Neobanks Are No Longer About Banking 🏦

The real business is now in stablecoins, payments, and identity

Hello,

Last month, Tejaswini wrote about crypto neobanks and why they finally work today. She explained how stablecoins are now regulated, how card infrastructure has become easier to access, and how many people now hold a meaningful part of their wealth on-chain. Putting it all together, spending from a wallet feels a lot easier than using a traditional bank.

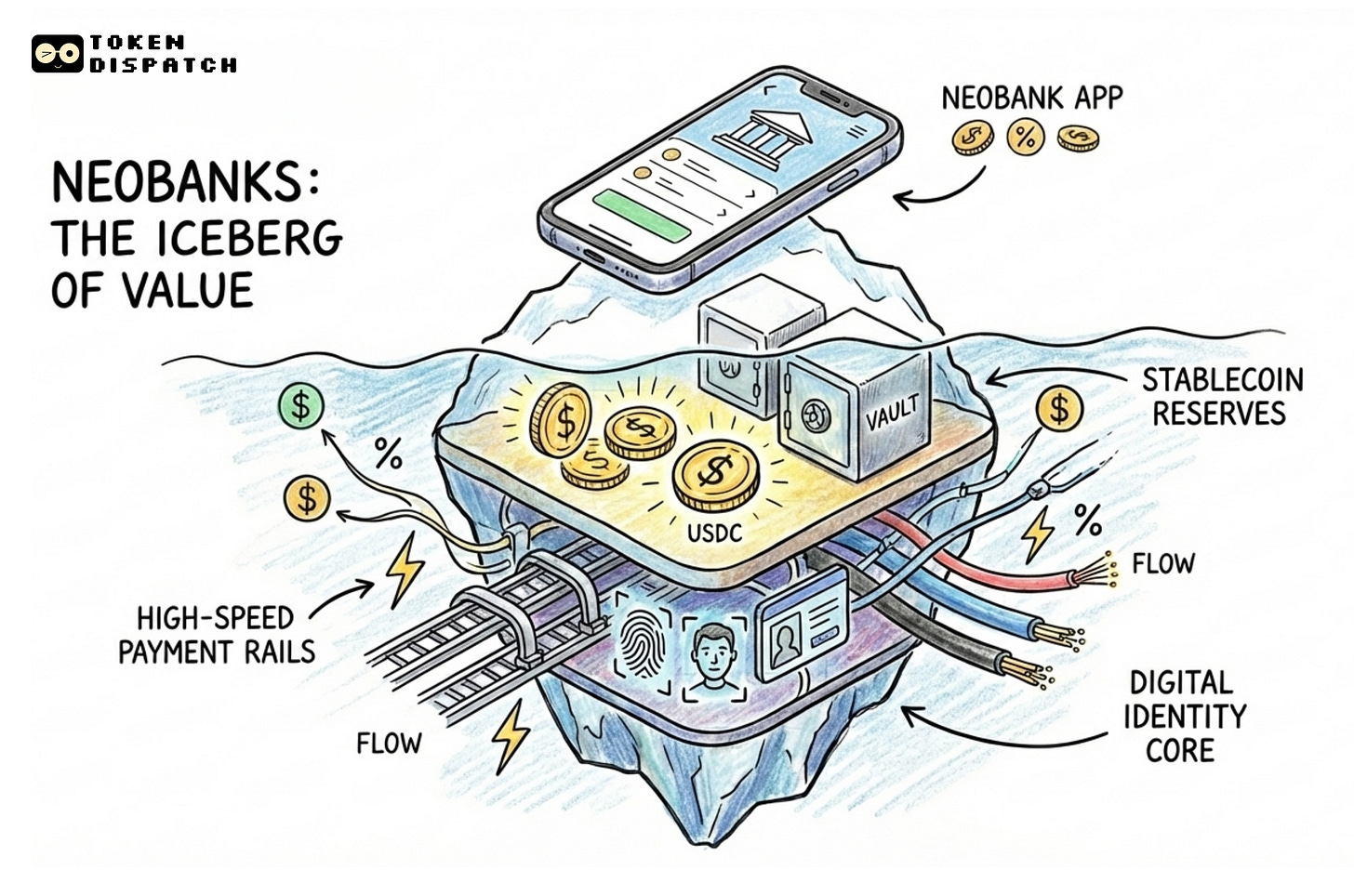

That piece made it clear that the basic foundations for running a bank on-chain are now in place. The model is no longer theoretical. But now that the rails are working, the question is, where exactly is the real value actually accruing in this market? Because it’s clearly not just issuing a card or letting people spend USDC. These have become baseline features.

Some neobanks are capturing value through yields and savings. Some are capturing it through payment volume and stablecoin flow. Still, others are positioning themselves closer to the infrastructure layer, where the margins are very different.

Today’s piece explores the next layer and how the category is starting to split based on where the economics make the most sense. Let’s get started!

Ready to Turn Predictions into Profit?

Limitless is a next-gen, on-chain platform letting creators launch custom prediction markets and share them with their communities. Trade on real-world events, crypto, macro, sports, and earn fees when your market grows.

Create markets in minutes and own your community’s engagement

Built on Base, backed by top-tier investors like Coinbase Ventures and Maelstrom Capital, with over $250M traded so far

Earn points now and position yourself ahead of the token launch

Where Value Is Actually Accruing Inside Neobanks?

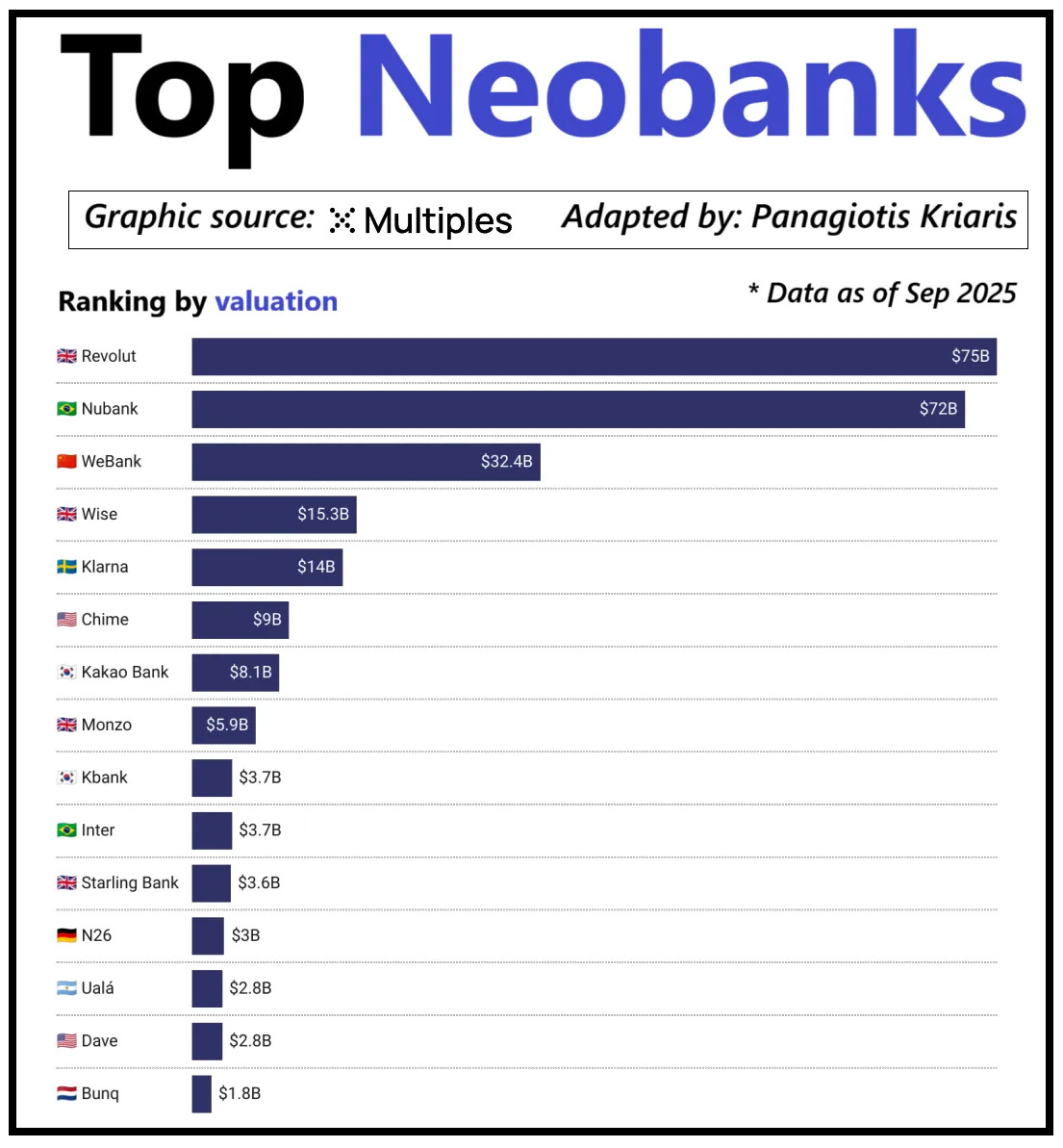

If you look at the biggest neobanks globally, the most valuable ones are not necessarily the ones with the most customers; they are the ones that actually capture meaningful revenue per customer. Revolut is the easiest example. It has fewer customers than Nubank, yet is valued higher because it earns across several products: FX, trading, wealth, and premium services. Nubank, meanwhile, built a huge business by owning credit and collecting interest rather than relying on card fees. WeBank operates differently by keeping costs extremely low and plugging directly into Tencent’s ecosystem.

Crypto neobanks are now reaching this exact point. A wallet with a card is not a business model; anyone can launch that. The differentiation comes from the one thing each platform chooses to monetise. For some, it is yield on customer balances. For others, it is the volume of stablecoin payments flowing through them. And for a few, the upside lies in issuing or managing stablecoins themselves, because that is where the strongest and most predictable revenue lies.

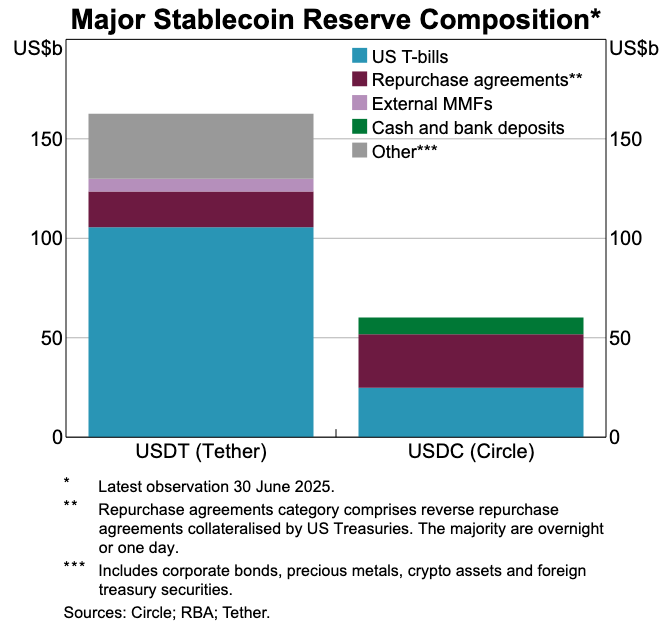

This is also why the stablecoin layer matters much more now. In a reserve-backed stablecoin, the real money is made from the interest earned on the reserves held in treasury bills or cash equivalents. This income goes to the issuer, not the neobank that simply allows users to hold or spend the token. This dynamic is not unique to crypto. Even in traditional finance, neobanks don’t earn interest on customer deposits; the partner bank that actually holds the money does. What stablecoins do is make this separation far more visible and concentrated. In a reserve-backed stablecoin, the entity holding the treasury bills and cash equivalents earns interest income, while consumer apps primarily handle distribution and user experience.

As stablecoin usage scales, the apps that onboard users, drive transactions, and build trust are often not the ones earning from the underlying reserves. That gap is what’s pushing companies to move vertically, away from being pure interfaces and closer to the part of the system that actually holds and manages the money.

This is why companies like Stripe and Circle are deepening their presence in the stablecoin stack. Rather than staying only at the distribution layer, they are expanding toward settlement and reserve control, where the fundamental economics are. Stripe launched Tempo, a new blockchain specifically built to move stablecoins cheaply and instantly. Instead of relying on existing chains like Ethereum or Solana, Stripe built its own rail to control settlement, fees, and throughput, all of which directly translate into better economics.

Circle did something similar with Arc, its own settlement network for USDC. Arc enables USDC to move between institutions instantly, without affecting public-chain congestion or incurring high fees. It essentially lets Circle run the USDC “back end” without relying on external infrastructure.

An equally important reason this matters is privacy. As Prathik explains in Making Blockchains Great Again, public blockchains record every stablecoin transfer on a transparent ledger. While this works well for open financial systems, it creates problems for business use cases like payroll, vendor payments, and treasury management, where transaction amounts, counterparties, and payment patterns are sensitive information.

In practice, this level of transparency makes it easy for third parties to reconstruct a company's internal economics using block explorers and chain analysis tools. Arc helps avoid this by allowing institutional USDC transfers to settle outside public blockspace, preserving confidentiality while still keeping the speed and settlement advantages of stablecoins.

Stablecoins Are Breaking the Old Payment Stack

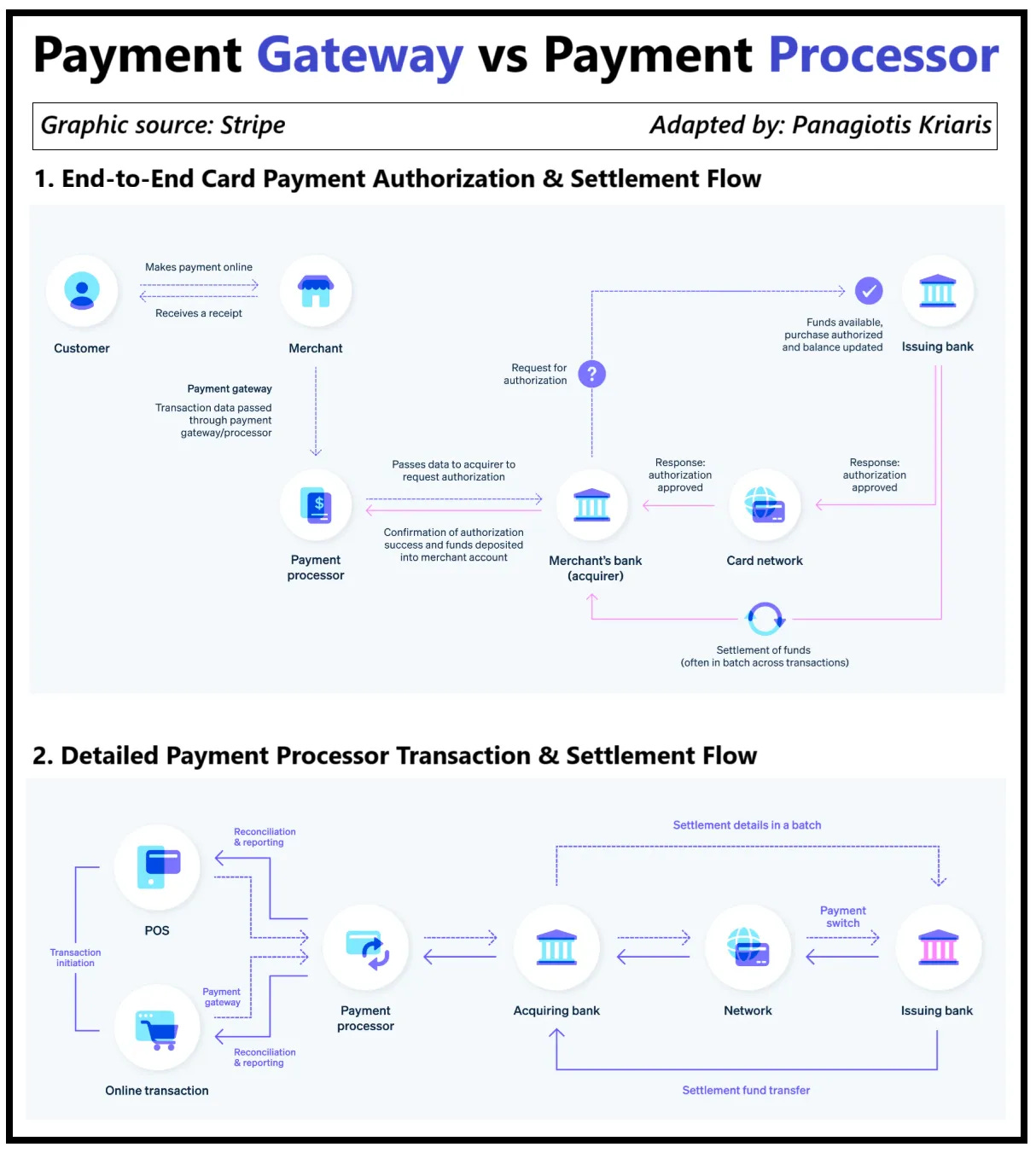

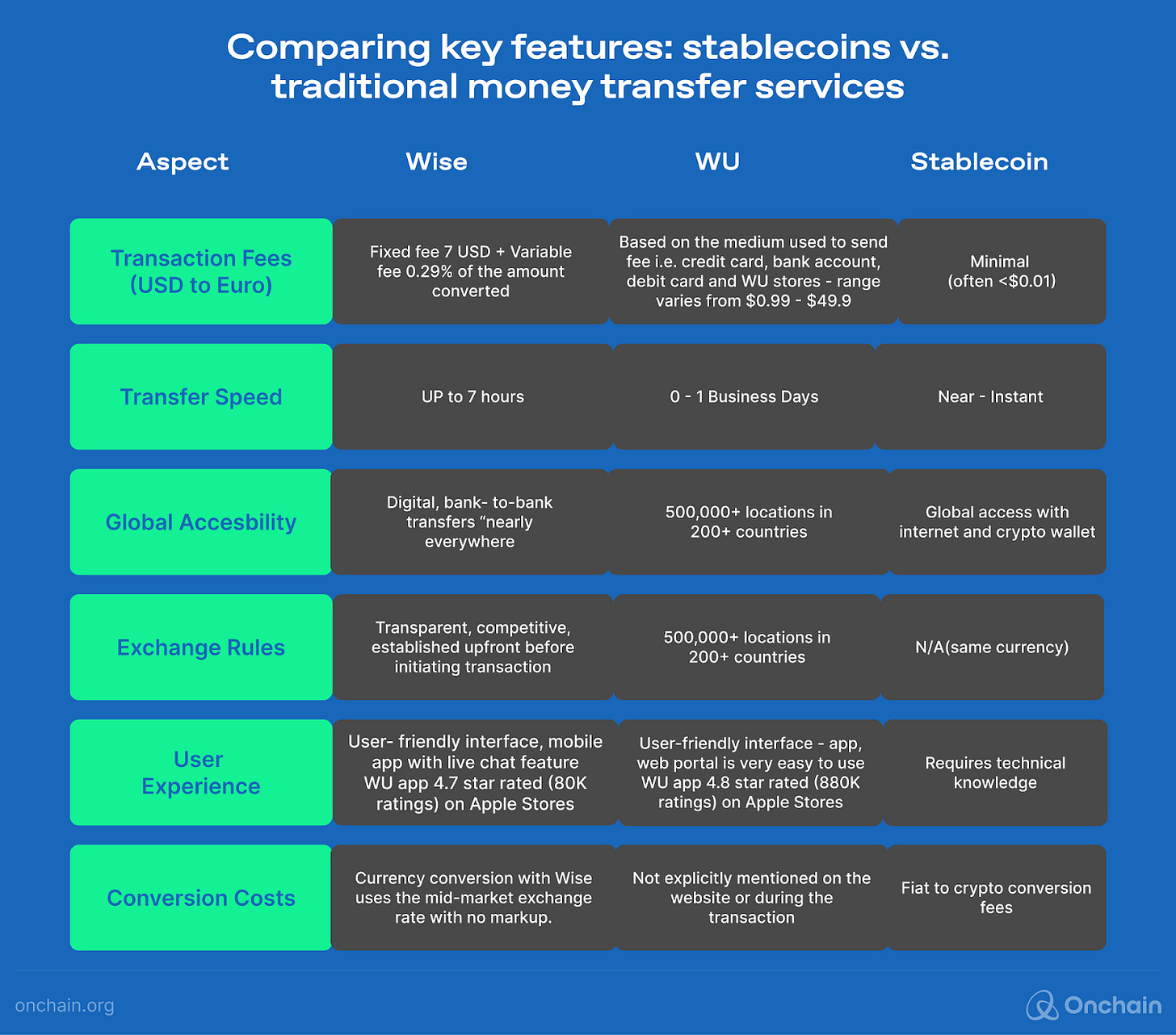

If stablecoins are where the core value lies, the traditional payment stack starts to look outdated. Today’s system involves several intermediaries: a gateway to collect the payment, a processor to route it, card networks to approve it, and banks on both sides to settle it. Every step adds cost and delay.

Stablecoins bypass most of this chain. Sending a stablecoin does not require a card network, an acquirer, or a batch settlement window. It is a direct transfer, and the “rails” are simply the network it settles on. This is important for neobanks because it changes what users expect. If someone can move money instantly elsewhere, they won’t accept slow or expensive routes inside a neobank. The neobank must either integrate tightly with these stablecoin rails or risk becoming the slowest link in the chain.

This shift also changes the business model. In the old system, neobanks earned a predictable margin from card transactions because payment networks sat in the middle of everything. In the new system, that margin shrinks. When stablecoins move peer-to-peer, there is no interchange fee to collect. So, neobanks that rely solely on card spend are now competing against a rail that bypasses the fee structure entirely.

As a result, the role of the neobank shifts from “card issuer” to something closer to a routing layer. Neobanks need to be the place where stablecoin transactions flow, because payments are moving away from cards and toward direct transfers. The neobanks that handle these flows well will hold the strongest position, because once users start treating the neobank as the default path for moving money, the product becomes much harder to replace.

Identity Is Becoming the New “Account”

As payments move faster and cheaper through stablecoins, another constraint that becomes equally important is identity. The old system treated identity as something separate: banks collected documents, stored them, and ran checks in the background. But when money moves across wallets instantly, every transaction depends on a trusted identity. Without that, compliance, fraud control, and even basic permissions can fall apart.

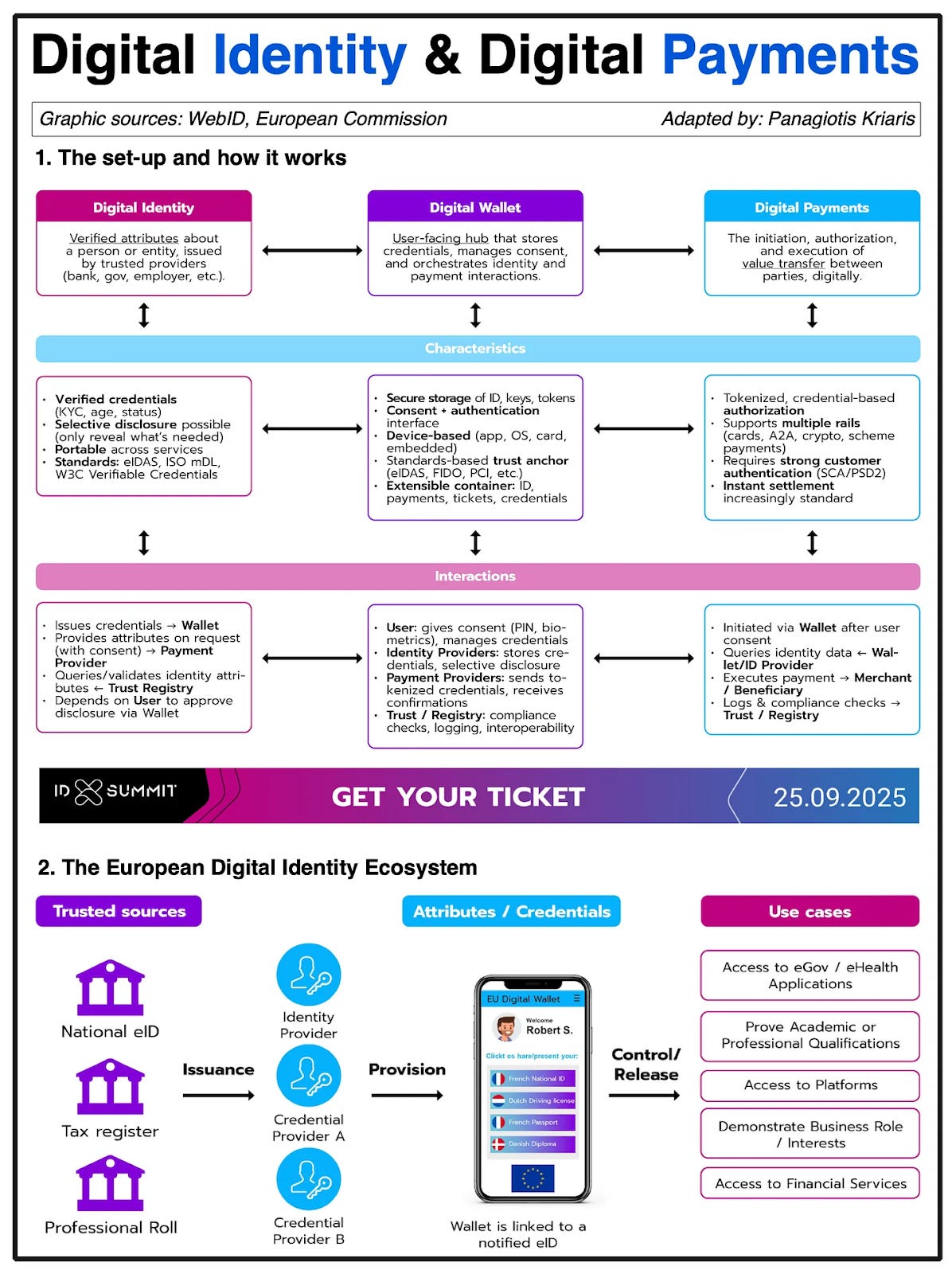

This is why identity is merging directly with payments. Instead of fragmented KYC processes across apps, the world is moving toward portable, verified identities that can be used across services, countries, and platforms.

This exact shift is happening in Europe with the European Digital Identity Wallet (EUDIW). Instead of each bank, app, and service running its own verification process, the EU is building a single, government-backed identity wallet that every resident and business can use. This wallet doesn’t just store an ID; it carries verified credentials (age, residency, licenses, tax info), lets users sign documents, and integrates payments directly inside it. A user can authenticate, share only the required information, and complete a payment in a single seamless step.

If EUDIW succeeds, it will flip the entire European banking architecture. Your identity will become the anchor and not your bank account. This makes identity a public good and makes banks and neobanks interchangeable unless they build on top of this trusted identity foundation.

Crypto is heading in the same direction. On-chain identity experiments have been running for years, and while none is perfect, they point to the same idea.

Some examples include:

Worldcoin tries to create a global proof-of-personhood to confirm users are unique humans without revealing unnecessary information

Gitcoin Passport bundles various reputation and verification signals to reduce Sybil attacks in governance and rewards

Polygon ID, zkPass, and ZK-proof frameworks let users prove facts (“I am over 18”, “I live in Germany”, “I passed KYC”) without revealing the underlying data

ENS + off-chain credentials now allow wallets to represent not just balances, but also social and identity attributes

Most identity projects in crypto aim to solve the same problem: giving users a way to prove who they are or specific facts about themselves without that information being locked on a single platform. The direction is the same as Europe is pushing with its EUDIW initiative: one identity can move with the user and be used across different apps without having to start from scratch each time.

If this becomes the norm, it changes how neobanks operate, too. Today, neobanks treat identity as something they control: you sign up, they verify you, and that becomes your “account.” But if identity becomes something the user brings with them, the neobank becomes one of the services that plugs into that verified identity. This makes onboarding easier, compliance more straightforward, and duplicate checks less frequent. It also means the wallet, not the neobank, becomes the user’s main point of ownership.

Where Is This Heading

Across all the sections, what it tells us is that the parts of the neobank stack that used to matter are no longer as important. User count isn’t a moat. Cards aren’t a moat. Even a clean UI isn’t a moat. The real differentiation lies in these three areas: the financial product the neobank earns from, the rails it uses to move money, and the identity it plugs into. Everything else slowly becomes interchangeable.

The successful neobanks won’t look like lighter versions of traditional banks. They will look more like wallet-first financial systems and anchor themselves to a single core economic engine, because that is what determines both margins and defensibility. Broadly, that engine falls into three buckets:

1. Yield-backed neobanks

These platforms win by becoming the default place users hold stablecoins. If they manage large user balances, they can earn yield from underlying sources such as treasury-backed stablecoins, on-chain yield, staking, or restaking, without needing millions of users. Their advantage is that the simple economics of holding money are more profitable than moving it. These neobanks behave less like consumer apps and more like modern savings platforms disguised as wallets. Their competitive edge comes from offering the smoothest “hold and earn” experience.

2. Payment-flow neobanks

Here, the value comes from volume. These neobanks become the main route through which users send, receive, and spend stablecoins. They integrate tightly with payment processors, merchants, on- and off-ramps, and cross-border corridors. Their economics resemble those of global payment companies, with small margins per transaction, but considerable aggregate revenue if they become the preferred path. Their moat is habit and reliability, and the place users default to whenever they need to move money.

3. Stablecoin-infrastructure neobanks

This is the deepest category and the one with the highest upside. These neobanks don’t just move stablecoins; they aim to own them, or at least part of the infrastructure behind them. That includes issuance, redemption, reserve management, and settlement. This is where the margins are strongest, because the most significant earnings sit with whoever controls the reserves. These neobanks blend consumer features with infrastructure ambitions. They are closest to becoming full financial networks rather than just apps.

In simple terms: yield neobanks make money when users stay; payment neobanks make money when users move; and infrastructure neobanks make money regardless of user behaviour.

I expected the market to split into two very different types of players. One group will remain consumer-facing apps, primarily packaging existing rails, simple, familiar, and easy to switch away from. The other group will move closer to the parts of the system where value compounds: stablecoin issuance, routing, settlements, and identity integration.

These players will feel less like “apps” and more like infrastructure with a consumer skin on top. They’ll be harder to replace because they will quietly become the operating systems for how money moves in and out of on-chain environments.

That was all for today. See you next Sunday.

And until then, stay curious!

Vaidik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

This is truly inspiring, to see crypto become this big thing I'm so proud i got interested in this space.

We will redefine how wealth and value is exchanged.