Hello, dispatchers. Happy Saturday!

When Ripple first offered Circle $4-5 billion back in April, most dismissed it as another crypto M&A (merger and acquisition) rumour. Those same whispers have turned into a full-blown bidding war this week, with reports suggesting Ripple's offer has ballooned to $9-11 billion.

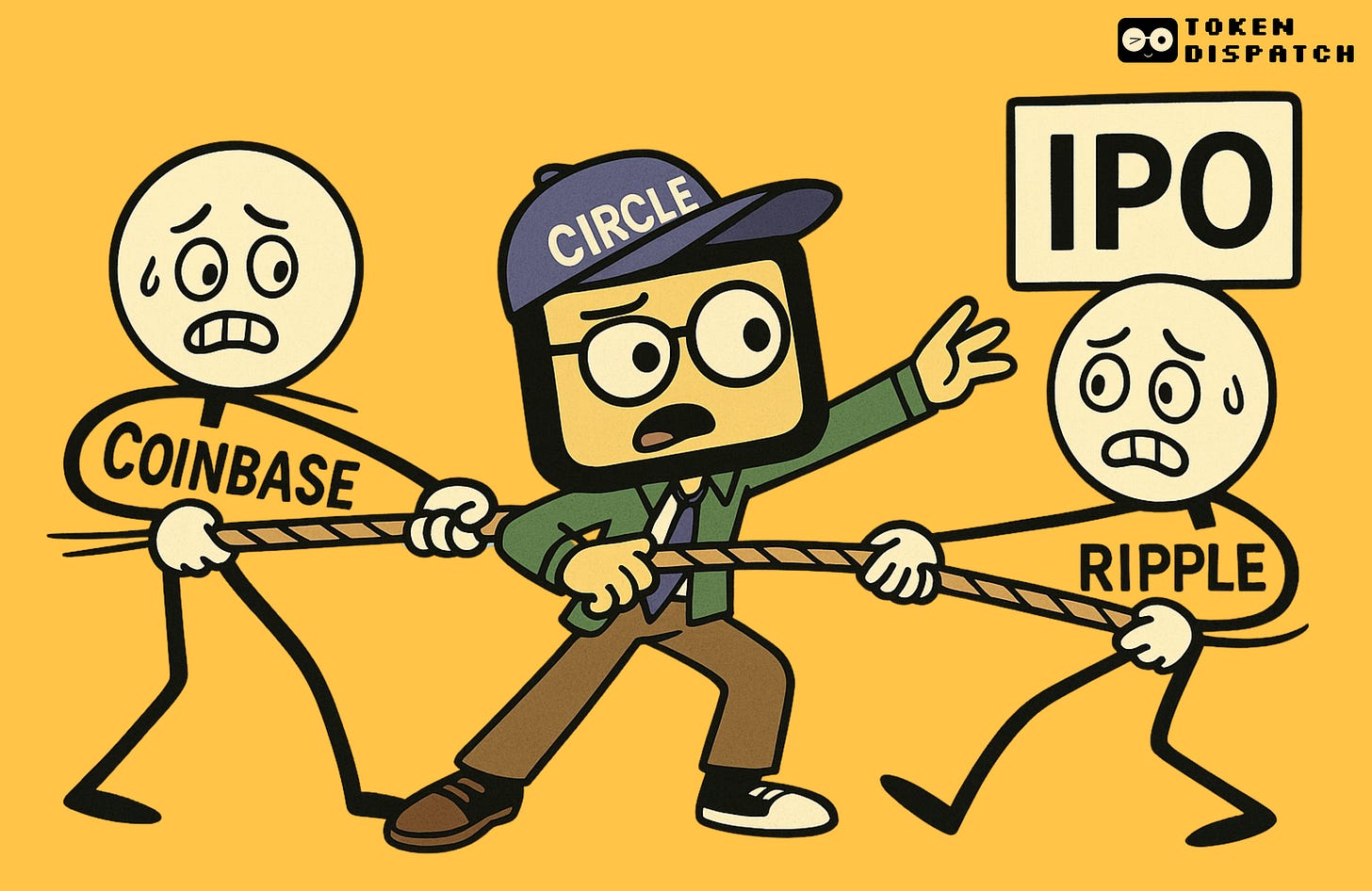

This is the battle for who controls the infrastructure of digital money itself.

Circle, the issuer of USDC, suddenly finds itself at the centre of a three-way tug-of-war. Coinbase, its longtime partner and distributor, wants to bring it fully in-house. Ripple, desperate to stay relevant in a stablecoin-dominated world, is throwing its war chest at the problem. And Circle? They filed for an IPO in April, eyeing a $5+ billion public debut.

With stablecoin markets projected to grow 10x to $2 trillion by 2028 and the Trump administration rolling out crypto-friendly policies, whoever wins this fight doesn't just get a company, they get to shape how the next billion users interact with digital dollars.

Find the Right Ledger Hardware Wallet for You

Crypto security made easy. Owning Ledger crypto wallets is the easiest and safest way to secure crypto, digital assets, and your peace of mind.

Why Chase Circle?

While Tether is the largest stablecoin issuer, Circle remains the gatekeeper to the regulated stablecoin world because of the former’s regulatory controversies.

Read: Circle Moving Fast in Stablecoin Race 🏃🏼

USDC is fast becoming the institutional favourite.

Circle pulled in $1.7 billion in revenue last year, with 85% of USDC reserves managed by the world’s largest asset manager BlackRock.

Yet Circle has a problem: it's uncomfortably dependent on Coinbase. Of that $1.7 billion revenue, $900 million, more than half, goes to Coinbase in distribution costs. It's a sweetheart deal that has made Coinbase indispensable to Circle's business model.

Now Circle faces a choice: sell to Coinbase and cement that relationship; take Ripple's cash and break free; or go public and maintain independence while navigating market volatility.

What’s in it for Coinbase and Ripple?

Got questions about a hot crypto topic that you want help understanding? Ask your question using the form and our crypto experts may answer it along with your name in the next Thursday’s News Rollups.

Coinbase: The Inside Track

If anyone has the inside track on acquiring Circle, it's Coinbase. The relationship runs deep. They launched the Centre Consortium together in 2018 to manage USDC.

That arrangement has only gotten more valuable. Coinbase's USDC-related income has now touched 50% of the residual payment base.

Meaning? The greater the proportion of USDC in circulation held on Coinbase’s platform, the greater the proportion of income payable to the crypto exchange for preferring to choose USDC for its transactions.

"I feel like they're one company," one banking source told Fortune. Precisely why Coinbase acquisition makes so much sense.

The deal could eliminate more than $900 million in annual distribution costs for Circle and turn them into pure profits for Coinbase. All this while gaining full control over the infrastructure that powers their trading pairs and institutional services.

Coinbase also recently joined the S&P 500 and made a $2.9 billion deal to acquire Deribit — a signal that they're evolving from a crypto exchange into a full-fledged financial services company. Owning USDC infrastructure accelerates that transformation. They become the company that powers digital commerce.

Get 17% discount on our annual plans and access our weekly premium features (Mempool, Game On, News Rollups, HashedIn, Wormhole and Rabbit hole) and subscribers only posts. Also, show us some love on Twitter and Telegram.

Ripple: The Desperate Disruptor

For Ripple, this deal is more about survival.

Remember when XRP was supposed to revolutionise cross-border payments? When banks were going to use it as a bridge currency to move money faster and cheaper? That vision has been systematically dismantled by stablecoins, which do everything XRP promised but better.

Ripple's own stablecoin, RLUSD, launched earlier this year with great fanfare yet sits at just $310 million in market cap. Compare that to USDC's $61 billion, and you see the scale of Ripple's problem.

Starting from scratch against that momentum is going to be a herculean task. "If you can't beat them, buy them,” goes the saying. Ripple understands this, which is why they're reportedly willing to throw everything at Circle.

It would be interesting to see if Circle wants to bet its future on a company that's been playing catch-up for years and has seen some new found energy after its CEO Brad Garlinghouse’s recent lobbying efforts at the White House.

Read: Brad Garlinghouse: The Power Broker ✊

Broader Implications

This is happening in the middle of crypto's busy consolidation wave.

Coinbase’s Deribit deal, Kraken’s NinjaTrader acquisition and Ripple’s Hidden Road buyout all point to a pattern: successful crypto companies are buying their way into adjacent markets rather than building from scratch. It's faster, less risky, and more capital-efficient.

Circle’s acquisition falls in this category — an infrastructure company that everyone needs but no one can easily replicate.

If Coinbase wins, they control both the exchange infrastructure and the money that flows through it.

If Ripple wins, they instantly become relevant again in a market they've been losing to for years.

If Circle goes public independently, it validates the IPO path for other crypto companies while maintaining competitive balance in the stablecoin market.

Token Dispatch View 🔍

Whoever manages to win this battle, they gain control over the rails that power their institutional services, trading pairs, and future products.

Strip away the billion-dollar headlines and complex deal structures, and this story reveals a truth about crypto's evolution: we're watching the battle to become the AWS of digital money.

The winner gets a profitable company and, more importantly, get to shape how money moves in an increasingly digital world.

The irony is stark. An industry built on decentralisation is consolidating around the very infrastructure that was supposed to eliminate intermediaries. Circle's regulatory compliance and institutional relationships have created exactly the kind of moats that crypto was designed to disrupt.

But crypto's maturation was always going to involve compromise between idealistic visions and practical realities. What will be important to note is if the consolidation happens around the right players with the right values.

Ripple's desperation bid represents crypto's past: a company trying to remain relevant in a market that's evolved beyond its original vision (think of the growing relevance of stablecoins). Coinbase's natural acquisition represents crypto's present: the incumbent leveraging existing relationships to maintain dominance. Circle's IPO option represents crypto's future: the possibility that profitable crypto companies can succeed as independent public entities.

The regulatory timing makes this a once-in-a-decade opportunity. Trump's crypto-friendly policies have opened the door for stablecoin consolidation just as institutional adoption is accelerating. Five years ago, this deal would have faced regulatory hostility. Five years from now, the market might be too mature for these kinds of transformative acquisitions.

Circle holds all the cards, but choosing wrong could reshape crypto forever.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.