Hello

Stripe just bought Privy, Shopify is making stablecoin payments the default option, and Amazon + Walmart are reportedly building their own stablecoin. The world's largest retailers are bypassing traditional banking to save billions in fees.

Check out Wednesday’s edition to know more.

On August 15, 1971, President Nixon appeared on television to announce the suspension of dollar convertibility to gold. “I have directed the Secretary of the Treasury to take the action necessary to defend the dollar against the speculators," he declared, altering the global monetary system. The speech that later came to be known as the ‘Nixon Shock’ received more criticism than praise.

This week, the US Senate delivered another monetary watershed moment, though with far less fanfare but more support. The GENIUS (Guiding and Establishing National Innovation for US Stablecoins) Act passed in the Senate with a decisive 68-30 vote, taking America's first comprehensive framework for digital dollars a step closer to becoming an Act.

It now awaits clearance from the House of Representatives, followed by a presidential assent.

Unlike Nixon's emergency measure to abandon gold backing, this legislation represents careful, deliberate construction of monetary infrastructure for the digital age. A $250 billion stablecoin market that the Citi Group projects to reach $3.7 trillion, in a bull case, by decade's end.

In today's deep dive, we look at how the GENIUS Act could transform the financial system, why Tether faces an existential reckoning, and whether America has indeed achieved a monetary watershed moment.

The Digital Dollar Blueprint

The GENIUS Act draws clear lines in the digital sand. Unlike the regulatory patchwork that's governed crypto for years, GENIUS establishes unambiguous standards.

Core requirements are straightforward: stablecoin issuers must maintain 1:1 backing with US dollars, short-term Treasuries (under 93 days), or equivalent liquid assets. Monthly public audits become mandatory. Yield-bearing stablecoins are banned outright.

Only three types of entities can issue payment stablecoins: subsidiaries of insured banks, federal qualified non-bank issuers approved by the Comptroller, or state-qualified issuers meeting federal standards. Foreign issuers get exactly three years to comply or face complete exclusion from US markets.

With this, the US effectively legitimised digital dollars while systematically eliminating non-compliant players.

The legislation's genius lies in treating stablecoins like what they actually are — digital money — rather than exotic crypto assets. Monthly reserve disclosures, criminal penalties for false certifications, and Bank Secrecy Act compliance transform stablecoins from unregulated experiments into legitimate financial infrastructure.

Tighter Competition

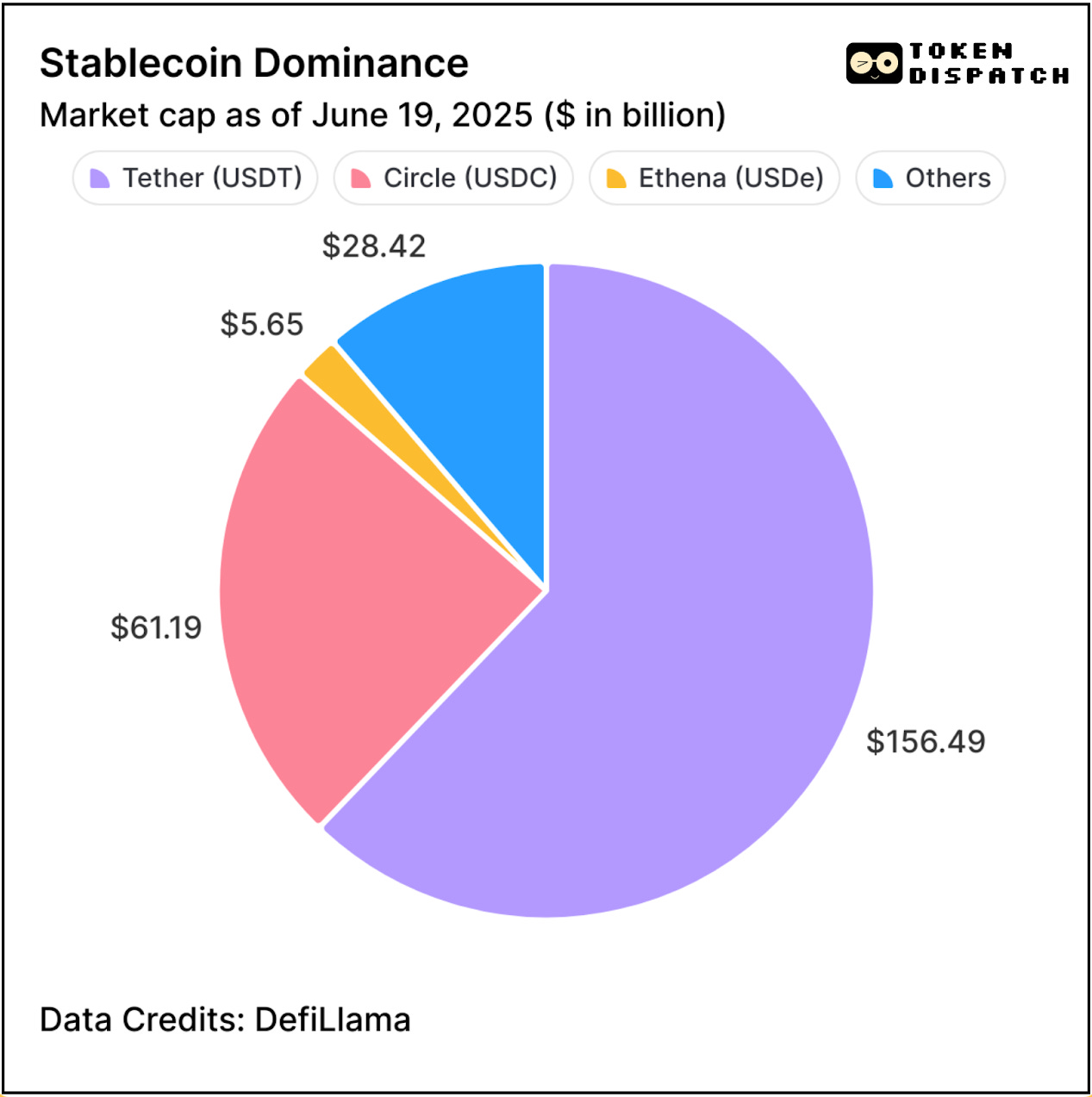

For Tether, the world's largest stablecoin issuer, GENIUS reads like an accurately worded ultimatum with a three-year countdown timer. The USDT issuer currently enjoys a 62% dominance in the stablecoin industry.

Yet, among all the stablecoin issuers, Tether’s got the most to lose. Perhaps a case of "The bigger they are, the harder they fall"?

Tether's current reserve composition falls short of the bill requirements. USDT reserves must be backed 1:1 with liquid assets. Currently, only 81.5% of Tether’s reserves are backed by Cash & Cash Equivalents & Other Short-Term Deposits, a disclosure on its website shows.

Tether's Italian auditor BDO doesn't meet the bill's requirement for US registered public accounting firms following Public Company Accounting Oversight Board (PCAOB) standards. Monthly certified reporting by CEOs and CFOs, with criminal penalties for false statements, would demand entirely new audit infrastructure.

CEO Paolo Ardoino has expressed willingness to create GENIUS-compliant offerings. The economics are punishing. Tether's business model partially relies on investing reserves in higher-yield assets, exactly what GENIUS prohibits in the name of safety.

The three-year grace period buys some time for Tether.

While individual Americans can continue holding USDT, institutional adoption becomes impossible. Your USDT holdings? They are safe, but expect fewer places to spend them over the next three years.

No bank will treat non-compliant stablecoins as cash equivalents. No payment processor will integrate them for merchant settlements. No treasury department will hold them as corporate reserves.

There’s Circle, the USDC issuer, closing in behind Tether. Circle’s stock has surged 35% following the Senate vote and peaked at $200, more than 5x from its issue price of $31. The company's US base, compliant reserve structure, and established banking relationships position it perfectly for the regulated stablecoin future.

Add to that the recent partnerships it’s closed: Shopify allowing its merchants to pay in USDC, and you begin to see the pace at which Circle’s been making its moves.

Read: Stablecoins Go Corporate? 🏢

Security Versus Innovation

GENIUS's most controversial provision, the complete ban on yield-bearing stablecoins, reflects Congress learning hard lessons from crypto's leverage-fuelled collapses.

The rationale is that payment instruments shouldn't double as investment vehicles. When stablecoins pay yield, they begin resembling bank deposits or securities, creating systemic risks the traditional banking system already manages through deposit insurance and capital requirements.

For decentralised finance (DeFi) protocols built around yield-generating stablecoins, this creates immediate disruption. The bill explicitly carves out "securities issued by investment companies" and "deposits," suggesting users seeking returns must migrate to tokenised bank deposits or regulated investment products.

There’s a counter-argument here.

While users bear the opportunity cost of holding non-yielding assets, stablecoin issuers capture the same income by parking the treasury in interest-earning instruments.

The trade-off brings institutional confidence that could dwarf lost DeFi yields. Monthly reserve transparency, mandatory AML compliance, and transaction monitoring transform stablecoins from crypto curiosities into legitimate financial rails.

Major banks can now treat compliant stablecoins as actual cash equivalents. Corporate treasuries can hold them without regulatory uncertainty. Payment processors can integrate them knowing they meet banking standards.

Mass Adoption Infrastructure

GENIUS builds the regulatory foundation for stablecoin integration into mainstream finance through two key pillars: custody protection and compliance clarity.

The custody framework protects consumers while enabling institutional adoption. Qualified custodians must segregate customer assets, prevent commingling with corporate funds, and maintain proper bankruptcy priority. These rules mirror established financial protections applied to digital assets.

For retail users, the bill preserves self-custody rights while mandating that service providers meet banking-grade standards. This places your stablecoin wallet protections at par with that of your bank account when using regulated services.

B2B applications unlock even greater potential. Cross-border settlements can clear in minutes rather than days. Supply chain payments can flow programmably without traditional correspondent banking. Treasury management can operate 24/7 without weekend delays.

For retail users, this means your freelance payments from overseas clients could arrive in minutes instead of days through traditional wire transfers and without hefty conversion fees.

The interoperability mandate, which requires regulators to assess compatibility standards, ensures stablecoins can work across different platforms and networks. This prevents the regulatory fragmentation that has hobbled previous financial innovations.

Implementation Challenges

Despite bipartisan Senate support, GENIUS faces hurdles that could determine its ultimate success or failure.

The compliance burden creates immediate winners and losers. Monthly audits by registered accounting firms, sophisticated reserve management, and continuous regulatory reporting favour large players dramatically. Smaller stablecoin issuers lack resources for banking-grade compliance infrastructure, and will likely see compliance costs shot up.

Cross-jurisdictional friction complicates global adoption.

Using a US-pegged stablecoin in a European jurisdiction could throw in “currency conversion” and “FX risk” concerns for some. German manufacturing giant Siemens prefers tokenised bank deposits for this precise reason, Heiko Nix, the company’s global head of cash management and payments, said in an interview with Bloomberg.

The yield ban could push innovation offshore if other jurisdictions permit interest-bearing stablecoins. While this preserves US financial stability, it risks ceding technological leadership to more permissive regulatory regimes. DeFi protocols built around yield-generating stablecoins face immediate disruption without clear migration paths to compliant alternatives.

State versus federal regulatory coordination adds another layer of complexity.

The bill allows stablecoin issuers under $10 billion in market cap to opt for state-level regulatory regime, provided they maintain "substantial similarity" to federal standards. The onus is on state regulators to submit a certificate satisfying their standards are of “substantial similarity” compared to federal standards. The Treasury Secretary can reject state certifications, potentially forcing unwilling issuers into federal oversight.

Token Dispatch View 🔍

Looking ahead, House passage seems likely given Republicans enjoy a 220-212 majority over the Democrats. Implementation will test whether America can balance innovation with stability, competition with consolidation.

The GENIUS Act could well be America's blueprint for monetary sovereignty in the digital age.

When the Nixon Shock in 1971 ended the gold standard era, it brought a lot of criticism with it. The decision broke a global promise which meant that foreign governments could no longer exchange US dollars for gold.

GENIUS could pave the way for the beginning of the regulated digital dollar era. The legislation allows the US to use stablecoins as tools of American financial influence.

Read: Beyond Stablecoins

Every compliant stablecoin must be backed by US dollars or Treasuries. Global stablecoin adoption becomes global demand for American monetary assets. The more the world uses digital dollars, the stronger America's monetary position becomes.

The bill's reciprocity provisions for "substantially similar" foreign regimes offer carrot-and-stick diplomacy. Comply with American standards, and your stablecoins can participate in the world's largest economy. Resist, and watch your digital currency lose access to American markets.

For crypto purists, GENIUS comes clad in an irony: a technology designed to escape centralised monetary control now voluntarily submitting to enhanced US oversight, transforming global stablecoin adoption into a tool of American financial dominance.

The larger finance industry might see it as an evolution. After spending years arguing that digital assets could improve traditional finance, this will come across as a breakthrough.

The market’s got no time to be bothered with these philosophical debates. By its reaction via Circle's stock surge, it has signalled what it cares about is regulatory clarity over regulatory chaos.

That's it for this week's deep-dive.

See ya next week.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Good article