Hello

We like to believe we make rational choices about where to do business. That we compare fees, read reviews, weigh features, and select the platform that best serves our needs. But watch what actually happens when you need to exchange currency at an airport. You walk to the nearest currency counter because it’s right there and the sign looks official. Convenience decides for us.

This is true for almost every market we’ve ever built. The trading floor doesn’t succeed due to superior pricing or better technology. It wins because it’s where everyone agreed to meet. Nasdaq succeeded in attracting tech and emerging consumer IPOs not by being technologically superior to NYSE, but by positioning itself where growth companies and their investors agreed to meet.

Ebay beat dozens of early auction sites not because its software was better, but because that’s where sellers and buyers agreed to meet.

Every marketplace begins cold. Participants don’t arrive because there’s nothing to trade, and there’s nothing to trade because participants don’t arrive. In exchanges that shows up as empty books, jumpy prices, and poor execution. The platform that solves this chicken-and-egg problem first tends to win everything. The second-place platform tends to die or remain a distant second.

We see similar things unfold in crypto markets. Decentralised exchanges (DEXs) promised a world where anyone could spin up a market, where fees would be transparent, and control wouldn’t concentrate in the hands of one. It worked, until it didn’t.

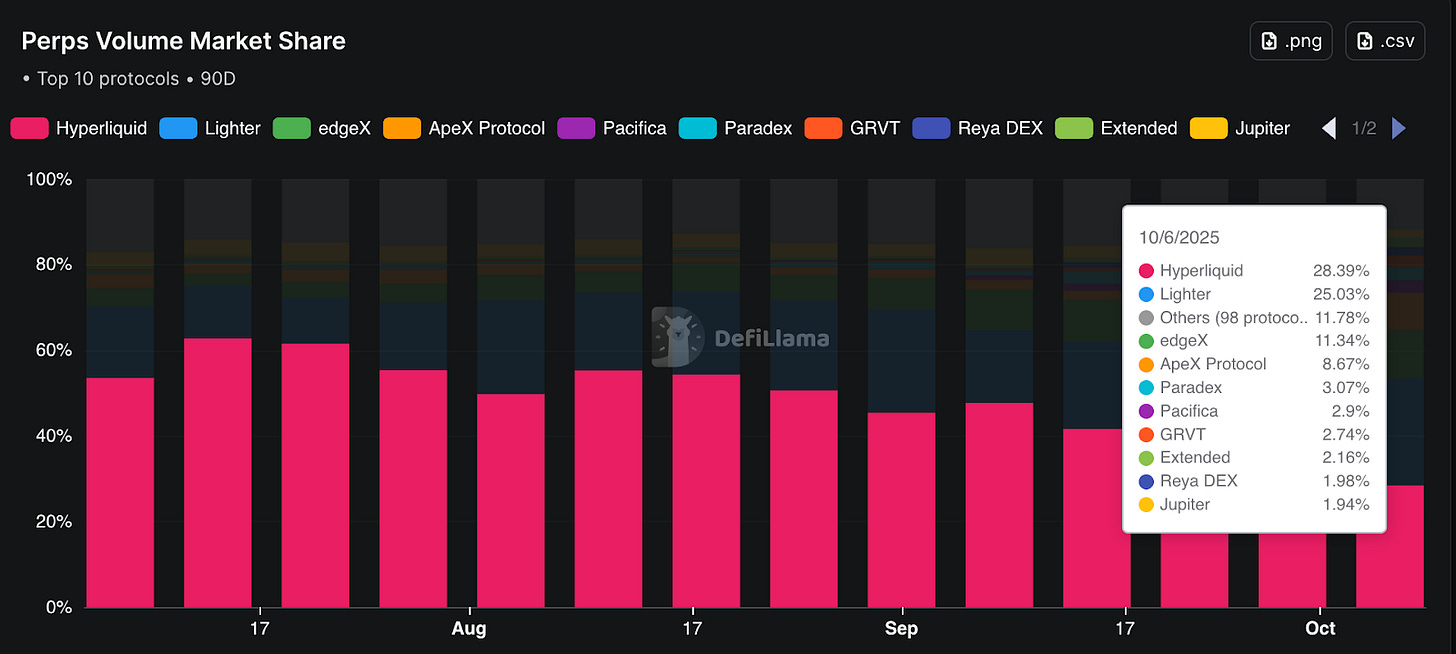

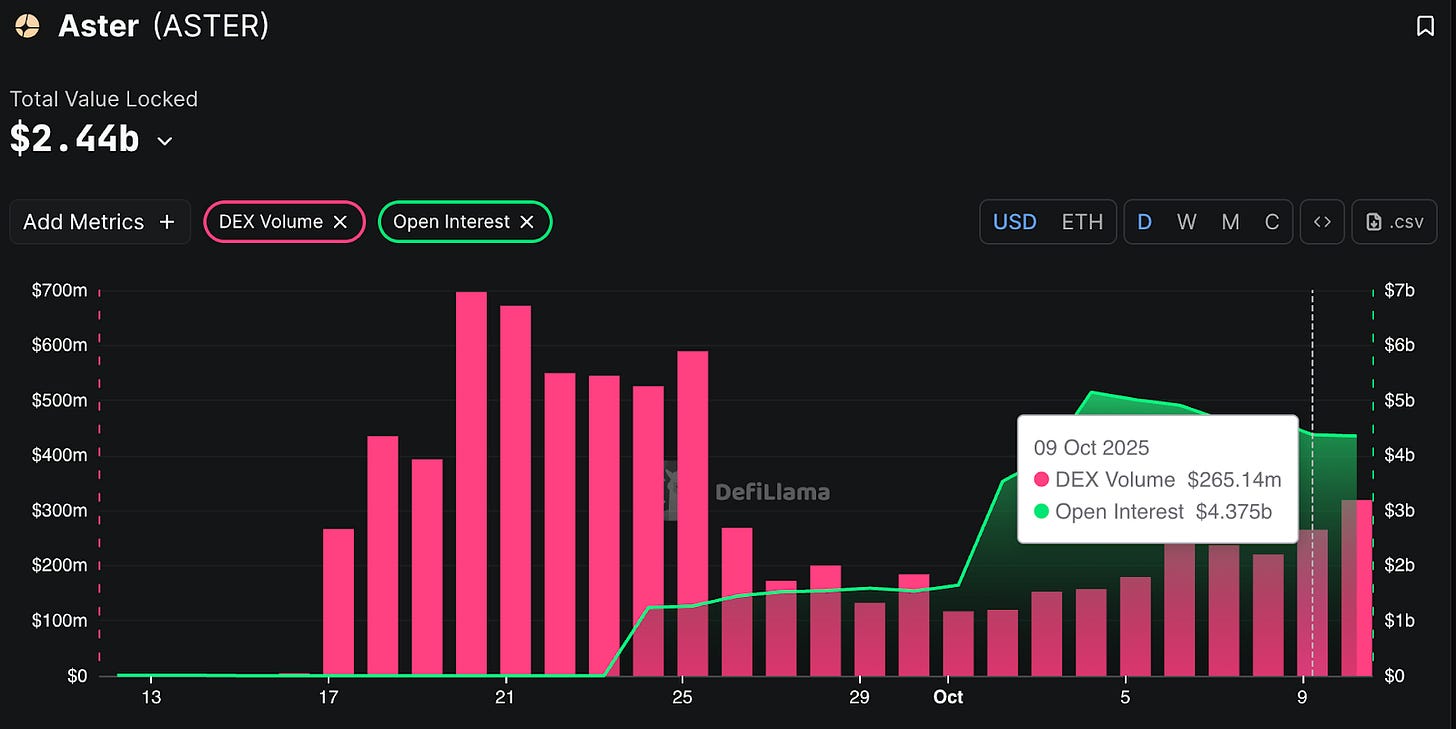

In September, Hyperliquid, the dominant DEX for perpetual futures trading, began losing market share. It wasn’t slow, the way giants usually erode. A new platform called Aster, backed by Binance founder Changpeng Zhao (aka CZ), exploded almost overnight. Then, three days ago, data tracker DeFiLlama delisted Aster’s numbers entirely. It said the volumes looked fake.

The fake data wasn’t even the most worrying aspect. It’s the irony that this happened even though every trade, wallet and fee in crypto is traceable. It’s discomforting to realise that it is almost impossible to tell the difference between an organically popular exchange and one that’s simulating popularity well enough to bootstrap real users. The infrastructure is the same. The order books look identical. The only difference is whether the crowd arrived on its own or was engineered into existence.

This is a story about that tension: how DEXs engineer virality, what separates momentum from market, and the simple tests that reveal which ones deserve your next trade.

Crypto Investing Without the Crypto Chaos

Forget seed phrases, exchange hacks, and late-night wallet setups.

With Grayscale, you can invest in Bitcoin, Ethereum, and other digital assets the same way you’d buy a stock — through regulated, SEC-reporting products.

No private keys to manage

No unregulated exchanges

No steep learning curve

It’s the easiest way for individuals and institutions alike.

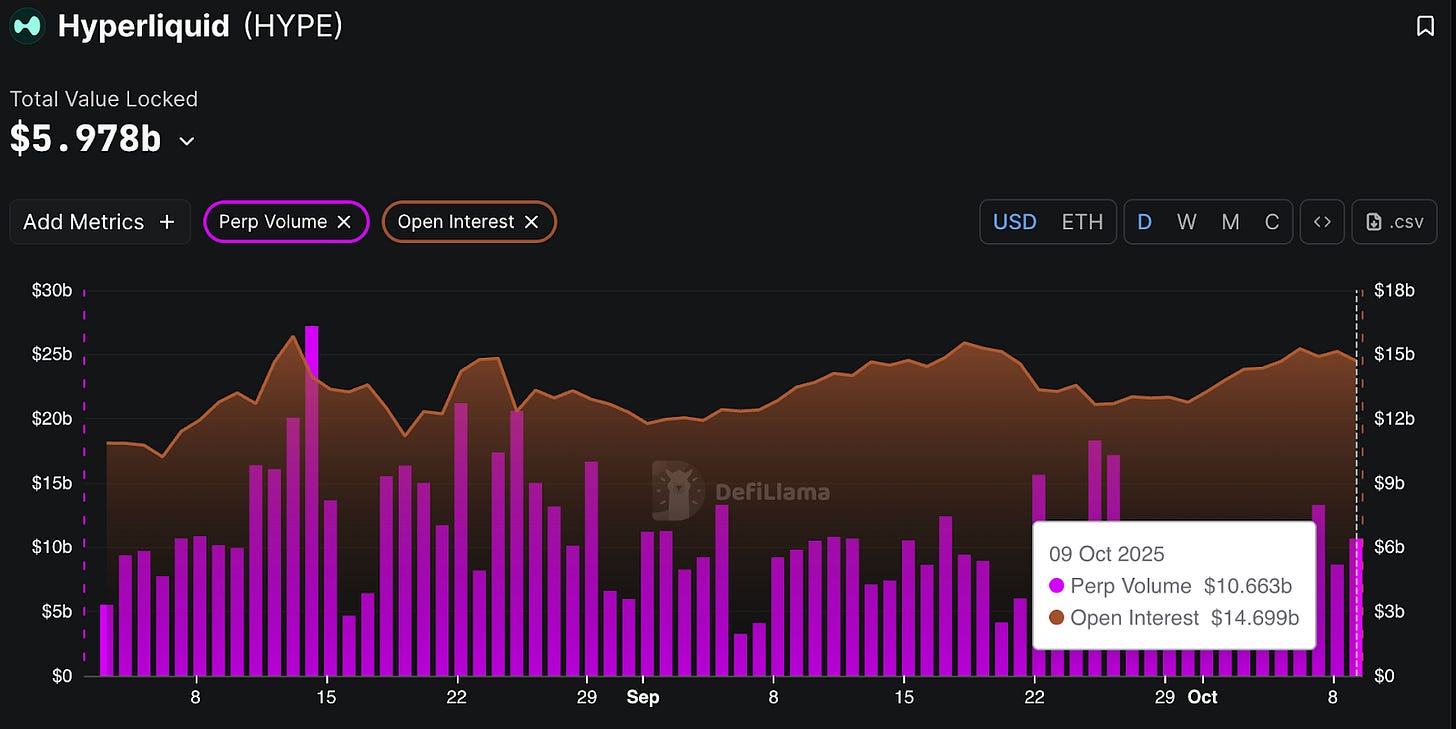

Step back for a second. September 2025 was the first month that perp DEXs crossed $1 trillion in volume. Not for the year, but for the month. The aggregate volume on perp DEXs from July to September was close to what the sector did in all of 2024 combined. Until May 2024, these platforms mostly handled less than 10% of what centralised exchanges like Binance processed. By September 2025, they hit 20%. One in five dollars in perpetual futures trading now happens on transparent, auditable infrastructure.

Although the earlier perp DEX leader Hyperliquid triggered the rush, it was fresh entrants such as Aster and Lighter that were driving it up.

Three things collided.

Regulatory pressure made traders nervous about custody on centralised platforms. The technology matured with sub-second execution, well-designed mobile apps and interfaces that felt like Binance. Tokenomics evolved into actual revenue machines. Route trading fees into token buybacks, and suddenly you have a sustainable business model on hand: more trading makes tokens more valuable, which attracts more traders, which generates more fees.

Read: Burn, Baby, Burn 🔥

Not all could keep up with the pace of exponential growth. Cracks emerged, revealing who was building for sustainability versus riding momentum. When everyone’s volume is up, every platform looks successful. The differences show up when incentives run out.

Take Hyperliquid’s story, for instance. It launched in 2023 as a custom Layer 1 blockchain purpose-built for trading. For most of 2025, it dominated the market with a lion’s share, processing $175-400 billion monthly. The platform gave away 27.5% of its HYPE tokens to 94,000 users and refused to raise VC money. The act gave users ownership instead of diluting them with insider dumps. This made them stick around.

Then Aster launched in September and immediately exploded with $420 billion in September’s trading volume. The token went from $170 million valuation at launch to $4 billion at peak. Hyperliquid’s market share collapsed from 45% to 8% in weeks.

The modus operandi involved massive airdrop programmes. Stage 2 alone distributed 320 million tokens worth $600 million at peak. It pushed traders to trade more, hold the token, refer friends and accumulate points. This worked and drove up volume. For a moment, Aster looked unstoppable.

And the next moment it vanished into thin air. You no longer find these numbers on DeFiLlama, since the tracker delisted Aster, citing fabricated numbers.

Today, Hyperliquid’s market share among perp DEXs is back to 28%, still less than half of where it stood two months back. Lighter is a close second at 25%.

This incident helps us reflect on what separates platforms that survive from the ones that vanish. I categorise them under four categories.

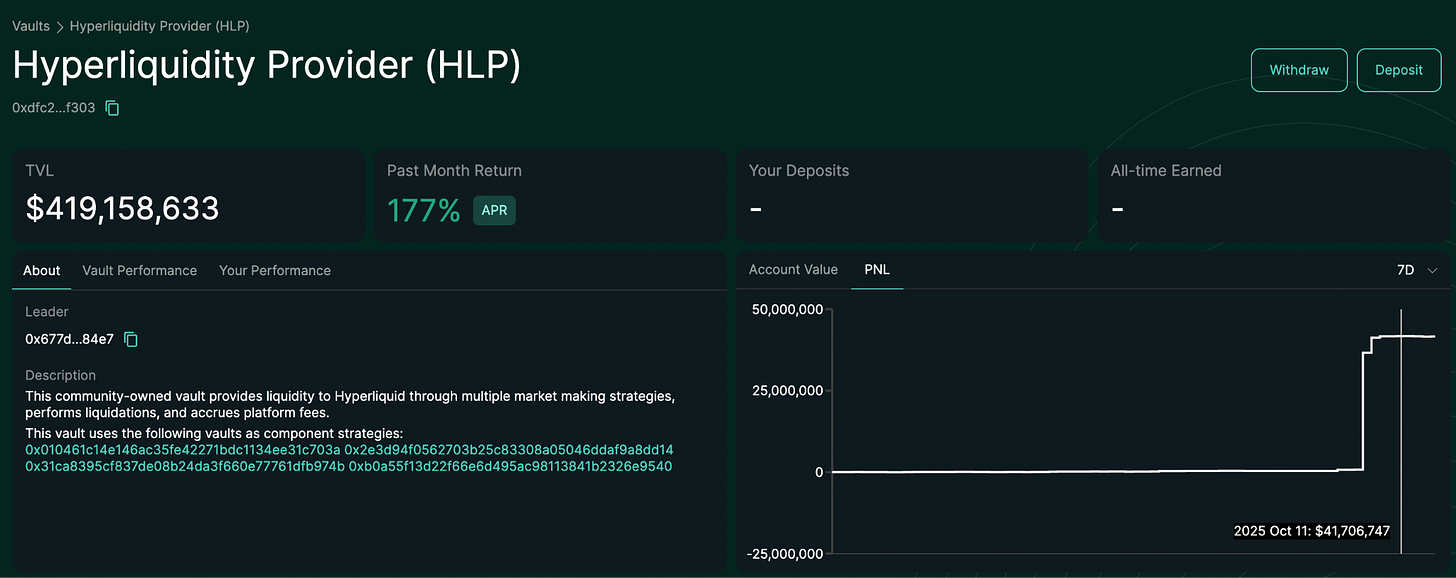

First is liquidity. It is like gravity.

Without deep liquidity pools, traders face slippage, which is the gap between the expected price and the actual execution price. Hyperliquid built its own Layer 1, achieving 20,000 orders per second with 0.2ms finality. Lighter used ZK-rollups for sub-5ms matching. But technology alone doesn’t solve the cold start problem: you need market makers, who won’t come without traders. Traders won’t come without liquidity.

Hyperliquid solved this with its HLP pool, a protocol-owned liquidity earning 6-7% APY that provided baseline depth until organic market makers arrived. On Friday, October 11, when US President Donald Trump stirred up fresh trade tensions with China by announcing 100% additional tariff, the crypto market saw $19 billion in liquidations across 24 hours. At this time, Hyperliquid’s HLP vault made $40 million in profits in a single day from liquidations, pushing returns to nearly 190% APR.

Most platforms never solve this liquidity problem. They launch with great tech and empty order books. Nobody shows up because there’s nothing to trade against.

Next are incentives. They create flywheels, at least, temporarily.

The difference between sustainable incentives and one-time expensive gifts determines sustainability. Hyperliquid’s model addressed this by distributing ownership broadly, then routing 93% of trading fees into token buybacks. This way, the token’s value is directly tied to protocol usage rather than future farming hopes. Aster sprayed tokens to users and hoped they would stay. It worked for generating volume. We can already see the long-term story unfolding in real time.

Third is user experience. UX determines retention.

If your DEX feels worse than Binance, users eventually leave. Hyperliquid’s interface could be mistaken for a centralised exchange even for a rookie trader. EdgeX launched with Multi-Party Computation (MPC) wallets, letting users trade without managing seed phrases. Lighter charges zero fees for retail. It’s the small details that make traders stay or leave. Think of guaranteed stop-losses, sub-accounts for risk isolation and user-friendly mobile apps.

Fourth is the cultural force. Memes and influencers create tribes.

Hyperliquid’s narrative is high-performance DeFi first, community-owned, no VC money, built from scratch. The recent airdrop, which rewarded early supporters with the Hypurr Cats NFT collection, is a testament to how culture can build a loyal community. Even in Aster’s case, the meme “CZ’s revenge”, which was coined for Binance building infrastructure that regulators can’t touch, paved the way for the sudden surge in adoption. Lighter positioned as “Ethereum’s perp saviour” with a16z backing and ex-Citadel engineers.

The cultural dynamics matter because a sense of belonging is as important to a loyal community of crypto traders. In crypto, users don’t stop at choosing platforms to trade. They then begin identifying with them, defending them, putting tokens in Twitter bios and participating in Reddit forums and Discord channels. That tribalism creates organic marketing and stickiness.

The platforms that work hit all four. Aster tried shortcutting by over-indexing on memes and incentives. When people questioned the liquidity’s legitimacy, everything wobbled.

DeFiLlama’s founder posted charts showing Aster’s XRP and ETH volumes mirrored Binance’s perpetuals almost exactly.

Hyperliquid’s volumes, by contrast, moved independently. One reliable metric is the Volume-to-Open Interest ratio. Open Interest measures how much capital is actually at risk in open positions. If $10 billion is trading but only $250 million is locked in positions, something’s off. Hyperliquid’s ratio hovers a little over 1, meaning real position-taking, while Aster’s ratio hit 20, hinting at a massive difference between the volume and open positions.

As someone in the crypto space, I keep coming back to the distinction between real and engineered growth. Every thriving marketplace in history has been engineered in some way. Nasdaq was designed to compete with the NYSE by letting smaller companies list. eBay was built to solve specific trust problems. The growth looked organic once it hit critical mass, but it was all deliberate design.

Crypto just makes the engineering visible in real time. You can watch platforms seed liquidity, incentivise users, iterate on features, and either hit product-market fit or collapse trying.

Aster is still around. Its Stage 2 airdrop of 320 million tokens, with no lockup, adds sell pressure. Aster’s Volume/OI ratio of 20 already suggests most volume wasn’t real position-taking.

The bigger takeaway from Aster’s case is what becomes possible when markets run on transparent rails.

For years, we pretended markets were neutral infrastructure, separate from the money flowing through them and the people controlling access. But markets have always been inseparable from the systems that run them, and the systems have always been tied to who controls them. We just couldn’t see the machinery clearly enough to ask whether it mattered.

Now we can see it. We can verify whether liquidity is real or bots trading against themselves. We can watch platforms either build sustainable businesses or execute elaborate extraction schemes.

The ones where trading is smooth, liquidity is deep enough that slippage doesn’t matter, and the interface feels so obvious that you forget you are using crypto at all are likely to succeed. In the long term, they will probably become invisible infrastructure like the VISA and Mastercards of the world.

We are surely not there yet. But we can see the anatomy of what goes into making a successful DEX. This allows us to ask the right questions about which platforms are building toward invisibility and which ones are just putting on a show. We’ll spend the next few years separating them from each other.

That’s it for this week’s deep dive.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Great article! Been a HyperLiquid user since this summer (2025). Got rekt yesterday unfortunately in this F*cktober.. (guess who hasn't? - Baron Trump probably) ; )) Regarding HQ: I can tell it's fluid polished UI is "catchy" and it all works smooth. Never had issue with App absence and security is designed well. When you are on mobile - can't withdraw or even "pour" more to Perps margin account - have to used web. Also.. they know and try not JUST get you "on" - they are interested to retaining users with not just silly coin airdrops. Perp leverage is designed with risk management in place. e.g X40 Max on BTC, when some "shitcoin" like Aster is X3 Max. In contrast go on https://www.asterdex.com/en/futures/BTCUSD - and check.. this "brownie" UI doesn't even look appealing. Only the spinning Aster circle coin catches your attention. The rest is pretty much basic. HQ UI feels like premium product to use. Anyway.. Oh.. yeah.. in contrast you can go 1000X on Aster as Degen mode (not recommended) ; )) .. This all raises question - so on Aster you are welcome to come and "leave" your deposit with 1000X. HiperLiquid - just doesn't want even to offer it! This means something.. It's like a barrier for "uncertainly".

Hope you can see my comment on Burn, Baby, Burn 🔥 article. I'd (& hopefully not only me) be delighted to know what you think about doing a deep dive in real market manipulation mechanics? We all need to be prepared somehow.. It's just no longer funny. Crypto valuation & stability will not evolve otherwise. Thanks for your post!

P.S. Just in case if anyone interested, ref link for HyperLiquid: https://app.hyperliquid.xyz/join/GETNOTREKT

Keep calm, do your research, market trends, seasonality etc, keep funds for life and food intact : ) In other words - play safe! Whoever interested will receive a 4% discount while using it.