Hello

Everyone wants a treasury. Each week, I see a new firm announce a pivot to the same playbook: buy crypto coins, label the business as a “digital-asset treasury,” and promise shareholders a cleaner way to ride the crypto wave.

The press release writes itself, a new ticker is born on the bourses, and the board learns a new phrase - ‘coin per share’. From software to medical, companies from diverse domains are pivoting into the DAT space because it appears faster, and probably easier, than pivoting into a new product category.

In today’s story, we examine three charts that tell the story behind the fluctuations in DAT stock prices as the crypto market navigates a correction phase.

Also, a shoutout to Wisdom, the data wizard at Decentralised.co, who was happy to help me crunch some numbers and data for this story.

On to the story now,

Prathik

WhiteBIT: Crypto Trading Simplified

Whether you’re new or seasoned, you get:

300+ cryptocurrencies & 780+ trading pairs to diversify your portfolio

0.1% maker & taker fees, trade more, waste less

96% assets in cold wallets & audited by Hacken security you can trust

WhiteBIT Nova Card, auto-invest, margin/futures, and quick send transfers all in one platform

VIP program with up to 100% trading fee discounts and priority features for high-volume traders

Join millions who trade confidently with WhiteBIT.

Trade on WhiteBIT!

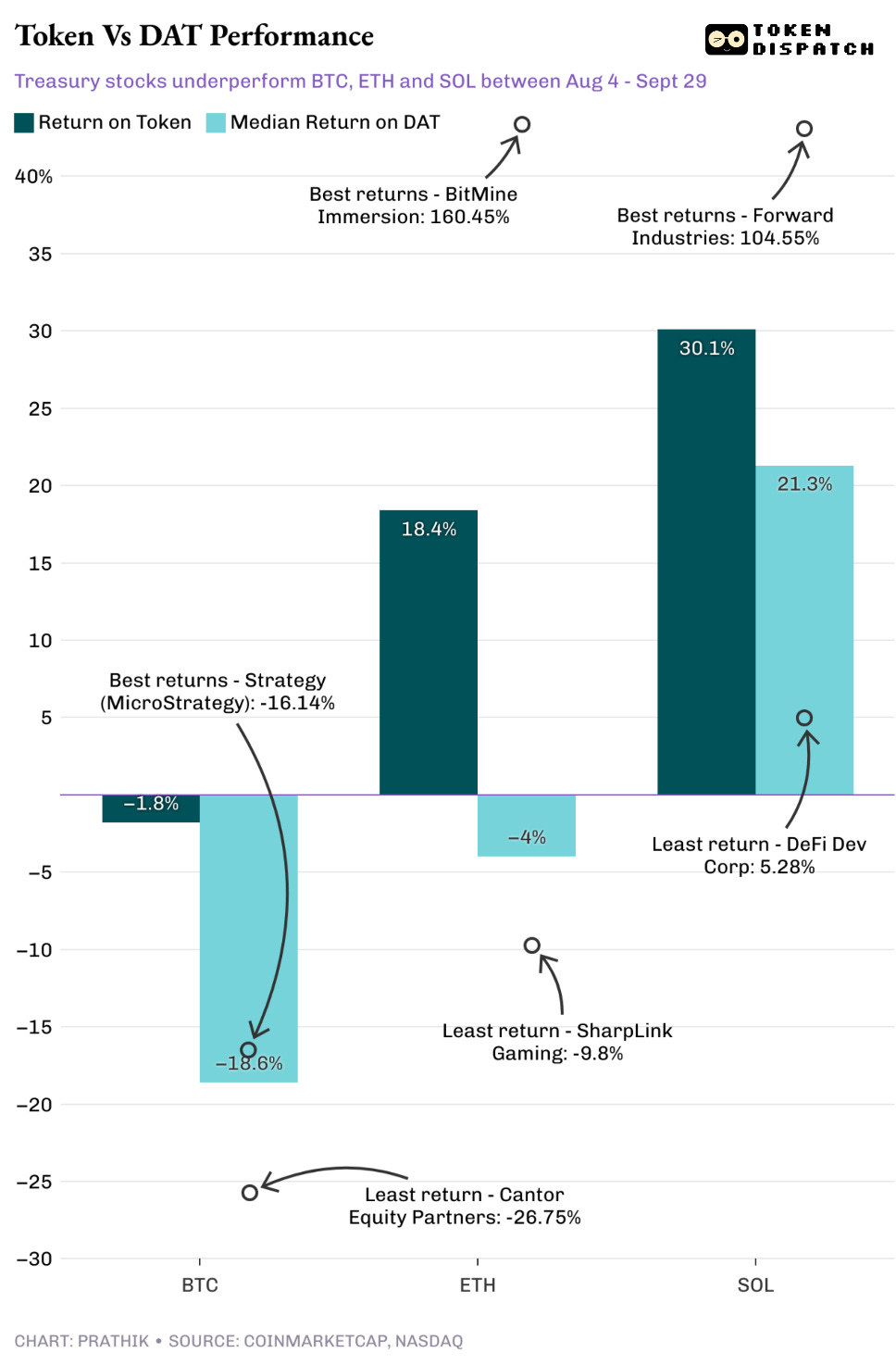

Coins have climbed, but their equity wrappers have not. Across Bitcoin, Ethereum, and Solana, the median Digital-Asset-Treasury (DAT) stock of the top three corporate treasuries has lagged the underlying asset over the past two months. The stock prices of these publicly listed entities still sit far below their peaks.

This gap is soon becoming a structural problem. The equity wrapper is no longer offering as much token beta, the key differentiator that made investors opt for these stocks over direct crypto custody.

If the proxy worked, the median line would loosely track the coin’s performance.

In BTC, the basket trails even when the coin is performing flat or slightly higher. In ETH, dispersion is wide, and the median still lags. SOL appears healthier because a couple of names surged; yet, the median is lagging here as well.

Investors have cleaner routes for exposure to cryptocurrencies. Consider direct custody and Spot exchange-traded funds. These routes provide investors with exposure to the coin without introducing capital structure risk or other business noise that comes with a corporate wrapper. Investors took these routes because they promised superior upside.

Once that premium is no longer in place, the wrapper loses its appeal as a proxy.

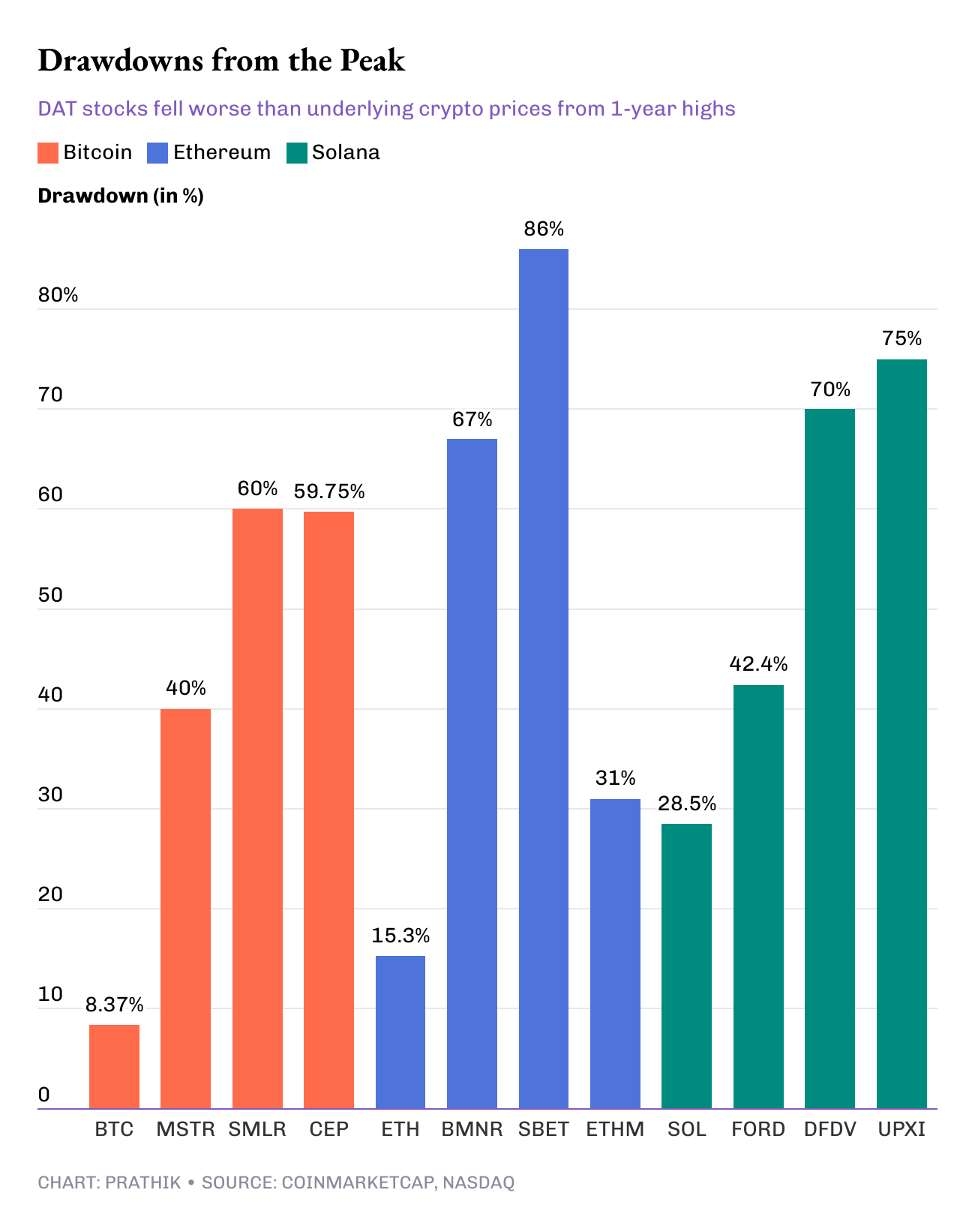

We see that translating into green returns for the underlying coins, but disproportionate or missing returns for the corporate stock holding the crypto treasury. Even during the recent corrections for bitcoin and other cryptocurrencies, the equity layer fared worse.

When investors paid a premium to own companies with coins on their balance sheet, DATs could compound the reward — the coin price appreciation and the premium on the shares of the DAT. But as the crypto market corrects, that premium shrank.

Now these stocks trade like bets on funding terms. ATM programmes, secondary sales, PIPE deals and lock-ups pull on the price. Shares tend to trade near recent issue prices rather than near their net asset value.

The first chart shows that the outlook for the entire crop of DATs is not significantly impacted by the performance of one outlier company. A single company can outperform through execution or clever treasury tactics. I don’t see DATs that do not have a strategy in place for timely accumulation to remain sustainable.

I say this because we have seen it happen with Strategy. The Michael Saylor-led BTC treasury giant has navigated various crypto market cycles due to its early mover advantage. Its considerably lower average price gives Strategy enough room not to be forced to liquidate to honour its debt-to-equity conversion obligations.

Read: The DATCO Machine 🔬

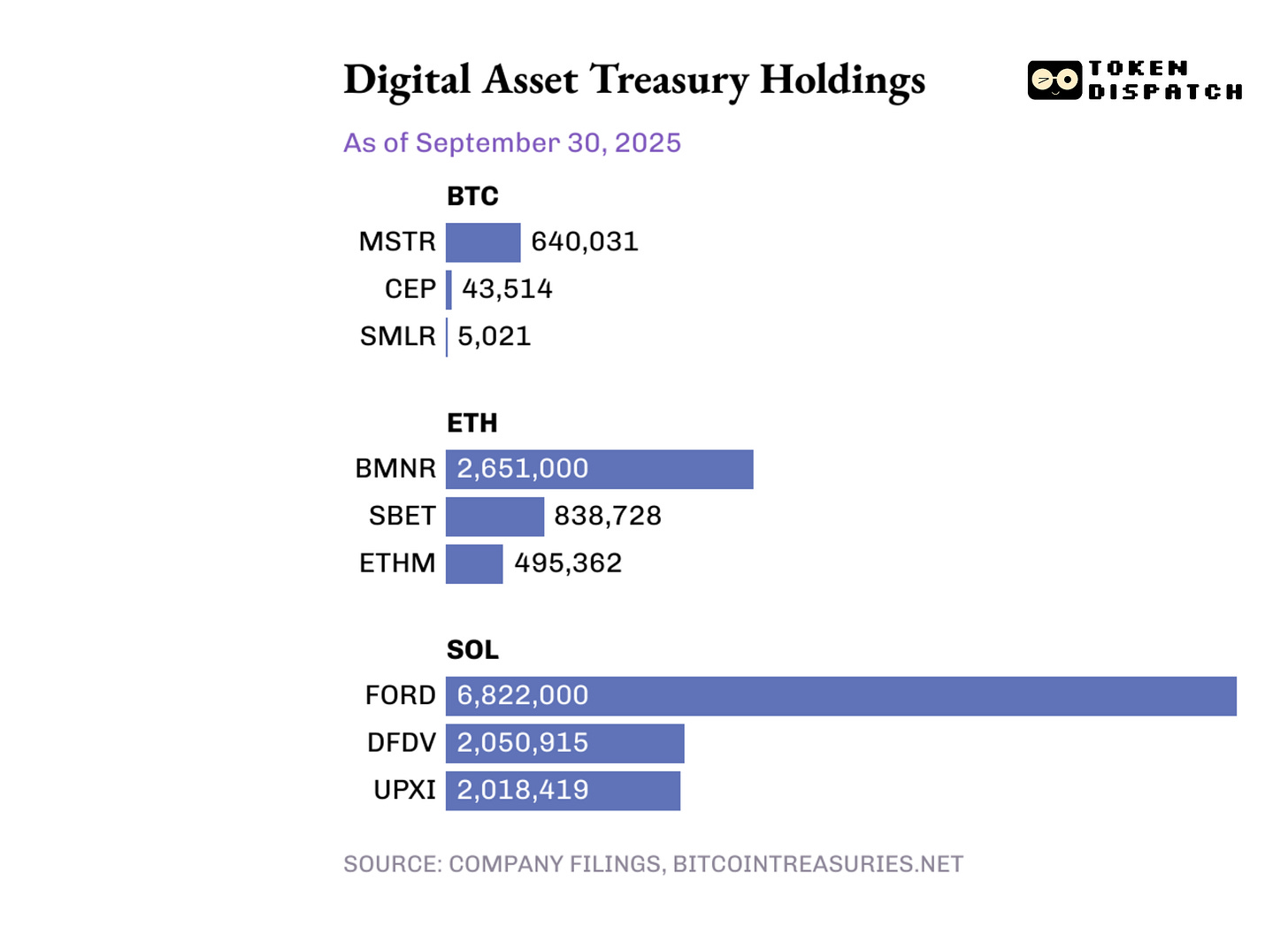

Yet, this has not stopped more companies from taking to the DAT route. Balances across the top treasuries in each cohort are substantial and continue to grow daily.

However, these newer entrants, due to their higher acquisition costs, run the risk of having to liquidate and pay off their debts in the event of a market meltdown.

The equity wrapper no longer serves as a crypto proxy if the investor’s willingness to buy its share above balance-sheet value has faded. Adding coins is necessary for the thesis these companies sell, but it is not sufficient while capital is raised against that same story.

What Next

DATs won’t cease to exist, though. They will have to evolve from just wrappers to operational businesses.

Many DATs use debt or convertible coupons to fund their crypto purchases since they have zero or insufficient revenue-generating business operations. Servicing these debts during a falling market could force the DATs to sell their crypto holdings, while most of them, including BTC giant Strategy, swear by the “never sell your treasury” principle.

How can DATs tackle this?

I see two paths.

First is to build a business unit that can bring in steady revenue to fund operations, interest expense and additional crypto purchases. The other route is to find a merger deal that boosts the coins-per-share metric.

But consolidation works only if the acquiring company is buying a target company under its NAV using the stock that trades above its own.

DATs will have to show how coin-per-share will increase without selling their holdings and that they can run a business that can fund itself while keeping the digital asset treasury intact.

That’s it for this week’s quants story.

I’ll see you next week.

Until then … stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Price / BookValue is well accepted metric in equity markets. Warran Buffet has spoken a lot about it. If P/BV > 1 is not an abberation but normal for a healthy growing company. Returns via dividend or asset share reflected in price.

Strategy is an unregulated Bitcoin bank and may be able to create more revenue streams.

In fractional banking the bank lends more then the deposits it has anyway.

Looks like prior comment went missing