Hello,

I like crypto’s seasonal traditions. Uptober. Recktober. People in the community throw a lot of stats around these events. And humans love trivia, don’t they?

The trend stories and reports around them are even more interesting: ‘this time, the ETF flows are different’; ‘crypto funding has finally matured this year’; ‘BTC is ready for a rally this year’, and many more. Recently, while going through one such report, ‘State of DeFi 2025’, some charts on how crypto protocols have been generating “serious revenue” caught my attention.

These charts show the dominant protocols across crypto that generated the most revenue during the year. They stand as testimony to one fact many in the industry have discussed over the last year: crypto has finally begun to find revenue sexy. But what’s shaping this revenue?

Implicit in these charts was also another, lesser-known story to chase. Where are these fees going?

Last week, I dug into DefiLlama’s fee and revenue data (revenue being fees retained after paying liquidity providers and suppliers) to find answers.

In today’s quantitative analysis, I attempt to add nuance to these numbers and show how and where money flows in crypto.

Onto the story,

Prathik

Crypto protocols generated over $16 billion in revenue last year, more than double the approximately $8 billion in 2024.

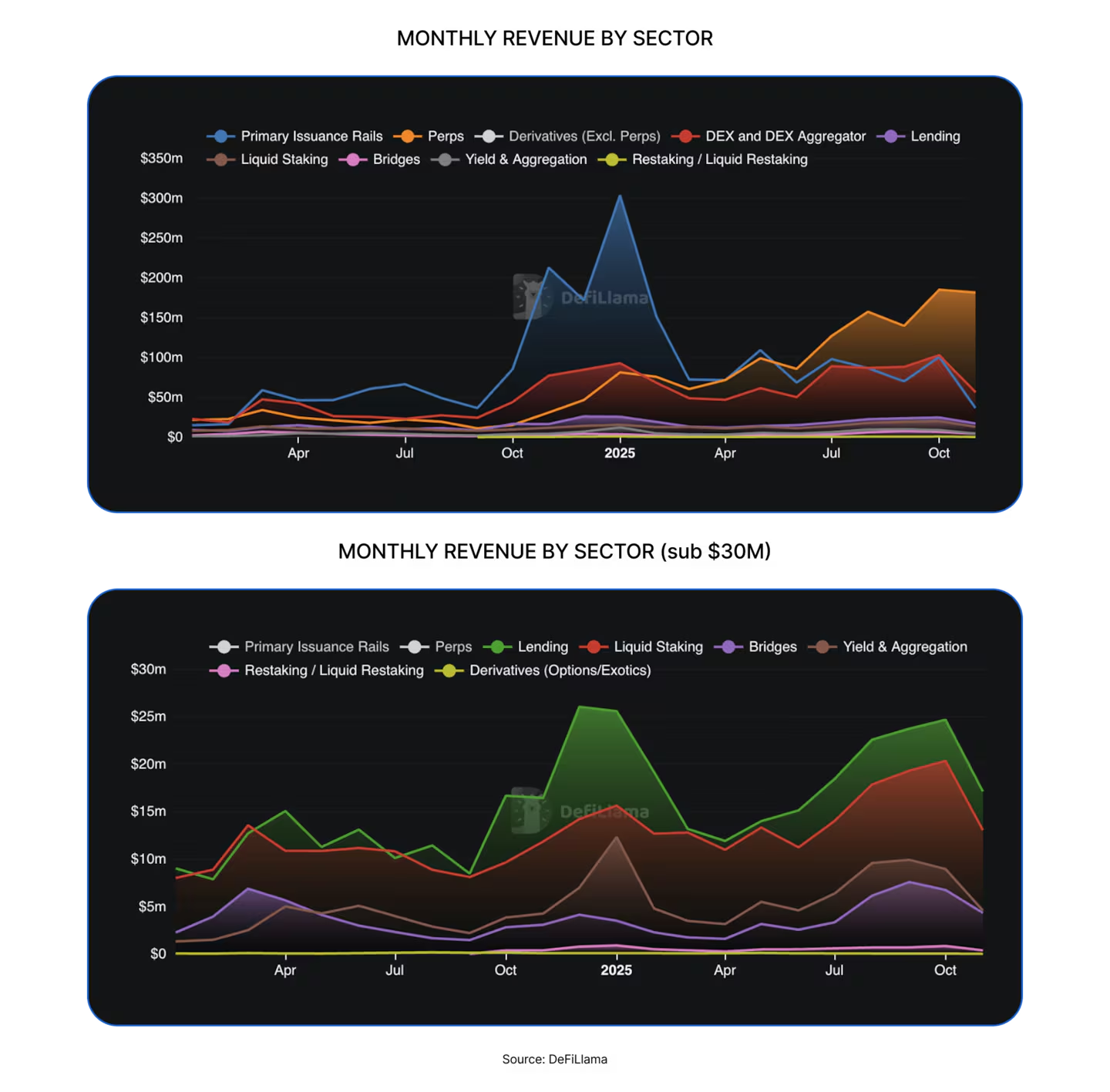

Value capture expanded across the crypto industry, with many new categories emerging in decentralised finance (DeFi) over the last 12 months, such as decentralised exchanges (DEXs), token launchpads, and perpetual DEXs.

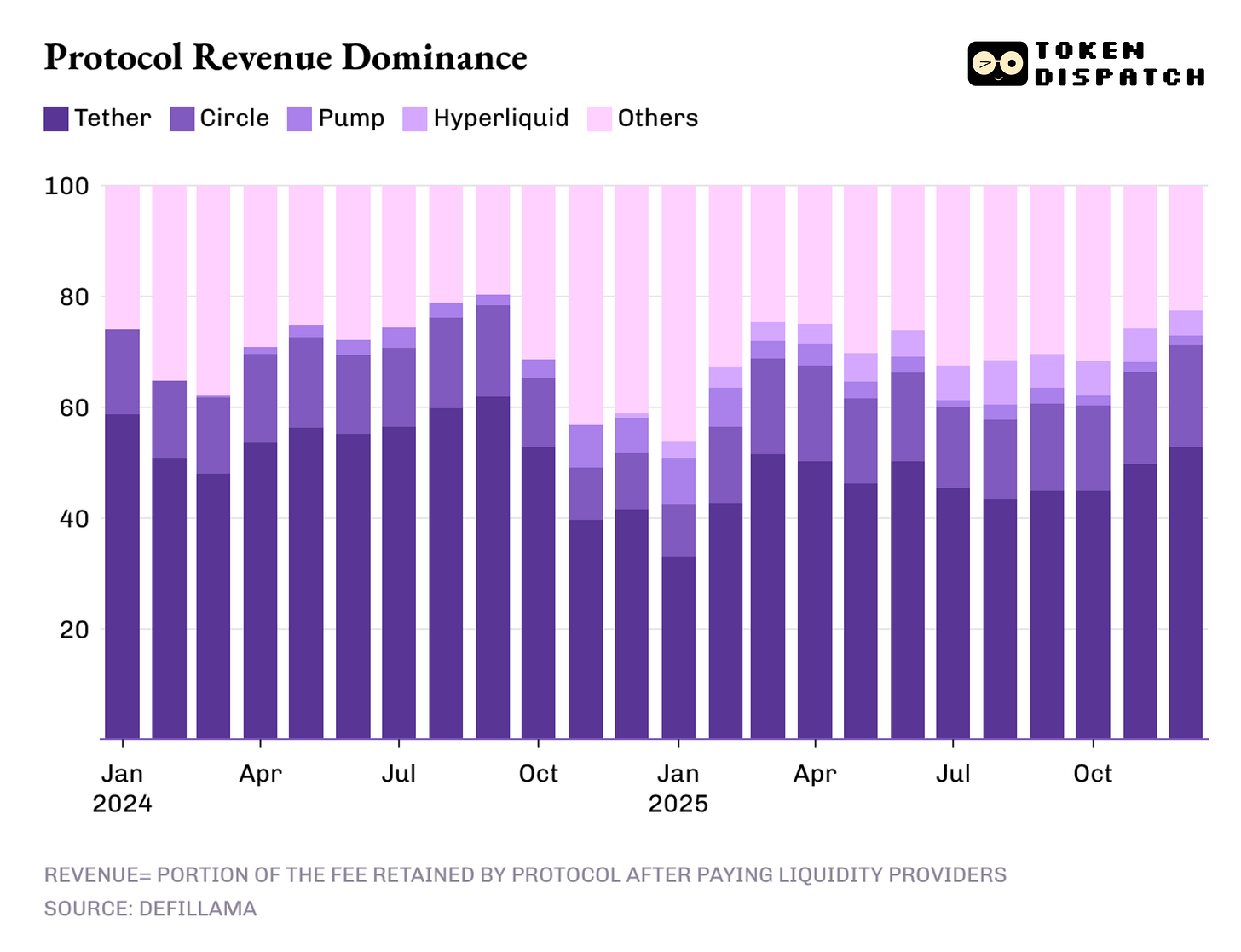

Yet the profit centres that generated the highest revenue remained concentrated in older categories—most notably stablecoin issuers.

The top two stablecoin issuers, Tether and Circle, accounted for over 60% of all revenue generated in crypto throughout the year. In 2025, their share dipped only marginally to 60% from about 65% the previous year.

But what the perpetual DEXs— barely present in 2024, achieved in 2025, cannot be underestimated. Hyperliquid, EdgeX, Lighter, and Axiom collectively accounted for 7-8% of the industry’s total revenue, far more than the combined share of protocols in established DeFi categories such as lending, staking, bridges, and DEX aggregators.

So what could drive revenue in 2026? I find the answer in the same three factors that influenced revenue concentration in crypto last year: carry, execution, and distribution.

The carry trade means that whoever holds and moves money earns a return on holding and moving that money.

Stablecoin issuers’ revenue models are both structural and fragile. Structural, because they scale with supply and circulation. Each digital dollar they hold is backed by Treasuries, which earn interest. Fragile, because the model depends on a macroeconomic variable over which issuers have little control: the Fed’s interest rate. And the easing phase has just begun. As rates fall further this year, so will the revenue dominance of stablecoin issuers.

Then comes the execution layer. This is where DeFi protocols built perp DEXs, 2025’s most successful DeFi category.

The simplest way to understand how perp DEXs grabbed meaningful shares so quickly is to look at how they help their users execute actions. They built venues that helped users get in and out of risk on demand, with minimal friction. Even when the markets aren’t moving much, someone can still hedge, have some leverage, score arbitrage, rotate funds or simply research and place positions for the future.

They allow users to execute continuous, high-frequency trades without the inconvenience of moving the underlying asset, unlike spot DEXs.

Although the execution part sounds simple and is lightning fast, there’s so much more than what meets the eye. These perp DEXs must build a robust trading interface that doesn’t crack under load, host a matching and liquidation system that can hold the ground amid chaos, and provide sufficient liquidity depth to keep traders busy. In perpetual DEXs, liquidity is the secret sauce. Whoever offers constant and ample liquidity attracts the highest trading activity.

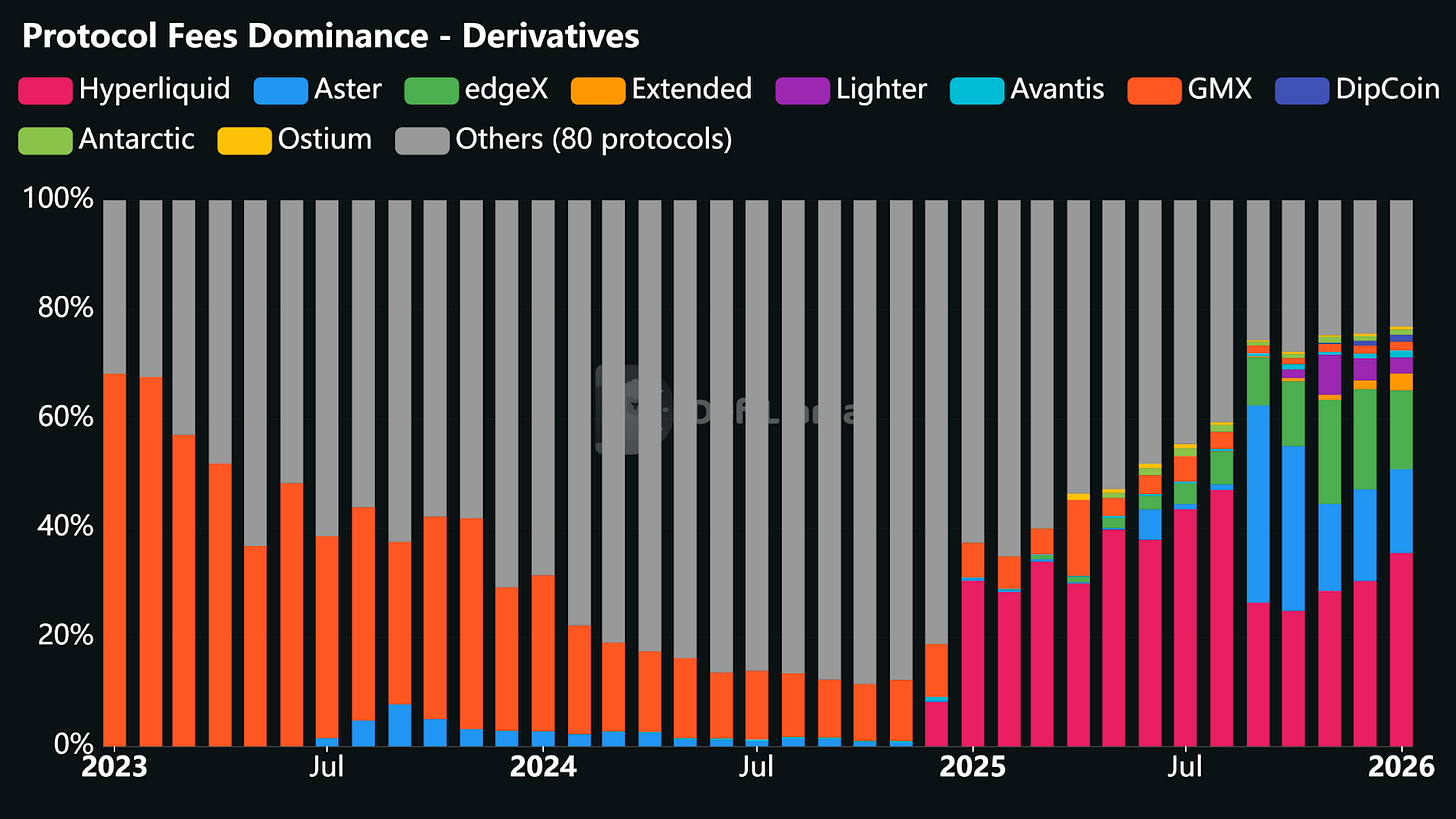

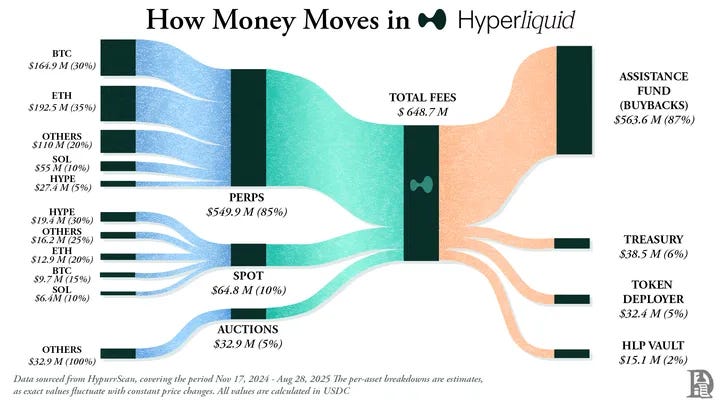

In 2025, Hyperliquid dominated the perp DEX space by offering ample liquidity enabled by the largest number of market makers on the platform. As a result, Hyperliquid was the most dominant perp dex in terms of fee collection in 10 out of the 12 months last year.

Ironically, even these DeFi category perp DEXs clicked because they didn’t expect traders to understand blockchain and smart contracts, and instead functioned like familiar, traditional exchanges.

Once all the above are taken care of, exchanges generate revenue on autopilot by charging marginal fees on traders’ high-frequency, high-volume trading activity. And this goes on even when spot prices are moving sideways, simply because of the range of options available to traders on the platforms.

This is precisely why I find perps DEXs, despite having single-digit revenue dominance last year, to be the only category that could even remotely challenge stablecoin issuers’ dominance.

The third factor, distribution, drives incremental revenue in crypto projects, such as token issuance infrastructure. Think pump.fun and LetsBonk. It’s not very different from what we see in Web2 companies. Although Airbnb and Amazon don’t own any of their inventory, their massive distribution play has helped them transcend their roles as aggregators and reduce the marginal cost of adding more supply.

Crypto issuance infrastructure also doesn’t own the crypto assets, such as memecoins, tokens and micro communities, created via its platform. Yet by making the user journey frictionless, automating the listing process, providing ample liquidity, and simplifying trading, it can become the default venue for people looking to create crypto assets.

In 2026, two questions may decide the trajectory of these revenue drivers: Will the stablecoin share of industry revenue slip from the 60% zone as rate cuts bite into the carry trade? Will perp venues push beyond their 7-8% foothold as execution consolidates?

Turning Revenue into Ownership

All three factors – carry, execution, and distribution – show how crypto revenue arises. But that’s just one part of the story. It is equally, if not more, important to understand what share of the gross fee is distributed to tokenholders before the net revenue is retained by the protocols.

Value transfer via token buybacks, token burns, and fee-sharing signifies that a token is an economic claim on ownership, rather than merely a governance badge.

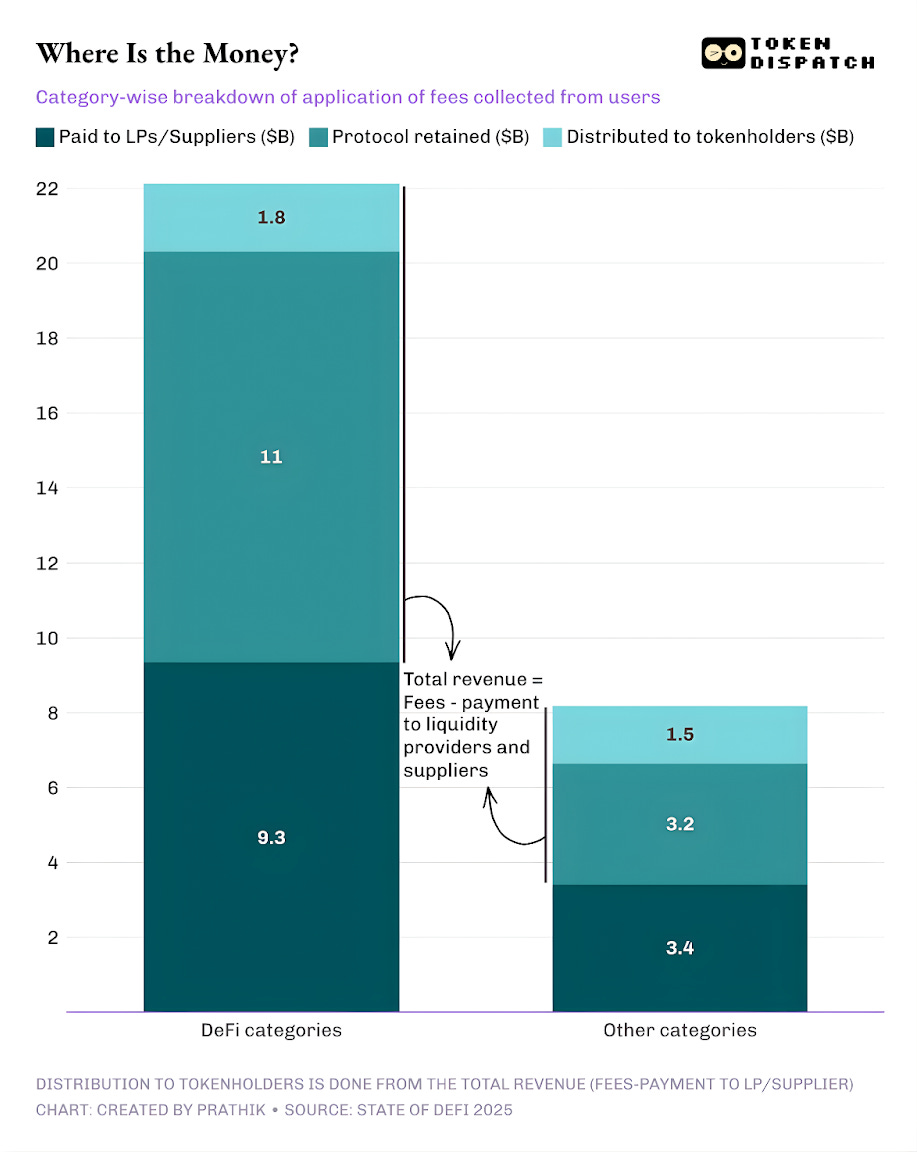

In 2025, users across DeFi and other protocols paid roughly $30.3 billion in fees. Of that, $17.6 billion was retained by protocols as revenue after paying liquidity providers and suppliers. About $3.36 billion of total revenue was returned to tokenholders through staking rewards, fee sharing, buybacks, and token burns.

That translates to 58% of fees becoming protocol revenue, and about 19% of revenue being captured by tokenholders.

This is a significant shift from the last cycle. We saw a growing share of protocols that attempted to make the token behave like a claim on operating performance. This gave investors a tangible incentive to stay invested and go long on projects they believed in.

I wrote about how Hyperliquid and pump.fun did this last year, here: Burn, Baby, Burn.

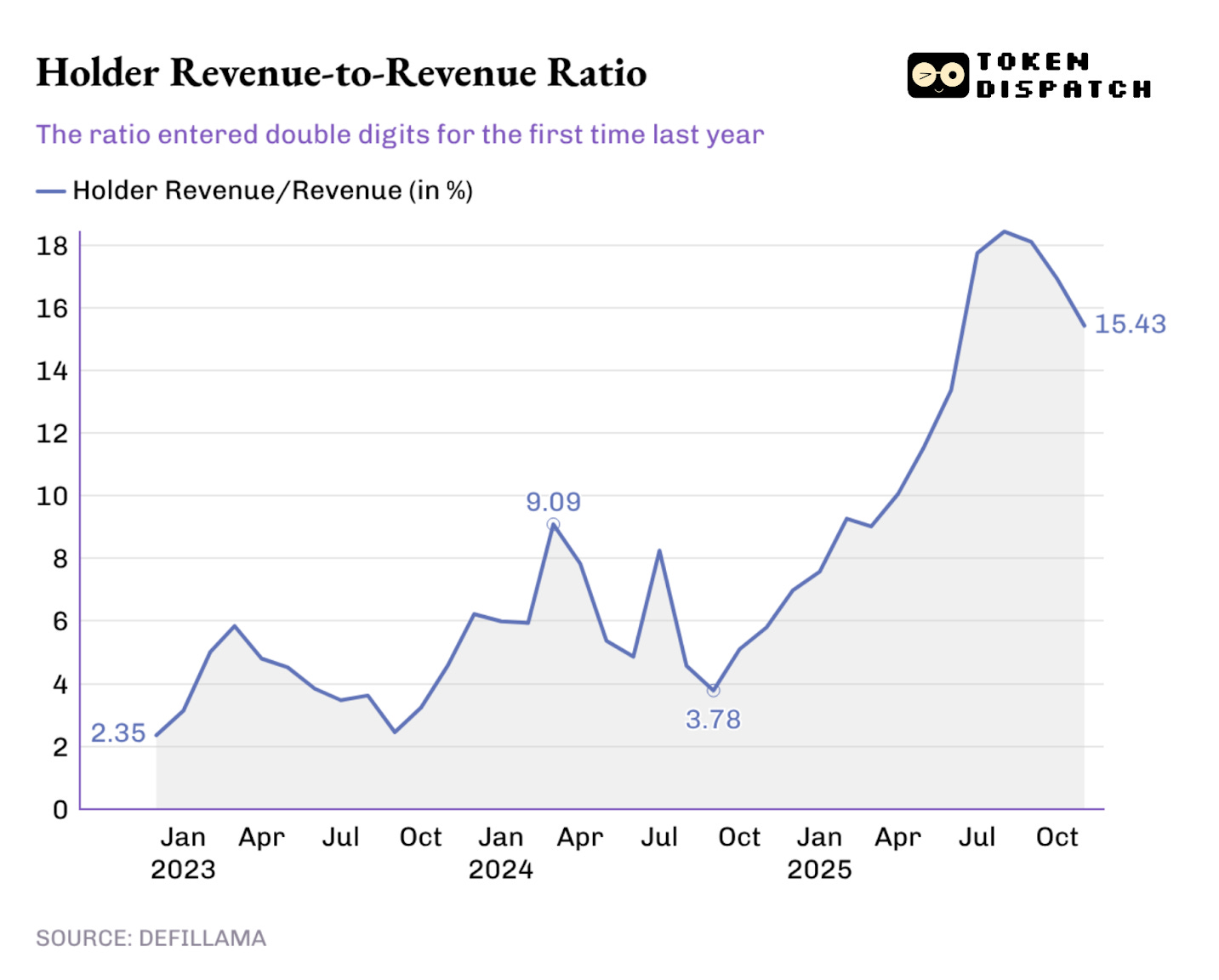

The crypto world is far from perfect, and most protocols still distribute nothing to token holders. But when you zoom out, you see the needle has moved a fair bit, signalling that things are changing.

The holder revenue as a percentage of the total revenue earned by the protocols has ticked up consistently through the last year. It surpassed the earlier record high of 9.09% early last year and even crossed 18%, at its peak in August 2025.

The impact of this is felt in token trades. If I am holding a token that never rewards me, my trades are based on the media narrative around it. But when I hold a token that pays me, whether through buybacks or fee sharing, I start treating it as a yield-bearing asset. Although it might not be as safe and reliable, it still changes how the market prices the token. Its valuation gets pulled a bit closer to fundamentals and farther from media narratives.

When investors look back at 2025 to understand where crypto revenue will flow in 2026, they will heavily factor in incentives. The teams that prioritised value transfer also stood out from the rest last year.

Hyperliquid built a culture around routing about 90% of its revenue back to its users via its Hyperliquid Assistance Fund.

Among token launchpads, pump.fun reinforced the idea of rewarding its community for activity generated on the platform. It has offset 18.6% of the circulating supply of its native token, $PUMP, via daily buybacks.

In 2026, expect “value transfer” to stop being a niche choice and become table stakes for any protocol that wants its token to trade on fundamentals. Last year trained the market to separate protocol revenue from tokenholder value. Once tokenholders see a token behave like an ownership claim, going back to the alternative starts to look irrational.

I don’t think the ‘State of DeFi 2025’ report tells us anything fundamentally new about crypto discovering revenue. That has been a trending observation for the past few months. What the report does is throw light on the numbers, which, when probed further, reveal the recipe most likely to succeed for anyone looking to generate revenue in crypto.

By examining the trend of revenue dominance among protocols, the report makes clear that whoever controls the pipes—carry, execution, and distribution—stands to earn the most.

In 2026, I expect more projects to start converting fees into durable, disciplined payouts for their tokenholders, especially as the rate-cut era makes the carry trade less attractive.

That’s it for this week’s quantitative analysis. I will be back with the next one.

Until then, stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.