Hello

Britney Spears was blasting from every radio, The Matrix had us questioning reality, and teenagers across the world were burning CDs to curate their mixtape. The internet was still clunky, accessed through screeching dial-up tones, but it was beginning to seep into everyday life. That was the late 1990s.

Search engines existed, but they looked and felt cluttered. Yahoo had directories that resembled the Yellow Pages. AltaVista and Lycos spat out long lists of links without much order but at good speed. Finding what you needed often was a herculean task.

Then came a white screen with a clean box and two buttons — Google Search and “I’m Feeling Lucky.” People tried it once and didn’t leave.

TOKEN2049 Origins’ Deadline is Here!

Want to participate in TOKEN2049’s premier hackathon event? Hurry up!

The registrations deadline is closing soon.

This is your chance to build the next wave of crypto, right in the heart of TOKEN2049 Singapore.

160 crack developers

40 teams

Full access to TOKEN2049 Singapore

Mentorship from ETHGlobal, GCR, Draper University, Alchemy and AltLayer

USD50,000 prize pool from Draper University

Merch, free-flow food & drink, and much more

TOKEN2049 Origins will convene the world’s top coders for an epic 36-hour marathon (September 30 – October 2). Forming teams of 4, they will take ideas from concept to working product.

That was Google’s first trick. The result? Larry Page and Sergey Brin’s creation turned ‘Google’ synonymous with the act of searching itself. “Don’t remember some physics theories? Just google it”, you’d say. “Want to learn how to tie a perfect tie? Why don’t you Google how to do that?”.

Overnight, retrieving facts, finding businesses, or even learning how to code felt natural.

The company would then repeat that playbook with Gmail, Android, and Cloud. Each time, it took something chaotic, it came up with a solution that was simple and boringly reliable.

In every domain that it today dominates, it wasn’t the first to enter but soon became the category leader. Gmail wasn’t the first email service, but it gave you gigabytes of storage when competitors were still rationing megabytes. Android wasn’t the first mobile operating system, but it became the backbone of every budget smartphone across continents. Those who refused it were in turn forgotten by the world. Remember Nokia, anybody?

Cloud wasn’t the first hosting solution, but it offered the reliability that made startups and banks willing to bet their business on it.

In each of these categories, Google turned a messy primitive into default infrastructure.

That was the last three decades. Today, Google is doing something paradoxical.

It’s gearing up to build on top of the innovation that was once conceived to displace such technology giants — a blockchain. With its native layer-1 blockchain, the technology giant is trying to pull off for value what it did for information all these decades.

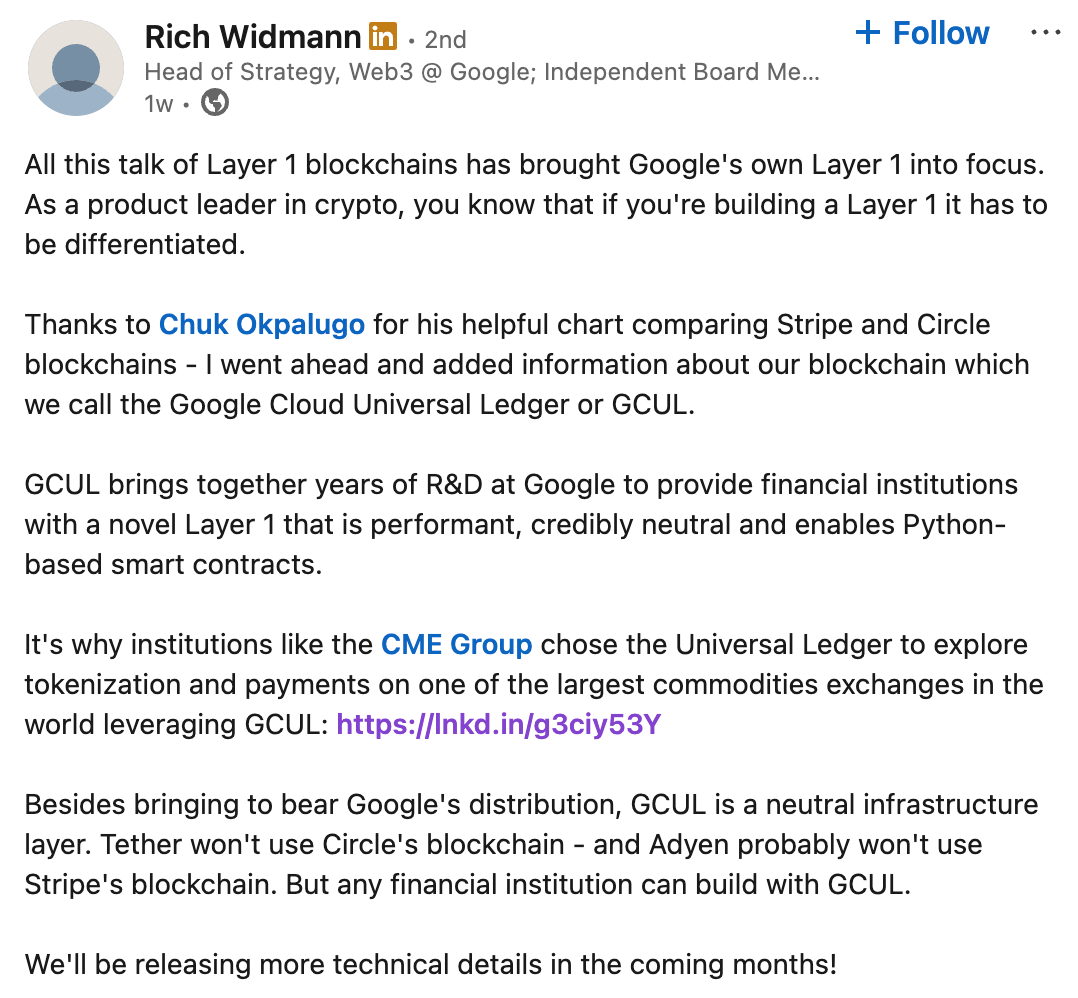

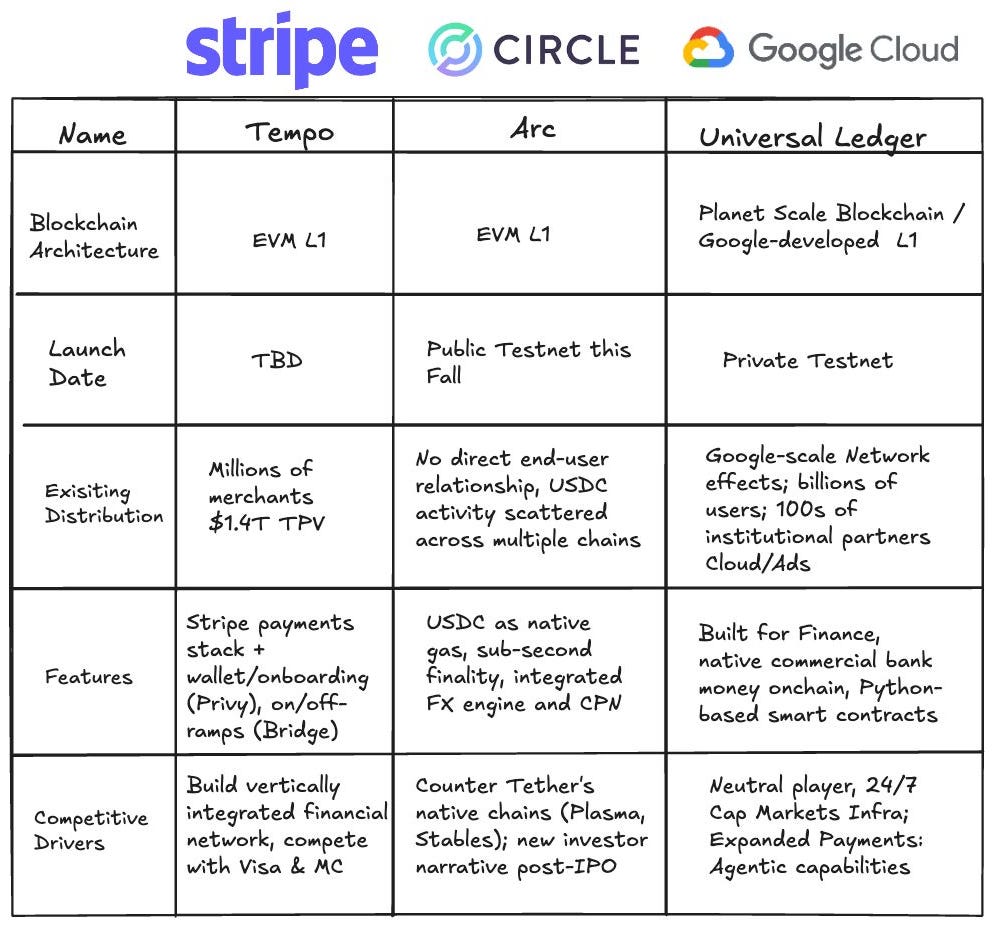

With Google Cloud Universal Ledger, the company wants to provide financial institutions with an in-house Layer 1 blockchain that is “performant, credibly neutral and enables Python-based smart contracts”.

Institutions like CME Group, the world’s leading derivatives marketplace, are already leveraging this chain to explore tokenisation and payments, reckons Rich Widmann, Head of Strategy, Web3 at Google.

Why build an in-house chain now?

Because the plumbing of money is calling for a fix.

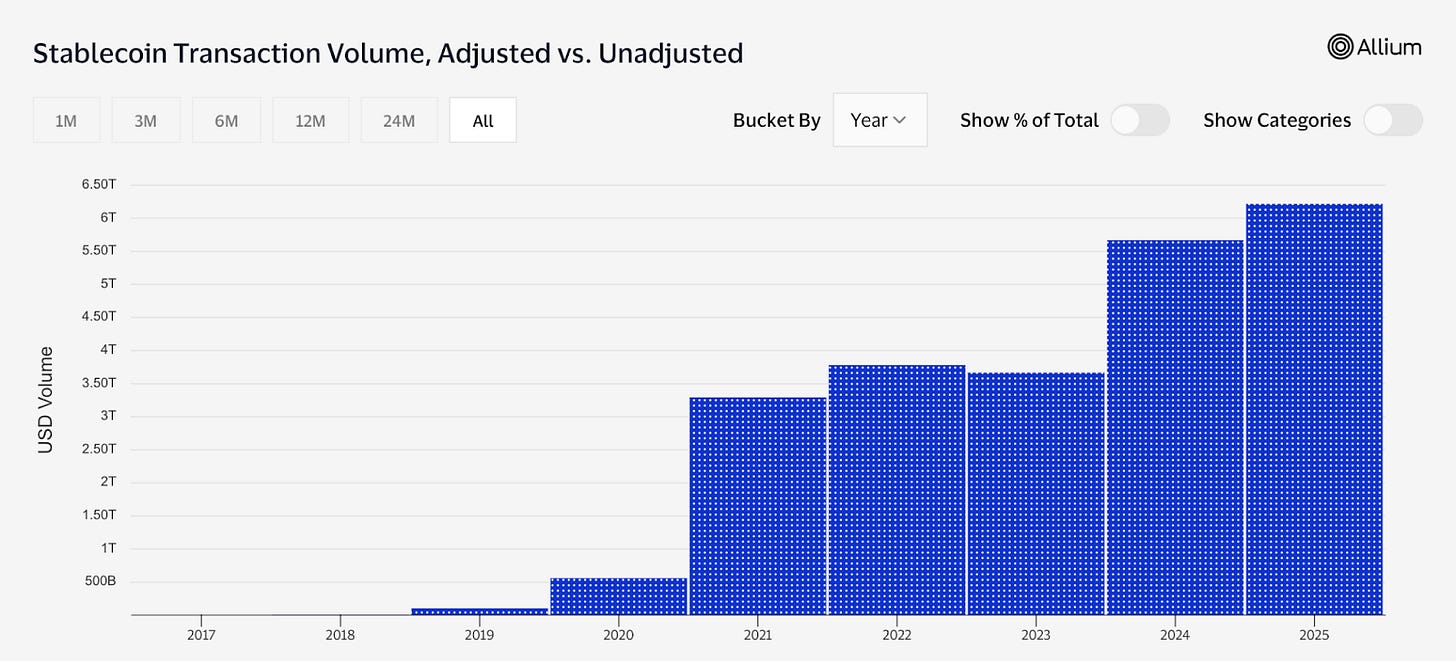

Stablecoins processed more than $5 trillion in adjusted transaction volume in 2024, outpacing PayPal’s $1.68 trillion in annual transaction volume and second only to Visa’s annual payments volume ($13.2 trillion).

Yet cross-border payments still take days to settle, cost a double-digit percentage, and rely on archaic systems. Inefficiencies in settlement are expected to drain $2.8 trillion annually by 2030 if nothing changes, The Economist noted.

Google wants to start with stablecoins but wants to go a step ahead. “Stablecoins are just the beginning. The real opportunity lies in tokenising a broader set of real-world assets and building programmable financial applications on open infrastructure,” Google wrote in its blog post.

Who will use it though?

The ledger is permissioned. Every participant must be KYC-verified. Smart contracts run in Python, the language financial engineers already use. Access comes through a single API, integrated into Google Cloud’s existing services.

The industry is sceptical about its “neutral infrastructure” tag. And I am not even surprised with the backlash when a technology giant that’s built its empire by centralising control over data, wants to now offer a “neutral blockchain”.

What makes Google different, beyond its scale? Widmann bets it will be a platform for other financial firms to build on top of. “Tether won’t use Circle’s blockchain — and Adyen probably won’t use Stripe’s. But any financial institution can build with GCUL.”

Stripe’s Tempo will naturally lean on Stripe merchants. Circle’s Arc is built around USDC. Google’s pitch is that it has no competing payments or stablecoin business, so it can credibly offer rails others might adopt.

Google, again, isn’t the first in this category either. Other corporate giants have built their own blockchains in the past.

Meta’s (earlier known as Facebook) Libra, later renamed Diem, promised a global stablecoin but never launched. Regulators lined up to stop it, warning it could undermine monetary sovereignty. By January 2022, the project’s assets were sold off.

R3’s Corda and IBM’s Hyperledger Fabric built credible platforms, but struggled to scale beyond limited consortia. They were all permissioned chains that were valuable to sponsors but failed to pull industries onto shared rails and ended up staying siloed.

Read: The DIY Blockchain Trend 👀

The lesson has been that networks fail if everyone believes one company controls the protocol. That’s the shadow hanging over Google too.

But GCUL’s first partner, CME Group, gives us a hint about where this is headed. If the Universal Ledger can handle the daily flows of the world’s largest derivatives exchange, the appeal of the scale reinforces the case for broader adoption. It also tackles the decentralisation argument.

Google Cloud already counts banks, fintechs, and exchanges as customers. For them, connecting to Universal Ledger via an API might feel like adding another service, not switching platforms. Google also has the resources to sustain what smaller consortia abandoned due to tighter budgets. That’s why, for institutions already embedded in Google’s stack, adoption might be more frictionless than starting from scratch elsewhere.

For retail users, this will be felt in a subtler way. You won’t be logging into a Universal Ledger app, but will still feel the impact.

Think of the refunds that take days to arrive, the international transfers that are stuck and the delays that have been normalised. If Universal Ledger works, it could quietly remove them.

You could also expect it to extend to everyday products. Pay a few cents to skip a YouTube ad instead of a monthly YouTube Premium subscription, a fraction of a dollar for an extra Gemini query, or stream payments in real time for cloud storage. The ad-subsidised internet could quietly tilt toward a pay-per-use model, giving users choice instead of one default.

For the first time, users might get to choose whether they want to trade attention or spend a few cents instead. Businesses could experiment with micro-transactions in ways that weren’t possible on old rails, from streaming payments for cloud storage to on-demand premium search results. The GCUL model, if it works, shifts Google’s empire from being funded almost entirely by advertising (accounts for over 75% of Google’s total revenue) to a more flexible, transaction-driven model.

The decentralisation vs centralisation debate will still lurk around.

I don’t see developers choosing to build permissionless apps on top of GCUL. No developer is going to spin up a yield farm or launch a memecoin on Google’s rails.

The institutions that already use Google’s Cloud and other enterprise tools will likely be the ones to adopt GCUL. The focus is narrow but practical: move value across the internet with less friction, reduce reconciliation headaches, and give banks and payment firms rails they can trust.

Even as a retail user, I don’t remember the moment I switched to Gmail. It just became synonymous to e-mail, just like Google became to the act of searching on the web. I didn’t even know Google owned Android when I bought my first Android phone.

If Universal Ledger becomes seamless infrastructure, you won’t care about the decentralisation aspect. It will just be the thing that worked.

That doesn’t rule out risks.

Google isn’t new to antitrust scrutinies. US courts have ruled in the past that the tech giant has maintained monopolies in both search and advertising. Building a financial rail will only intensify regulatory interest. Libra’s collapse is proof of how fast projects can unravel once central banks feel sovereignty is at stake.

For now, Google’s UCL is still on testnet. CME is onboard. Other partners are being courted. A wider rollout is planned for 2026. But I don’t find the ambition misplaced.

Google is betting it can turn the movement of money into infrastructure as boring, reliable, and invisible as typing into a search bar.

The story began with a blank white page and a search box. Its next chapter could have a ledger no one sees, yet everyone uses.

That’s it for this week’s deep dive.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Major platforms like Google aiming to make blockchain a mainstream financial infrastructure is a significant leap. Do you believe permissioned chains can coexist with the decentralized ethos? I would sincerely appreciate your critique and thoughts on my newsletter “The $110k Bitcoin Reality Check and The Perpetual Bias” (https://beyondthecoin.substack.com/p/the-110k-bitcoin-reality-check-and).