From Mining Coins to Mining Intelligence

Galaxy bets on AI infra to escape crypto's margin squeeze

Hello

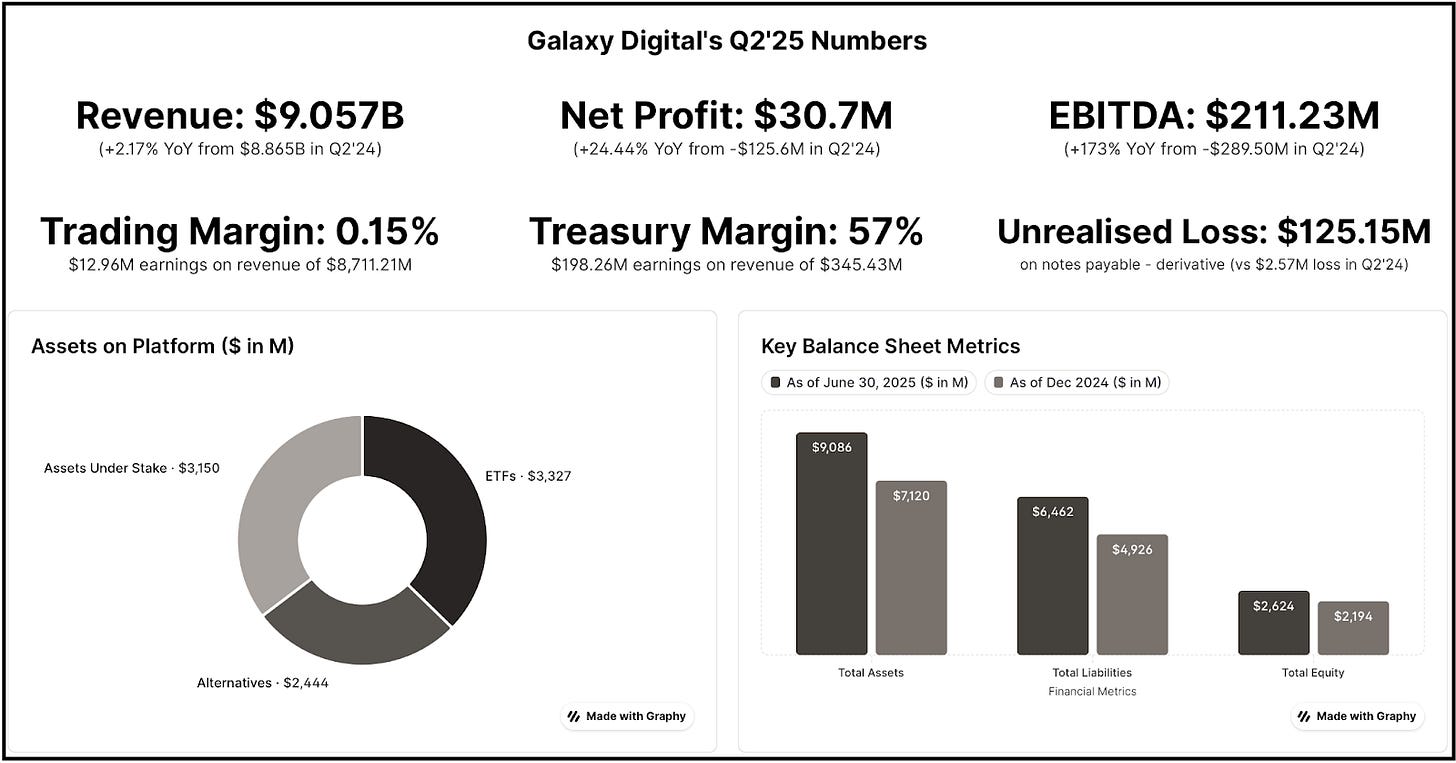

Today, we are diving deep into Galaxy Digital’s Q2 2025 earnings as the digital assets and data centre solutions provider prepares for a pivot. From its core business that generates 95% revenue with less than 1% margin, to a business model that promises a revenue-expense ratio that sounds too good to be true.

TL;DR

Galaxy's crypto trading generates $13M profit on $8.7B revenue (0.15% margins) while paying $18.8M quarterly compensation - core business is cash flow negative

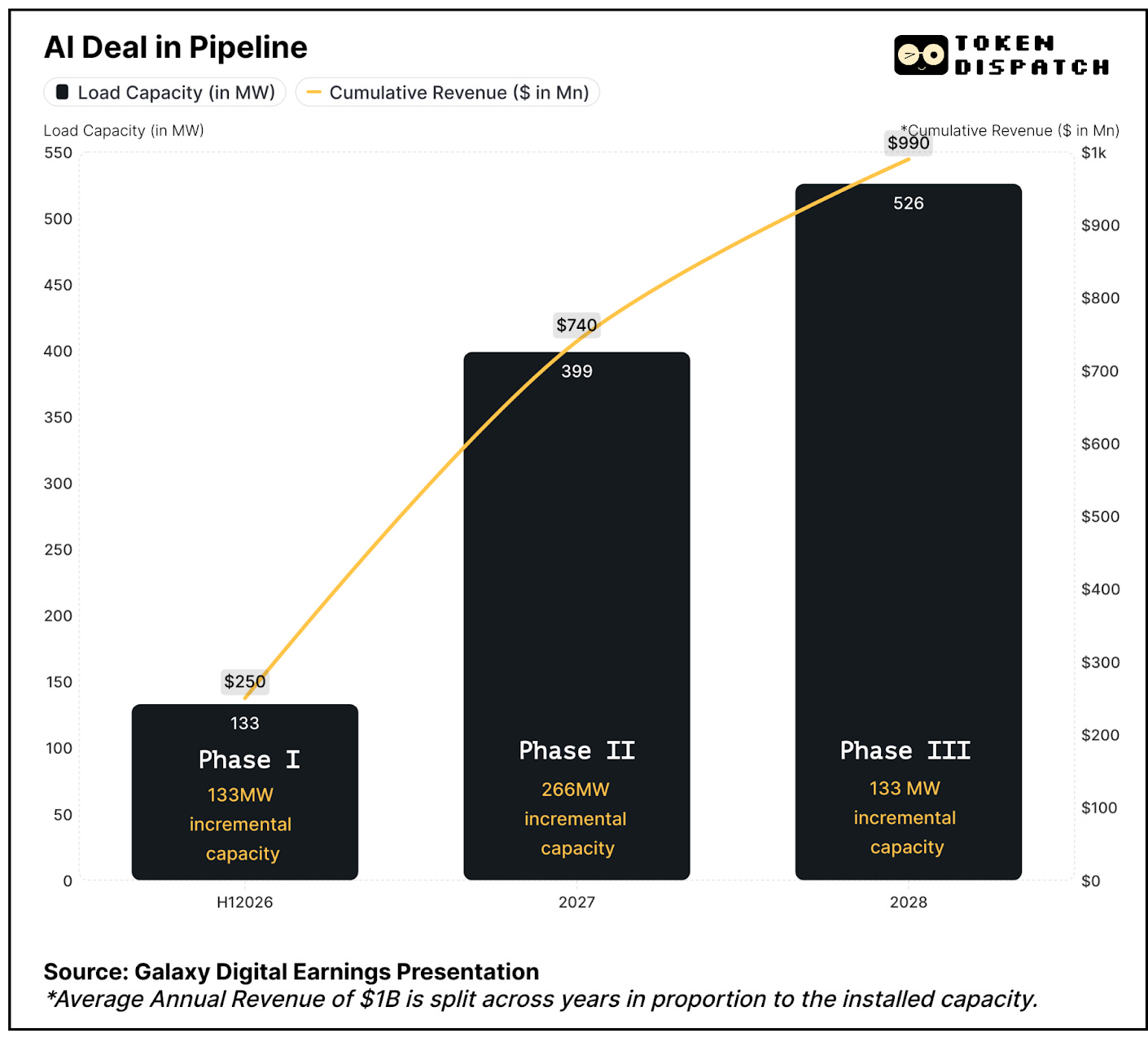

AI pivot: 15-year CoreWeave deal for 526MW promising 90% margins on $1B+ average annual revenue across three phases starting H1 2026

Controls 3.5GW Texas capacity in supply-constrained market where data centre demand must quadruple by 2030

Secured $1.4B project financing, validating commercial viability and removing execution risk

Current model depends on crypto treasury gains ($198M Q2) to fund operations due to capital-intensive trading with minimal returns

Stock up 17% then declined as investors don’t see incremental revenue until H1 2026

When you look at Galaxy Digital's Q2 numbers, one thing is easy to miss: what's coming next. Look closer, and you see how the Michael Novogratz-led company is at the cusp of shifting from cyclical crypto trading to a more consistent AI infrastructure revenue.

Crypto Investing Without the Crypto Chaos

Forget seed phrases, exchange hacks, and late-night wallet setups.

With Grayscale, you can invest in Bitcoin, Ethereum, and other digital assets the same way you’d buy a stock — through regulated, SEC-reporting products.

No private keys to manage

No unregulated exchanges

No steep learning curve

It’s the easiest way for individuals and institutions alike.

The AI Infrastructure Goldmine

Galaxy Digital is making one of crypto's biggest business pivots – switching from a low-margin trading to high-margin AI data centres.

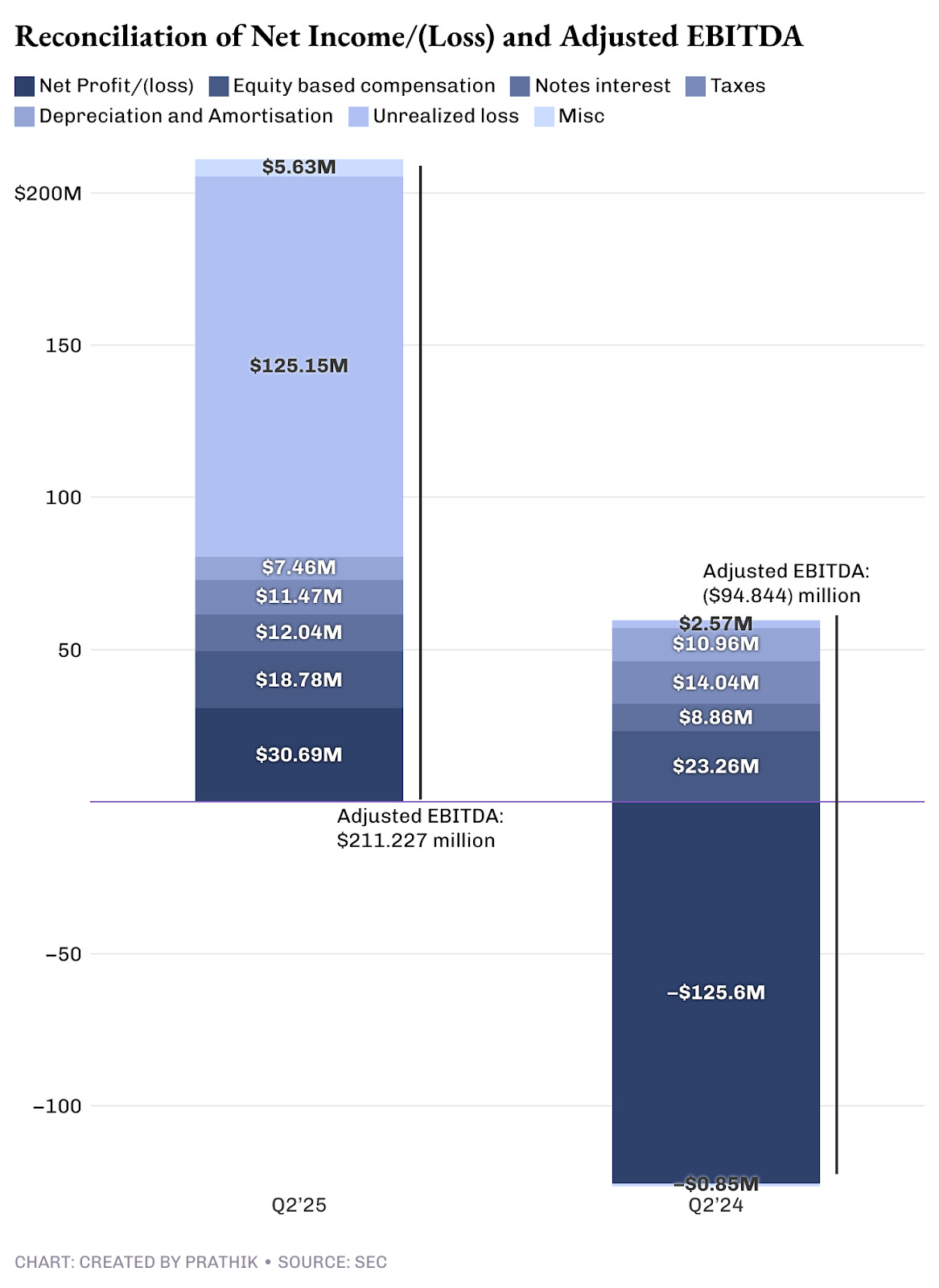

Galaxy’s clocked $31 million in net income for the quarter, which after adjusting for the non-cash and unrealised expenses totalled to $211 million in adjusted EBITDA.

Out of the total earnings, its trading business made just $13 million in earnings from $8.7 billion in sales - that's barely 0.15% profit margins. So 95% of their revenue makes almost no money.

In contrast, their new AI data centre contract promises 90% earnings margin on over $1 billion in average yearly revenue.

While I am bullish on building AI and high-performance compute capacity, I find the margin it promises too exaggerated. Don’t take my word. Compare it with what top AI data operators like Equinix and Digital Realty reported this quarter: 46-47% margin.

Yet, I feel the direction is right. Purely from a revenue-generating perspective. Currently, Galaxy makes a majority of its revenue from its trading operations that are high-cost and low-margin. It makes a majority of its earnings (revenue less expenses) from its Treasury and Corporate segment.

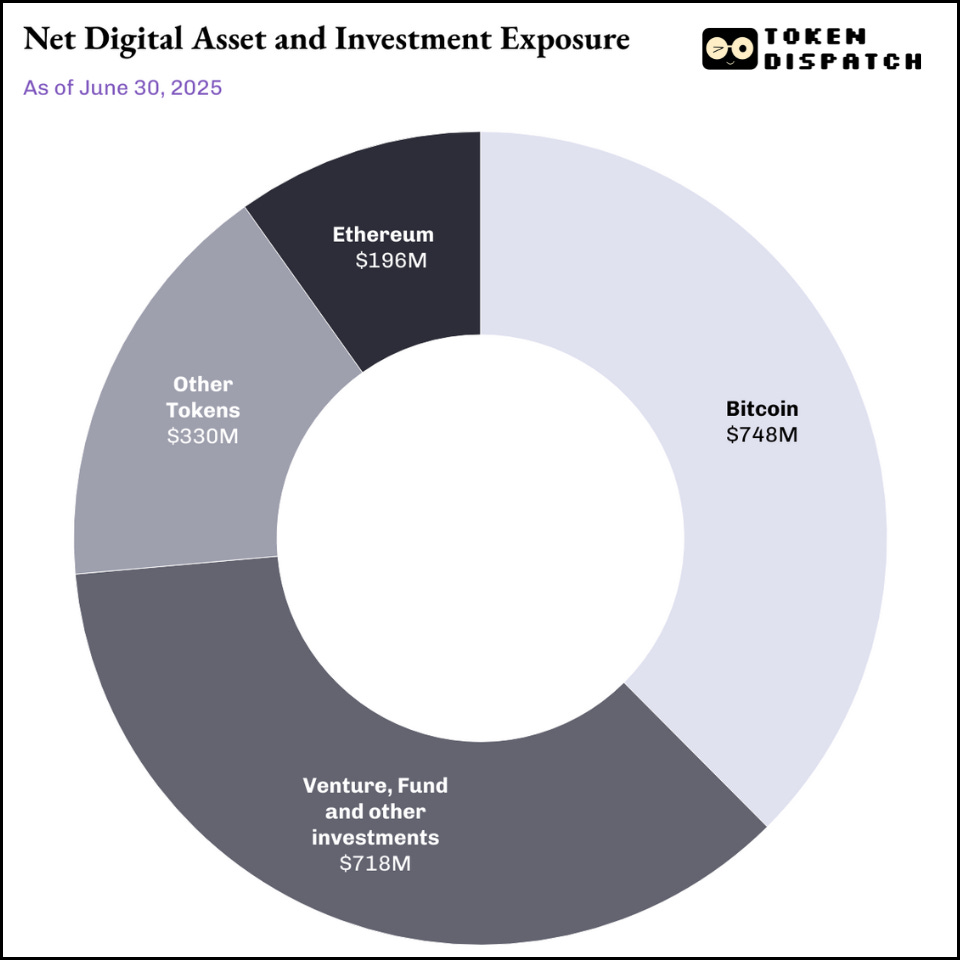

The Treasury segment includes investment in digital assets and mining activities, equity investments, realised and unrealised gains and losses on those digital assets and equity investments.

Its $2 billion treasury serves as an investment vehicle and even as a strategic funding source in favourable market conditions.

The segment generated $198 million in earnings excluding non-cash unrealised gains. Unlike pure-play crypto companies, Galaxy's treasury business enables access to funds by selling treasury assets at strategic times.

This is where I find Galaxy’s crypto treasury approach quite different from Michael Saylor’s Bitcoin treasury. Strategy’s ‘buy, hold but never sell’ approach managed to make a $14 billion unrealised gain for this quarter. But all that is just paper-profit. None of Strategy’s shareholders get a bite of that $14 billion unrealised gain.

Read: Strategy’s Mark-to-Moon 🌒

Galaxy’s case is different. It doesn’t just buy and hold crypto in its treasury, but also makes strategic sales, which bring home realised profit. Real money that shareholders get a share of.

Yet I find Galaxy’s treasury segment an unreliable revenue stream. So far as the crypto market is at its best, the segment will keep generating gains. But that’s not how markets work, neither traditional nor crypto. Markets are cyclical at best, making these returns heavily reliant on the state of crypto markets.

This is why Galaxy needs its AI pivot to work, because its current model is unsustainable.

The Market Opportunity

Galaxy has positioned itself at the intersection of two massive trends: exploding AI computing demand and chronic US power infrastructure shortage. Global data centre demand is projected to quadruple from 55GW (2023) to 219GW (2030), a McKinsey report showed.

Hyperscalers, which are large-scale cloud service providers, are expected to invest $800 billion as capital expenditure (CapEx) in data centres through 2028, up 70% from 2025, but are constrained by power availability.

Galaxy's advantage lies in their 3.5GW capacity potential at the Helios campus in Texas, enough to power over 700,000 homes in the state. With 800MW already approved and an additional 2.7GW under Electric Reliability Council of Texas (ERCOT) study, Galaxy controls some of the largest available power capacity in the supply-constrained AI infrastructure market.

The foundation of Galaxy's transformation is their 15-year commitment with CoreWeave, representing one of the largest AI infrastructure deals in the industry. CoreWeave has committed to 526MW of critical IT capacity across three phases.

The 90% projected earnings margin is attributed to the asset-light nature of data centre operations once infrastructure is built.

I see one big risk in the CoreWeave deal: execution. And just when I sat thinking about the scale of funding, planning and execution Galaxy will have to put together, the firm cleared the first obstacle.

On August 16, Galaxy successfully closed a $1.4 billion project financing facility for the Helios data centre, securing the capital needed to complete Phase I construction. This makes me feel more confident about how it could help remove a key funding risk and validate the commercial viability of the Helios project.

Cash Flow Equation

Galaxy's current cash flow exposes the unreliability of their trading operations business while highlighting why AI infrastructure offers genuine financial stability.

The company closed Q2 with $1.18 billion in cash and stablecoins, which sounds like a lot but has more to it. Galaxy's trading business operates on a capital-intensive model where margin lending requires substantial cash reserves. The majority of that $1.18 billion isn't freely deployable.

Galaxy's actual free cash flow generation is minimal. After covering $14.2 million in interest expenses and ongoing operational requirements, the core business barely breaks even on a cash basis.

This forces Galaxy to be dependent on crypto market appreciation i.e. its treasury and mining business, amid inherent cyclical and unpredictable nature, to generate gains that fund operations. Precisely where CoreWeave's three-phased contract structure and a high margin nature of the business will likely create immediate positive cash flow.

Even though the margins may not be as high as 90%, even a more considerate 40-50% margin will still be more reliable and consistent than the cyclical treasury segment.

Unlike trading operations that require ongoing capital investment in working capital and technology infrastructure, data centre operations generate cash that can be reinvested in expansion or returned to shareholders.

Galaxy's recent Helios project financing helps answer cash flow concerns. By securing dedicated construction funding, Galaxy has separated infrastructure development from their operational cash flow needs. This wouldn't be possible with trading business expansion, which requires balance sheet capital that competes directly with other corporate needs.

The Expense Breakdown

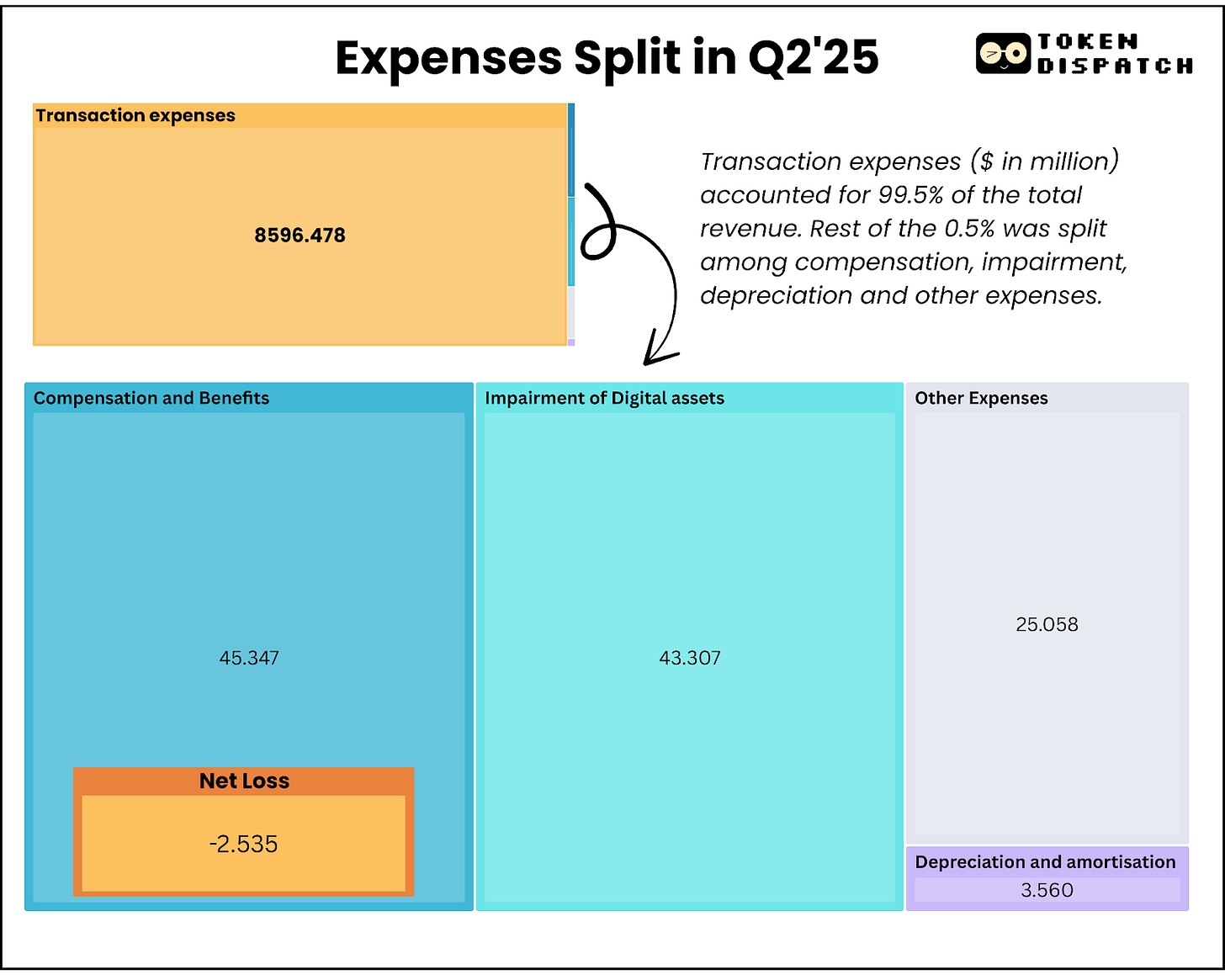

Expenses for the Digital Assets segment totalled $8.714 billion out of which transaction expenses accounted for a lion’s share ($8.596 billion). These are pure pass-through costs with minimal markup opportunity. There’s little Galaxy can do to optimise these costs since they are unavoidable in a commoditised trading business where spreads continue to compress.

More concerning is that quarterly compensation expense includes $18.8 million in stock-based compensation that must be paid in cash. Meaning, Galaxy is paying more to retain talent than their core business generates in earnings ($13 million).

The AI infrastructure pivot will help change this equation. Data centre operations require minimal variable costs once facilities are operational.

For perspective, Galaxy's entire Digital Assets business generated $71.4 million in adjusted gross profit in Q2. At full utilisation, just Phase I and II of Helios (~400MW) will likely generate quarterly revenue of $180 million with a fraction of the operational complexity and costs.

How the Market Reacted

Galaxy's stock recorded a modest 5% gain within 24 hours of announcing its Q2 earnings and went on to jump ~17% within a week before investors pulled out their money.

It’s likely because investors recognised that $180 million of the $211 million in earnings came from non-cash adjustments and treasury gains rather than operational improvements.

Investors have likely not yet factored in Galaxy's complex pivot to AI infrastructure since no meaningful data centre revenue is expected until H1 2026.

I am still optimistic about the long-term sentiment given what’s yet to come.

The 2.7GW of additional capacity under ERCOT study shows Galaxy's intent to reinforce its position as a long-term infrastructure provider rather than a single-tenant facility operator.

At full development, Galaxy's Texas operations could rival some of the largest hyperscale data centre campuses operated by Amazon, Microsoft, and Google. This scale could provide negotiating leverage with additional AI companies while creating operational efficiencies that improve profit margins.

The company's crypto native expertise provides unique positioning in the emerging intersection between AI and blockchain technologies.

The Path Forward

Galaxy is making a massive, binary bet. If the AI infrastructure pivot works, they'll pivot from a margin-compressed trading shop into a cash-generating machine. If it doesn't, they'll have spent billions building expensive real estate in Texas while their core business slowly bleeds out.

The $1.4 billion project financing validates external confidence, but I'm watching two key metrics: can they actually deliver 133MW of AI-ready capacity by H1 2026, and will those 90% margins hold up once they start paying real operational costs?

Current operations provide sufficient cash flow to maintain operations but require continued crypto market strength for meaningful growth investment. The AI infrastructure opportunity promises consistent and reliable revenue-generating potential, whose success depends entirely on execution over the next 18-24 months.

The recent project financing closure removes a significant execution risk, but Galaxy must now prove they can successfully convert crypto mining infrastructure into enterprise-grade AI computing facilities for its investors to bet long.

That’s all for Galaxy’s Q2 earnings’ coverage. We will be back with another one soon.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

✌️✌️✌️