Crypto’s Courting Wall Street 🔔

Traditional markets provide capital impetus

Hello!

Did you know? BTC dominance has increased for 5 straight weeks (week-on-week) despite persistent macro uncertainties? Ominous signs for the altcoin loyalists? Altcoin season 404 error not found?

More on this in our Monday analysis on the week that was.

Justin Sun, founder of TRON, is taking his blockchain empire public via a reverse merger with SRM Entertainment, a Nasdaq-listed toy company.

Why would someone who built his career on overthrowing traditional finance now line up at Wall Street's doorstep with an IPO prospectus in hand?

Welcome to crypto's great identity crisis of 2025.

The Rush to Wall Street

The stampede started with Circle. When the stablecoin giant went public this month, shares surged 168% on debut. The offering was 25 times oversubscribed: the public demanded 850 million shares against 34 million offered.

Read: Circle's Wild Ride 🎢

Circle is currently worth more than $33 billion, 3x of the $9-11 billion buyout offer the USDC issuer reportedly got from Ripple before it went public.

Read: Coinbase v Ripple: The Battle for Circle🥊

Circle's success did more than reward early investors. It inspired a crop of crypto-native firms to consider tapping Wall Street, and pushed a few others to bring back their listing plans from the back-burner.

Gemini filed for an IPO three days later. Now, Tron has announced its plans.

Circle has provided a template to prove that traditional markets would pay massive premiums for regulated crypto exposure and that mainstream investors were hungry for blockchain innovation wrapped in familiar corporate structures.

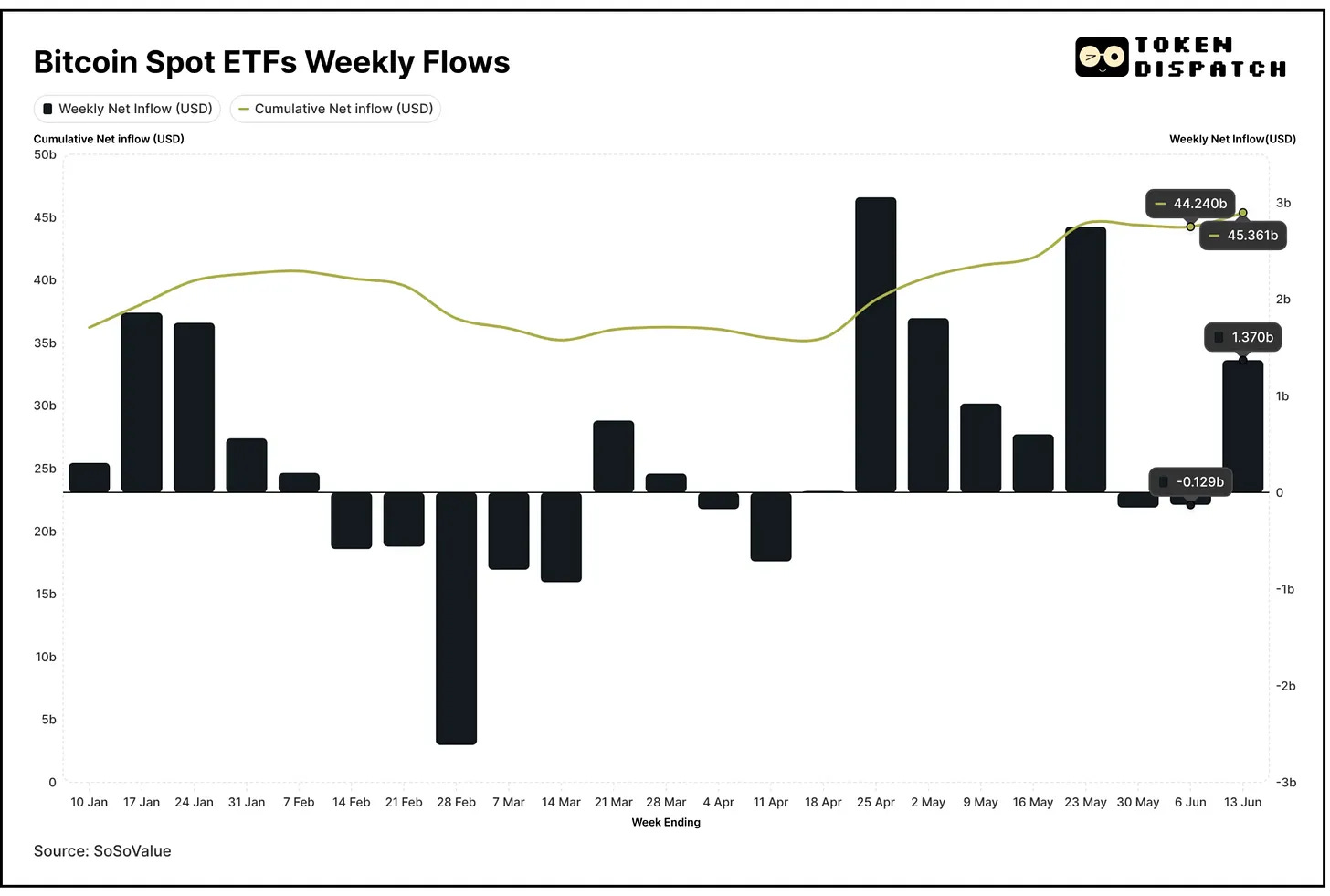

The public had already lapped up crypto products delivered through traditional Wall Street channels. Bitcoin ETFs have raked in over $45 billion in net flows since January 2024.

Strategy's (formerly known as MicroStrategy) stock trades at multiples of its Bitcoin holdings: with a market cap of ~$106 billion and a Bitcoin holdings worth ~$62 billion. Michael Saylor’s Bitcoin bet has inspired many more listed companies to take the treasury route.

These cases crystallise a hypothesis: the fastest route to mainstream acceptance might not be by transitioning the world to holding self-custody wallets and using DeFi protocols. Instead, the path to mass adoption ran straight through traditional finance infrastructure, by making crypto accessible through channels people already trusted.

Consider the math of adoption. Traditional finance touches billions, versus 560 million cryptocurrency owners across the globe.

When ETFs brought Bitcoin to 401(k)s and pension funds, it accomplished more mainstream penetration in a year than a decade of "not your keys, not your coins" evangelism.

Companies that had spent years building pure crypto products began eyeing adjacent offerings that could bridge worlds. Circle used stablecoins to build digital payment rails and corporate treasury services. Coinbase outgrew its crypto exchange image by building institutional custody and prime brokerage services that rival traditional banks.

The IPO route offers something the crypto ecosystem doesn’t: the ability to use public market capital to fund these adjacent product lines. Need to build enterprise-grade custody solutions? Issue shares. Want to acquire traditional fintech companies? Use stock as currency. Planning to expand into regulated lending or investment management? Public market credibility opens doors that crypto-native credentials can't.

Why Trust Trumps Ideology

The traditional finance courtship also solves one of crypto's most nagging problems: institutional trust. For years, crypto companies struggled with a credibility gap that no amount of technological innovation could bridge.

When Coinbase went public in 2021, institutions viewed it as a risky bet on an emerging asset class. Today, with its S&P 500 inclusion and billions in institutional assets under custody, Coinbase represents crypto's integration into the mainstream financial system.

Read: The Coinbase's Conquest 🏆

This trust-building mechanism works through multiple channels.

SEC oversight provides regulatory comfort that pure-play crypto investments can't match. Quarterly earnings calls and audited financials offer transparency that community governance forums simply don't provide. When pension fund managers can point to S&P’s ratings and decades of corporate law precedent, crypto becomes an asset allocation decision rather than a leap of faith.

The validation runs both ways.

Wall Street's embrace of crypto companies legitimises the entire sector. It's much harder to dismiss blockchain technology as a speculative bubble when BlackRock is actively building crypto infrastructure and Fidelity offers Bitcoin services to millions of retirement accounts.

There’s also a practical necessity, beyond just philosophical evolution.

Crypto VC funding collapsed 65% in 2023 following FTX's implosion. When the second-largest exchange gets exposed as a house of cards built on customer deposits, investors get skittish about writing cheques.

Traditional venture funding that once flowed freely to anything with "blockchain" in the pitch deck dried up fast. Companies accustomed to $50 million Series A rounds found themselves explaining basic concepts to investors who wouldn't return calls.

Read: When VCs started asking questions 💰

Public markets remained open.

The same institutional investors who wouldn't touch a crypto startup were perfectly happy buying shares in regulated, SEC-compliant crypto companies with audited financials and clear business models.

This funding shift accelerated the strategic pivot toward adjacent products.

Token Dispatch View 🔍

The emerging playbook is to build something that solves genuine problems, demonstrate product-market fit through crypto-native channels, then scale through traditional finance infrastructure.

The philosophical tension might exist, but isn’t necessarily problematic.

Companies that master this transition will be able to offer DeFi innovation with traditional finance reliability. They will deliver decentralisation's benefits, including faster settlement, global accessibility, programmable money, to mainstream users who will never manage private keys or understand gas fees.

The crypto industry's early promise was eliminating intermediaries entirely. But, most people still want intermediaries, and maybe better ones. Faster, cheaper, more transparent, and more global than traditional banks, but intermediaries nonetheless.

Crypto companies planning to build blockchain empires will likely not shy away to look beyond ideological purity for want of funds. They might instead be focused on raising capital from the public to build infrastructure that brings crypto's benefits to the next billion users.

The trust-building mechanism seems to be working from an adoption perspective: traditional routes are accelerating crypto acceptance faster than pure-play crypto ventures.

Crypto founders who have achieved a product-market fit shouldn’t be afraid to knock, when the time is right, on Wall Street's door. They look eager to let you in.

That’s it for today.

See you … later,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.