM compatible so developers already familiar with Ethereum tooling can build faster

Whether you’re a dev, business, or crypto user, Stable gives you rails that actually feel like digital dollars, not blocked rails.

The Limits of Float

Circle’s challenge has never been demand. It is evident from USDC’s supply doubling year-on-year (YoY) to $73.7 billion, giving it nearly 29% of the fiat-backed stablecoin market. The issue is how much it has relied on this to monetise.

For most of 2025, the stablecoin issuer made 4.5 cents on every dollar of fiat currency it held in US Treasuries to back its USDC circulation. This income accounted for over 99% of its total revenue in Q2. That makes every single buck it earns come from parking funds in government treasuries. Steady, but not fixed.

In Q3, although USDC’s circulation grew over 100% YoY, reserve income rose only 66% to $711 million. The rest of it was offset by the U.S. Fed cutting interest rates. A 96-basis-point decline in average yield cut Circle’s reserve income by $122 million.

That’s just one part of the risk. The interest-income-driven revenue model also entails significant costs.

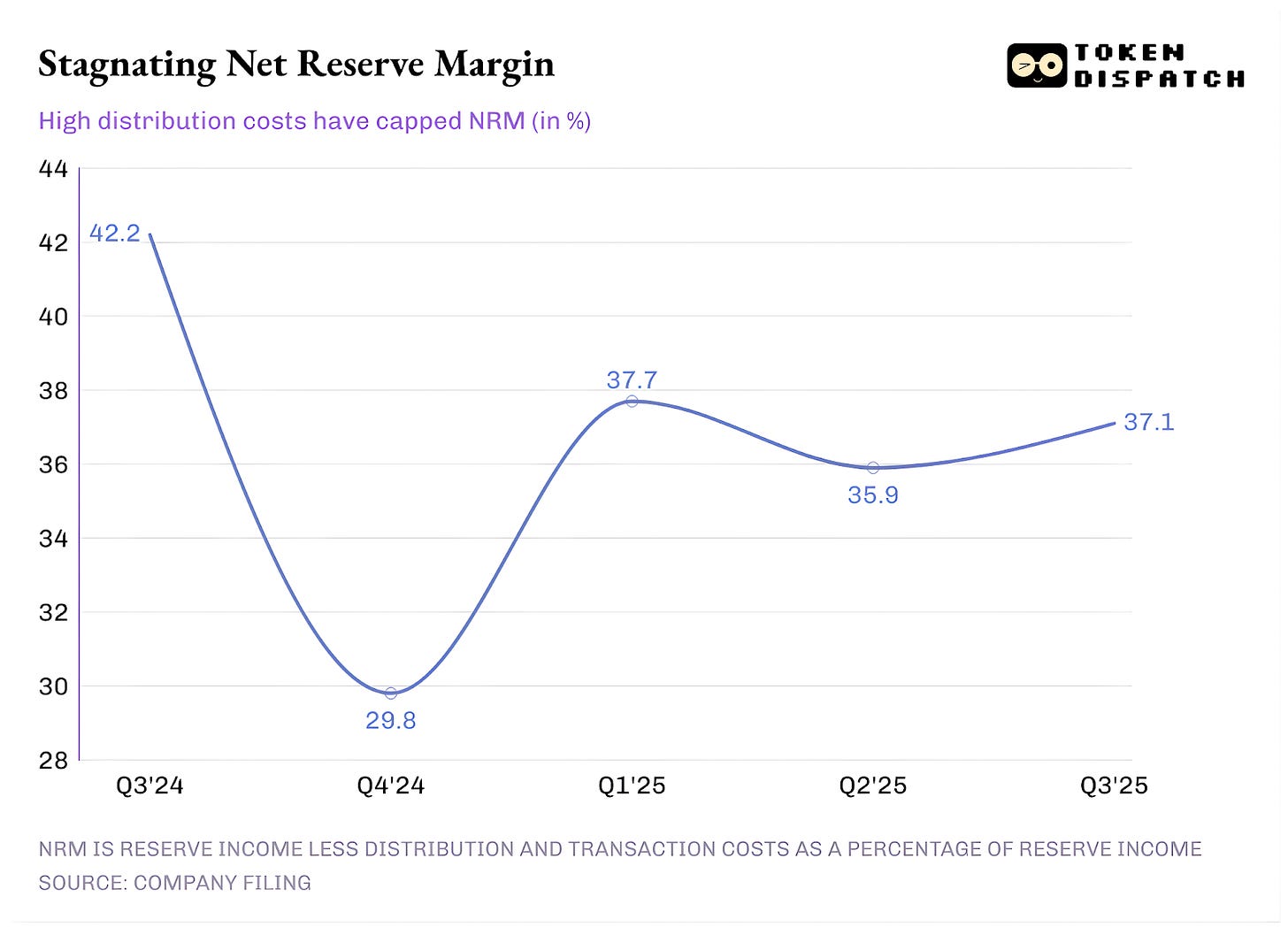

Circle has scaled its market share over the past couple of years through massive distribution. For every dollar of reserve income it earned, it had to burn 60 cents as distribution and transaction costs. That’s the share of revenue it paid to exchanges like Coinbase and other wallet partners that help distribute USDC and increase its circulation.

That’s why the company’s RLDC (total revenue less distribution costs) and Net Reserve (reserve income less distribution costs) Margins have stagnated under 38%, down from 42% a year ago.

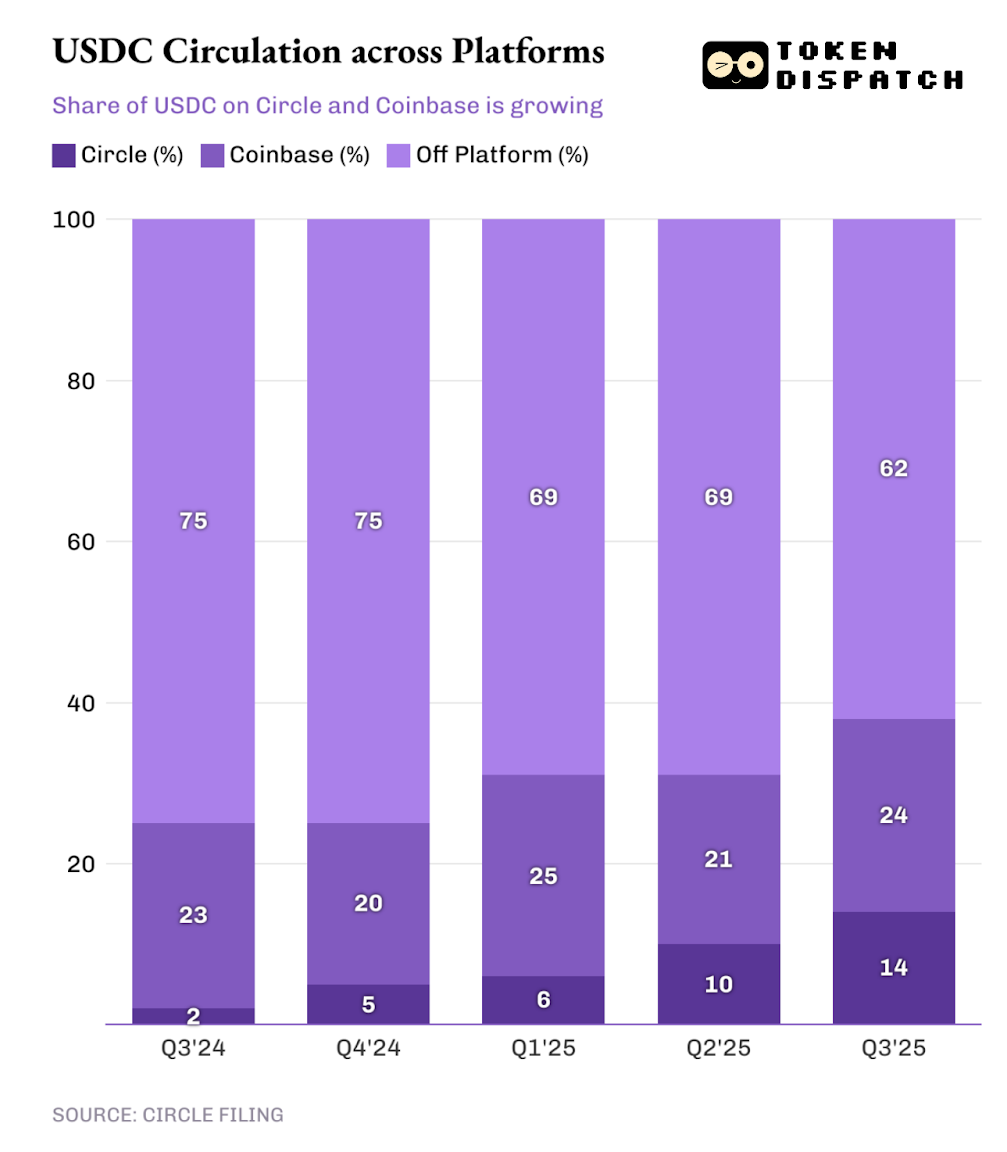

In Q3 2025, Coinbase alone accounted for $358.6 million of the $447.6 million (~80%) in total distribution and transaction payouts.

It is a structural risk to be almost 100% reliant on an income that’s dictated by fluctuating interest rates, and to have over half of the revenue earned paid to a single distribution partner.

The company cannot remain as a perpetual proxy on Treasury bills. It needs to earn from flowing dollars, not just from parked ones.

Enter CPN-Arc architecture.

The Distribution Hedge

The evolution of Circle’s business model starts with the Circle Payments Network (CPN), which connects financial institutions directly to Circle’s settlement rails. The network enables them to mint, redeem, and route USDC across borders without going through an exchange.

Since launching in April, CPN has enrolled 29 institutions, with 55 under review, and a 500-institution pipeline.

How can it turn this into a revenue engine? Each transaction settled through CPN saves Circle a share of revenue that would otherwise go to distributors.

In Q3, the portion of USDC held directly on Circle’s platform rose 4.5 percentage points, a small percentage but significant for margins. Every percentage point shift toward “on-Circle” balances adds to the RLDC margin.

If CPN scales, Circle’s dependency on Coinbase and similar partners will naturally decline.

Yet monetising CPN won’t happen soon, as the company’s spokesperson admitted in the earnings call. For now, Circle wants to build it as an adoption funnel by prioritising reliability and regulatory coverage over collecting fees from its partners. But the reward, if Circle makes this work, is big: control over distribution and data.

Although the company claimed that it is still some time away from monetising CPN, the trajectory becomes clearer when you look at its other projects.

While CPN re-wires settlement, Circle is also rewriting the execution layer by marrying the financial infrastructure as we know it today with on-chain technology using Arc.

The Compute Hedge

Circle describes Arc as a Layer-1 blockchain designed for real-world economic activity.

The public testnet, launched in October with over 100 partners, promises sub-second finality, USDC as gas, and built-in FX functionality, providing a deliberate contrast to general-purpose chains.

I don’t see Arc competing with Ethereum or Solana, but it will tilt control over programmable dollars back into Circle’s hands. On existing chains, Circle pays others’ fees for using the chain. On Arc, it can collect them.

Collectively, CPN and Arc provide Circle with added value. While CPN builds distribution, Arc offers computation. Together, they can internalise both sides of the transaction stack, something that Circle has not ventured into so far.

If Arc succeeds, Circle could capture a fee on every on-chain dollar movement without the baggage of holding customer deposits or securities. It will also optimise capital by generating income while flowing through the DeFi ecosystem rather than earning by simply holding user funds in low-return treasuries.

Even my modest estimates, say 5 bps on $1 trillion in annual settlement volume, could generate $500 million in revenue, enough to offset four times the revenue Circle lost due to a full percentage-point cut in the Fed funds rate in Q3.

But Arc still has no mainnet, no final validator design, and no clear token model. It needs to be able to pull the token economics well for this to make economic sense for its partners.

How will Circle add value to its partners? Enter its native token for Arc.

The Token Fork

Circle’s management is exploring the possibility of a native token on Arc to align network participants. That opens some paths to monetisation.

It could align the incentives for those who run, build on and distribute the network. Arc and CPN are useless if they don’t scale. The myriad partners, including the banking giants, RWA tokenisation pioneers, fintechs, and other collaborators across the stack, will deliver scalability. But they need an economic layer that rewards the institutions and developers driving adoption.

A token could serve this purpose, giving stakeholders a reason to invest in the network.

Circle’s token economics could take many shapes. It could offer benefits or fee discounts to token holders while using Arc. It could incentivise CPN members by rewarding them for routing volume and providing liquidity. It could also allow those operating Arc’s infrastructure to stake the token to secure the network and earn rewards.

This would turn Arc and CPN into a shared economic network rather than a Circle-run system.

The most significant advantage for Circle in this will be that they will not have to change their underlying currency. The economics still flow through USDC, with the fees paid in USDC and platform revenue still fiat-denominated. The token will sit above that as a coordination layer, accelerating adoption and reducing dependence on rate-driven reserve income.

There’s still a lot to lose.

What Could Go Wrong

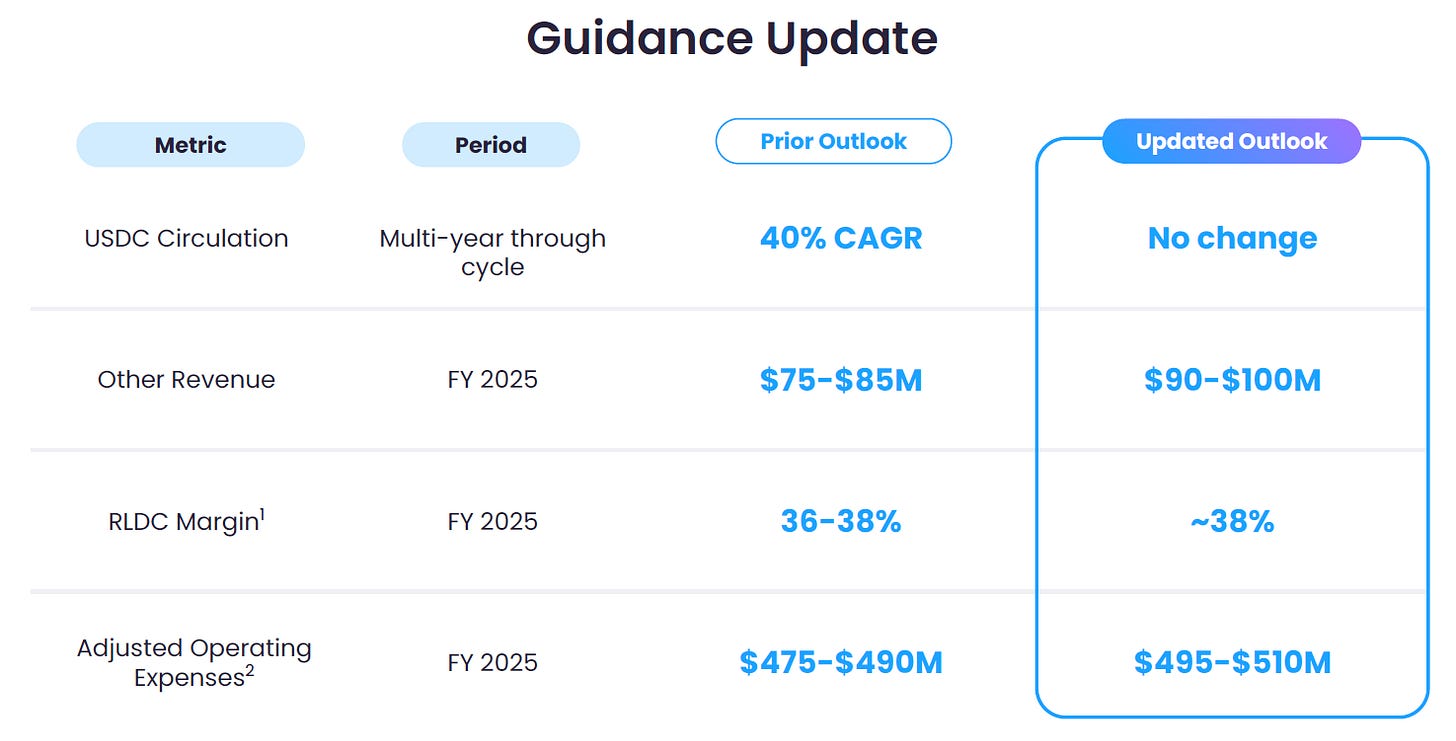

Neither CPN nor Arc is wholly operational yet. Building bank-grade corridors across countries in various continents is expensive and slow. The funding for this expansion could partly explain why Circle has raised its guidance for adjusted operating expenses for FY 2025 from $475-$490 million to $495-$510 million.

This is where Circle walks into a tricky territory.

The nature of the native token will ruffle a few feathers in the public markets. Why would the market approve of or attach value to a native token that captures the value Arc and CPN generate, rather than letting it flow back into Circle’s income statement? Why would Circle’s surplus being used to fund the cost centre that is not expected to plough back profits to the shareholders?

The current shareholders won’t stand for it.

The investors on public market buy CRCL for its reserve income, platform-fee potential and its improving RLDC margin. They will likely not to watch a new asset absorb the upside of infrastructure they’ve financed. If a token captures all the value, equity gets diluted.

How Circle threads this needle will determine whether the market views the token as a coordination tool that boosts CRCL’s earnings, or as a parallel asset that siphons away the value Arc and CPN will create. The broader market may not assign value to a token that competes with the stock.

There could even be regulatory hangovers across geographies that obstruct smooth collaboration between Circle and its partners.

As CPN grows, new partners will demand their own incentives. A rising on-Circle share doesn’t guarantee higher RLDC if Circle must rebate volume.

Reducing dependency on Coinbase, while desirable, will not be easy to achieve, as it remains one of the largest U.S.-regulated crypto exchanges. As a crucial partner, Circle may even risk missing out on the advantages it could gain from Coinbase’s ‘The Everything Exchange’ vision.

Read: The Everything Exchange 💱

If the Fed eases interest rates faster than CPN or Arc monetise, the earnings gap could reopen before the new rails deliver for Circle. However, Circle’s cash balances should provide enough runway to fund the project.

Circle faces the enviable task of mastering token launches. History has shown that the crypto industry scrutinises new token launches, and investor confidence will depend on credible governance.

At the bourses, CRCL’s stock continued to face selling pressure despite reporting better-than-expected earnings. The stock fell over 12% on Wednesday to close at $86.3 apiece, the lowest since it closed at $83.23 on its Nasdaq debut.

Investors should track Circle’s progress over the next two quarters as it builds Arc and CPN into infrastructure rails of the quality that its management claims to deliver.

The key factors to monitor include the number of corridors activated, throughput on CPN, and the on-Circle USDC share.

If Circle successfully launches the Arc mainnet, it will be reflected in the “Other revenue” (non-reserve income) trending upward.

The stakes are high. Should Circle fail, it would allow the largest stablecoin issuer, Tether, to widen the gap at the top with its planned U.S.-regulated stablecoin version.

That’s it for today. I’ll see you with the next one.

Until then … stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

The analogy of Circle transitioning from a treasury proxy to a utlity layer is spot on. What strikes me is the token dilema you raised. If Arc captures value through a seperate token, existing shareholders could push back hard. Curious if theres any precident for how publc companies have managed dual asset structures like this without cannibalizing equity value.