Today’s edition is brought to you by Polymarket.

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it.

Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

Hello

Hope you are having a great holiday with your loved ones and spending some time relaxing, reflecting and recharging.

We’re taking a brief pause from publishing new pieces this week. Instead, we are revisiting a handful of stories from 2025, ones that still hold up or feel more interesting now than when we first wrote them. With each recap, we’re adding a little colour on what’s changed since, and what’s worth carrying into the year ahead.

Today, we are rewinding to why prediction markets didn’t fade after the 2024 election cycle and found a more durable use case.

Onto the story,

Prathik

When we wrote about prediction markets more than a couple of months back, the volume and other metrics were shooting up. The peak seemed to be approaching, and the volume growth looked set to plateau soon.

Nobody knew for sure, though. The trajectory of prediction markets surprised most of the world after the euphoria died down following the 2024 US Presidential elections.

Political volumes had peaked, traders were rotating out, and there was a concern that the category had lived through its “once-every-four-years” moment. If elections were the main engine, relevance would always be cyclical.

In our story, we argued that elections won’t be the endgame.

Read: The Sports Engine 🎰

Sports, as a category, offered what politics couldn’t. The frequency, repetition, and muscle memory ensured that prediction markets fed on something that was not cyclical, like elections. Prediction markets capitalised on humans’ innate desire to speculate on everything and allowed them to monetise those speculations.

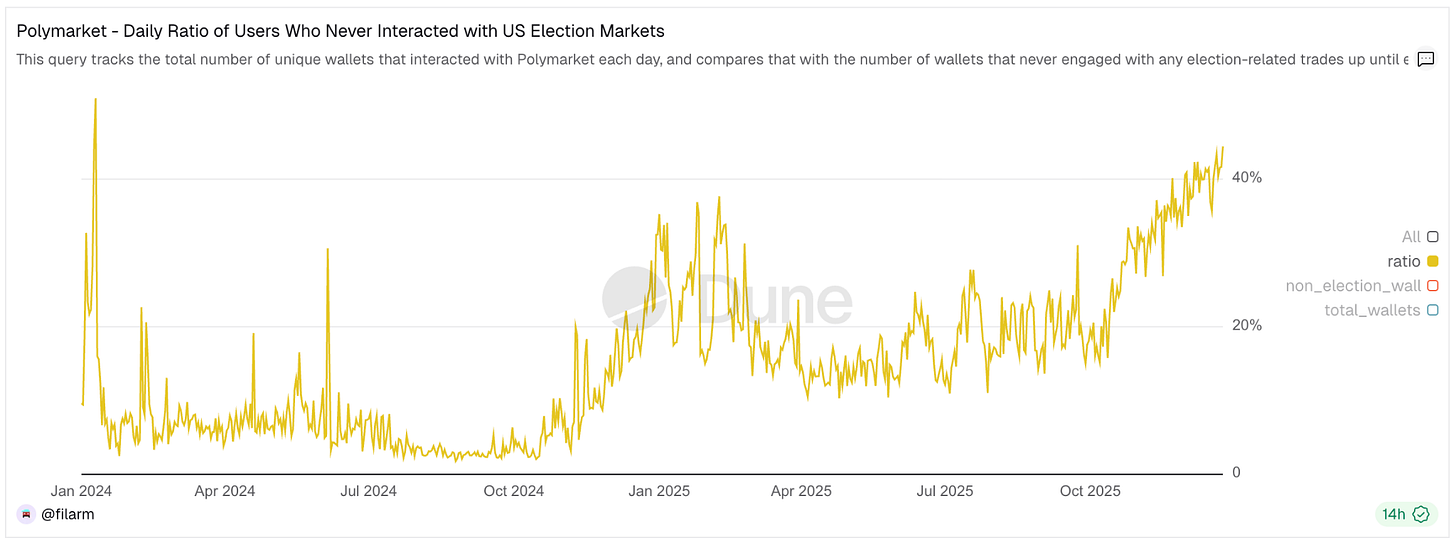

The user data now clearly reflects that shift.

On Polymarket, the share of daily users who have never interacted with US election markets has climbed steadily and recently touched ~40%, the highest level on record.

Volume followed users.

Both Kalshi and Polymarket have seen their spot volume touch record highs in October and November. Together, the two largest prediction platforms did nearly $10 billion in monthly volume, their strongest showing yet.

This surge isn’t slowing down. December volumes are already tracking higher as we speak.

What’s changed since we wrote The Sports Engine is not just where the activity is coming from, but how visible it has become.

Polymarket briefly topped the App Store’s sports category in early December. Kalshi has moved from being a niche CFTC-regulated exchange to powering prediction markets inside mainstream platforms. And with Coinbase integrating prediction markets directly into its app, monetising speculation is now as easy as a tap of a button, alongside trading, payments, or staking.

If 2025 showed that prediction markets could retain users, the next phase will be about distribution. As exchanges and consumer platforms turn “monetised opinions” into a routine feature, prediction markets may stop feeling like bets reserved for a sophisticated crop of users.

That’s it for today’s recap.

Wish you a happy holiday week,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.