Oops, Toly Built a DEX? 👀

An accidental repository, a sharded exchange, and Solana's bid to reclaim DeFi

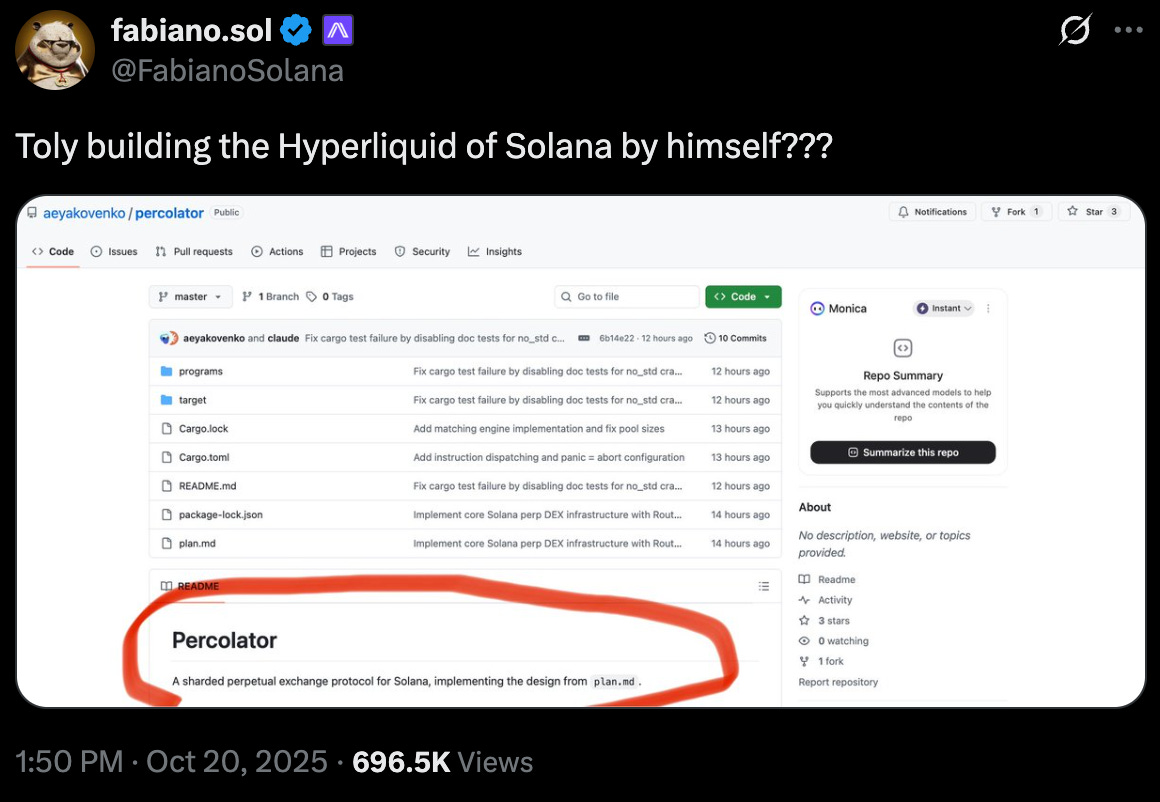

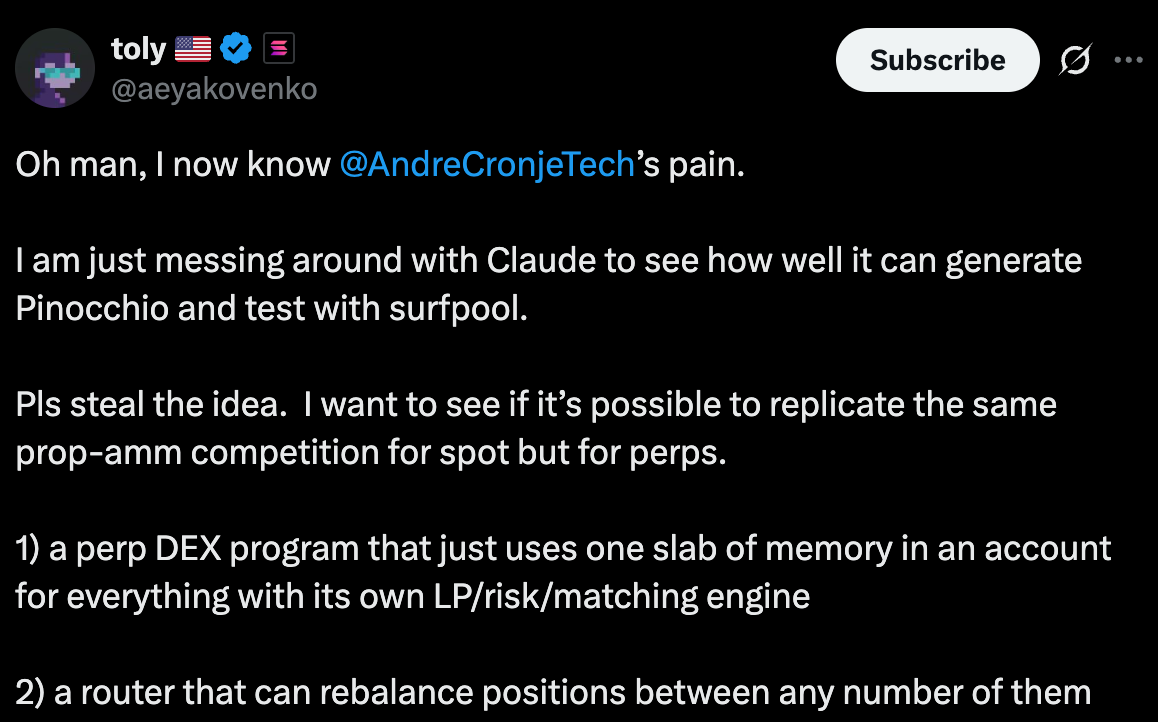

The situation is simple: Anatoly Yakovenko was “messing around” with Claude AI to code a decentralised perpetual futures exchange. In the process, he accidentally made the GitHub repository public, and now, everyone believes Solana is building a competitor to Hyperliquid. Yakovenko’s response? “Steal the idea.”

Within hours of the code going public on October 20, 2025, crypto Twitter exploded. A memecoin named after the project surged to a $6.23 million market cap before Yakovenko clarified that he wasn’t actually building this product. The memecoin promptly crashed by 98% drop from the peak. Classic crypto.

Although Yakovenko claims he was merely vibe coding with AI and never intended to launch Percolator as a product, the code he published reveals something far more significant than just another perpetual futures DEX. It provides a blueprint for how Solana plans to achieve modularity without fragmenting into numerous rollups as seen with Ethereum.

Percolator represents Solan’s solution to the fundamental scaling issue that blockchain faces: how do you gain modular benefits without adding the complexity of modularity?

So, even if this was just a weekend coding project that never becomes a real product, the architecture itself reveals everything we need to know about Solana’s future direction.

The suit-and-tie way to buy Bitcoin.

If you want exposure to crypto but don’t want to touch a wallet, remember 12 words, or worry about rug pulls, Grayscale’s got you.

No private keys to manage

No unregulated exchanges

No steep learning curve

It’s the easiest way for individuals and institutions alike.

For the past two years, Solana has been trapped in a narrative it created for itself. While memecoins and NFTs drew attention and volume, but also pigeonholed the network as the casino chain, rather than serious player in financial infrastructure. Meanwhile, Hyperliquid built what Solana should have: a high-performance perpetual futures platform that generated 35% of all blockchain revenue in July and posted $317 billion in monthly trading volume.

The VanEck report from that month was particularly damaging. Hyperliquid was “poaching high-value users from Solana” offering, according to VanEck “a simple, highly functional product.” Solana was losing the traders that mattered most.

Aster’s emergence on the BNB Chain only added pressure. Within months of its launch, Aster surpassed Hyperliquid in daily volume, hitting $14.5 billion and offering leverage up to 1,001x on Bitcoin. The perpetual DEX sector was exploding, and Solana’s presence was barely noticeable.

Read: The Aster Counterstrike ⚔️In this competitive environment, Percolator represents Solana’s attempt to reclaim its legitimacy in decentralised finance. Rather than simply matching existing platforms, Solana aims to leapfrog them by building a derivatives infrastructure that’s far more advanced.

What is Percolator?

Percolator is a perpetual futures exchange built directly into Solana’s Layer 1 blockchain. Unlike traditional DEXs that process all trades through a single order book, Percolator splits markets into independent “slabs” which are separate trading engines that run in parallel. Each slab handles its own perpetual market with its own liquidity providers and risk models. A “router” program sits above them, managing collateral and allowing traders to use the same funds across multiple positions simultaneously. The result is a derivatives platform that can scale throughput by adding markets rather than hitting a bottleneck, while keeping traders’ funds isolated from risks in other markets. It’s designed to match centralised exchange speed while maintaining self-custody and onchain settlement.

The broader industry’s shift toward modularity sets the strategic context. Ethereum’s roadmap revolves around rollups and fragmented liquidity. Cosmos advocates for app-chains. Even within single-chain architectures, the trend is toward specialisation, with different execution layers for different tasks.

Solana’s counter-thesis has always been monolithic throughput. One chain, maximum speed, no fragmentation. But Percolator suggests an evolution. Solana can achieve the benefits of modularity through internal architectural design, rather than relying on external chain proliferation. The Alpenglow and Firedancer upgrades have already positioned Solana for parallel execution at the validator level. Percolator extends that vision into application design.

Rather than launching separate chains for different derivatives markets, Percolator creates independent execution environments within a single Layer 1. It’s modularity without fragmentation, sharding without the coordination overhead makes cross-rollup communication expensive and slow.

The Percolator Blueprint

The technical architecture of Percolator revolves around three key components that work in concert to solve scalability for perpetual DEXs.

Slabs are independent trading engines. Each slab handles one specific market. Say, Bitcoin perpetuals or Ethereum perpetuals. They’re run by different liquidity providers and operate completely separately from each other. Each slab has its own order book, processes its own trades, and can be upgraded without affecting any other market.

This separation matters more than it sounds. If a bug hits the Bitcoin slab, Ethereum trading keeps running normally. If one liquidity provider wants to experiment with aggressive margin requirements, they can do it in their slab without risking everyone else’s money. And because slabs run in parallel using Solana’s architecture, adding more markets actually increases total capacity instead of slowing everything down.

The router ties everything together. It sits above all the slabs and handles the messy coordination work. When you want to trade across multiple markets using the same collateral, the router makes it happen in a single transaction. This is crucial for capital efficiency: instead of locking up separate funds for each trade, a single collateral pool can back multiple positions at once.

The router also acts as a safety mechanism. It holds your collateral and gives each slab a specific allowance, like handing different stores different credit cards with different limits. No single slab can access more than its allocation, which means a problem in one market can’t drain your entire account.

This extra coordination layer might sound like it would slow things down, but Solana’s architecture handles it differently. Because the router and slabs all execute on the same Layer 1 with atomic transactions, there’s no network hop or messaging delay between them. The coordination happens within a single block, maintaining the speed advantage that makes Solana competitive with centralized exchanges in the first place.

The open invitation is the third piece. Yakovenko uploaded actual working code and told developers to copy it, fork it, and build their own versions. The GitHub repository contains everything needed to launch: order book logic, memory management systems, and the coordination layer between slabs and the router.

Yakovenko is deliberately trying to spark an explosion of competing implementations. Multiple teams building different versions means faster iteration and improvement than any single team could achieve on its own. It’s the same strategy that made Uniswap’s automated market maker design so influential.

It’s the same dynamic that made Uniswap’s AMM design so successful. Release it, let others copy it, and watch the ecosystem improve it faster than you could alone.

The Strategic Angle

Percolator’s design choices reveal a coherent thesis about how DeFi infrastructure should evolve on high-performance chains.

Yakovenko’s return to hands-on engineering after years focused on ecosystem development and marketing carries its own signal. Solana spent 2024 in somewhat of an identity crisis: it was strong on memes and speculation, but weak on serious financial infrastructure. Percolator repositions the narrative. It’s the network’s CEO writing production code for a financial primitive that could anchor a new phase of DeFi.

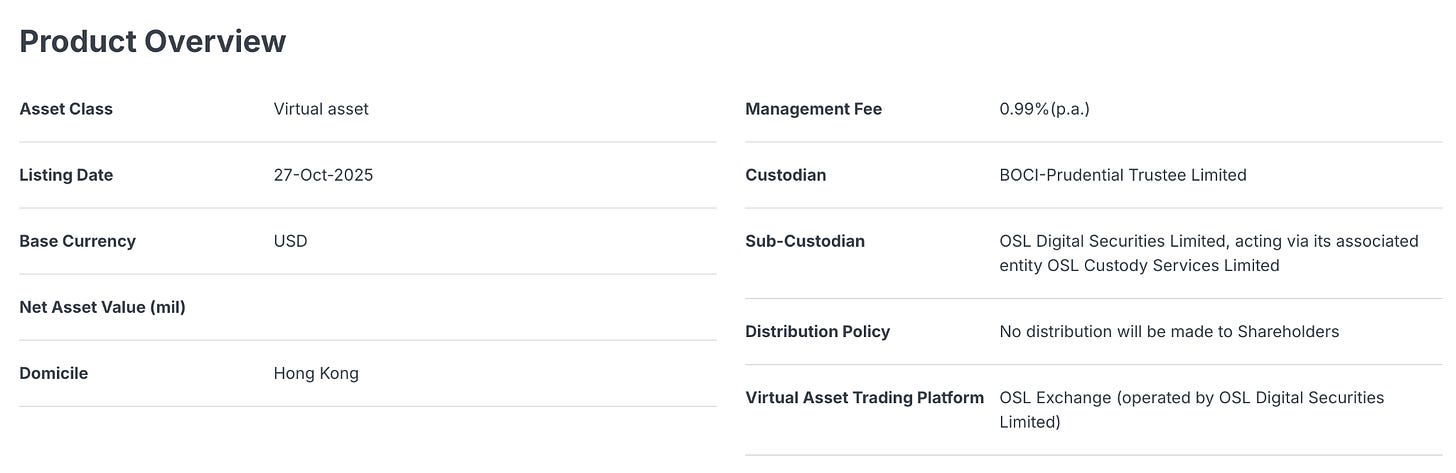

The timing intersects with meaningful market shifts. Solana DEX volume has been surging throughout 2025. Hong Kong just approved the first Solana spot ETF, with trading beginning October 27. Over 150 crypto ETF filings are pending SEC review, with proposals for Solana proposals among the most numerous. The infrastructure is converging toward legitimacy at the same moment Solana gains a credible derivatives platform.

Percolator also arrives as concerns mount about systemic risk in perpetual markets. The $19 billion liquidation cascade in October highlighted how high leverage across competing platforms can create contagion risk. Percolator’s slab isolation model offers a structural response: failures in one market mechanically cannot spread to others because the execution environments are physically separated.

The AI-assisted development deserves mention as well. Yakovenko has been explicit about using Claude to accelerate coding and documentation. This is indicative of how quickly sophisticated financial primitives can now be prototyped and deployed. The time from concept to implementation-ready code has collapsed, and that acceleration changes the competitive dynamics of protocol development.

The broader implication is that Solana is positioning itself as a financial operating system rather than just a fast blockchain. Percolator provides the derivatives layer. Existing DEXs such as Jupiter handle spot trading. Lending protocols manage collateral. Native USDC and USDT provide settlement rails. Firedancer brings validator-level parallelisation. Together, these components start to resemble a vertically integrated stack for on-chain finance.

This stands in contrast to Ethereum’s multi-rollup future, where each application may potentially live on a different chain with different security assumptions and bridging requirements. Solana bets that modularity within a unified security and settlement layer will prove more capital efficient and composable than modularity across chains.

Whether that bet pays off depends on the execution that hasn’t happened yet. The liquidation modules aren’t complete. Stress testing hasn’t begun. No launch date exists. But the architecture is coherent, the code is real, and the invitation to build is explicit.

Yakovenko revealed more than he intended. What started as messing around with AI became a public blueprint for how Solana plans to compete in the next phase of DeFi. The accident was the announcement. The invitation to steal it was the strategy.

That’s it about the Percolator leak.

Next week, whatever breaks next. Until then... keep your bags ready,

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.