Welcome to our weekly Bitcoin macro and news analysis: Mempool.

We're looking at Week 29 of 2025 (July 14-July 20)

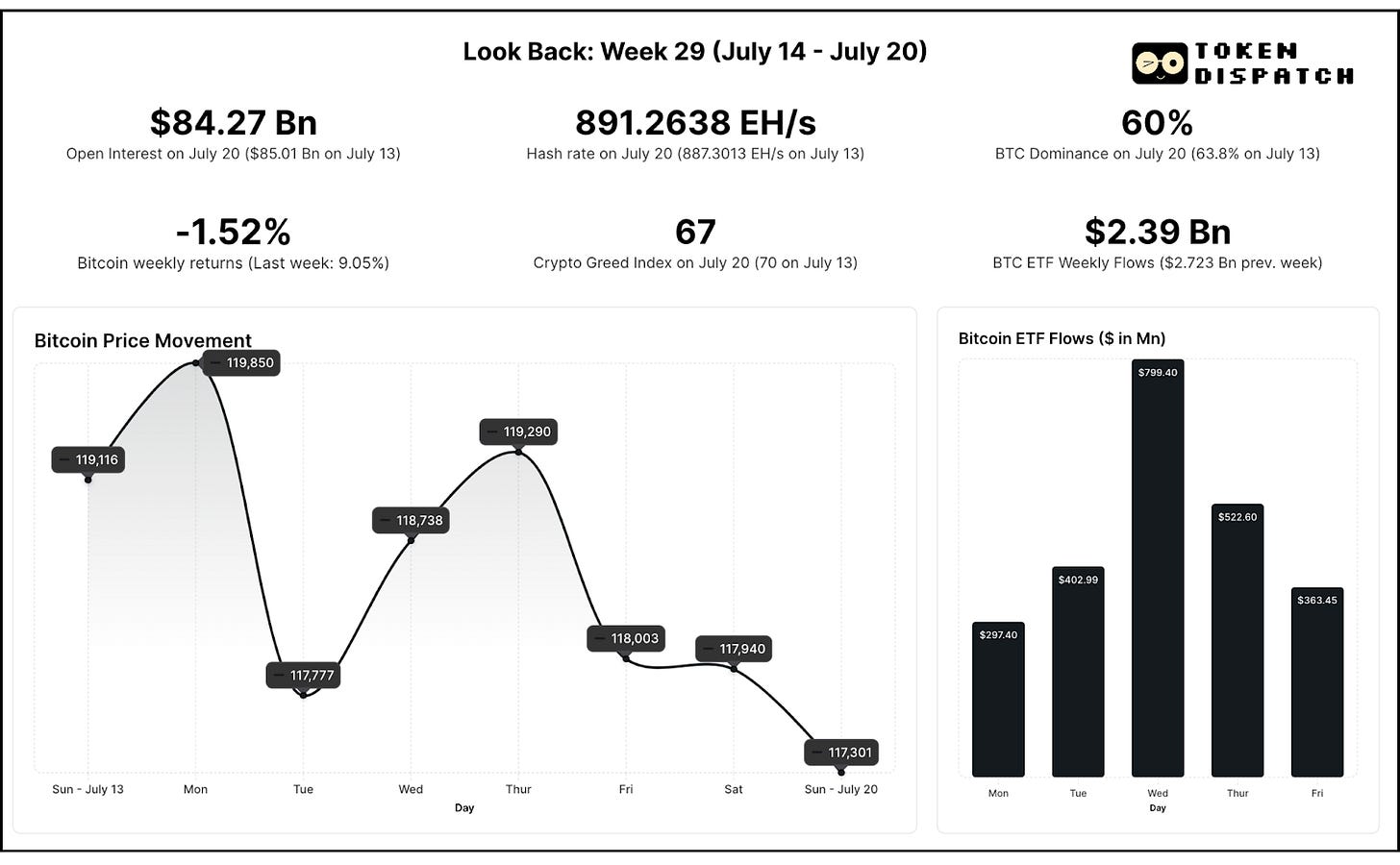

BTC dominance touches 60% after 4 months

Hashrate reaches all-time high

BTC remains in greed territory through the week

Open interest persisted above $80 billion

BTC ETFs record inflows of over $2Bn in back-to-back weeks

Build the Skillset Crypto Teams Are Hiring For

Safary Certification is a 4‑week bootcamp taught by the very people behind growth at Kraken, Stargate, EigenLayer, and others.

In this bootcamp, you’ll learn:

How to position a crypto brand using narrative-first frameworks.

Funnel-building from acquisition to retention using onchain data.

Partnership strategies & token launch playbooks.

Building a personal brand that gets you hired in web3 growth.

Cohort 1 had 170 students. Cohort 2 kicks off August 1 with only 100 seats.

Week That Was

After a week that delivered new all-time highs on a near-daily basis, Bitcoin entered a different phase last week. The euphoric ascent to $122,884 gave way to something more measured.

Bitcoin closed last week at $117,301, declining 1.52% as it spent most of its time navigating a tight range between $117,000 and $119,850.

This consolidation phase, while appearing unremarkable on weekly charts, represented the market's first serious attempt at establishing sustainable demand above $112,000 — Bitcoin’s all-time high until last week’s rally pushed it past the $120,000 mark.

The week's trading pattern was a series of probes and retreats. Bitcoin would test higher levels, reaching as high as $119,850 on Monday, only to pull back as profit-taking kicked in from both miners and long-term holders.

Notably, the miner activity coincided with new peaks in the technical infrastructure supporting Bitcoin's network last week. The hashrate touched an all-time high of 1.0322 Zh/s on Tuesday.

Over the week, Bitcoin’s price fell to $115,600 but held the level at its first retest attempt.

Although many in the market were quick to celebrate the meteoric price rise above the $120,000-mark in the preceding week, we had signalled the possibility of corrections to the range of $115,000 in last week’s edition.

Read: The Climb That Never Ends 🧗🏽

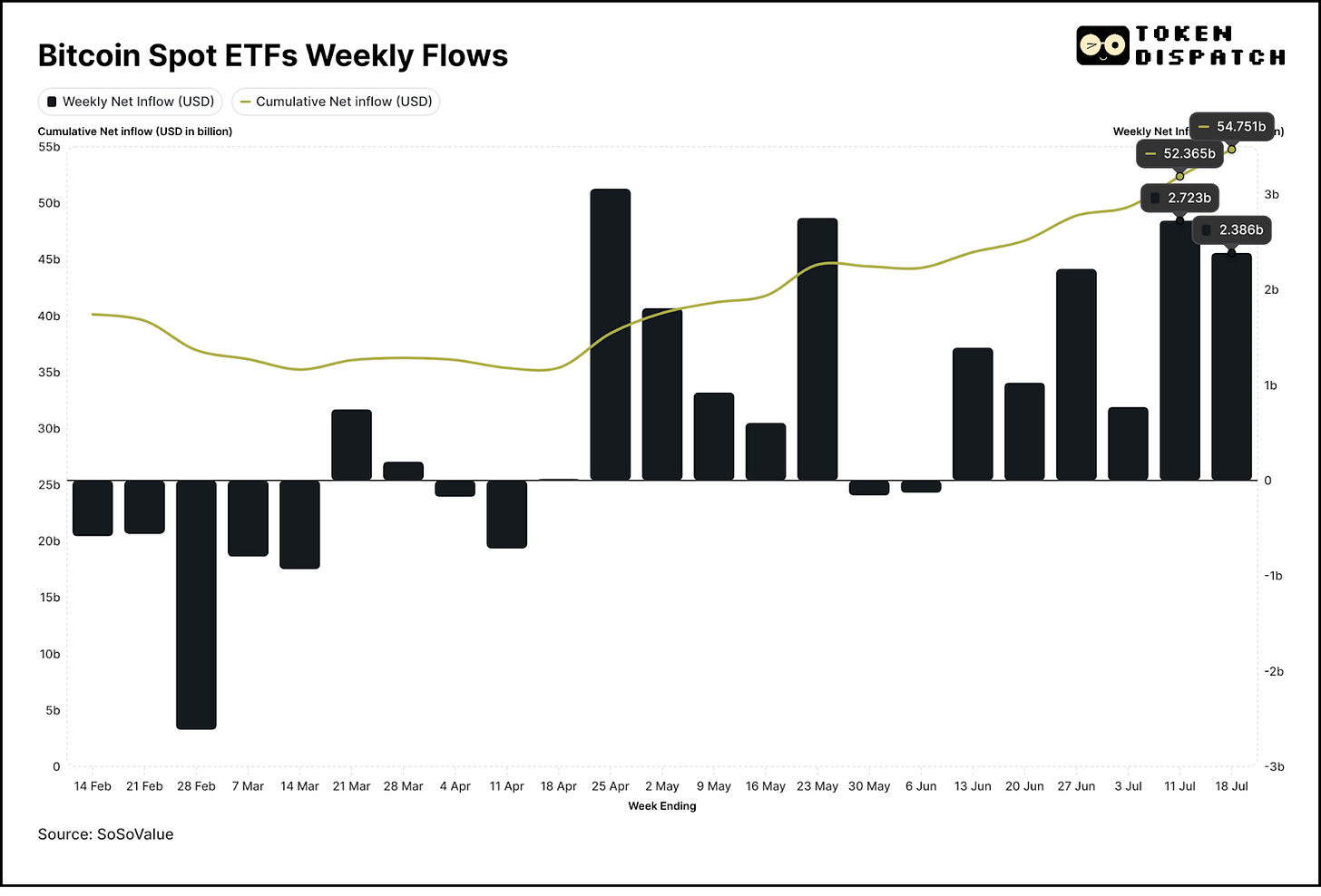

Positive flows into Bitcoin exchange-traded funds (ETFs) continued despite the sideways movement of price, hinting at a healthy price discovery phase.

Bitcoin ETFs recorded their sixth consecutive week of positive inflows, bringing in $2.39 billion and marking only the third time since their January 2024 inception that back-to-back weeks had exceeded $2 billion in inflows.

However, Bitcoin dominance dropped to 60% for the first time last week since March 3. This divergence suggested that as Bitcoin's momentum temporarily stalled, investors began rotating toward alternative opportunities. The beneficiary was Ethereum, as its investor sentiment turned positive after a rally north of $3,500.

The Crypto Fear and Greed Index maintained its position in "greed" territory for the entire week, marking the first time since May that this psychological barometer had shown such consistency.

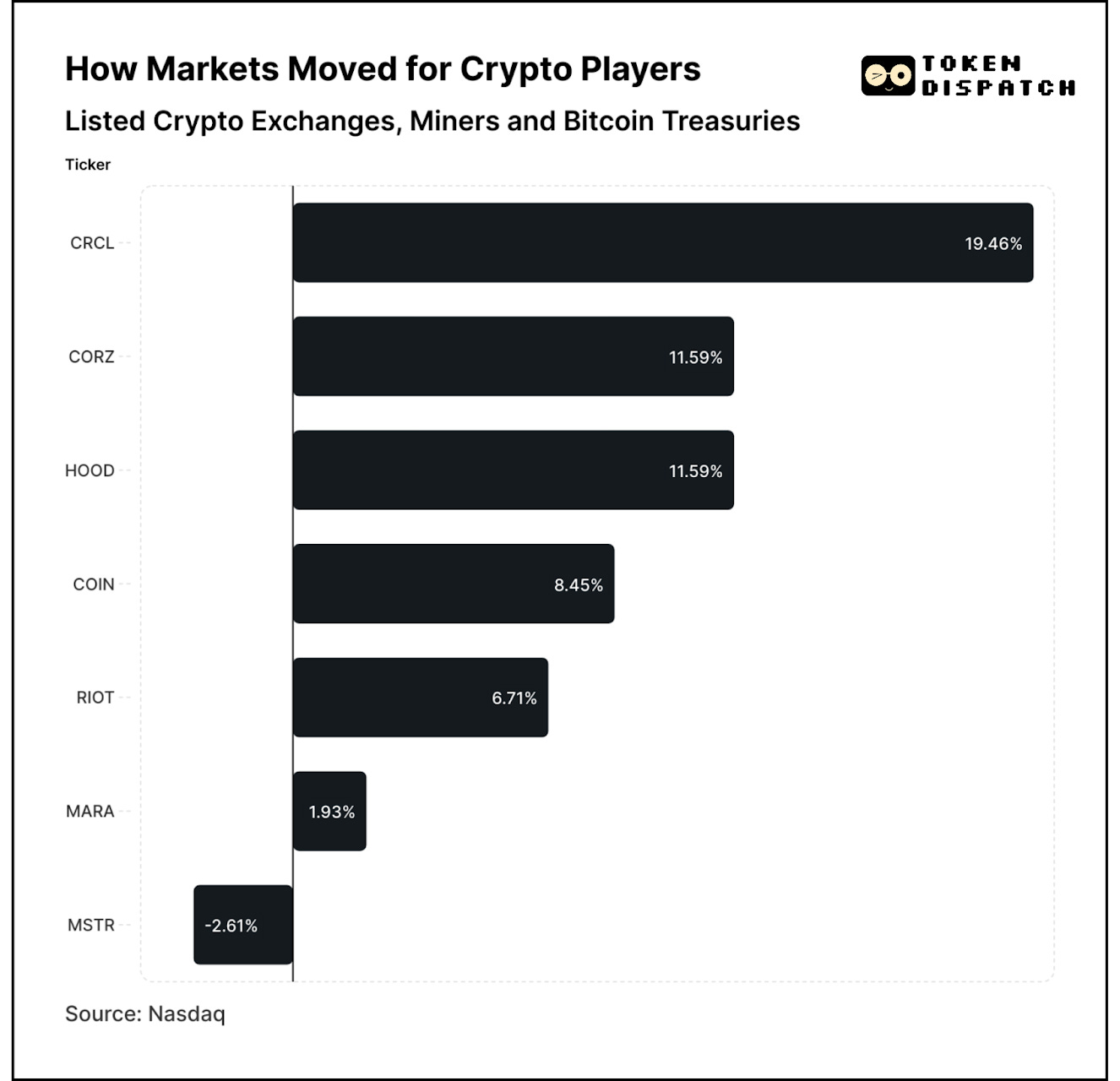

Crypto Stocks Record Gains, Barring Strategy

As Bitcoin traded in the consolidation zone, traditional financial markets continued to deepen their exposure to crypto.

Circle led the pack with ~20% weekly rally, fueled by the US House passing GENIUS Act — landmark stablecoin legislation — and the anticipation of President Donald Trump signing it into law, which he did on Saturday.

Both Core Scientific and Robinhood posted identical 11.59% gains. The former’s scrip rose to a near-six-month high, while Robinhood's shares crossed the three-figure mark and marched toward a new all-time high for yet another consecutive week.

Coinbase's 8.45% gain helped it climb to $419.78, including an intraweek peak at $444.65 — levels not seen ever before. The exchange benefited from multiple catalysts throughout the week, including the passage of crypto-friendly stablecoin legislation, record trading volumes, and the unveiling of its ambitious Base App ecosystem that aims to transform how consumers interact with digital assets.

The week's only disappointment came from MicroStrategy, which despite reaching an eight-month high of $457.22 early in the week, ultimately closed at $423.22, 2.61% lower than the preceding week’s closing price of $434.56.

Surfer 🏄🏾♂️

Jack Dorsey’s Block Inc. (formerly Square) will join the S&P 500 on July 23, sending shares up 10% in after-hours trading. Block, a Bitcoin-focused tech company behind Square, Cash App, TIDAL, Bitkey, and Proto, replaces Hess in the index.

Tim Draper warns that macroeconomic forces, including the falling US dollar and rising fiat inflation, will reduce the impact of Bitcoin's usual halving cycle. He predicts global Bitcoin demand will surge as investors seek refuge from currency devaluation and financial instability.

Bitcoin captured 43% of all crypto social chatter after hitting a new all-time high just over a week ago, signalling a possible short-term top and an imminent pullback, according to Santiment. Analysts say this spike in online attention could mark a key entry point for buyers once market euphoria settles.

What's Next for Bitcoin

It might still be too early to call definitive levels for Bitcoin, but last week’s consolidation suggests that support is forming around the ~$115,000 range.. Even if Bitcoin reclaims the psychological threshold of $120,000, which recently triggered profit-taking, the rally may not hold unless it establishes solid support levels between $115,000 and $120,000.

The downside scenario also remains viable.

A breakdown below $115,000 could trigger deeper corrections toward $110,000, levels that might still not be too unhealthy, given the recent rally hasn’t been tested enough.

Institutional demand will be key to absorbing the selling pressure that profit-takers are creating.

That's it for this week's Mempool edition.

See ya next Monday.

Until then …stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.