Robinhood On Charge 🤠

Robinhood to acquire Bitstamp in $200M deal. Franklin Templeton exploring crypto funds beyond BTC and ETH. Kraken's $100M funding round, potential IPO. Global liquidity hits all-time high of $94T.

Hello, y'all. Rooster on 🐓

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

A little surprise from popular stock trading app Robinhood.

It's acquiring veteran crypto exchange Bitstamp.

A $200 million deal.

This all-cash deal, expected to close in 2025, marks a major step for Robinhood's global ambitions.

Why Bitstamp?

Founded in 2011, Bitstamp boasts a global presence with millions of customers across Europe, the UK, Asia, and even the US.

While its trading volume has dipped in recent years, it holds a crucial advantage for Robinhood: over 50 regulatory licenses worldwide.

This acquisition is a strategic power move for Robinhood.

By joining forces with Bitstamp, Robinhood widens the net.

A wider retail user base.

Institutional cred: Bitstamp brings a reputable name in the institutional crypto space, a new market for Robinhood.

A broader crypto product range: Bitstamp's staking and lending services will complement Robinhood's existing crypto offerings.

Johan Kerbrat, general manager of Robinhood Crypto:

“Through this strategic combination, we are better positioned to expand our footprint outside of the US and welcome institutional customers to Robinhood.”

Robinhood's crypto push

This acquisition comes amidst a crypto market boom and Robinhood's own financial rebound.

After a rough 2023, the company is back on track with record Q1 earnings and a $1 billion stock buyback.

Crypto trading fuelled nearly 40% of Robinhood's transaction revenue and Robinhood's crypto custody holdings surged 78% to $26.2 billion.

The company is actively recruiting for its crypto team and recently launched services in the EU and expanded its crypto wallet.

Robinhood is clearly diversifying its offerings beyond just stock trading, venturing into credit cards, retirement accounts, and now, a full-fledged crypto exchange.

“Everything we’ve been doing in the past few years has been because our engagement from customers has been that they want more crypto products,” Kerbrat said.

What it means for users

The Bitstamp deal could transform Robinhood's crypto experience.

Currently, Robinhood sources crypto from market makers.

Owning Bitstamp could mean Robinhood offering its own exchange, potentially with a wider range of tradable tokens (Bitstamp offers up to 85 compared to Robinhood's current dozen).

Services like lending and staking could also be on the horizon.

Regulatory Hurdles

Robinhood's crypto ambitions might face roadblocks from the SEC, which recently threatened a lawsuit over its token offerings.

Read: SEC Can't Stop Suing 👨⚖️

Robinhood is not alone, mainstream has been lapping up crypto

Revolut partnered with MetaMask to allow users to buy and deposit crypto into their MetaMask wallets. Allows users to purchase up to 20 cryptocurrencies without additional verification for existing Revolut customers.

Payments giant Stripe brought back crypto payments in 2024. Users will be able to make and receive USDC transactions through Ethereum and Solana. Users can connect various wallets like MetaMask and Coinbase Wallet to their Stripe accounts.

PayPal has launched its stablecoin, PYUSD, on the Solana blockchain network. PayPal is also competing with Visa, as both companies seek to establish themselves in the stablecoin market.

Mastercard and Visa: MasterCard is set to be resuming services for payments and deposits in crypto on Binance, after switching it off in August of 2023. The Binance-branded Visa card has also resumed functionality on the exchange.

Block That Quote 🎙️

Venture capitalist, Tim Draper

“Put a third of your money in Bitcoin.”

Draper is urging startups to diversify their finances and include Bitcoin as a safety net, following the collapse of Silicon Valley Bank (SVB) in March 2023.

Many crypto and tech companies heavily relied on SVB, leaving them scrambling for access to funds when the bank went bust.

This incident highlighted the dangers of putting all your eggs in one basket.

Draper's three-part plan for risk management

Draper advises startups to adopt a three-pronged approach to financial security:

Spread the Wealth: Allocate a third of your capital to a reputable large bank.

Small Banks, Big Bailouts: Invest another third in a smaller bank, which would likely receive government support in case of a crisis.

Bitcoin as a Lifeline: Finally, dedicate the remaining third to Bitcoin. This digital currency offers independence from traditional banking systems and could serve as an emergency reserve during financial turmoil.

Crypto Funds Beyond BTC and ETH?

Investment giant Franklin Templeton is reportedly exploring a crypto fund focused on tokens beyond Bitcoin and Ethereum.

This wouldn't be their first foray into crypto – they already have a spot Bitcoin ETF that manages over $350 million.

But this new fund would set its sights on a wider range of cryptocurrencies.

Why it matters? Franklin Templeton manages around $1.64 trillion in assets as of March 2024. It shows that established financial institutions are taking a broader interest in the future of digital assets.

While their Bitcoin ETF hasn't quite reached the heights of competitors like BlackRock and Fidelity, Franklin Templeton has its sights set on a global crypto expansion.

The news gets even more interesting with whispers of staking rewards being offered, which wasn’t included when spot Ethereum ETFs gained initial approval last month.

Institutions pile into memecoins?

Institutional investors are surprisingly jumping on the meme coin bandwagon, according to a report by crypto exchange Bybit.

Holdings of meme coins by institutions have skyrocketed over 300% this year, peaking at nearly $300 million in April.

Dogecoin (DOGE) and Shiba Inu (SHIB) are clear favourites, likely due to their ample liquidity. A new meme coin, BONK, even managed to snag over $75 million in institutional bets.

DOGE holds the largest share of meme coin holdings for both regular folks and institutions.

Institutions seem to be bigger fans, allocating a whopping 36% of their meme coin funds to DOGE compared to retail investors' 24.5%.

In The Numbers 🔢

$94 trillion

That’s where the global M2 has hit.

Bitcoin's current bull run is about to take off thanks to a brand new record.

Philip Swift, the guy behind on-chain data platform LookIntoBitcoin.

The world's money supply (M2) and its correlation with Bitcoin's price.

Global M2 hits an all-time high, surpassing the previous peak that coincided with Bitcoin's $69,000 record - significant jump from the lows of $85 trillion we saw during the crypto bear market of late 2022.

Swift calls this the "most important chart for this bull run" and hints at even greater things to come.

This record-breaking liquidity isn't the only bullish sign.

Bitcoin vs. the US M1 money supply is about to break free from a seven-year slumber. This long consolidation period suggests a potential explosion for Bitcoin's price.

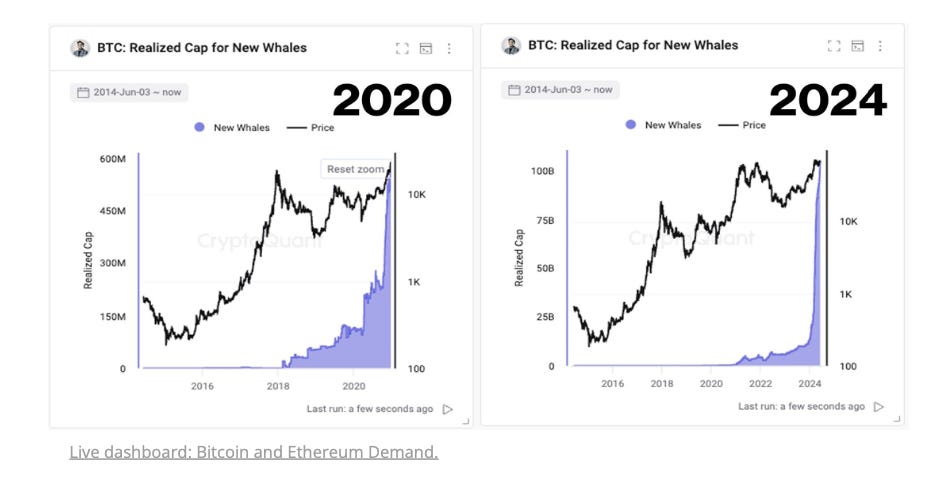

Institutional investors seem to be following the 2020 playbook. CryptoQuant, another on-chain analytics platform, reports similarities in investor behaviour between now and the 2020 bull run, where Bitcoin skyrocketed from $10,000 to $70,000.

We're seeing large investors entering the market and Bitcoin ETFs experiencing a surge in inflows.

All signs point towards a bright future for Bitcoin.

With record liquidity and echoes of the 2020 boom.

Kraken Eyes $100M Funding Round, Potential IPO

Cryptocurrency exchange Kraken is reportedly prepping for a potential public offering (IPO) with a possible $100 million fundraising round, according to a Bloomberg report.

To bolster its public image, Kraken is also said to be looking to add a "marquee" company to its board.

This news comes despite Kraken previously stating a preference for a direct listing over a traditional IPO, similar to what Coinbase did in 2021.

Kraken is currently facing a lawsuit from the SEC over alleged unregistered securities activity.

They settled a $30 million SEC case in 2023 and are facing new accusations in 2024. The SEC's charges echo those against Coinbase, but Kraken denies wrongdoing.

The Surfer 🏄

McDonald's Singapore has launched a metaverse called "My Happy Place." Locals can build virtual burgers, play multiplayer games, and earn rewards. The metaverse was developed in partnership with Bandwagon Labs.

F1 Team McLaren and sponsor OKX are launching free Ethereum NFTs on the X Layer network. Fans can mint the first NFT commemorating the Canadian Grand Prix on the OKX Wallet. The NFTs combine multimedia and audio to allow fans to relive the races.

Telegram has launched a new in-app currency called Stars, which can be converted into Toncoin. Stars can be purchased with fiat currency through in-app purchases or within Telegram itself. The currency will be used to buy digital goods and services within Telegram mini apps.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋