Memecoin Prophet 🤼♂️ Blockchain Sleuth

ZachXBT's explosive reveal of Murad Mahmudov's memecoin empire. Breaking down Murad's $24 million memecoin holdings. Navigating the ethical minefield of crypto transparency.

Hello, y'all. Enjoy long-form articles trusted by the best in Web3? Get them right in your inbox 👇

Crypto twitter, always on fire.

This time it's all about privacy vs transparency.

The players?

ZachXBT: Everyones’s favourite pseudonymous blockchain sleuth

Murad Mahmudov: The memecoin prophet predicting a "Memecoin Supercycle"

What happened?

On October 9, ZachXBT revealed the wallet addresses of Murad.

ZachXBT identified 11 wallets linked to Mahmudov

These wallets hold $24 million in memecoins

The coins are spread across Ethereum and Solana networks

ZachXBT's reason? So the community can monitor his future activity.

He has history of being the community watchdog.

Read: ZachXBT vs Big Bro🍿🔍

But this move has opened a pandora's box of ethical questions in the crypto community.

Read: Sued, doxxed ... but up for a fight 🤼♂️

Who is Murad Mahmudov?

Notable figure in crypto world

A Princeton University graduate

Recognised for his insights on Bitcoin as a global store of value

Recently delivered a 20-minute speech at a Singapore crypto conference

Went viral for predicting a "Memecoin Supercycle"

Gained a significant following on Twitter (X) for his memecoin predictions

Argues that "delusional memecoin cults that resonate with a lot of people are the next big thing"

The community reacts. A house divided.

Unlock Web3 Insights by the Web3 Builders

A weekly podcast that takes you closer and deep into things that are shaping the world of crypto and Web3. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

Do tune in for depth, insight & numbers on how the internet is evolving.

Brought to you by Joel John, Saurabh Deshpande, Shlok Khemani and Siddharth.

Block That Quote 🎙️

ZachXBT's response

“How dare ZachXBT put Murad at risk by sharing how much he owns”

Despite the uproar, ZachXBT seemed unfazed by the criticism. He threw sarcasm at his detractors, sharing a screenshot where Mahmudov himself disclosed owning 2.8% of a memecoin's circulating supply.

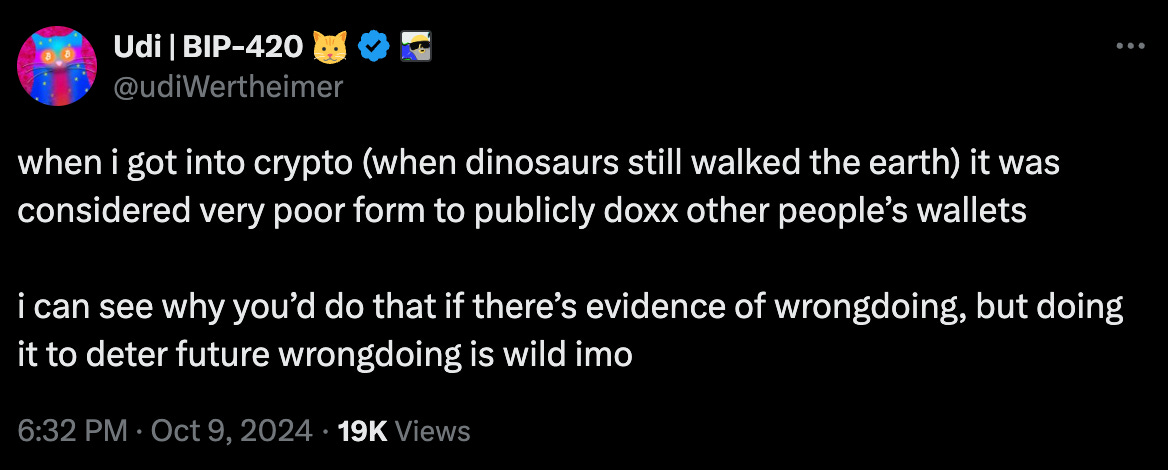

The crypto world is split on ZachXBT's actions.

Pro-transparency camp: Argue that blockchain is inherently transparent. Believe this move could prevent potential rug pulls and see it as a form of community protection.

Privacy advocates: Warn about the dangers of doxxing wallets. Argue that privacy is a core value of the crypto world. Worry about setting a dangerous precedent.

Gabriel Shapiro (MetaLeX founder and lawyer) suggested ZachXBT's actions could be "kinda hypocritical". Called for ZachXBT to disclose his own deals with analytics companies and government agencies.

But that’s got an immediate response.

In The Numbers 🔢

$24 million

That's the eye-popping value of memecoins held across 11 wallets allegedly belonging to Murad Mahmudov, as exposed by crypto sleuth ZachXBT.

11: The number of separate wallets Murad allegedly uses to disguise his holdings

61x: The astronomical increase in Murad's SPX token holdings from June to October

35.69 million: The number of SPX tokens Murad purchased across multiple wallets

Wallet diversification: 11 wallets spreading $24 million averages to about $2.18 million per wallet.

From June to August, Murad's SPX purchases coincided with frequent bullish posts about the token.

That means, thousands of followers potentially affected by Murad's memecoin promotions.

“Memecoin Supercycle”

Murad Mahmudov's recent Token2049 talk suggests memecoins are entering a "supercycle," offering more than just profits - think community, identity, and fun.

The Numbers

Memecoin market: $53 billion (2.3% of total crypto market)

New memecoins since January 2024: 2.3 million

Solana memecoin traders losing money or breaking even: 64.7%

Traders making over $1 million: A mere 0.0028%

Reality Check

Most memecoin investors are not profiting.

The vast majority of new memecoins likely won't succeed.

Memecoins don't aim to solve real-world problems or advance blockchain technology.

The argument: Some argue memecoins are a response to failed VC-backed projects. But is this the right approach?

Some food for thought

Internet bubble cost investors $5 trillion, but look where we are now

Failed crypto projects = valuable lessons (Terra, anyone?)

Permissionless markets allow for experimentation (and yes, some failures)

Token Dispatch View 🔍

Transparency is the basic premise on which the crypto ecosystem thrives.

ZachXBT's decision to disclose on-chain data about Murad's wallet holdings serves a critical purpose: it empowers investors to make informed decisions in a space often rife with manipulation and misinformation.

By shedding light on the activities of influential figures in the memecoin market, ZachXBT is not only promoting accountability but pushing for transparency that can protect investors from potential scams.

Although some critics argue that such actions infringe upon personal privacy, it's crucial to recognise that blockchain technology is inherently transparent. The information ZachXBT revealed was already accessible on the blockchain; he merely brought it to public attention.

This approach can help mitigate risks associated with unchecked influence in the crypto space and encourages a more informed community.

It's vital for the crypto community to engage in meaningful discussions about ethical guidelines for on-chain analysis and influencer conduct.

The Surfer 🏄

Ethereum founder Vitalik Buterin is being considered as a candidate for the 2024 Nobel Prize in Economics. Economists Tyler Cowen and Alex Tabarrok discussed Buterin's potential during an episode of their Marginal Revolution podcast on October 8.

Stablecoin use is surging in Argentina amid soaring inflation rates, which is currently at 236.7%. A report by Chainalysis reveals that stablecoins account for 61.8% of all crypto transactions in Argentina, as residents seek to protect their savings from the devaluation of the peso and gain exposure to US dollars.

Asset manager VanEck has launched a venture capital unit to raise $30 million for its first fund. VanEck Ventures' first fund will focus on early-stage startups in fintech, digital assets, and artificial intelligence. The fund, led by former Circle Ventures leaders Wyatt Lonergan and Juan Lopez, plans to make 25 to 35 investments, targeting innovations in tokenisation and stablecoin platforms.

Ark Invest has purchased 12,994 shares of Coinbase, valued at $2.2 million, marking its first investment in the cryptocurrency exchange in nearly a month. Simultaneously, it has sold over $36 million in Robinhood stock.

Solana has reached a milestone of 100 million active wallets, but most of these accounts are empty. Over 86 million users hold no SOL, leading to critics suggesting that this growth may be inflated by bot activity.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

As the crypto landscape evolves, it's clear that some level of regulation may be necessary to protect investors. However, regulations should focus on preventing manipulation without stifling the innovative spirit that defines the crypto ecosystem. We need discussions on how to achieve this.

Thanks for the post. These recaps are much easier on the eyes than following along on twitter.