Today’s edition is brought to you by Polymarket.

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it.

Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

Hello

It’s that time of the year — jingle bells, Secret Santa, the Christmas tree, scrumptious fruit cakes, Mulder wine and some melodious carols to go with all of it. Aah! Can’t ask for anything better.

Speaking of carols, here’s an absolute beaut that I find myself going back to at this time, every year, as a ritual.

I hope you enjoyed listening to that.

It is time for celebrations, and my team at Token Dispatch is taking a short breather from publishing new pieces over the coming week. We will be spending some time with our loved ones, rewinding, relaxing and recharging. We hope you get a much-needed break, too.

But we didn’t want to disappear from your inbox entirely, lest the algorithm gods show their wrath. So, we will revisit some of our favourite stories from 2025, the ones that still matter, still hold up, and in some cases, look very different in hindsight.

With each recap, we add a small commentary on what’s changed since we wrote it and what to watch out for as we head into 2026.

Think of this as a rewind week.

Here we go then!

When we last wrote about perpetual (perps) decentralised exchanges (DEXs), they had just begun driving a quiet but meaningful shift among DEXs. Volumes were climbing fast, on-chain perps had crossed the trillion-dollar mark for the first time, and decentralised venues were no longer easy to dismiss as a side-show to centralised exchanges (CEXs).

The competition among DEXs was just beginning to heat up, and we were seeing new players emerge and topple incumbents. We saw Hyperliquid do that earlier in the year. Just as it seemed difficult to beat the EVM-compatible DEX, Lighter and Aster came to take over the pole positions. But that didn’t last for too long.

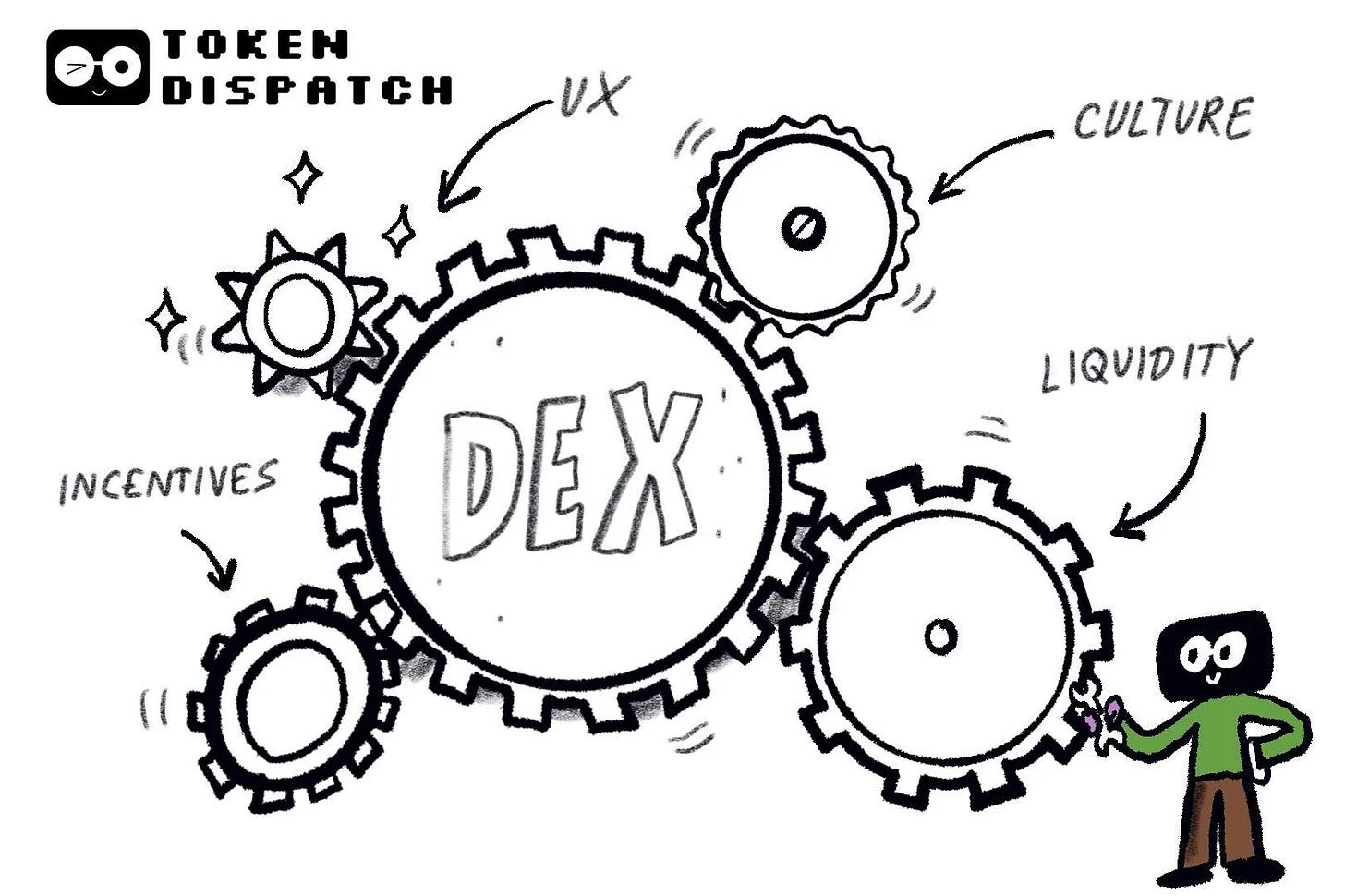

We thought it was essential to understand what makes or breaks a DEX, and so we did, with The Anatomy of DEXs 💀.

We looked at how incentives can drive activity, token rewards can distort rankings, and users can often mistake momentum for durability.

DEXs have lived up to the hype since we wrote this piece and have nibbled into CEXs’ share. Lighter and Aster have taken the top two spots as the perp DEXs with the highest 30-day volume. Hyperliquid follows, in third position.

Looking ahead to 2026, we expect less tolerance for momentum-driven volume and more scrutiny of liquidity quality as users become more comfortable using DEXs with retail-friendly UX.

CEXs will still account for a lion’s share, and DEXs will find it challenging to topple them just yet. But that’s for another story, to explore how CEXs can keep up their dominance.

That’s it for today’s recap.

Wish you a happy holiday week,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.