Hello

I like how crypto compresses culture. It is obsessed with speed and rewards those who are fast. The difference between booking a profit and a loss could be a fraction of a second. Every day, I read about a new protocol that is helping traders automate bots and bring the execution of a trade down to milliseconds.

From seeing barely a single memecoin being launched in years to over 1,000 being launched in a day, we now see memes peak and die in under an hour. If you are not fast, you are last. Patience among crypto investors has always been a luxury to afford.

Until we saw a set of cartoon cats prove the opposite.

Crypto Investing Without the Crypto Chaos

Forget seed phrases, exchange hacks, and late-night wallet setups.

With Grayscale, you can invest in Bitcoin, Ethereum, and other digital assets the same way you’d buy a stock — through regulated, SEC-reporting products.

No private keys to manage

No unregulated exchanges

No steep learning curve

It’s the easiest way for individuals and institutions alike.

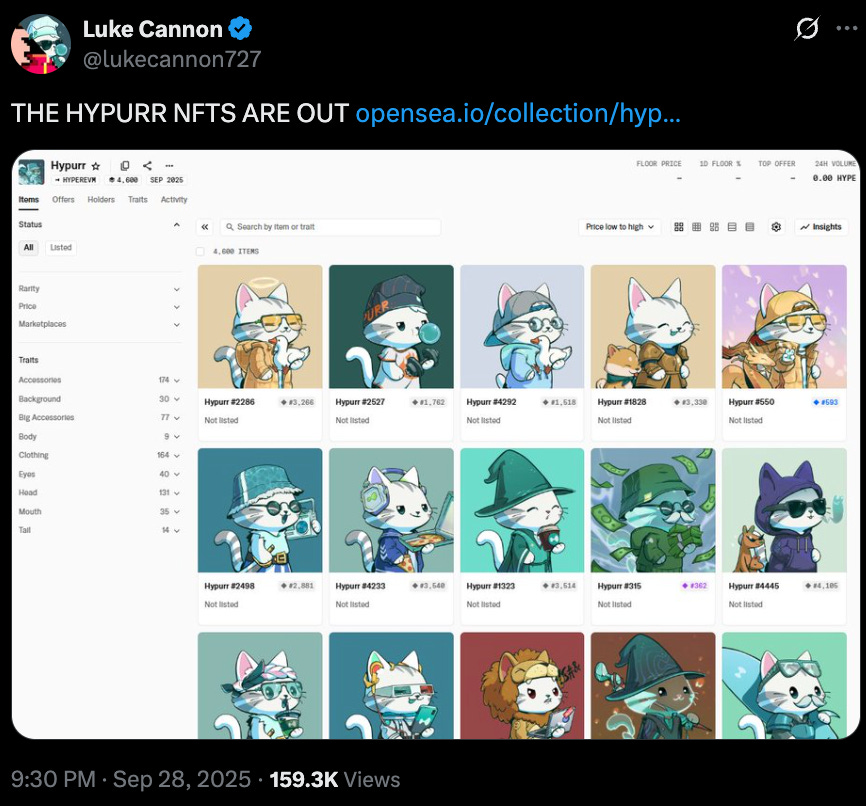

Hyperliquid’s Hypurr collection dropped 4,600 NFTs earlier this week and rewarded patience in a way that you rarely see in the crypto space. A community that had been waiting for almost a year, speculating on when, or if, the airdrop would happen, suddenly woke up to a surprise. Without even having to mint them, NFTs were already in their wallet. They would later trade for millions of dollars in the market.

But the genesis of this dates back to November 2024.

Hyperliquid, the blockchain best known for its decentralised exchange to trade perpetual futures, teased the idea of an NFT collection as a memento for early users. And then, there was silence. Months passed. Crypto Twitter moved on to other obsessions, including prediction markets, memecoins, ETFs and Bitcoin’s rally beyond the six-figure mark.

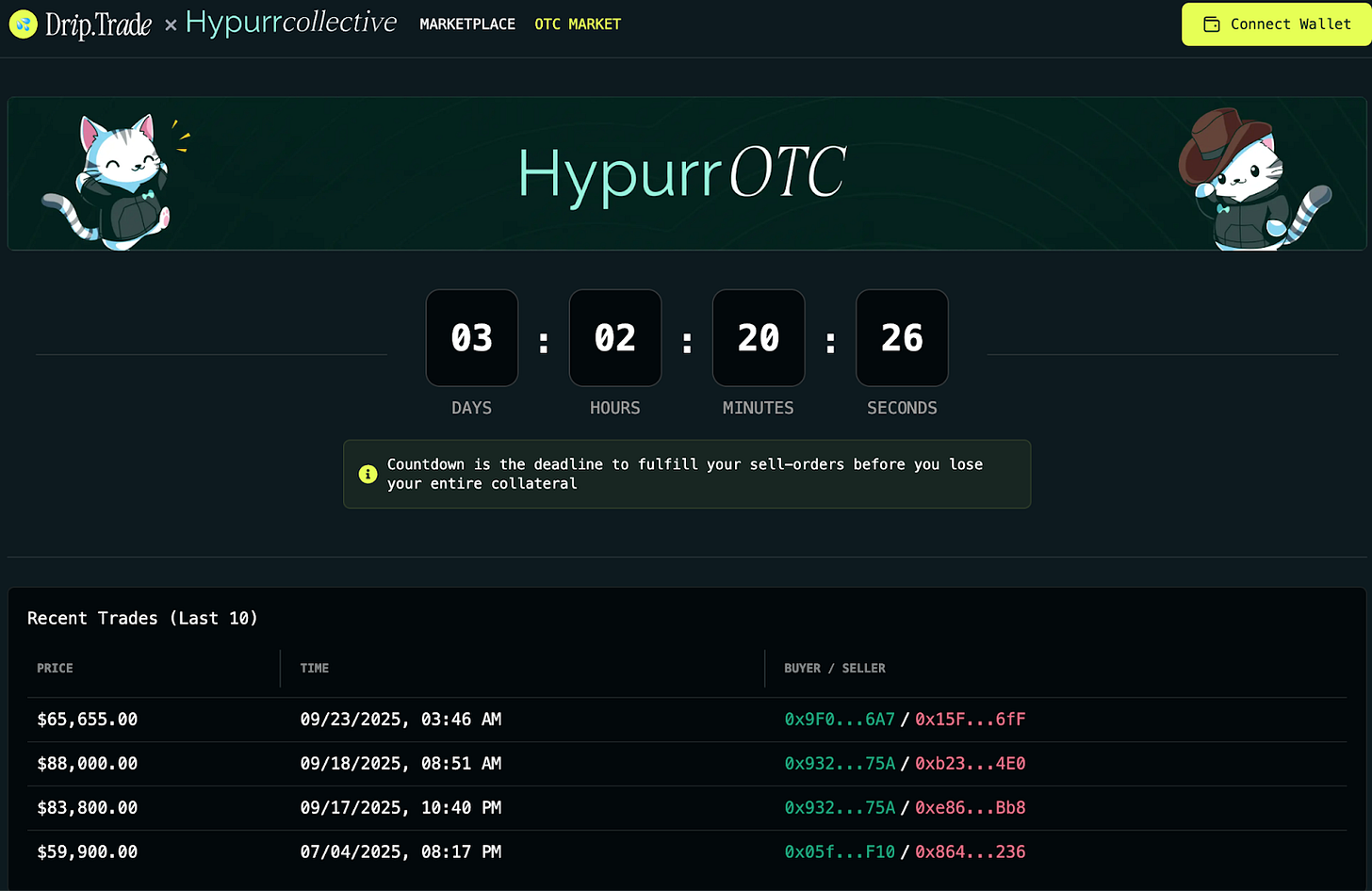

Then, in early July, almost three months before the official launch of Hypurr NFTs, people started trading them over the counter on drip.trade, a high-frequency NFT marketplace on Hyperliquid.

Prices kept creeping upwards from $40,000 to as high as $88,000, at one point.

It was surprising because an asset that didn’t exist on-chain was already commanding more than the median US salary in the private market. The delay, instead of killing the hype, had manifested into a force that made traders believe and bet that these cats, whenever they arrived, would be worth more than what they bought them for.

And they did arrive with a bang.

On September 28, the wait ended as Hyperliquid pushed Hypurr live on its HyperEVM. Eligible users, mostly early traders, woke up to find these cats in their wallets. The floor price shot past $75,000. By the next day, Hypurr had become the second-most traded NFT collection in the world, behind only CryptoPunks.

The cartoon cats immediately struck a chord with traders and aligned with inside jokes of a community that prided itself on being anti-venture capital, pro-degen, and playful.

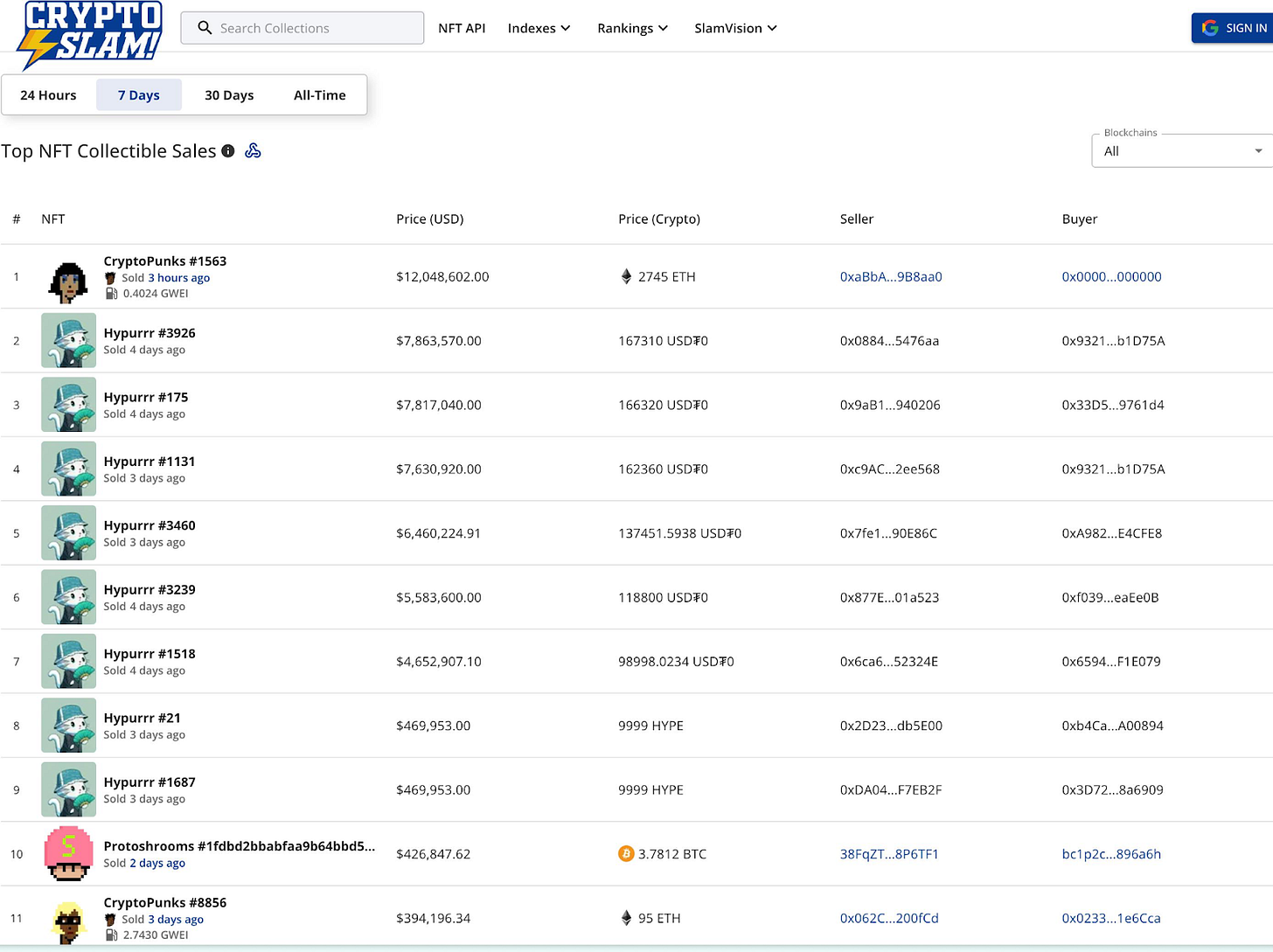

One rare Hypurr cat, clothed in a black leather jacket, sold for around $7.86 million. Five others were bought for $4-7 million apiece.

Nine out of the top 10 NFTs sold in the last seven days were from the Hypurr cats collection.

In the first 24 hours, the collection did over $67 million in volume. By the end of its first week, the figure had grown to nearly $90 million. The established blue-chip collections, such as CryptoPunks and Bored Ape, generated $16.5 million and $2.1 million, respectively, in sales over the seven days. For a new project, this was unheard of.

Often, sceptics dismiss NFT launches, claiming that they are marred by wash trading, a form of market manipulation where a group of participants trade an asset among themselves to artificially inflate the price and volume.

In Hypurr Cats’ case, the wash-trading accounted for $1.08 million of the $88.77 million sales volume across three days. That’s a little over 1% of the total volume.

What led to this, then? Scarcity? Perhaps.

Out of the total 4,600 NFTs in the collection, 4,313 were dropped to those who participated in the Genesis Event last November, the event where Hyperliquid launched and distributed its native HYPE token. Out of the rest, 144 NFTs were awarded to the Hyper Foundation, and 143 to core contributors — including Hyperliquid Labs, NFT artists, and other contributors.

But scarcity alone couldn’t have driven the floor-price surge.

The community’s pride in owning something rare could have been the other factor. Holders began greeting each other with “Gmeow,” a feline twist on the crypto-native “gm” wish. Screenshots of cats dressed in quirky hats and glasses filled the crypto timelines.

In most airdrops, the narrative is around the financial value it carries. Hyper Foundation explicitly framed Hypurr Cats as a “memento” in their note on X, making it sound like a cultural thank-you to early believers rather than a mere promise of financial utility. Probably why the drop felt like a homecoming to those who bet and patiently waited.

Crypto history is littered with projects that rushed. We have seen projects with higher implied credibility collapse in a couple of nights. Think of Argentine President Javier Milei’s memecoin scandal. There have been NFT mints that initially seemed promising but faded over time, performing worse than the NFT market’s meltdown. We often encounter protocols that overpromise and underdeliver. At such a time, Hypurr managed to do the opposite. It promised little, delivered late, tested the patience and yet rewarded its community exactly what it wanted.

Hypurr Cats’ launch could kickstart a new playbook for future NFT rollouts, where free drops to loyal users become the norm. It could also pave the way for a behavioural change among the early supporters’ community.

It’s hard not to compare Hypurr Cats with the legacy of blue-chip collections. We have seen how the cultural dominance of the Bored Ape Yacht Club has undergone a rollercoaster ride over the years, but Hypurr’s anti-VC roots are likely to set it apart.

Hypurr Cats is also different because it comes with a reputational tailwind. The exchange has been one of crypto’s breakout products in the past two years, and that trust has also carried into the collection.

Read: Burn, Baby, Burn 🔥

It helped that many of those who got the NFT were also rewarded during the GENESIS event with the HYPE token airdrop.

This windfall wealth that the early believers were able to create has led them to treat Hypurr as an earned badge rather than inventory to be offloaded.

That’s it for this week’s deep dive.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.