Hello,

Back in the early 2000s, when the internet was still in its infancy, “shipping a product” also meant builders had to handle all the infrastructure around it. They had to buy servers by guessing demand, shop for hardware, and pray it all fell in place on launch day. It was the one thing the builders dreaded most.

Amazon, the e-commerce giant, saw an opportunity to solve this problem. In the spring of 2006, Amazon launched Amazon Web Services (AWS), an infrastructure platform designed to address the concerns of businesses building for the web-driven economy.

AWS began with the launch of its Simple Storage Service (S3) to provide businesses with scalable storage. It then introduced Elastic Compute Cloud (EC2), which allowed users to rent virtual computers rather than own them.

What AWS did was eliminate recurring pain points for builders, enabling them to focus on their product while AWS handled the infrastructure needed to support their business.

I know I risk being called a cliché for using the AWS analogy. But I couldn’t come up with a better one to describe this one.

Hyperliquid, the layer-1 blockchain that houses its namesake perpetual decentralised exchange (perp DEX), has built something similar for traders in financial markets.

In today’s story, I will explore how what started as a crypto-native platform is now addressing multiple friction points across global financial markets, including forex, commodities, equities, and more.

Onto the story…

With AWS, Amazon offered to manage equipment procurement, peak demand, and reliability in exchange for a utility-style billing model. This provides a useful lens for understanding what Hyperliquid has been building over the past three months.

Hyperliquid, as a blockchain, was built specifically for trading. The chain hosts an on-chain order book engine (HyperCore) and an Ethereum Virtual Machine (EVM) environment, which can seamlessly integrate with the market data and execution layer.

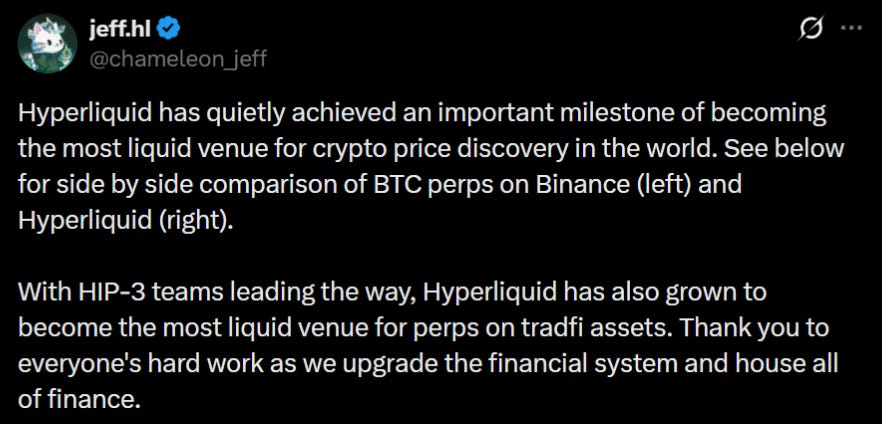

While Hyperliquid’s perp DEX grabbed the attention of the crypto community and traders throughout 2025, it was the platform upgrade at the end of last year that propelled it into something much larger. The growth has been so pronounced that it has surpassed Binance in terms of liquidity.

In mid-October, Hyperliquid launched the HIP-3 upgrade (Hyperliquid Improvement Proposal), which provided the infrastructure for anyone to list and trade markets ranging from crypto to traditional assets.

Before, only core validators determined which markets could be listed. But this upgrade allowed any builder who stakes 500,000 HYPE to bring their own perpetual market to life on Hyperliquid’s chain.

I wrote about it here last year:

The deployer defines the asset, integrates an oracle - which pulls the price data of real-world assets from off-chain exchanges, sets leverage limits and other parameters, and in return, earns a share of the trading fees for that specific market.

With HIP-3, deployers became mini-exchange operators within the mega exchange that Hyperliquid has become.

HIP-3 has transformed Hyperliquid from a crypto-perp DEX into a foundational layer for on-chain financial markets. It lets any developer create markets for global assets, such as equities, stock indices, commodities like gold and silver, forex pairs, and even niche markets like pre-IPO shares (think companies like Anthropic, OpenAI, and SpaceX) or prediction markets. Just as AWS enabled anyone to deploy new applications, HIP-3 enables anyone to deploy new financial markets.

HIP-3 offers continuity for traders navigating the complex world of financial markets.

In traditional markets, and through most of DeFi’s previous cycles, each new trade required a reset. Trades across different markets required different venues, collateral, risk engines, liquidity pools, and, worse, an entirely different interface.

Even when a trader wanted to act on simple ideas like “I think silver will go up and BTC down”, they had to execute the trades differently on different platforms. This becomes a cognitive friction point that makes traders trade less and smaller and intimidates new entrants who find it all messy.

Hyperliquid has provided a unified platform where traders can switch between tabs with a single click and trade on one interface. This brought the entire liquidity pool under one roof.

For traders, high liquidity is the holy grail. It means faster trade executions, minimal price slippage, and tighter bid-ask spreads. Stop-loss orders are also more likely to be triggered at desired prices. Overall, it improves efficiency and reduces trading costs.

This has driven more traders to Hyperliquid and pushed volumes to record highs across markets.

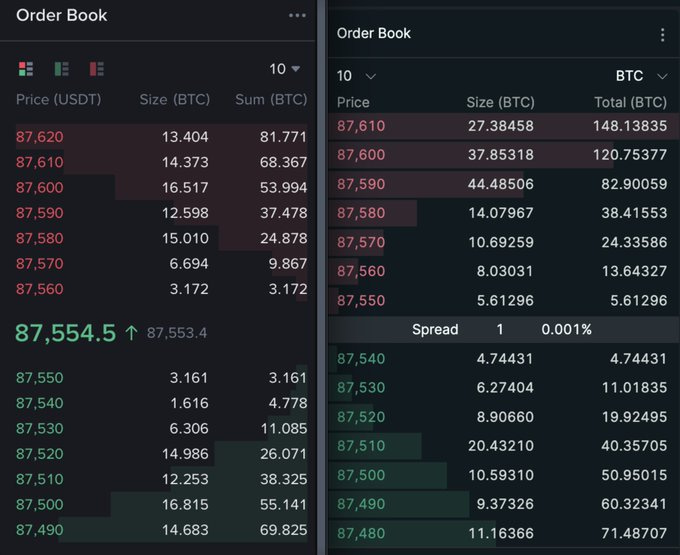

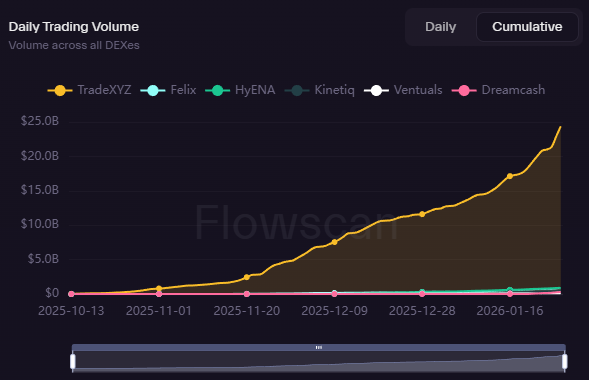

HIP-3 recorded an all-time high single-day trading volume of over $1.7 billion on both January 26 and 27. For context, HIP-3 achieved a cumulative trading volume of $1.78 billion in its first month since launch.

While it grew steadily in the last two months of last year, the activity accelerated the most this year. In just the last month, the cumulative trading volume across all HIP-3 deployers more than doubled to $27 billion from $12.17 billion on December 27, 2025.

Among all its deployers, TradeXYZ alone accounts for over 90% of all the trading volume. The deployer has launched over 30 perpetual trading pairs collateralised by USDC across various asset classes. These include commodities like Silver and Gold, equities like Nvidia, Robinhood, Tesla, forex trades like USDJPY and EURUSD.

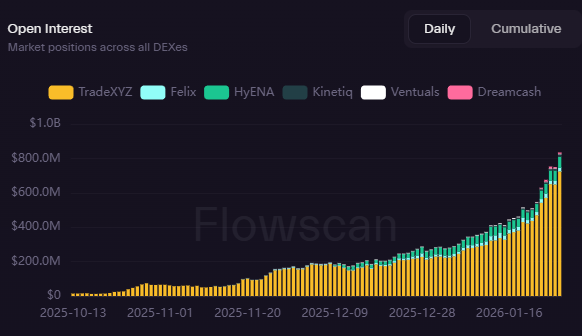

While trading volume reflects trader behaviour, Open interest (OI) indicates the level of conviction behind it.

HIP-3’s OI recorded a new high on at least 20 of the last 30 days. On January 27, OI surpassed the $800-million mark for the first time.

Trading volume can sometimes be manipulated in crowded markets, suggesting that capital may simply be passing through. But OI offers a cleaner proof of trader conviction in the markets.

It tells us that more people are treating this venue as a stable part of their trading routine. This is where the destination becomes constant, and the asset remains the variable.

What stands out the most to me is how what started as a crypto-native venue has witnessed $1.1 billion in trades in just 24 hours for a single metal. Neither a cryptocurrency nor a listed crypto company. Not even an index pair, XYZ100, that tracks the top 100 non-financial companies listed on a U.S. exchange. But a perpetual trading pair for Silver. Let that register.

Most crypto-native venues have historically struggled to attract traders beyond crypto narratives. Most DeFi traders like to trade what their timelines, friends and memes talk about.

So, when a silver perp becomes one of the most active markets on a crypto-native venue, it offers a crucial behavioural insight. Once an interface is constant, attention can be rotated across asset classes seamlessly.

If traders are given a frictionless way to express their views, with a familiar platform and clean execution, their habits will evolve to treat any underlying indifferently. That’s because most active traders, unlike investors, don’t trade on one single thesis for six months. They mostly bet on short-term, quick instincts like ‘this could pump’, ‘this is crowded’, or ‘this will likely break out’. What they need to achieve this is the ability to quickly rotate their money.

For deployers, Hyperliquid offers exactly what AWS provides to businesses: a fast and affordable platform to host their markets, tap into a shared liquidity pool, and welcome a loyal, engaged trading community.

The Road Ahead

For Hyperliquid, the difficult part will be sustaining trader activity amid challenges and competition.

With Hyperliquid earning a significant portion of its revenue from non-crypto traditional perps, Binance, too, launched TradFi Perpetual Contracts. It said the product will “bridge the gap between traditional finance and digital assets”.

While Hyperliquid enjoys the first-mover advantage, it will still have to manage second-order risks that could arise at any time. Since HIP-3 allows deployers to choose oracles, set parameters, and define leverage, the platform could be susceptible to bad inputs and thin liquidity in some cases.

These caveats don’t weaken the thesis. HIP-3’s success offers lessons for whoever wants to learn and adapt accordingly.

Humans like systems that reduce decisions. Money moves better on modular infrastructure that reduces friction. Markets prefer venues where liquidity can stay in one place.

HIP-3’s recent surge shows us that the maturation of crypto and traditional markets doesn’t have to be mutually exclusive. It shows that if utilities can reduce the cost of expressing speculation to a sufficiently low threshold, traders will become indifferent to asset classes and trade anything that is tradeable.

That’s all for this week’s deep dive. I will be back with the next one.

Until then, stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.