Happy Sunday dispatchers!

In ancient Rome, the concept of "Lex talionis" — the law of retaliation — suggested that justice meant returning the exact harm suffered. An eye for an eye. A tooth for a tooth.

But crypto companies in 2025 appear to have discovered a far more sophisticated form of retaliation.

After years of being systematically walled off from the banking system in a modern financial exile, crypto is seeking re-entry.

It's becoming the very thing that once rejected it.

Multiple reports confirm that Circle, BitGo, and potentially Coinbase and Paxos are preparing applications for US banking licenses. Meanwhile, global banking giants Deutsche Bank and Standard Chartered are accelerating their crypto ambitions in America, racing to ensure they won't be left guarding empty fortresses.

This architectural reversal follows the Federal Reserve's decision to join the OCC(Office of the Comptroller of the Currency) and FDIC(Federal Deposit Insurance Corporation) in withdrawing previous crypto warnings to banks — effectively dismantling the regulatory ramparts that kept crypto companies outside the financial city walls.

For an industry that just months ago couldn't even maintain basic checking accounts, the prospect of actually running banks represents a tectonic shift in financial power dynamics.

Buy Once, Earn Daily Bitcoin Forever

Infinity Hash brings the best aspects of cloud and colocation mining into a transparent and reliable system that provides long-term cash flow.

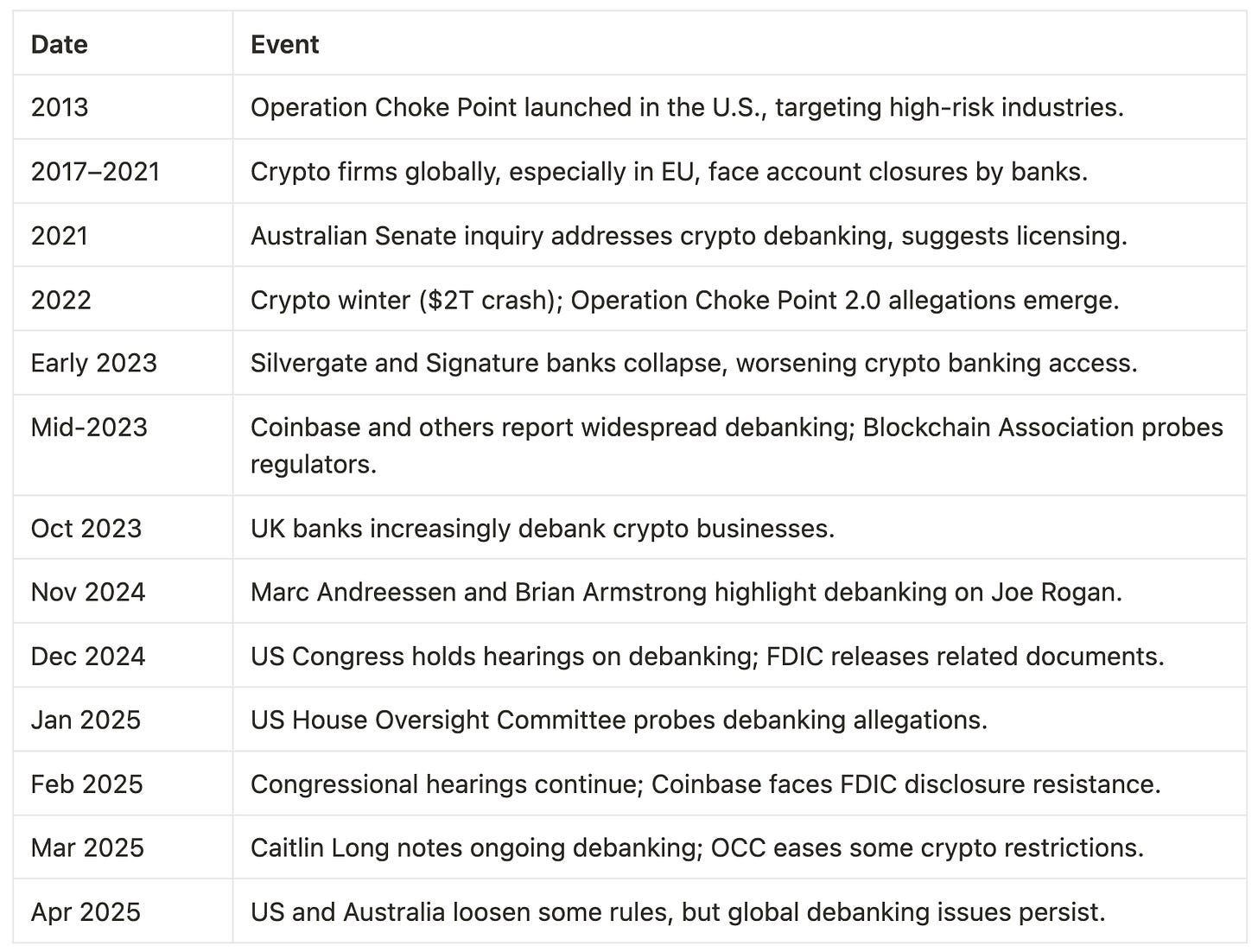

The Great Debanking

The financial exile of crypto companies didn't happen with formal decrees or public banishment ceremonies. It occurred through quieter, more insidious means.

Companies with spotless regulatory records would suddenly receive identical letters from their banks.

"Please move your funds. Your account is being closed."

No explanation. No appeal process. Just financial relationships terminated with the bureaucratic equivalent of being escorted to the city gates and pushed outside.

This wasn't selective exile. It was systematic:

Coinbase's Brian Armstrong and other executives had personal accounts shuttered Frax's Sam Kazemian watched JPMorgan close his account citing "crypto associations" Kraken's Jesse Powell detailed multiple banking relationships suddenly terminated.

Read: When Banks Can't Bank 🖐🏾

A 2024 survey by the Alternative Investment Management Association revealed that 75% of crypto-focused hedge funds were struggling to access basic banking services. That's 120 out of 160 crypto funds surveyed facing exile, while their traditional finance counterparts remained safely inside the walls.

"There's no due process," venture capitalist Marc Andreessen explained on Joe Rogan's podcast after revealing that over 30 tech founders in his portfolio had been systematically denied banking services. "None of this is written down. There's no rules. There's no court. There's no decision process. There's no appeal."

The crypto industry had a name for this phenomenon: debanking.

Behind closed doors, another term circulated: Operation Chokepoint 2.0, an apparent reference to the Obama-era DOJ(Department of Justice) initiative that pressured banks to cut ties with "high-risk" industries.

Internal FDIC documents later revealed by Coinbase's chief legal officer Paul Grewal showed explicit instructions to banks to "pause all crypto asset-related activity." Not through formal channels, but through quiet "guidance" that banks dare not ignore.

Like medieval cities using moats and walls to keep out undesirables, the banking system had constructed invisible but effective barriers around its domain. Crypto companies found themselves on the outside looking in, forced to build makeshift settlements in the financial borderlands.

Get 17% discount on our annual plans and access our weekly premium features (Mempool, Game On, News Rollups, HashedIn, Wormhole and Rabbit hole) and subscribers only posts. Also, show us some love on Twitter and Telegram.

The Blueprints Emerge

The first signs of crypto's architectural counteroffensive came not with storming the gates, but with careful study of the existing structures.

The OCC's March 7 Interpretive Letter 1183 confirmed that crypto-asset custody, certain stablecoin activities, and participation in distributed ledgers are permissible for national banks.

The FDIC followed, withdrawing two joint statements from 2023 that had addressed crypto-asset risks.

And finally, last week, the Federal Reserve completed the trifecta, rescinding four pieces of crypto guidance, including the requirement that state member banks provide advance notification of crypto-asset activities.

"These actions ensure the Board's expectations remain aligned with evolving risks and further support innovation in the banking system," the Fed's statement read — bureaucratic language for "the drawbridge is being lowered."

But crypto companies weren't merely waiting for re-admission. During their exile, they'd been drawing up plans for fortresses of their own.

The Wall Street Journal's recent bombshell report confirmed that Circle and BitGo are preparing to apply for US banking licenses.

Coinbase and Paxos are reportedly considering similar moves.

These applications could range from narrow licenses focused on stablecoin issuance to full-fledged bank charters that would allow activities such as holding deposits or issuing loans.

It's as if the exiles, having studied the city's architecture from afar, are now preparing to build not just huts but rival citadels, using the very same building codes once used to exclude them.

The Blueprints of Anchorage

To understand the architectural challenges facing crypto-banks, consider Anchorage Digital Bank — currently the only crypto-native firm with a federal bank charter.

Securing those building permits in January 2021 required navigating a labyrinth of regulatory requirements.

Each stone in this new financial fortress had to be carefully placed according to banking regulations designed for structures of a different era. Every corridor, every vault, every security system had to satisfy regulators more accustomed to traditional banking blueprints.

But those painstakingly drawn plans have allowed Anchorage to construct partnerships with financial giants like BlackRock, Cantor Fitzgerald, and Copper — creating bridges between its new fortress and the established financial city.

Now other crypto firms are unfurling their own architectural drawings, convinced that the cost of construction will be worth the stability of owning their own financial infrastructure:

For Circle, a banking license could fortify its position in the stablecoin wars against Tether, adding regulatory ramparts to its USDC token.

For BitGo, which will reportedly custody reserves for the Trump-linked stablecoin USD1, a bank charter provides the necessary security features for a politically sensitive project.

For Coinbase, already a public company with substantial resources, banking status represents the capstone in its institutional architecture.

The regulatory landscape is changing too, creating more favourable building conditions. Congress is advancing stablecoin legislation that would require issuers to secure federal or state licenses, essentially mandating formal structures where makeshift arrangements once sufficed.

But what will these new financial fortresses look like? Will they simply mimic traditional banks, or will they incorporate innovative elements from their crypto heritage?

Competing Architectural Styles

As crypto firms break ground on their banking projects, several distinct architectural styles are emerging:

The Disruptive Modernist: Crypto-native banks like Anchorage and potentially Coinbase and BitGo are building from the foundation up, designed specifically for digital assets but operating within regulatory building codes. They're creating structures that look nothing like traditional banks internally while maintaining compatible exteriors.

The Focused Specialist: Stablecoin issuer banks like Circle and Paxos may pursue more narrowly focused licenses, creating specialised financial structures rather than all-purpose institutions. These are precision instruments rather than general-purpose buildings.

The Renovation Specialists: Traditional banks with crypto services — Deutsche Bank, Standard Chartered, and potentially Bank of America — represent established structures being remodeled to accommodate new functions. They're adding crypto wings to their existing edifices.

The Hybrid Development: Partnerships like Custodia Bank's arrangement with Vantage Bank represent joint ventures between traditional and crypto architects, creating innovative structures that draw from both traditions.

Each approach has its merits and challenges. The crypto-natives understand the technology but face steep learning curves with banking regulations. Traditional banks understand compliance but may struggle to innovate. Hybrid models offer middle paths but require complex coordination.

What's clear is that the financial landscape is being fundamentally redrawn, with crypto companies now designing permanent structures in a domain where they were once forbidden to even camp.

Stablecoins: The Cornerstone

If there's a cornerstone to these new financial fortresses, it's stablecoins — the bridge between traditional fiat currency and the crypto ecosystem.

Recent legislation like the STABLE and GENIUS Acts has created clearer pathways for stablecoin issuance, making these tokenised dollars the logical foundation for crypto-banking structures.

Read : How STABLE is the GENIUS Act? ⚖️

Stablecoins offer the perfect building material: They're familiar enough for traditional finance to understand yet innovative enough to solve real problems in payments and settlement.

They also represent a massive construction opportunity. The combined market cap of USD stablecoins currently exceeds $130 billion, with much of that value sitting in unregulated or offshore structures.

Bringing that activity into regulated financial fortresses could both legitimise stablecoins and provide a solid foundation for banks facing erosion in traditional business lines.

It's no coincidence that Circle is targeting a banking license as it prepares for a potential IPO, or that Bank of America is eyeing stablecoin issuance. Both see stablecoins as the essential building block of next-generation finance.

But stablecoins are just the foundation. Once established, these new financial structures will incorporate everything from crypto-backed loans to interest-bearing crypto accounts, all within regulated frameworks.

Got questions about a hot crypto topic that you want help understanding? Ask your question using the form and our crypto experts may answer it along with your name in the next Thursday’s News Rollups.

The Treasury Room

The most valuable chamber in these new financial fortresses will be the treasury room — where yield is generated from crypto assets.

During their outsting, crypto companies relied on DeFi protocols for yield, offering tantalising returns but with significant risks, as the collapses of Celsius and Voyager painfully demonstrated.

Banking licenses could transform this approach entirely, allowing for secure treasury operations where:

ETH holdings generate interest through regulated staking programs

Stablecoins produce yield through carefully managed lending

Bitcoin serves as collateral for structured loans

All within an environment with deposit insurance and prudential oversight — like a treasury room with both innovative contents and traditional security systems.

"For audit and bank examination purposes, stablecoins promise transparency and fungibility that have proven difficult to duplicate with other existing crypto instruments," notes crypto banking expert Sean Stein Smith, highlighting why stablecoins are likely to anchor these treasury operations.

The prize is enormous: capturing even a fraction of the $18 trillion in US bank deposits would represent a quantum leap for the crypto industry, which despite its cultural impact still measures its entire market cap in the low trillions.

Token Dispatch View 🔍

Bitcoin was born as a deliberate rejection of the banking system. "Chancellor on Brink of Second Bailout for Banks," read the message embedded in its genesis block. It was designed specifically as an alternative to the financial structures that would later reject its descendants.

Now, fifteen years later, crypto companies are applying for permits to build the very structures they once sought to make obsolete. The revolutionaries are becoming the establishment.

But that's not necessarily a betrayal of crypto's founding blueprints — it might be their ultimate expression. The goal was never really to live permanently in exile. It was to force the financial city to evolve, to become more transparent, more inclusive, more efficient.

In that light, crypto's banking invasion represents not capitulation but the ultimate victory.

What we're witnessing is crypto companies using that heritage to redesign banking according to their own plans. The revolution is entering its institutional phase.

Of course, building to code is never simple.

Banking regulations exist for good reasons, and crypto firms will face legitimate challenges in meeting safety requirements, ensuring structural stability, and protecting occupants. Not every crypto-bank blueprint will receive final approval.

But for an industry that spent years in financial exile, the opportunity to build permanent structures is too compelling to ignore.

After being kept outside the walls, crypto is becoming the new master builder.

And for traditional banks that once thought they could simply banish the crypto innovators? They're about to learn what outstered architects throughout history have proven: Sometimes those forced to build from scratch end up designing the future.

Week That Was 📆

Saturday: Can Altcoin ETFs Avoid ETH ETFs' Fate? 🌀

Friday: Jesse Pollak: The Base Builder 🧱

Thursday: The US Fed’s Independence 🇺🇸

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.