Pieverse: Finally, Crypto Receipts 🧾

Gasless transactions with actual receipts your business can use.

Money has always been a story we agree to believe.

For thousands of years, this story required intermediaries to verify it. Banks kept ledgers. Governments minted coins. Accountants reconciled books. The entire apparatus of modern finance exists because we needed trusted third parties to say “Yes, this transaction happened, and here’s the proof.”

Blockchain was supposed to change that. No more intermediaries. No more trust requirements. Just pure, cryptographic certainty that value moved from one address to another.

But in removing the intermediary, we also lost the context.

When you pay someone through a bank, you don’t just get confirmation that the money moved. You get an invoice. A receipt. A paper trail that explains what the payment was for, when it happened, and why it matters. You get a story that other people, especially auditors and tax authorities, can actually understand.

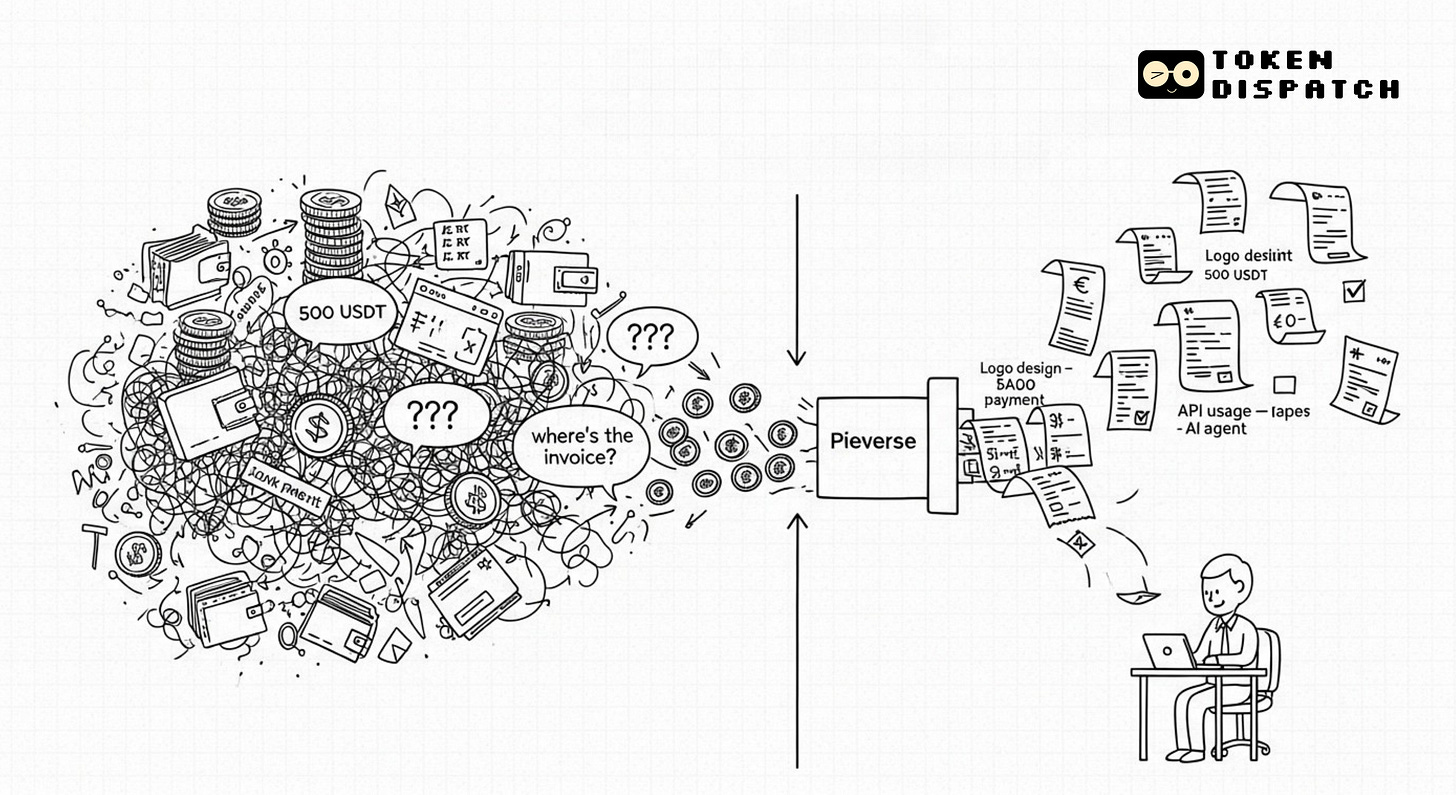

Crypto stripped all that away. We got the transfer. We lost the narrative.

Let’s say you paid a freelancer 500 USDT for a logo design. The transaction settled in seconds. Beautiful. Efficient. Trustless.

Then your accountant asks for the invoice and there’s absolutely nothing that resembles a business record.

This is the fundamental tension at the heart of crypto adoption. We built a system that moves value without intermediaries, but we forgot that businesses don’t just need to move value. They need to document it, categorise it, audit it, and prove it happened in a way that satisfies regulators who don’t speak blockchain.

Pieverse is fixing that disconnect.

What Is Pieverse, in Plain English?

Pieverse is a payment infrastructure that reintroduces the missing piece to crypto transactions: context.

But on-chain, immutable, and verifiable by anyone who needs to see it.

When you pay someone with crypto today, you’re basically handing them cash in a dark alley. The money moves, but there’s no receipt, no invoice, no proof of what the payment was for.

👉🏼Explore pieverse.io

Pieverse adds all that missing context. It generates actual invoices. It creates compliant receipts. It timestamps everything on-chain so you have an immutable paper trail.

It does all this without gas fees, which removes one of the biggest friction points that makes crypto payments annoying for everyday use.

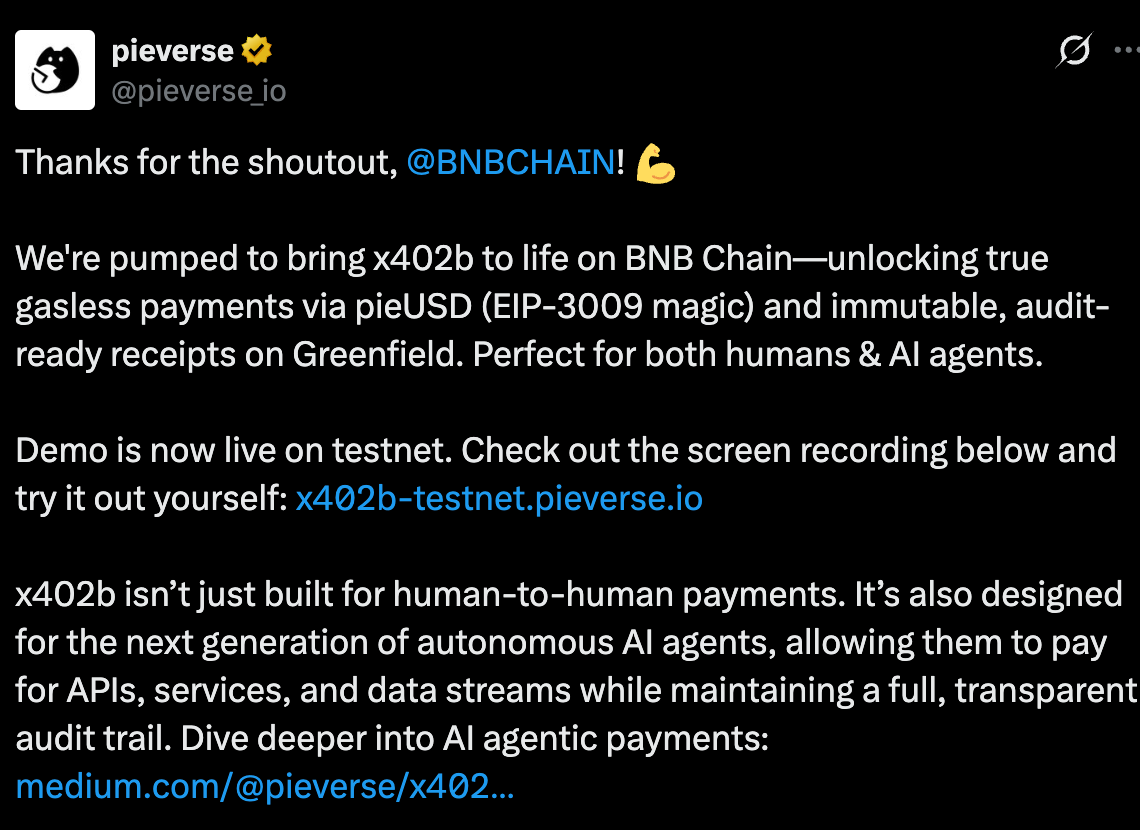

The platform runs on the BNB Chain using something called the x402b protocol. But you don’t need to understand the technical architecture to benefit from it. From a user perspective, it works like any normal invoicing and payment system. You just happen to get blockchain’s transparency and immutability as bonuses.

It does all this without gas fees, which removes one of the biggest friction points that makes crypto payments annoying for everyday use.

The platform runs on the BNB Chain using something called the x402b protocol. But you don’t need to understand the technical architecture to benefit from it. From a user perspective, it works like any normal invoicing and payment system. You just happen to get blockchain’s transparency and immutability as bonuses.

Why This Actually Matters for Regular Users

If you’ve ever tried to:

Pay a freelancer in crypto and then explain it to your bookkeeper

Run a DAO treasury and need to track where funds actually went

Use crypto for business expenses and realise you have zero documentation

Manage any kind of crypto transactions that need to survive an audit

You’ve felt this pain.

Pieverse removes the headache. It turns messy blockchain transactions into organised financial records. The kind banks and tax authorities actually recognise.

Pieverse solves this problem across several specific use cases:

Freelancers and contractors: You can generate a professional invoice in under a minute, accept payment in pieUSD (a wrapped stablecoin that makes the whole system work), and automatically receive a tax-compliant receipt. The system handles all the documentation you need to file taxes or satisfy clients who require proper billing records.

DAOs and crypto organisations: Managing a shared treasury stops being pure chaos when every payment automatically generates a verifiable record. You can issue checks for contributor work. Timestamp every expenditure with details about what it funded. Export everything for governance reviews or community audits. The paper trail is built into the system from day one, rather than being something you desperately try to reconstruct months later from raw blockchain data.

Small businesses: If you’re accepting crypto payments from customers, you need records that actually integrate into normal accounting workflows. Pieverse gives you structured data that fits into QuickBooks or whatever software you’re using.

AI agents and automation: This one’s more futuristic but increasingly important. As AI agents become more autonomous and start handling transactions independently, they need to generate receipts that their human operators can audit. An AI agent paying for API access, buying training data, or hiring another agent for a task needs to produce records. Pieverse is built for this use case from the ground up. The agent transacts autonomously, and the system generates the complete paper trail automatically.

For anyone using crypto: You get gasless payments via something called pieUSD (a wrapped USDT), which means you can send money without needing to hold BNB for transaction fees. One less thing to think about.

How Pieverse Actually Works

The core technology behind all this is the x402b protocol. It’s an extension of something called x402, which is basically a web standard for payments that can happen over HTTP.

Read: HTTP 402: Payment Required

Here’s the breakdown:

Gasless payments: You authorise a payment by signing a message off-chain. A “facilitator” handles the actual blockchain transaction and covers the gas fee. You never need to hold native tokens just to make payments work.

Instant receipts: Every transaction automatically generates a compliant receipt with all the details you’d expect: date, amount, what it was for, tax information. These receipts follow standards like GAAP and IFRS, so they’re audit-ready from day one.

Immutable storage: All this data gets stored on BNB Greenfield (decentralised storage), which means nobody can alter it later. Your records are permanent and verifiable.

Smart contract verification: The system uses something called “settle-then-work” logic, which means payments confirm before services execute. No more paying for something and hoping it actually delivers.

The result is a payment that looks and feels like a normal web transaction, but with all the transparency and verifiability of blockchain.

There’s also a “nerd corner” for those who care: x402b extends the historic HTTP 402 “Payment Required” standard (recently revived by Coinbase) with EIP-3009-style transfer authorisation. The facilitator model is similar to meta-transaction systems in other gasless protocols, but it’s specifically optimised for BNB Chain and tightly integrated with compliance tooling.

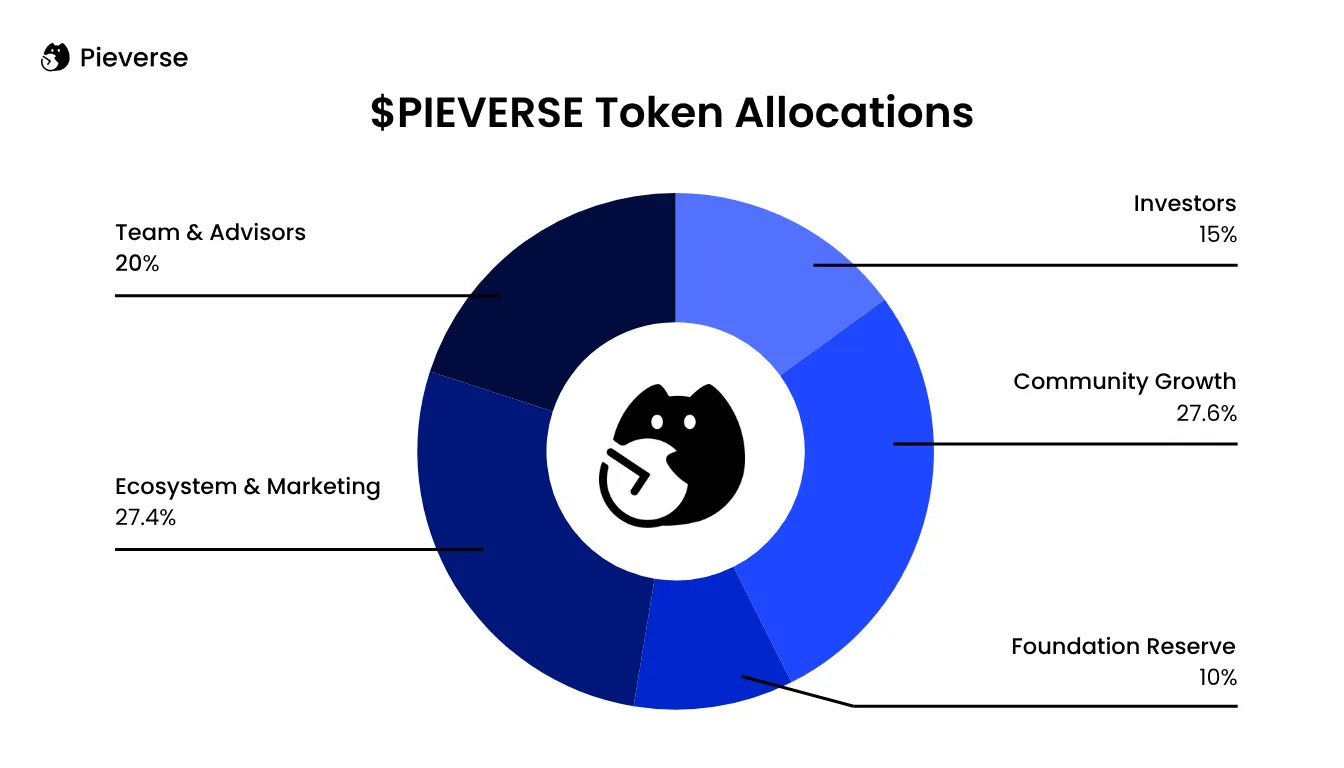

The native token, $PIEVERSE, launched in November 2025 and is currently trading on multiple exchanges including Binance, Gate.io, and MEXC. There was a significant airdrop campaign for early users.

The vesting schedule is designed to prevent immediate token dumps. Team and investor allocations are locked for a full 12 months, then release linearly over time. That structure suggests long-term orientation rather than quick exits.

What Makes Pieverse Different

The good stuff:

Clean user experience: You don’t need to understand blockchain to use this. It works like sending a payment link or generating an invoice in any normal business tool.

Built for small users: Most crypto infrastructure is designed for whales and institutions. Pieverse actually works for freelancers, small DAOs, and everyday people who need to move money without jumping through hoops.

Real compliance: The receipts Pieverse generates aren’t just for show. They’re jurisdiction-specific (US, EU, Asia) and designed to satisfy actual tax requirements. If you’ve ever scrambled during tax season trying to document crypto transactions, this is the tool you wish you had.

Works across wallets and chains (eventually): You can connect different wallets and track everything in one dashboard. No more logging into five different platforms to see where your money went.

Agent-ready infrastructure: If AI agents are going to transact autonomously, they need payment systems that generate audit trails automatically. Pieverse is one of the few platforms built with this use case in mind.

The tradeoffs:

It’s early. Pieverse is live but still building out features. Some advanced functionality (like cross-chain expansion and DAO governance) is coming in 2026, not today.

Chain coverage is limited. Right now, it’s focused on the BNB Chain. If you’re deep in the Ethereum or Solana ecosystems, you’ll need to wait for multi-chain support.

Data sync can vary. Like any blockchain-dependent system, there can be delays when networks get congested. It’s usually fast, but it’s not instant in every case.

This is a tracking and compliance tool, not an exchange. You can’t trade or swap assets here. It’s purely for managing payments and generating records.

What This Could Mean If It Works

Retail tools in crypto usually come last. Exchanges get built first. DeFi protocols next. The stuff normal people actually need? That’s an afterthought.

Pieverse feels different. It’s solving a problem that every single person who uses crypto for real work has encountered: the gap between blockchain transactions and real-world business needs.

If the platform scales, it could change how small businesses, freelancers, and DAOs handle money. Instead of crypto being this separate, messy thing you need to reconcile manually, it just becomes another payment method. One that actually works with your accounting software and tax filings.

And if AI agents do become economic actors (which seems increasingly likely), having payment infrastructure that’s compliant by default is going to matter a lot.

Pieverse raised $7 million from serious investors like Animoca Brands and UOB Ventures. It’s backed by Binance’s MVB program. The token launched in November and is trading on multiple exchanges.

If your crypto workflow feels like a junk drawer with payments scattered across wallets, and no receipts, Pieverse might be worth checking out. It’s trying to bring order to chaos.

That’s Pieverse. Payments in, receipts out.

Until next time, keep building.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.