Stablecoins Go Corporate? 🏢

Hello!

Justin Sun, founder of TRON, is taking his blockchain empire public via a reverse merger with SRM Entertainment, a Nasdaq-listed toy company.

Check out Tuesday edition to know more.

Yes, stablecoins are hot. Circle's stock went parabolic. The GENIUS Act is advancing through Congress. But forget all that.

The real change is hidden in plain sight. Stripe just bought a crypto wallet company, Shopify is making stablecoin payments the default option, and Amazon plus Walmart are reportedly building their own stablecoin.

When the world's largest retailers start bypassing traditional banking to save billions in fees, that's more than crypto adoption.

That's the entire payment system getting disrupted by companies we already trust. There are four big signs of the commercialisation of crypto.

1/ Privy Matters More Than You Think

Stripe's acquisition of Privy is more than just another day in crypto.

Why? They bought the missing piece of their digital payments empire.

Earlier this year: Stripe acquired Bridge for $1.1 billion (stablecoin infrastructure).

Bridge is the infrastructure that makes stablecoins work like regular money for businesses. Their APIs convert between USD and stablecoins seamlessly, so companies can send instant global payments without dealing with crypto wallets or blockchain complexity. Think of Bridge as the translator between traditional banking and the new digital dollar economy.

This week: Stripe acquired Privy (crypto wallet integration)

Privy makes it possible to connect wallets to familiar interfaces like email addresses without exposing users to the complexity of private keys or seed phrases. For Stripe's massive user base, this means accessing crypto payments without learning crypto technology.

What do I see? Complete crypto payments stack from wallet to settlement.

The acquisition signals Stripe's intention to make stablecoin payments as easy as traditional card processing. Companies that already use Stripe — which processes over $1 trillion annually — can now offer crypto payments without building new infrastructure or asking customers to download wallet apps.

This matters because Stripe powers payment processing for millions of businesses globally.

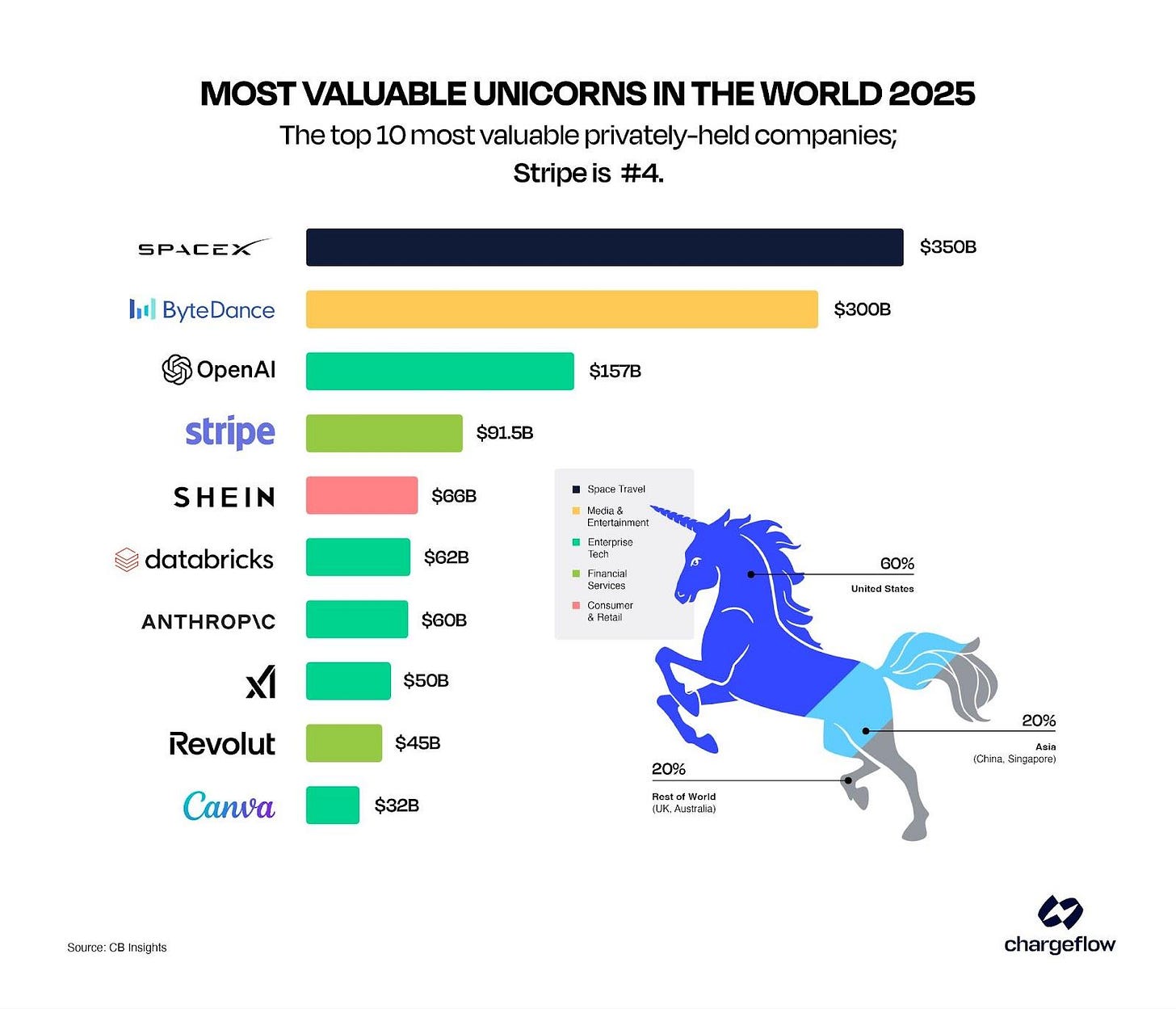

Stripe's reach is staggering: 1.4 million active websites and 90% of adults have used it for transactions according to a chargeflow report. The company processes more than 465 million transactions during a single Black Friday weekend.

When they integrate stablecoin support, it's not just one company adopting crypto. It's enabling crypto adoption across their entire ecosystem.

Privy powers 75 million accounts across 1,000+ developer teams. Stripe is essentially betting that crypto payments will become as common as credit cards.

2/ When E-commerce Gets Disrupted by Its Own Platform

Shopify just announced something that should terrify traditional payment processors. USDC payments are rolling out to millions of merchants, and stablecoin rails will be the “default option” unless sellers opt out.

What happens now?

The partnership with Coinbase and deployment on Base creates a complete payment stack that handles everything from wallet creation to settlement. Customers can pay with USDC while receiving 1% cashback, and merchants benefit from faster settlement and lower fees compared to traditional credit card processing.

What does it tell me?

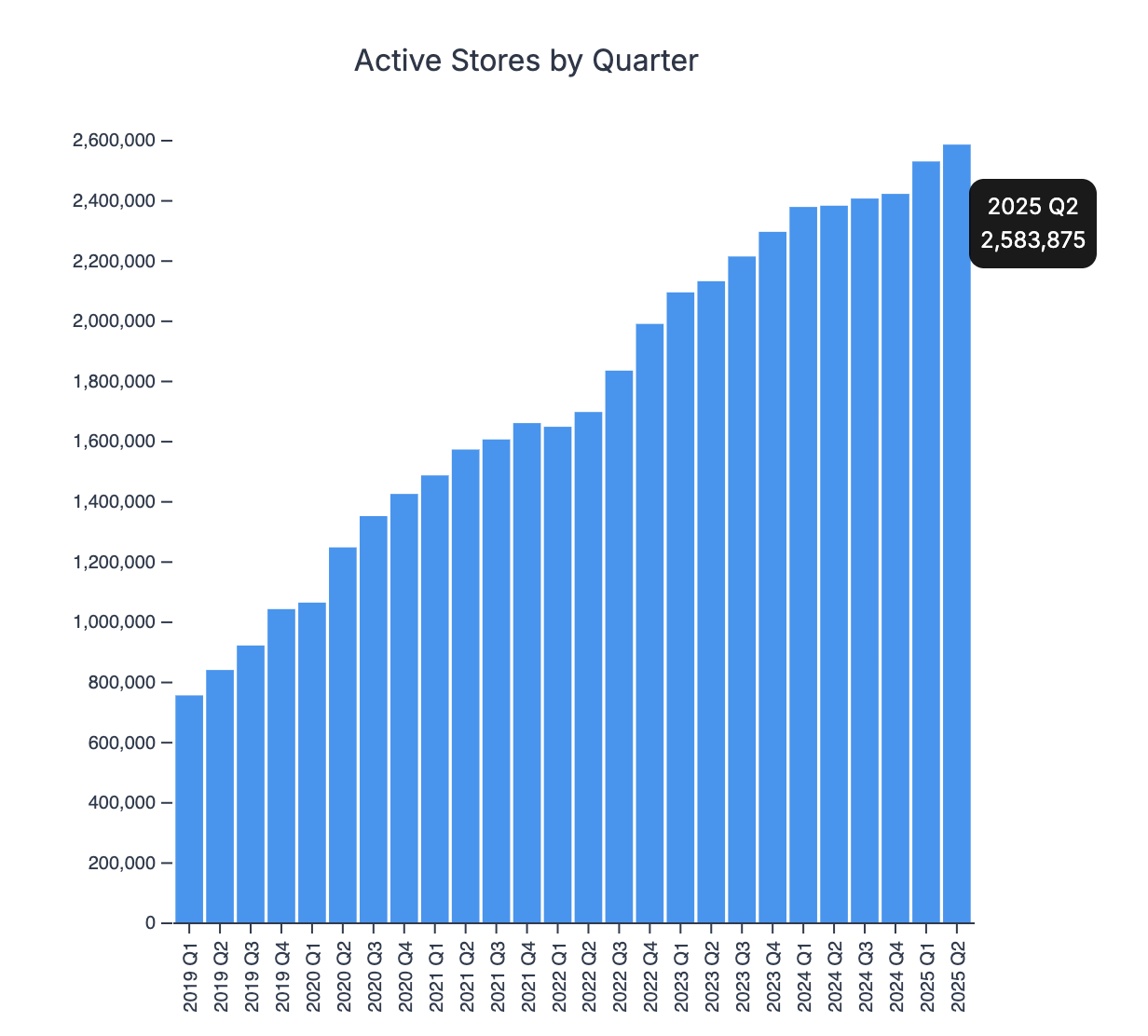

Shopify powers millions of online stores globally - 2.6 million merchants span 150+ countries, from solo entrepreneurs to Fortune 500 companies.

When they flip a switch and suddenly every merchant can accept USDC payments with 1% cashback incentives, I want to call it “revolution,” and I will tell you why.

Traditional payment processing costs retailers 2-3% per transaction. Stablecoin payments cost pennies.

For a $100 purchase:

Traditional: $2-3 in fees.

USDC on Base: ~$0.05 in fees.

Multiply that across Shopify's ecosystem and you're talking about billions in savings.

Here's what that means for you as a customer: those savings don't just disappear into corporate profits. Retailers can either pocket the difference (making them more competitive) or pass savings directly to consumers through lower prices.

Shopify's already dangling the carrot. They're offering 1% cashback in local currency for USDC payments. So instead of paying a premium for convenience, you're getting paid to use the cheaper payment method.

Once Shopify merchants start saving 90%+ on payment processing, every other e-commerce platform will face an impossible choice: adopt stablecoin payments or watch their merchants migrate to platforms that do.

3/ When Retail Giants Build Their Own Money

According to WSJ, both Amazon and Walmart are "mulling plans to issue their own US dollar-backed stablecoins for customers." Again, the scale we’re talking about..BIG.

Amazon: $638 billion annual revenue, $447 billion in e-commerce sales.

Walmart: $100+ billion in e-commerce sales annually.

If either company launches their own stablecoin payment system, they could instantly divert billions in cash flow from their banking partners.

What does it mean for customers?

Faster checkout - instant settlement vs T+2 processing.

Lower prices - retailers can pass on savings from eliminated processing fees.

Seamless international purchases - no currency conversion fees or delays

Once Amazon or Walmart customers experience buying something for $98 instead of $100 because there are no payment processing markups, they'll expect every other retailer to offer the same deal. Suddenly, every business needs stablecoin integration or risks losing customers to competitors who can offer the same products at 2-3% lower prices.

The network effect becomes unstoppable: customers demand the savings, retailers need the cost reduction to stay competitive, and traditional payment processors watch their business model evaporate.

4/ The Ultimate Irony. The Banks Themselves

In May, WSJ reported that the largest financial institutions, including JP Morgan Chase, Bank of America, Citigroup, and Wells Fargo, are exploring the creation of a consortium-backed stablecoin. The four largest US banks collaborating on crypto infrastructure they spent years dismissing.

And now, JPMorgan - whose CEO Jamie Dimon has spent years criticising Bitcoin - just filed a trademark for "JPMD" covering digital asset trading, exchange, transfer, clearing, and payment processing.

The same bank that processes $1.5 trillion annually through their private JPM Coin is now building public-facing crypto services.

You do know why this matters. It's not because the largest bank in America loves technology. It's because they see their payment monopoly ending and want to control the transition.

Banks make billions from payment processing fees. Stablecoins threaten to eliminate those fees entirely (clearly we are already on the way).

Their choice? build crypto infrastructure or become irrelevant. Yes, you may call it a “surrender.”

Token Dispatch View 🔍

All these corporate stablecoin announcements aren't happening in a vacuum. Companies have been waiting for regulatory clarity before committing billions to stablecoin infrastructure. The GENIUS Act provides that clarity, which is why we're suddenly seeing all these headlines.

The regulatory momentum creates a pathway for mainstream stablecoin adoption without the uncertainty that has limited corporate engagement with other crypto assets.

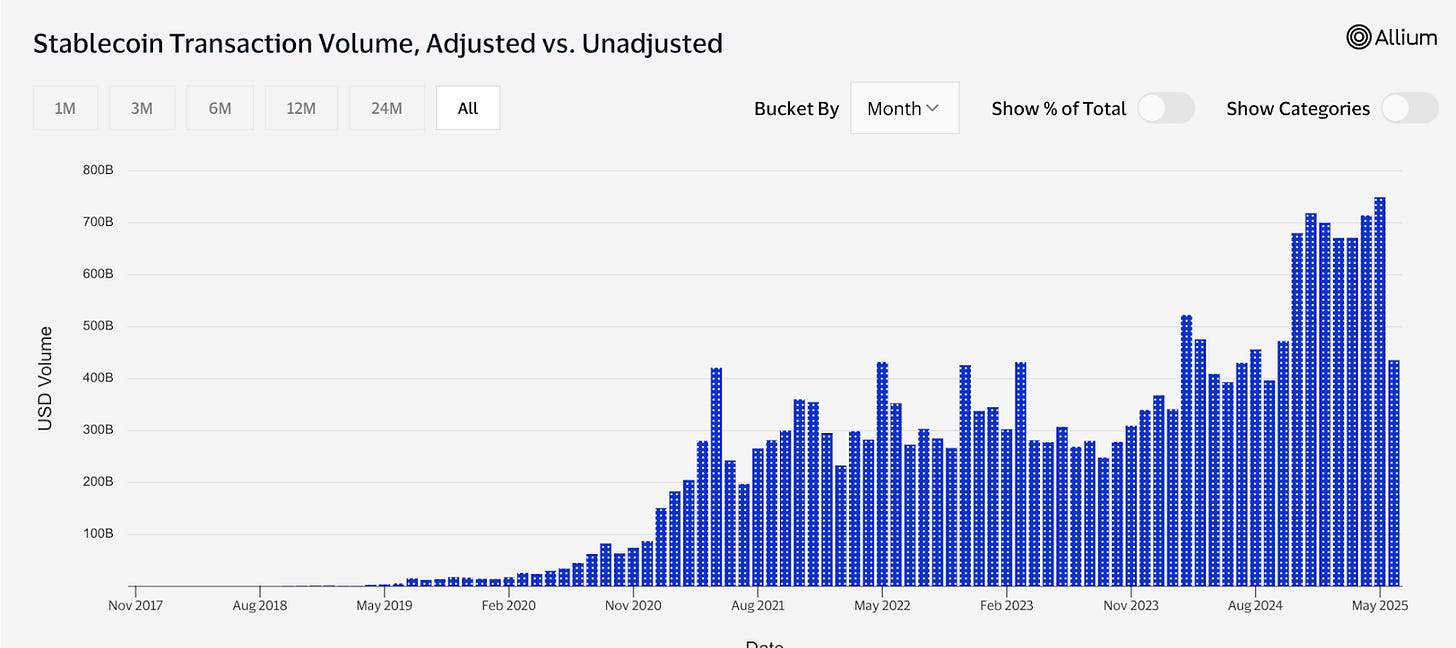

But I want to talk about the scale of reality. The numbers behind stablecoin commercialisation reveal why traditional companies are taking notice. Stablecoin transaction volume reached $4 trillion in May 2025 alone and $34 trillion year-to-date.

Visa's annual transaction volume is approximately $15.7 trillion and PayPal's is around $1.7 trillion. This indicates a significant and growing presence of stablecoins in the global payments landscape.

B2B cross-border payments using stablecoins hit $3 billion monthly, compared to $1.1 billion for traditional card-based spending. The speed and cost advantages of blockchain settlement are driving business adoption ahead of consumer adoption.

18% of small and medium US businesses aware of cryptocurrency now use stablecoins for business needs, up from 8% in 2024. This adoption is happening through practical utility rather than speculative investment.

When Shopify (millions of merchants), Amazon ($638B revenue), and Walmart ($100B+ e-commerce) start pushing stablecoin adoption, the numbers get ridiculous quickly.

If just 10% of their combined transaction volume moves to stablecoins, that's an additional $75+ billion in stablecoin usage annually.

Once a critical mass of merchants accept stablecoins, consumers will demand them everywhere. Merchants must offer them or lose business. We're watching the early stages of a payment system migration that could reshape global commerce within the next 5 years.

The crazy part? Most people won't even notice it's happening. They'll just wonder why their online purchases suddenly process faster and cost less.

Whether this represents crypto's ultimate victory or its transformation into something entirely different is out with the jury. But all of this suggests that crypto's real impact might come through evolution and by becoming so embedded in existing systems that its presence becomes unremarkable.

See you … later,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.