Hello

Bulldozers idled under the intense heat. The terrain was barren, the contracts uncertain, and the notion that a crypto trading firm could evolve into a power company felt delusional.

A year ago, the Helios data centre site in Texas was nothing more than a promise in the desert.

Today, things have changed considerably. While the turbines are not operational yet, the dotted line has been signed, and the financing deal is complete. The land has been leased, and transformers are on order. The company that made a significant portion of its earnings by capitalising on volatility is now investing in certainty.

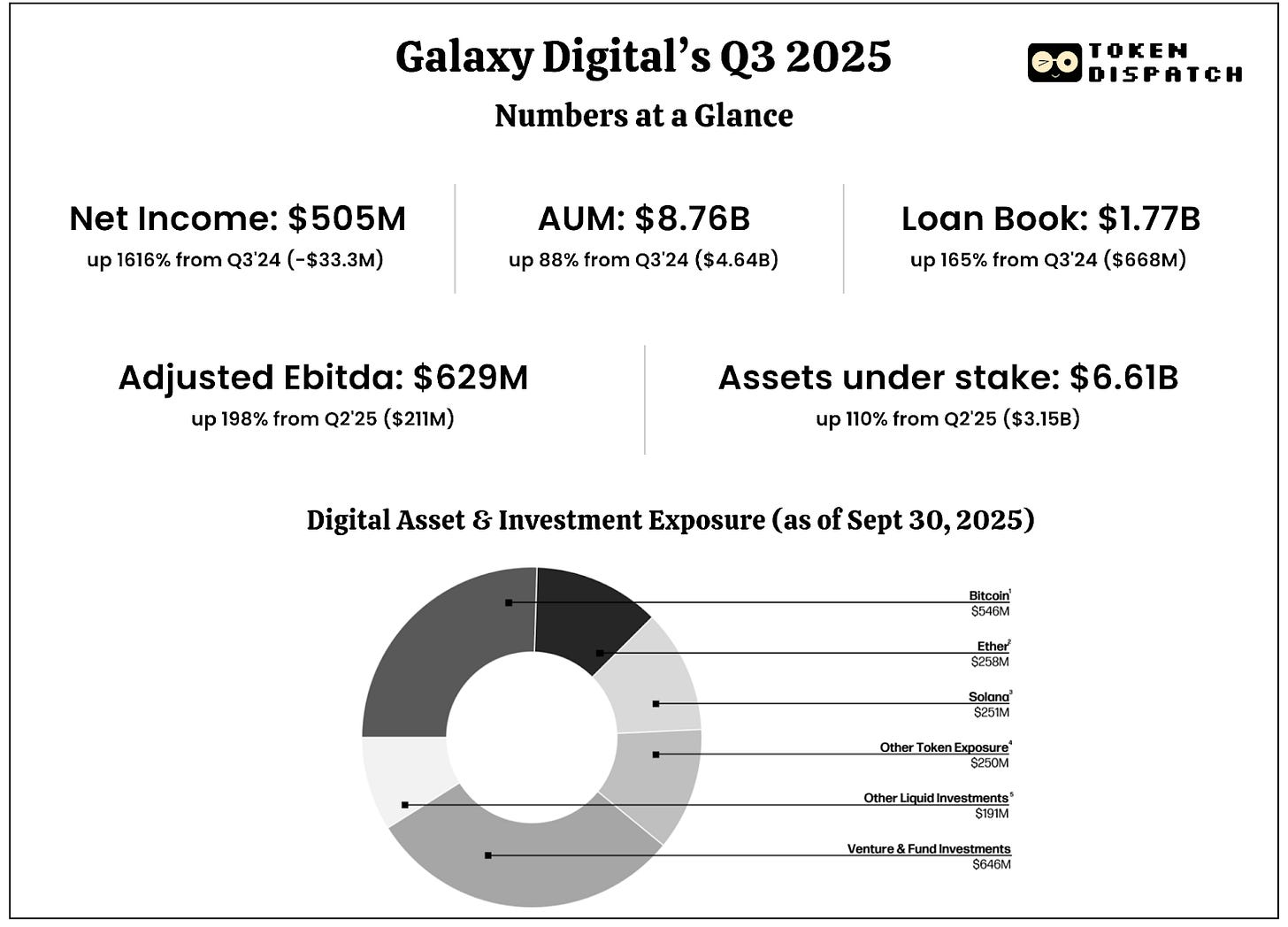

Galaxy Digital’s earnings report for the quarter ending September 30, 2025, may not directly tell this story, but a closer look at its numbers over the last year reveals a clear transformation. Galaxy’s trading desk is still moving billions, but the trajectory in the months ahead is unmistakable to anyone paying attention.

Quarter after quarter, Galaxy is gradually looking less like a trader and more like a banker.

TL;DR

Galaxy’s trading volume hits new highs, but profit share dips compared to other business segments

Corporate-treasury mandates grow 4x YoY, generating $40M in annual recurring revenue, marking Galaxy’s first predictable revenue stream

Treasury & Corporate segment gains rise to $408 million, now over 55% of total adjusted gross profit

Helios project in line with scheduled H1 2026 launch, closes 15-year CoreWeave lease deal (526MW) and $1.4 billion in project financing

Galaxy Digital Inc. shares dip by over 10% despite strong growth in earnings

On to the story now,

Prathik

Polymarket: Where Your Predictions Carry Weight

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it. Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

👉 Explore Polymarket

The Banker for DATs

Over two months ago, I discussed how the noise inside Galaxy’s offices is shifting; from the clatter of traders to the gentle hum of clients parking their idle capital. What began as a side project helping token issuers manage their stablecoin reserves has now transformed into assisting corporations in managing their Digital Asset Treasuries (DATs).

Over the past couple of quarters, this business unit has generated reliable cash flows by assisting clients, including DAOs, exchanges, and startups, with a platform that integrates custody, yield, and liquidity together. Galaxy helps these clients build their treasuries and earns basis points on each layer.

In the last twelve months, this business has more than quadrupled from managing around $1 billion in treasury assets to over $4.5 billion today. While the income from this business in Q3 2025 may be relatively modest compared to trading, it marks a significant trend: a shift from a transaction-based model to a subscription-based one. With roughly $40 million in annual recurring revenue, the corporate treasury represents a consistent, long-term fee instead of sporadic trading gains.

However, the treasury management is not without risks, nor is it immune to market fluctuations. Galaxy CEO Mike Novogratz has acknowledged that this business moves up and down along with the crypto market.

Despite these challenges, the trajectory is clear. Each quarter, Galaxy is learning to decouple its income from volatility. Though it’s still a gradual process, the firm’s financials show that it is on the right path.

Although it is not the most exciting revenue stream, it is dependable and a strategic shift for a company that built its reputation on traders’ adrenaline.

The Margin Problem That Started It

Galaxy still makes most of its income the old way, by charging fees on trades executed on behalf of clients. However, this fee structure remains marginal, with sub-one-percent margins.

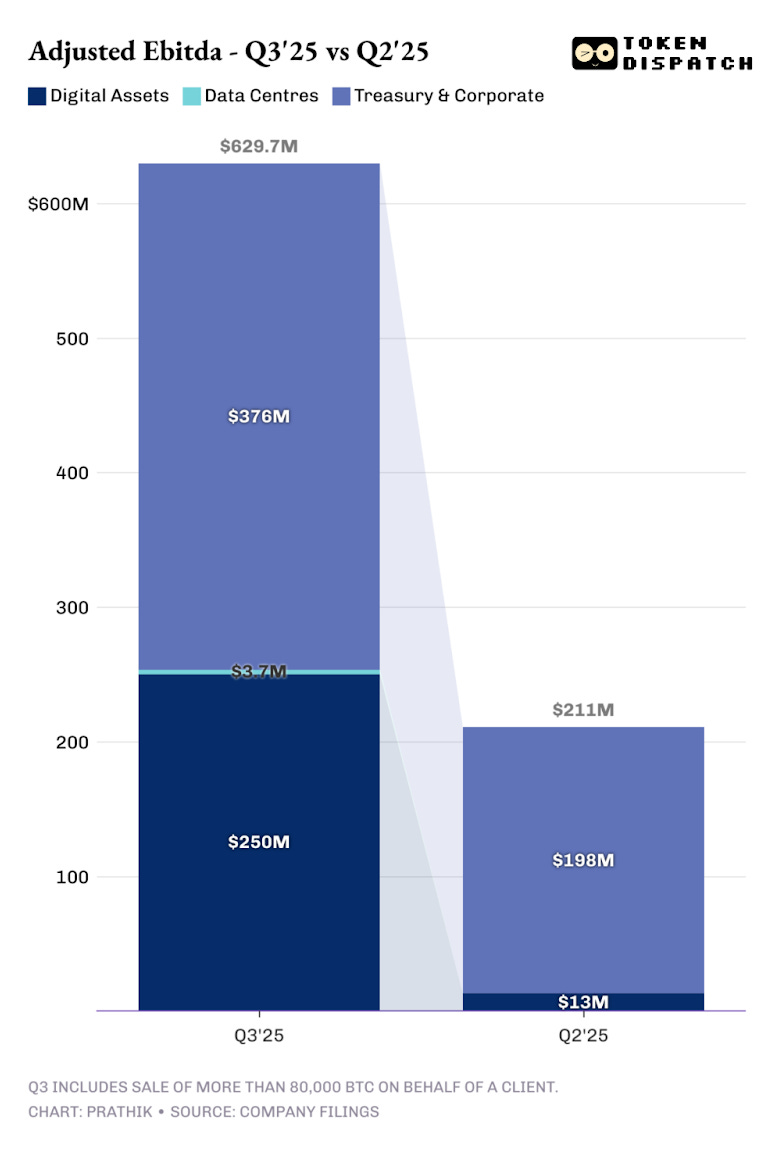

Last quarter, I wrote about the firm’s “0.15% problem” — record trading volumes, but wafer-thin spreads. This quarter, the pattern persists. Although the Digital Assets desk recorded 140% year-on-year (YoY) growth in spot and derivative trade volume for Q3 2025, a significant chunk of it came from the execution of a sale of 80,000 BTC on behalf of a client.

In Q3 ‘25, over 97% of Galaxy’s revenue-generating Digital Assets segment returned an adjusted Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBITDA) of only $250 million, accounting for less than 45% of the total EBITDA.

In contrast, the Treasury & Corporate business segment recorded $376 million in adjusted EBITDA, accounting for less than 2% of total revenue.

This is the crisis Galaxy has decided to deal with: the more liquidity they provide, the less they earn from it.

So how do they address this? Find a way to mint yield. While others mint stablecoins or lend against them, Galaxy has focused on building a corporate treasury business. This model doesn’t rely as heavily on arbitrage or market timing as trading does; instead, it depends on long-term relationships, custody, and recurring fees.

The strategic pivot suggests that Galaxy’s future growth will come more from advising DATs on markets than from the ups and downs of those markets themselves. While DATs contribute modest but steady income, the company’s next big bet — Helios adds a more substantial and sustainable physical yield.

The Two Yield Engines

Out in West Texas, the desert’s heat no longer represents risk; it represents opportunity. The business that once thrived on perfect market timing has now secured contracts, raised capital, and struck a deal with CoreWeave, one of the leading AI computing firms in the US. As a tenant, CoreWeave guarantees rent for 15 years.

Once fully online, the Helios data centre is projected to generate over a billion dollars in annual revenue at 90% EBITDA margins. Both the treasury and data centre businesses will gradually relieve Galaxy of the need to time the market - a luxury in the volatile crypto space.

This strategic pivot aims to build a stable revenue base that remains unaffected by market volatility.

The Takeaway

Investors should note that while trading still drives headlines for Galaxy, fee income and future leases are starting to smooth out the volatility curve.

Every crypto company eventually faces the same dilemma, ‘What do you build once the thrill of speculation fades?’

For Galaxy, this quarter marked the inflection point. Building yield that shows up on time, every time, may be the most boring idea the company has ever had, but it could also be the most transformative.

That’s it for this week’s deep dive.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Astute. The shift from pure trading to infrastructure echoes broader tech convergence trends.