Circle's Wild Ride 🎢

IPO that rocked Wall Street

Hello!

Two weeks ago, Joe Lubin, cofounder of Ethereum and founder and CEO of Consensys, announced his decision to chair SharpLink Gaming's board and lead their $425 million Ethereum treasury strategy.

This adds a new page in the efforts to revive the second largest cryptocurrency, which has remained stuck below $3,000 for over four months.

Check out our Tuesday edition to know more.

Circle went public at $31 per share and immediately sent traditional finance into a frenzy.

The stock hit $133 within days, institutional giants threw hundreds of millions at it, and suddenly everyone's talking about stablecoins like they discovered fire.

It's the moment digital dollars became undeniably mainstream.

Wall Street is currently experiencing what psychologists call "cognitive dissonance" - the uncomfortable feeling when a crypto company behaves like a normal business.

Meanwhile, Circle's CEO is probably wondering why it took everyone else so long to figure out that "park money in Treasury bills and keep the interest" was a viable business model.

Sometimes the most radical thing you can do is be incredibly boring.

All the Web3 Funding Data You Need

Don’t raise funds in the dark — know who’s investing and who’s deploying in Web3. Get clarity with Decentralised.co’s all-in-one Funding Tracker.

Here’s a note on how to use the tracker.

If you are a founder, reach out to us at venture@decentralised.co

The IPO That Broke Wall Street's Brain

Let's start with the numbers as always.

Circle priced at $31 per share on June 5. By June 10, it hit $133. That's a 329% gain in five trading days. To put that in perspective, most stocks consider a 10% move in a year noteworthy.

The IPO was oversubscribed by 25x. Translation: for every share available, 25 investors wanted it. The company raised $1.05 billion, and the market immediately decided that wasn't nearly enough.

Who bought in?

ARK Invest: Cathie Wood threw $373 million at it, making CRCL one of ARKK's top 10 holdings

SBI Holdings: Japan's banking giant dropped $50 million within days of the IPO

Circle's IPO coincided perfectly with Congress debating the GENIUS Act - the first comprehensive stablecoin legislation.

While politicians were writing the rules, investors were betting billions that those rules would be very, very good for Circle.

Circle's Money Machine

Circle's business is beautifully simple once you strip away the crypto jargon.

People give Circle dollars

Circle gives them digital dollars (USDC)

Circle invests those dollars in US Treasuries

Circle keeps the interest

Repeat until rich

The Numbers?

Circle pulled in $1.7 billion in revenue in 2024, with annualised Q1 2025 revenue hitting $2.3 billion (growing 59% year-over-year).

Here's where that money comes from:

Reserve Income: The bulk of their revenue. Circle parks USDC backing in short-term US Treasuries yielding 4-5%. With $61.5 billion in USDC outstanding, that's serious money.

Distribution Costs: The painful part. Circle pays out over half their revenue ($900 million+) to partners like Coinbase who hold USDC on their platforms.

Current Position

USDC market cap: $60 billion (up 92% year-over-year)

Market share: ~25% of total stablecoin supply

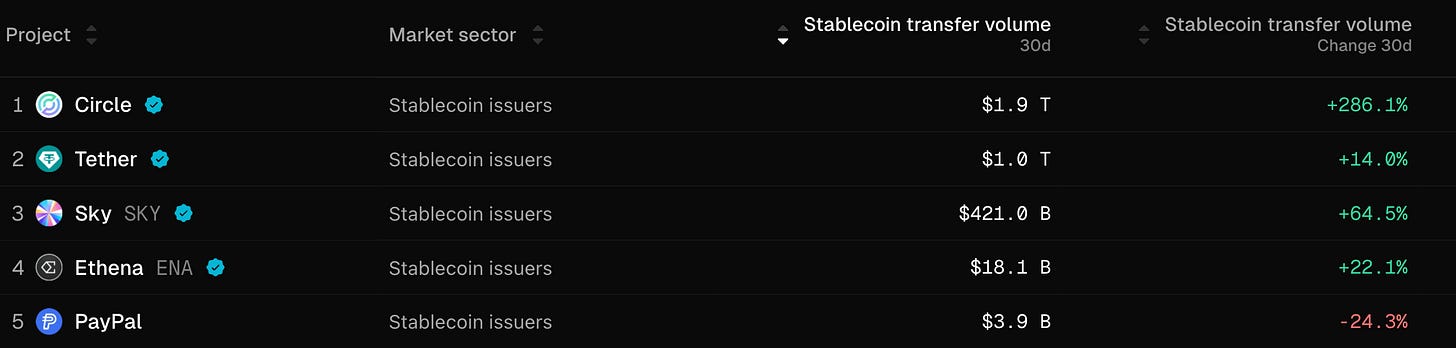

Transfer volume dominance: 53% of all stablecoin transactions (despite having less market cap than Tether)

Circle is giving tough competition to other stablecoin issuers. But is that all?

They're building the infrastructure that could replace correspondent banking for international payments.

The Q1 financials put this in perspective:

Annualised revenue = $2.3B, growing 59% YoY

Annualised gross profit = $932M, growing 46% YoY

Annualised net income = $259M, growing 32% YoY

Why Everyone Suddenly Cares About Digital Dollars

The answer lies in the US economic engine.

Sumanth Neppalli, explains this on Decentralised - Beyond Stablecoins.

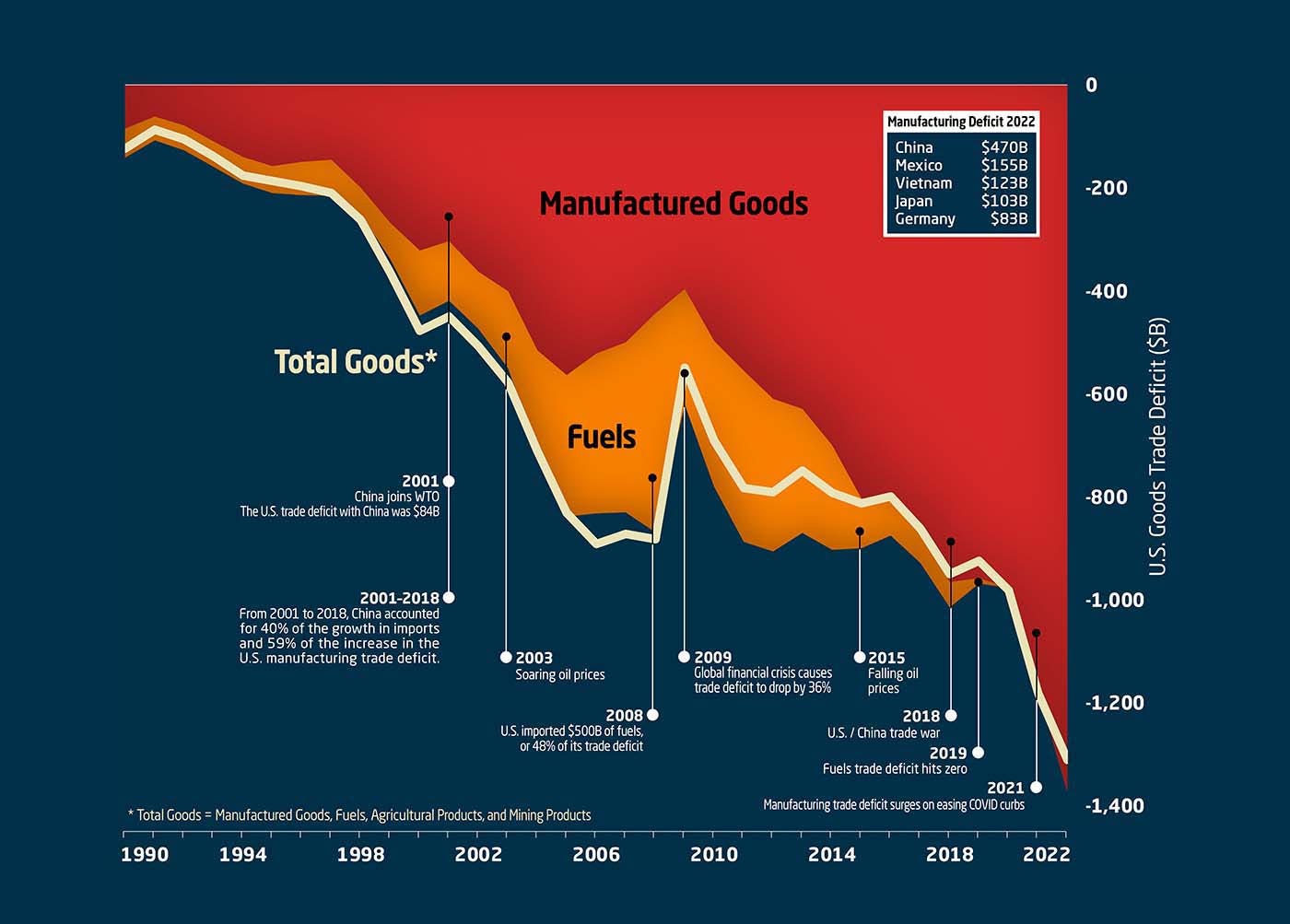

Since the 1990s, America has outsourced production to nations like China, Japan, Germany, and the Gulf states, paying for every container of imports with freshly minted dollars. Since the US imports more than it exports, it runs fat trade deficits. A trade deficit is the gap between what a country buys from the world and what it sells back.

These dollars pose a dilemma for export nations as converting those dollars back to local currency would drive exchange rates higher, gut competitiveness and undercut their own exports. Instead, the central bank scoops up dollars and reinvests them in Treasuries, recycling the cash without rocking the forex market. This also gives these banks the T-bill yield with virtually the same credit risk as holding idle dollars.

These incentives create a nice self-reinforcing loop. Ship stuff to the U.S., earn in dollars and park them in Treasuries to earn interest. Keep the home currency weak so you keep selling more.

This vendor-financing loop with exporters has accounted for roughly a quarter of Washington’s $36 trillion debt stock, locking in key advantages. Break that loop through a protracted trade war, and Washington’s cheapest source of funding starts to dry up.

Traditional Treasury buyers are getting nervous. China's reducing its holdings, yields are rising, and America needs new buyers for all that debt.

Enter stablecoins.

The GENIUS Act forces stablecoin issuers to back their tokens with US Treasuries. If stablecoins grow to $2 trillion by 2028 (Treasury's own projection), and 80% goes into Treasuries, that's $1.6 trillion in new demand.

Circle alone, with $60 billion in USDC, already holds more Treasuries than many small countries.

Real Usage is Exploding

Despite skeptics calling stablecoins "just for trading," actual payment usage is growing fast.

$72.3 billion in real stablecoin payments annually (88% growth)

B2B payments: $36 billion annualised, up 315% year-over-year

Global reach: USA, Singapore, Hong Kong, Japan, and UK are top sending countries

Tether dominates the actual payments (86% market share), but Circle owns the regulated, institutional-friendly space that Wall Street understands.

The Tokenisation Wave

Stablecoins are just the beginning.

Once cash is tokenised, everything else follows.

24/7 settlement instead of T+2

Programmable money with built-in compliance

Composability (your Treasury bond can be collateral for three different loans simultaneously)

Transparency (regulators can see systemic risk in real-time)

BlackRock's Larry Fink wasn't joking when he said "every asset will be tokenised." Circle is building the rails for that future.

How Circle Built a Golden Cage

Here's the uncomfortable truth about Circle's business: they're massively dependent on Coinbase, and that dependency is getting more expensive every day.

The Revenue Split Reality

Of Circle's $1.7 billion in 2024 revenue, over $900 million goes straight to Coinbase and other distribution partners. That's more than half their total revenue.

Under their current agreement

Revenue gets split based on how much USDC each platform holds

Interest income from off-platform USDC (like DeFi wallets) gets split 50/50

The more USDC sits on Coinbase, the more Circle pays them

Read: Coinbase v Ripple: The Battle for Circle 🥊

The Growing Dependency

The relationship is getting more lopsided by the quarter.

2022: 5% of USDC held on Coinbase

2023: 12% of USDC held on Coinbase

2024: 20% of USDC held on Coinbase

March 2025: 25% of USDC held on Coinbase

As one banking source told Fortune: "I feel like they're one company."

Why This Matters

Circle's distribution costs are expected to grow from 60% to 70% of revenue by 2029. That's the price of success in a world where Coinbase controls the on-ramps.

Coinbase, meanwhile, sees USDC as 50% of their residual payment income. It's become core to their business model, not just a nice-to-have.

The Strategic Implications

This is why the acquisition rumours make perfect sense.

Coinbase's perspective: Eliminate $900 million in annual payments and gain full control over USDC infrastructure

Ripple's desperation: Their RLUSD stablecoin has $310 million market cap vs USDC's $61.5 billion. Buying Circle is easier than competing

Circle's dilemma: Go public and maintain independence while paying increasing distribution costs, or sell and lose control

Ryan Yi, a former Coinbase Ventures employee, publicly argued Coinbase should just buy Circle for $5 billion. His logic: capture all the revenue currently being split, and control the entire stablecoin stack.

The fact that he felt comfortable making this case publicly suggests the acquisition discussions aren't hypothetical.

Token Dispatch View 🔍

We have an AWS analogy.

Just like Amazon's cloud infrastructure powers half the internet, Circle's stablecoin infrastructure could power global digital payments. Every payment app, every DeFi protocol, every corporate treasury that wants to move money 24/7 - they all need stablecoin rails.

The network effects are powerful: more USDC usage → more institutional trust → more regulatory acceptance → more USDC usage.

Let's talk about where this could go if everything breaks Circle's way.

Base Case Assumptions (Artemis Research)

Total stablecoin market grows to $1 trillion by 2030

USDC grows market share from 24% to 28%

USDC supply reaches $240 billion (4x current levels)

Fed funds rate stabilises around 3%

Distribution costs grow to 67% of revenue

Result: $19 billion market cap, 22.4% IRR over three years. Not bad for a "risky crypto stock."

Bull Case Assumptions

Stablecoin market hits $1 trillion faster (by 2028)

USDC maintains current usage dominance

Fed keeps rates higher for longer

Circle develops additional revenue streams beyond reserve income

Result: $30 billion market cap, making Circle worth more than many traditional banks.

Strip away the billion-dollar headlines and complex deal structures, and Circle's story reveals something profound about crypto's evolution: we're watching the battle to become the AWS of digital money.

The irony is stark. An industry built on decentralisation is consolidating around the very infrastructure that was supposed to eliminate intermediaries. Circle's regulatory compliance and institutional relationships have created exactly the kind of moats that crypto was designed to disrupt.

But crypto's maturation was always going to involve compromise between idealistic visions and practical realities. The question is whether consolidation happens around the right players with the right values.

Three Scenarios for Circle

Independent Public Company: Circle maintains its IPO trajectory, uses public market capital to expand globally, and becomes the neutral infrastructure provider for digital payments. Best case for competition and innovation.

Coinbase Acquisition: Circle gets absorbed into the Coinbase ecosystem, creating a vertically integrated crypto financial services giant. Efficient but potentially monopolistic.

Ripple's Hail Mary: Ripple overpays for Circle in a desperate attempt to stay relevant, potentially destroying value for shareholders but creating interesting competitive dynamics.

The Bigger Picture

Circle's success validates the thesis that profitable crypto companies can succeed as independent public entities. The regulatory timing - Trump's crypto-friendly policies coinciding with institutional adoption - creates a once-in-a-decade window.

Five years ago, this IPO would have faced regulatory hostility. Five years from now, the market might be too mature for these kinds of transformative opportunities.

Circle holds all the cards, but choosing wrong could reshape how money moves for the next decade.

See ya, next Sunday.

Until then … stay curious,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.