Hello

Welcome to our weekly Bitcoin macro and news analysis.

We're looking at Week 35 of 2025 (August 25-August 31):

Bitcoin falls below $110K, tests $107-108K support

Fear & Greed Index enters "fear" territory

ETF flows turn positive as institutions absorb 4x miner issuance

September seasonality raises "Rektember" concerns

Turn Bitcoin Mining Into Passive Income

With Abundant Mines, you purchase mining hardware and their team handles everything else: setup, maintenance, repairs, and monitoring. You simply collect steady Bitcoin payouts straight in your wallet.

Start with as little as $10,000 (including hardware and first-year energy costs)

Guaranteed 95–99% uptime with expert on-site care

Powered by low-cost hydroelectric energy for consistent, affordable operation

Enjoy powerful tax advantages like 100% first-year equipment depreciation

Projected returns: 30–50% per year if Bitcoin price holds steady

No tech skills required, just invest and earn.

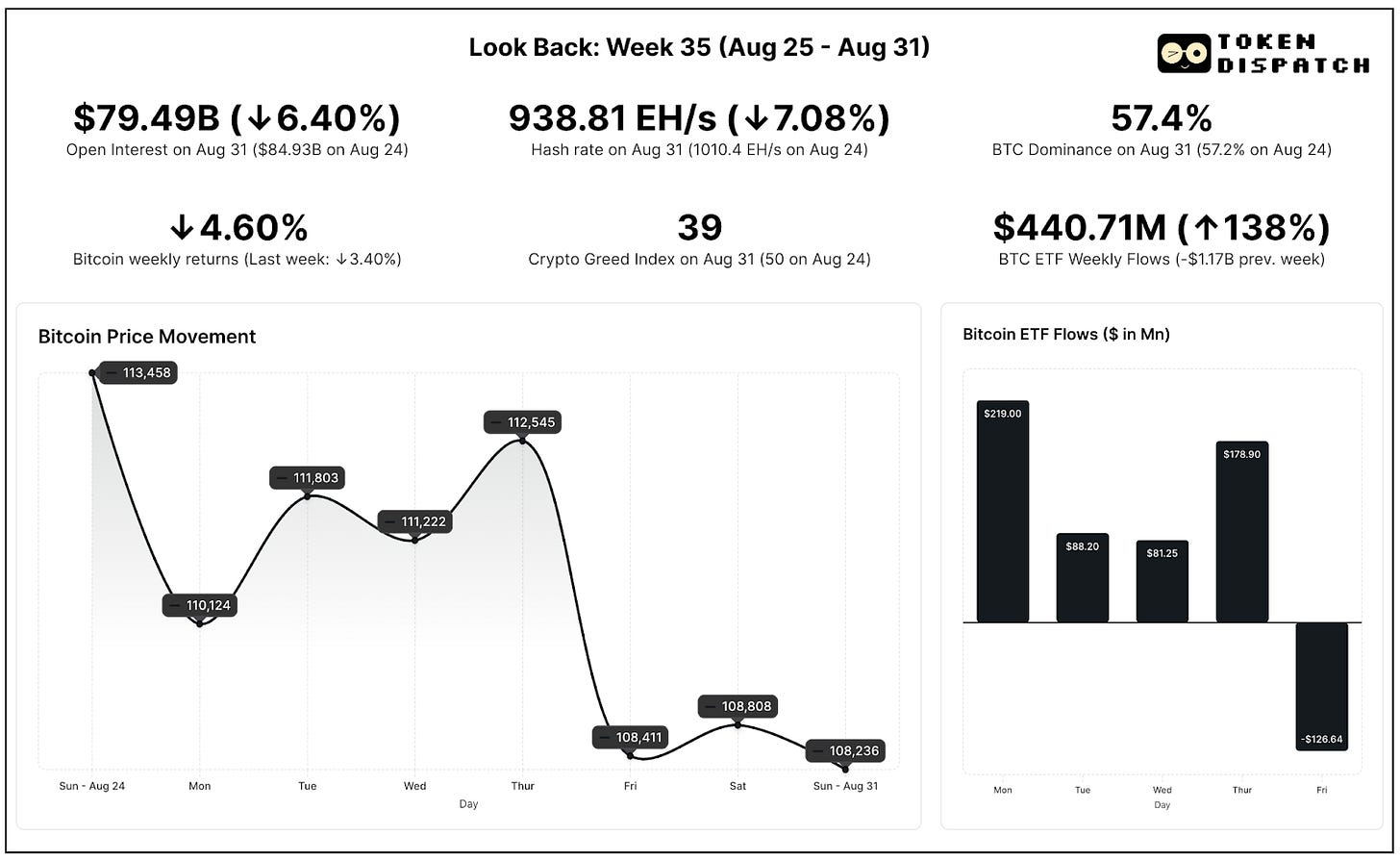

Week That Was

In last Monday’s edition, I wrote that Bitcoin’s outlook hinged on whether the US Fed would actually deliver September rate cuts despite sticky tariff-driven inflation, and whether $110K could hold as a line of defence. If easing came through, $120K could flip into support. If not, $110K would be the level to defend.

Last week gave us the latter.

Bitcoin slipped below $110,000 on Friday and has since struggled to hold above it, resting in the $107K–$110K band, the same support it last tested in early July. That puts BTC down more than 13% in just over two weeks from its ~$124,400 peak.

The fall coincided with the release of US Personal Consumption Expenditures (PCE) data that showed the core inflation (PCE excluding food and energy) for July at 2.9%, meeting estimates but higher than June and the highest annual rate since February.

Bitcoin closed the week on August 31 at $107,840, down 4.6% for the week.

On Friday, the crypto fear and greed index also plunged into "fear" territory at 39, its first reading below 40 since June 23.

The Bitcoin futures open interest declined 6.4% to three-week lows, which suggest institutional positions turning defensive.

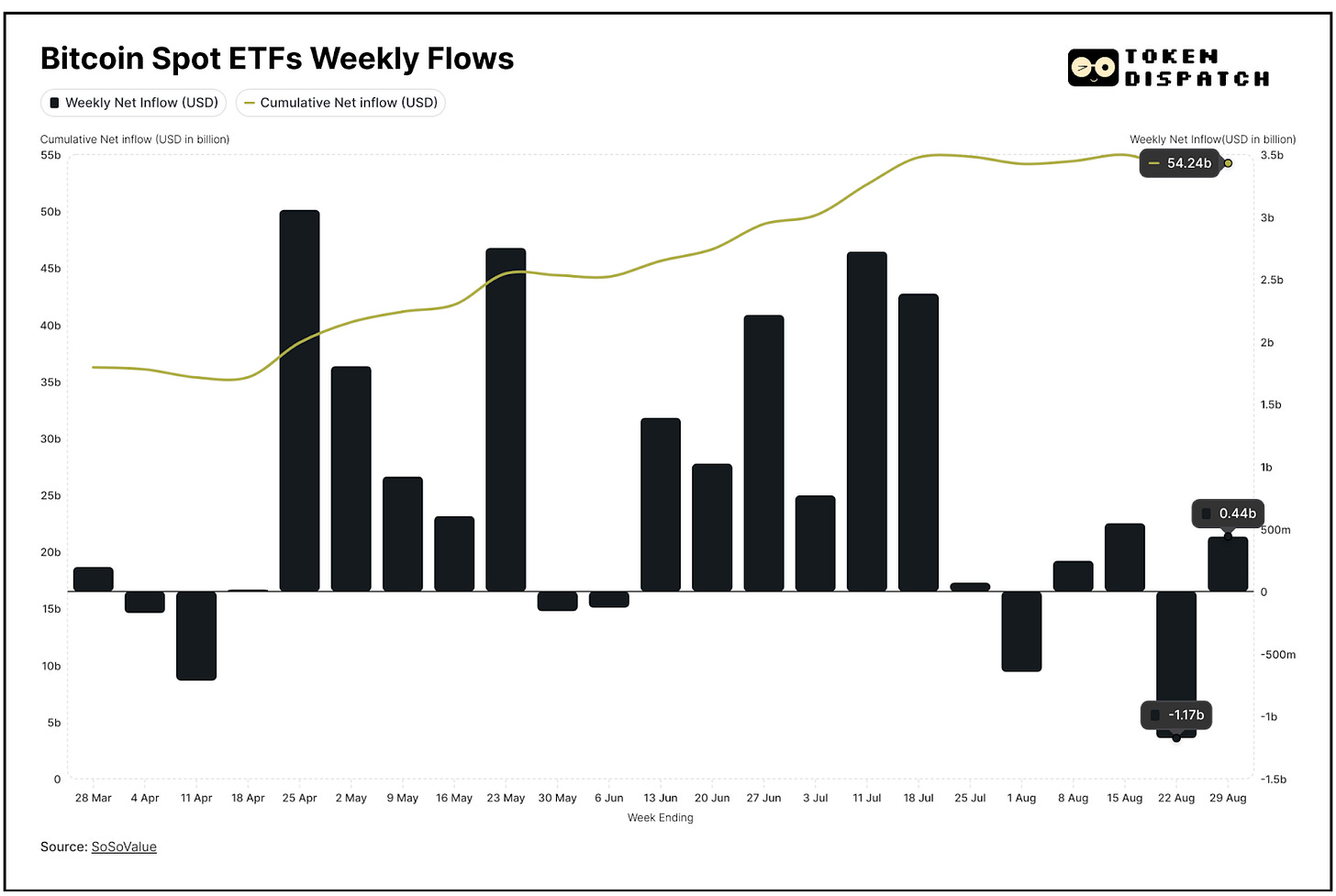

The only consolation through the week were Bitcoin Spot ETF flows. They made a moderate comeback turning net positive last week, $440 million, after the preceding week saw $1.17 billion in redemptions.

However, Friday gave us a glimpse of what to expect from the ETFs in the coming week as the flows turned negative after the unfavourable core inflation data came in.

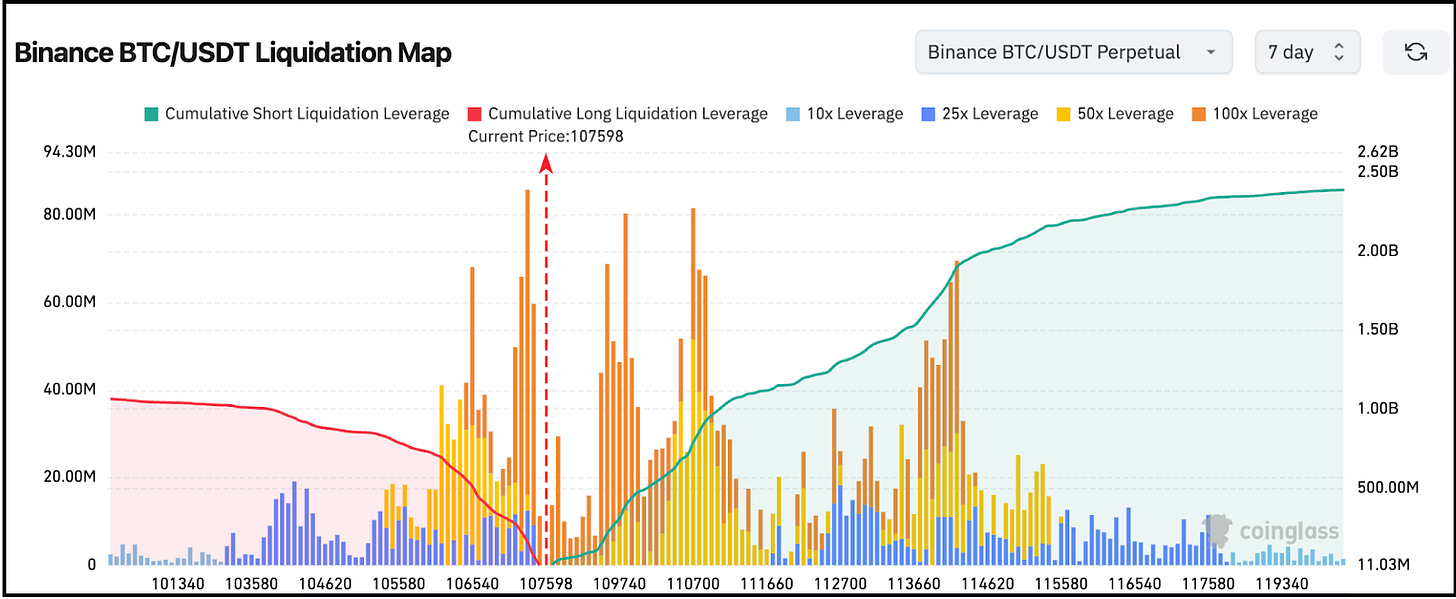

When Bitcoin dropped below $109,000 on Friday, it triggered over $140 million in long position liquidations within 24 hours. Some traders attributed the liquidations to manipulative behaviour from large holders (whales) using deliberate liquidity shifts to influence price action and trap retail traders, while the whales moved their funds from BTC to ETH.

Price Action

As Bitcoin tests the critical $107,000-$110,000 range, the next few weeks will determine whether the drawdown below $110,000 is a healthy correction or the beginning of a deeper retracement toward the psychologically important $100,000 mark.

The $110,700 level represents a massive liquidation wall with over $750 million in short leverage, which if breached could spark explosive upward momentum toward $116,000. However, the heavy concentration of leveraged shorts above $110,000 also explains why any relief rally faces immediate resistance, as these positions add selling pressure once squeezed.

Below $105K, the liquidation map reveals limited support cushions down to $100,000, suggesting any breakdown could accelerate quickly toward the $92,000-$95,000 range where longer-term holder cost bases provide more substantial demand.

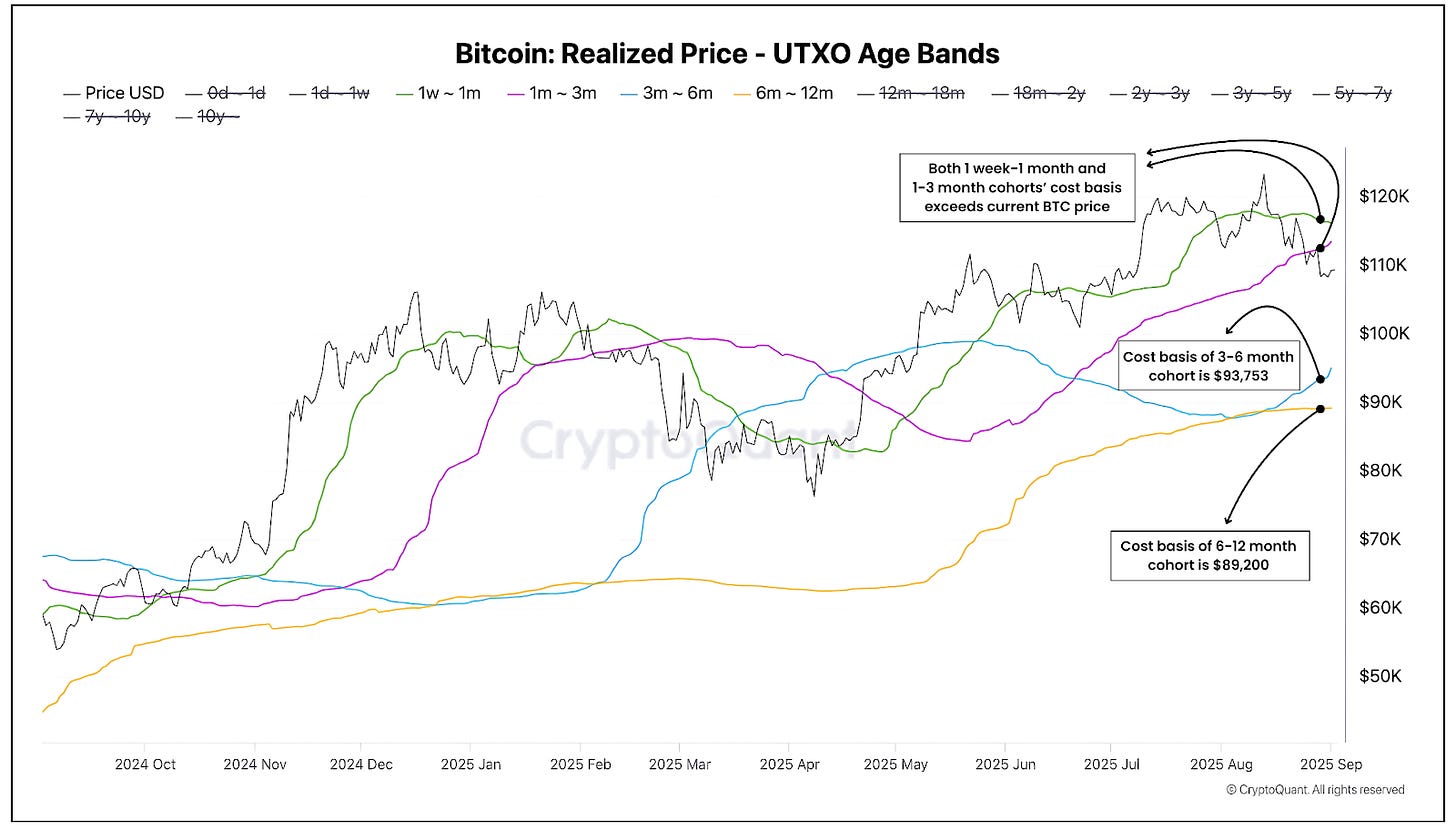

The realised price chart helps you understand this better as it reveals the situation that Bitcoin faces as it tests current support levels. The data shows a stark bifurcation between short-term and longer-term holder cost bases that creates significant vulnerability.

Short-term holders are facing significant stress, with 1-week to 1-month cohorts holding cost bases at $116,421 and 1-3 month holders at $112,905. Both groups are sitting on substantial losses at the current $108K levels. This explains the persistent distribution pressure we're witnessing across wallet cohorts.

What’s more concerning is the massive support void below.

Once you move past stressed recent buyers, the next meaningful cost basis support doesn't appear until the 3-6 month cohort at $93,753, with 6-12 month holders anchored even lower at $89,200.

This shows Bitcoin could face accelerated selling with limited buyer support between current levels and the $89-93K range.

The wide gap between stressed short-term positioning near recent highs and comfortable longer-term holders with cost bases 20-50% below current prices means any breakdown below $105K could trigger cascading moves toward that deeper demand zone, leaving little in between to cushion the fall.

Smaller wallets (<1 BTC and 1-10 BTC) and Whales (1K-10K BTC and >10K BTC) kept accumulating in early August, but the later half of the month showed sell-off across all cohorts.

These technical indicators, combined with seasonal headwinds entering September, which has historically been Bitcoin's worst month with -3.49% average monthly returns. Of the past 12 years, only four Septembers have posted positive returns for Bitcoin, earning it the "Rektember" moniker among traders.

However, since Bitcoin has already corrected 13% from its peak despite the high probability (87%) of a Fed rate cut in September, if Fed Chair Jerome Powell indeed changes his stance, it could set the base for an upward movement.

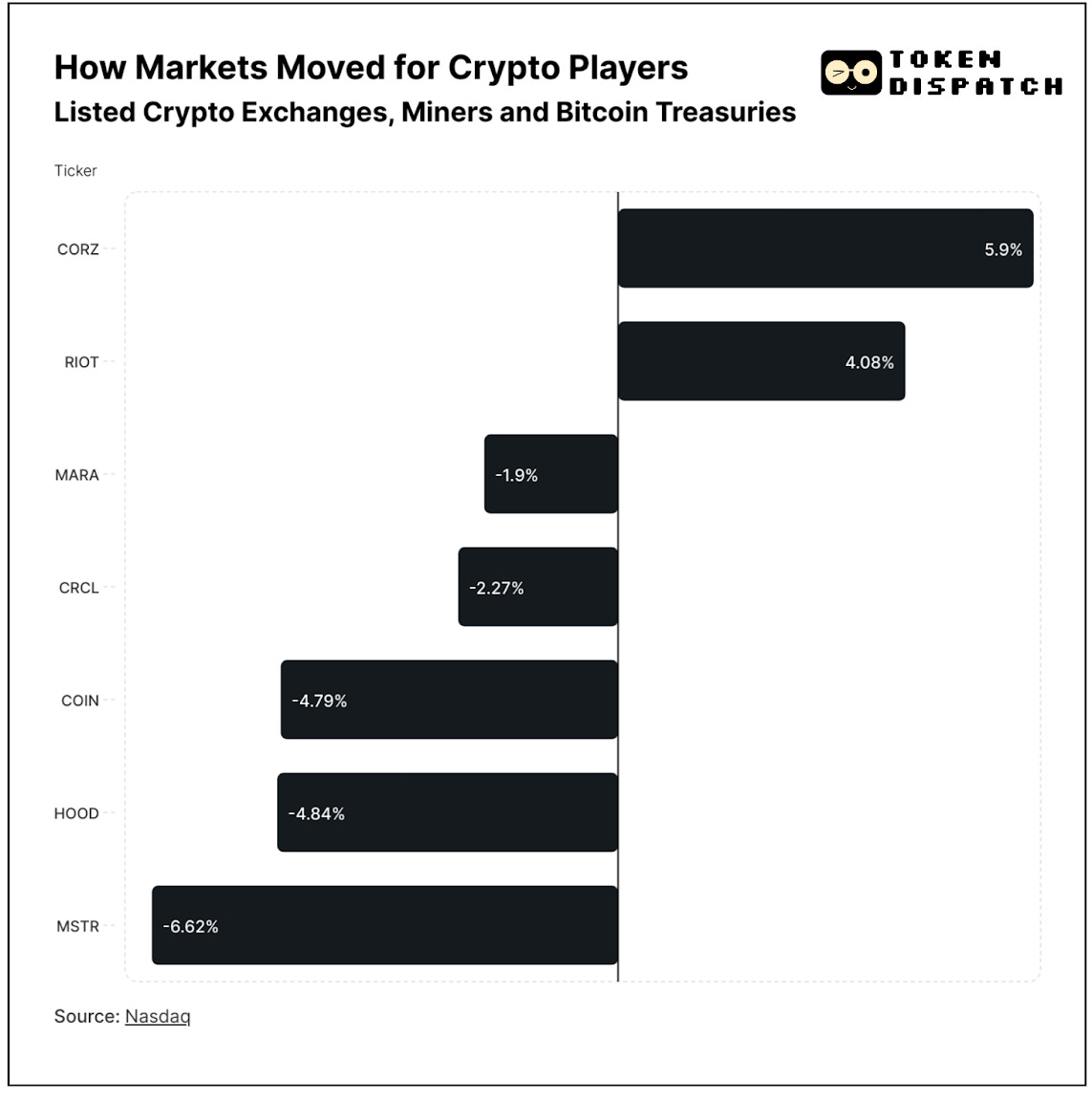

S&P 500 Snub Hit Strategy, HOOD

Crypto-exposed stocks delivered a decidedly mixed week, with mining companies outperforming while exchanges and treasury firms faced selling pressure.

Core Scientific led gains with a 5.9% rally, followed by Riot Platforms at 4.08%, as both miners were the standalone winners of the week despite Bitcoin's price decline.

Both Robinhood and Strategy returned losses for the week as the firms faced disappointment after they lost the coveted spot in the S&P 500 index to Interactive Brokers Group.

Strategy fared worse, declining 6.62% as it faced the double blow of S&P rejection and Bitcoin's correlation drag. However, its investors dropped a class-action lawsuit that had accused the company of misleading shareholders about how new fair value accounting practices would impact profitability.

Coinbase also closed the week with 4.79% loss, while Circle continued its steep decline as it fell another 2.27% last week.

Surfer 🏄🏾♂️

French semiconductor maker Sequans has launched a $200 million equity offering to expand its Bitcoin holdings as it aims for a 100,000 BTC treasury by 2030. The Paris-based company currently holds 3,171 BTC and expects to increase its treasury to nearly 5,000 BTC this year.

TRIO and Swarm Markets have launched tokenised gold bars on the Bitcoin blockchain, linking each token to a physical gold bar in a Brinks vault through unique serial numbers. Owners can trade these tokens like other Ordinals assets, with physical redemption requiring KYC due to regulatory compliance.

Kindly MD has filed a $5 billion shelf offering, after purchasing $679 million in Bitcoin through its subsidiary Nakamoto Holdings last week, in a move to make BTC its main treasury reserve asset.

The Great Bitcoin Vacuum

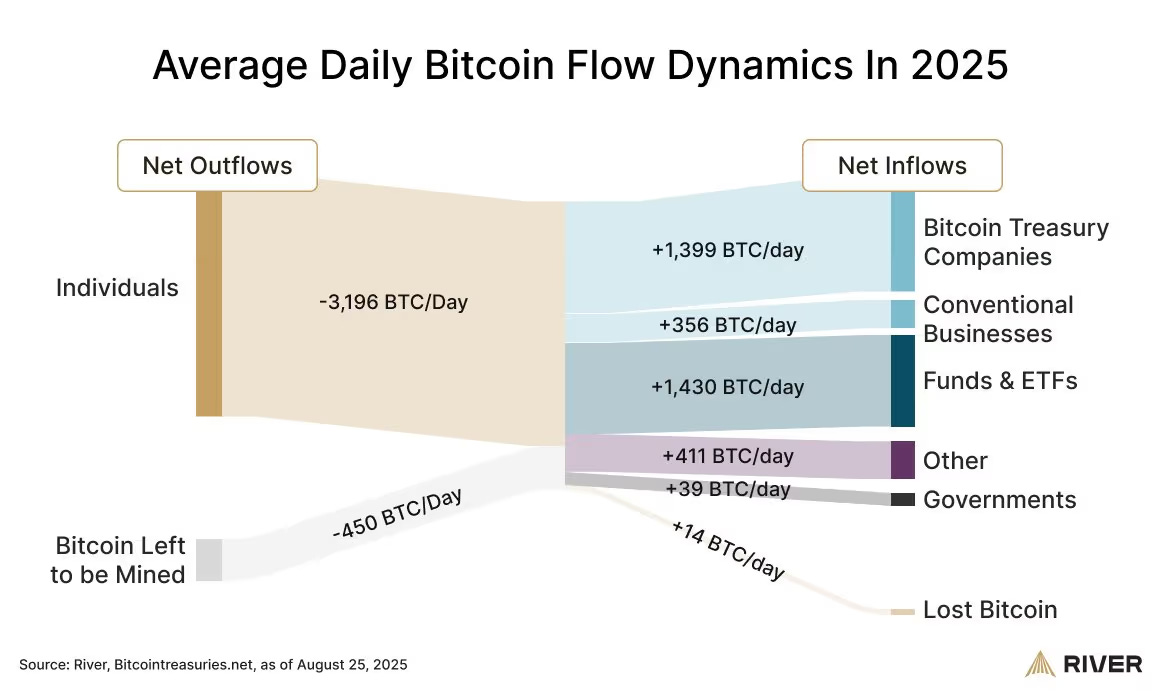

Despite Bitcoin's price struggles, institutional appetite remains robust, a research from River showed.

The firm's flow analysis reveals that businesses are absorbing approximately 1,755 BTC per day, nearly four times the 450 BTC that miners produce daily since the April 2024 halving.

When combined with ETFs and investment funds adding another 1,430 BTC daily, institutional demand totals over 3,185 BTC per day, creating what River calls a supply squeeze at the margin.

The flow data shows individuals as the primary source, with net outflows of 3,196 BTC daily, though this largely represents coins moving from retail wallets to institutional custody rather than panic selling.

This absorption rate explains why Bitcoin maintains structural support despite short-term volatility.

Even if businesses and funds maintain current accumulation patterns rather than accelerating purchases, they're removing available supply at multiples of new issuance. The data suggests that any sustained price rally could face severe supply constraints, particularly if retail selling pressure eases and institutional demand accelerates from current levels.

That's it for this week's Mempool edition.

See ya next week.

Until then …stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.