President Joe Vetoes 🆑

US President Joe Biden vetoes pro-crypto resolution, defends SEC. Missed chance to correct stance on crypto? Crypto ramps up election campaign spend. Coinbase accuses SEC of trying to destroy' crypto.

Hello, y'all. O Joe, what have you done? 🙋

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

So it has come down to this.

The President gets his veto.

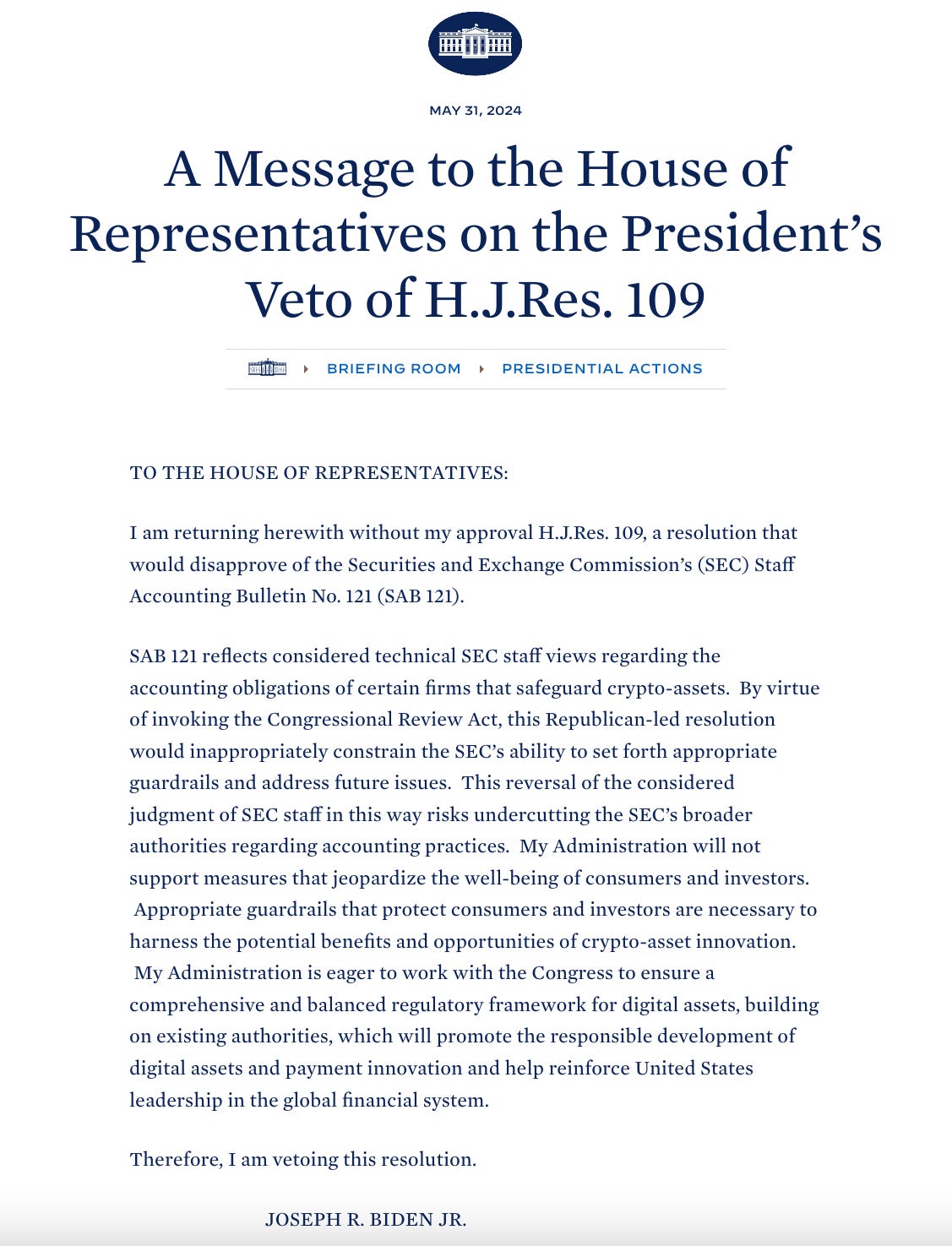

President Joe Biden has vetoed congressional disapproval of SEC accounting bulletin on crypto assets - SAB 121 guidelines.

Explain? Vetoed a bill that aimed to allow financial firms to self-custody crypto funds, including Bitcoin and other cryptocurrencies.

Argument? SEC standard is "necessary" for crypto innovation, and the bill would undermine the SEC's ability to establish critical safeguards for potential risks to financial stability.

What now? Article I, Section 7 of the US Constitution gives the president the power to veto bills passed by Congress. A presidential veto can be overridden by a two-thirds vote in both the Senate and House of Representatives.

President Biden has issued 11 vetoes during his presidency as of June 2024.

Understand it better

The SAB 121 guidelines require companies holding customers' crypto assets in custody to record them as liabilities on their balance sheets, along with a corresponding asset requirement.

This has been seen as a deterrent for publicly reporting banks to engage with crypto.

The Republican-led resolution had received bipartisan support in Congress and was endorsed by Wall Street banking groups.

The White House news release stated that the administration is "eager to work with the Congress to ensure a comprehensive and balanced regulatory framework for digital assets."

Crypto camp reacts

Block That Quote 🎙️

United States Senator Cynthia Lummis.

“… instead of listening to the will of the American people and reining in the SEC, President Biden doubled down on his administration’s failed policies at the expense of American consumers”

According to the pro-crypto US Senator, President Joe Biden has missed the opportunity to "correct" his administration's position on cryptocurrency assets by vetoing the repeal of controversial cryptocurrency accounting guidelines known as Staff Accounting Bulletin (SAB) No. 121.

Crypto's PAC Power

Crypto’s parabolic spending on political action committees (PACs) in the 2024 election cycle is a clear indication of the industry's ambitions to shape the regulatory landscape in its favour.

According to data compiled from the Federal Election Commission (FEC), over $117 million have already been contributed to crypto PACs.

The emergence of new PACs, such as Fairshake and its affiliated committees Defend American Jobs and Protect Progress, has replaced the dormant pro-crypto PACs from the previous cycle.

These PACs are strategically targeting battleground states and using contributed funds for voter research, consultation, and election ad campaigns.

The crypto industry's political spending is not without controversy, as it comes in the wake of the FTX scandal and mounting evidence of rampant crypto crime.

The influx of funds from major players like Coinbase and Ripple, as well as venture capitalists Marc Andreessen and Ben Horowitz, suggests that the industry is determined to overcome this hurdle and shape the regulatory landscape to its advantage.

Crypto's political involvement extends beyond PACs. Presidential candidate Robert F. Kennedy Jr. recently revealed that he has bought 21 bitcoin and believes that "Bitcoin is the way to save the dollar."

He also expressed support for commuting the sentence of Silk Road founder Ross Ulbricht, a position shared by former President Donald Trump.

As the 2024 election cycle progresses, it remains to be seen how the crypto industry's political spending will impact the outcome and the future of cryptocurrency regulation in the United States.

Read: Crypto campaign spending ramps up

In The Numbers 🔢

$700+ million

The amount cryptocurrency bankruptcy lawyers and advisers at major law firms have amassed in fees from significant cryptocurrency bankruptcy cases.

The recent bankruptcies of major crypto organisations such as FTX Trading Ltd, Genesis Global Capital, BlockFi, Celsius, and Voyager Digital have led to a surge in legal fees, creating a goldmine for firms like Sullivan & Cromwell and Kirkland & Ellis.

Read: Legal fees skyrocket in high-profile crypto bankruptcies

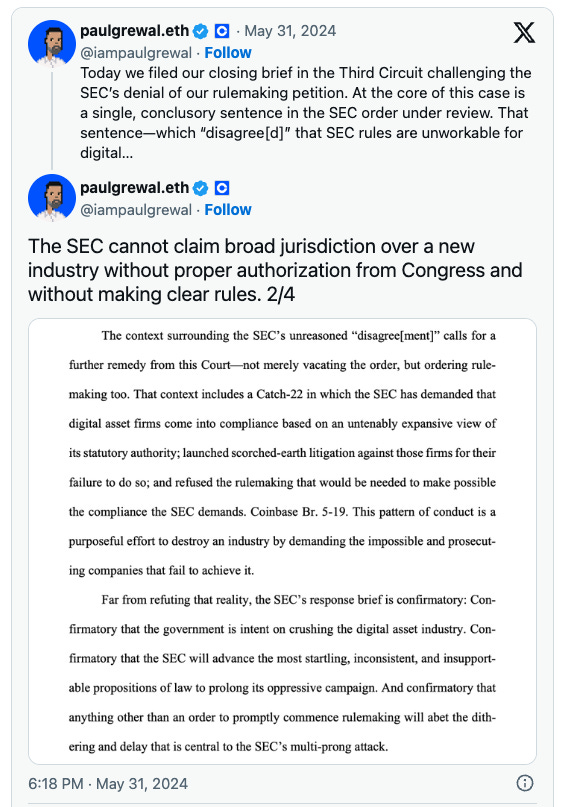

Coinbase Blasts SEC's "Scorched-Earth" Tactics

Coinbase has accused the US Securities and Exchange Commission (SEC) of pursuing a "scorched-earth litigation" strategy against crypto companies.

Exchange claims

SEC doesn't provide clear rules, then punishes companies for not following them.

It aims to destroy the crypto industry through unclear regulations.

This accusation comes in the wake of ongoing legal battles between Coinbase and the SEC, with the exchange pushing for the regulatory body to establish clear guidelines for crypto companies to follow.

The Surfer 🏄

Tether, world’s largest stablecoin issuer, has entered into a subscription agreement with Bitdeer to purchase up to $150 million worth of its shares in a private placement, a Bitcoin mining and technology company listed on Nasdaq.

Bybit's botched airdrop of NOT tokens that affected 320,000 users and led to a $26 million compensation for users. The crypto exchange responded by restructuring its executive team and offering compensation to affected users.

The Japanese cryptocurrency exchange DMM Bitcoin was hacked around 1:30 pm local time on May 31, 2024. The security breach resulted in the loss of 4,502.9 BTC, over $300 million. Exchanges has pledged to cover the full amount lost and has taken measures to prevent further unauthorised transactions.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋

Yes