Today’s edition is brought to you by Polymarket.

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it.

Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

Hello

On December 17, Coinbase launched what they’re calling the future of finance. One app to trade stocks 24/5, crypto on centralised exchanges (CEXs) and on-chain, futures and perpetual contracts, prediction markets where you can bet on elections or politics, all topped with an AI-powered finance analyst. All this is accessible from your phone, with one balance that rotates instantly between asset classes.

A week earlier, Robinhood was already there: tokenised equities in Europe, 24/5 futures trading, crypto that generates yield, and plans to launch Robinhood Social in 2026.

The narrative on X frames this as an evolution into an “everything app.” However, people are missing that this is more than just adding features. It collapses the artificial boundaries between financial asset classes that only existed due to regulatory and technical constraints.

In this analysis, I’ll show you why finance apps are rebundling after a decade of fragmentation, and what this means for users and platforms caught in the middle.

Now, onto the story,

Nishil

The Fragmentation Problem

For the past decade, we have seen fintech apps emerge that provide support for part of the financial stack. Separate apps for stock trading, crypto, payments, and savings.

It gave users choice and allowed individual companies to focus on one solution at a time. However, in practice, it created a mess.

You want to sell a stock and buy crypto? Your stock trade executes on Monday and settles on Tuesday due to the T+1 settlement window. Then you initiate a withdrawal, which takes 2-3 days to reflect in your bank. After that, you transfer it to Coinbase, which takes another 1-2 days. The total timeline from “I want to rotate capital” to “capital is deployed” is roughly five days. During those five days, the opportunity you saw probably moved, while your money crawled.

You wanted to buy BTC at $86,000 on December 18, but ended up buying it at $90,000 five days later. This situation worsens for more volatile opportunities such as memecoins, Initial Coin Offerings (ICOs), or Initial Public Offerings (IPOs).

And the fragmentation isn’t just local. An Indian interested in buying NVDA stocks goes through repetitive KYCs, creates an account with a broker that allows investment in U.S. stocks from India, and then deposits extra capital only to buy one stock.

We all felt this friction, but the infrastructure to fix it didn’t exist until recently.

What Changed: The Infrastructure

Three structural shifts made unified platforms possible:

Tokenisation removed time barriers. Traditional stocks trade during NYSE hours, 9:30 am and 4 pm Eastern Time, five days a week, while crypto trades 24/7. Tokenising equities on Layer-2s showed that proper mechanics can make equity theoretically tradeable round the clock.

Tokenised stocks on Robinhood in Europe now trade 24/5, and so will they do, now on Coinbase.

Regulatory clarity emerged. The last couple of years saw the launch of Spot Bitcoin ETFs, the legalisation of stablecoins and the deliberation of tokenisation frameworks. Prediction markets have also received CFTC approval. The regulatory environment hasn’t been perfect, but it has been clear enough to allow platforms to build multi-asset products without fear of being shut down altogether.

Mobile wallet infrastructure has matured. Embedded wallets can now handle cross-chain complexity invisibly. Privy, now acquired by Stripe, allows wallet creation through existing email addresses, and users never touch the seed phrase. Fomo, a recently launched crypto trading app, lets non-crypto users trade tokens from Ethereum, Solana, Base, and Arbitrum without ever selecting a network, and handles Apple Pay deposits. The backend handles the complexities. The user just clicks on “buy token,” and it works.

The Liquidity Consolidation Thesis

What’s driving the shift is that capital stranded across apps is capital wasted.

In the unified model, you hold one balance. You sell your stock position, and the funds are instantly available to buy crypto. No settlement windows, withdrawal waiting periods, or bank intermediaries. The opportunity cost of those five days disappears.

Platforms that consolidate liquidity win on efficiency. They can offer better execution because their liquidity pools are deeper. They can host more trading pairs because everything shares the same base liquidity. They can offer yield on stranded capital, as banks do. And they capture more fee flow because users trade more when friction disappears.

The Coinbase Playbook

Coinbase is the clearest example of this rebundling strategy. The company started as a simple crypto exchange in 2012. You could buy Bitcoin and Ethereum. That was it. Over the next few years, they added institutional custody, staking services, and “earn” products that let users lend crypto for yield. By 2021, they were a full-service crypto platform.

They’ve only expanded ever since: Coinbase Card for spending crypto, Coinbase Commerce for merchant payments, and Base as their own Layer 2 blockchain.

The December 17 launch marks the culmination of its vision to become an everything app. Coinbase now offers 24-hour stock trading, with eventual plans to announce Coinbase Tokenize for institutional real-world assets early next year, integrated prediction markets through Kalshi, allowed futures and perpetual futures trading, and integrated Solana DEX trading on their app. They expanded the Base App to 140 countries and doubled down on the app’s social trading experience.

This is Coinbase becoming the on-chain operating system for finance. One interface and one balance for all asset classes. The goal is that users never need to leave.

Robinhood has been following the same playbook. They started with commission-free stock trading, added crypto, a gold subscription with 3% cash back and 3.5% interest on deposits, futures, and then tokenized equities in Europe.

Both platforms are betting on the same thesis: users don’t want separate apps for stocks, crypto, and derivatives. They want one balance, one interface, and the ability to rotate capital instantly.

Social Trading: The Emerging Differentiator

While asset bundling solves the liquidity problem, it doesn’t solve asset discovery for users.

How do users find what to trade when there are millions of asset options to choose from? How do they curate their portfolios?

This is where social features shine. Coinbase’s Base App includes a feed where users see what others are buying. Robinhood is launching Robinhood Social in 2026. eToro has been doing this since 2007, paying copied traders 1.5% of the assets following them.

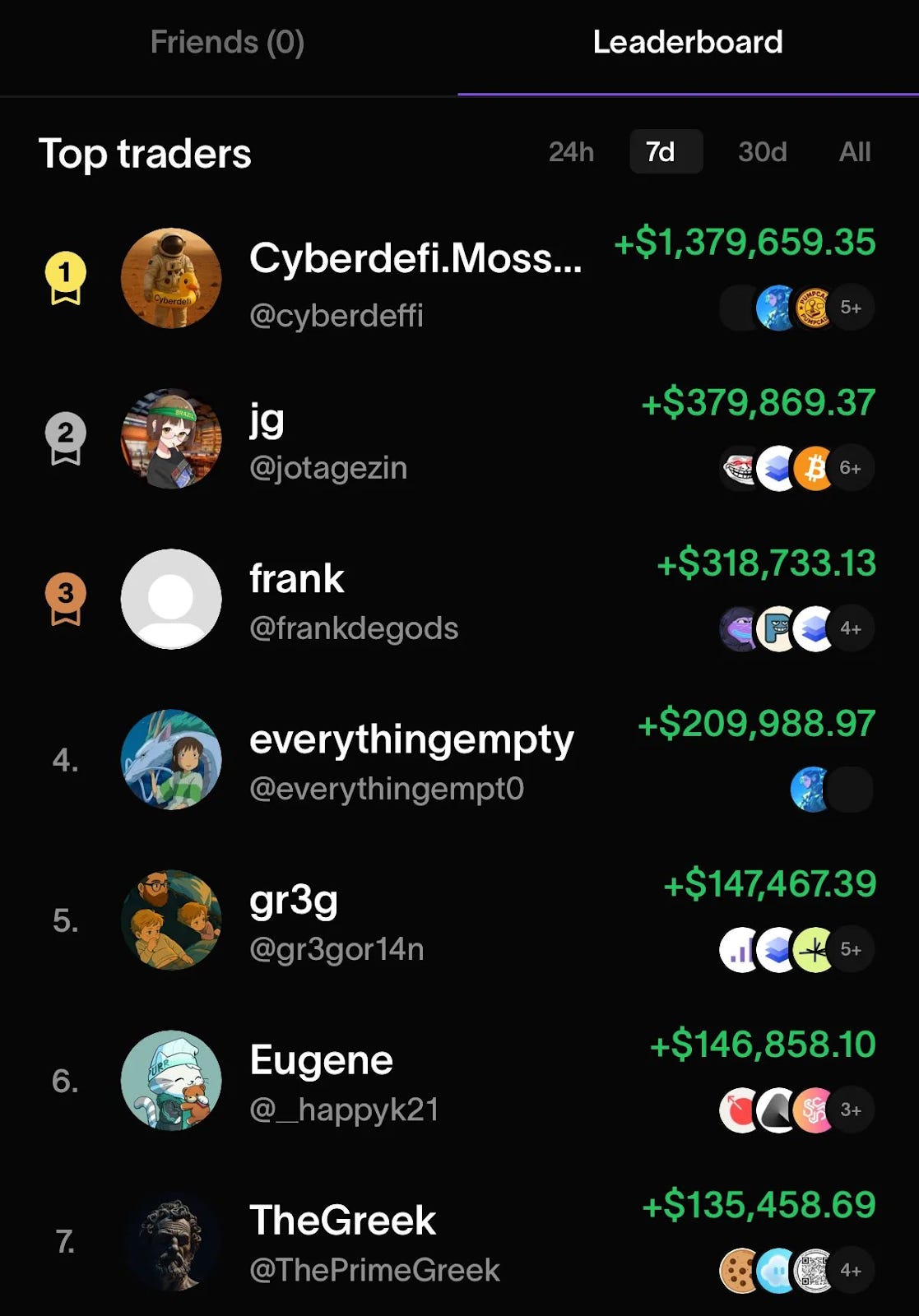

On-chain, we have Fomo, 0xPPL and Farcaster - some initial wave of crypto apps experimenting with Social Trading features. These apps allow users to look at what friends and people they admire have been investing in, follow them, and follow their trades.

Social trading is when users can see other people’s trades in real time and copy them with one tap. It collapses the decision friction: instead of researching independently, you follow traders whose strategies you trust. Once a community forms around a platform - users following traders, building reputations - they don’t migrate easily. This builds defensibility and stickiness into the trading app.

Copy trading on centralised exchanges has existed since 2022, but it remains under 2% adoption. Mobile apps are betting that better UX changes that. Whether they’re right will determine if social becomes a real differentiator or just another feature.

The Pessimistic Case

Let’s be honest about what’s happening. Crypto was supposed to decentralize finance. Remove intermediaries. Give users control.

And now we’re rebuilding centralized platforms. Coinbase controls custody, execution, and the social graph. Robinhood holds the private keys for embedded wallets. Users are trusting platforms to remain solvent, secure, and operational. There is counterparty risk underneath all this.

Robinhood’s tokenised stocks are derivatives tracking the price, not actual shares. If the platform fails, you hold IOUs.

The gamification problem intensifies, too. 24/7 markets mean you can trade at 3 am when you’re emotional. Social feeds make you feel FOMO when you see everyone else making money. Push notifications alert you to every market move. It’s casino psychology at scale, optimised by designers who know exactly how to trigger dopamine responses.

Whether this is democratisation or just a prettier version of the same extractive system is a philosophical question.

What This Actually Reveals

We spent a decade unbundling finance. The assumption was that fragmentation created competition and choice.

But that fragmentation created inefficiency. Capital got stranded, liquidity was split apart, and users kept more money idle than they needed because moving it was painful. The new era is changing that, and it will be interesting to see how that plays out.

Coinbase and Robinhood are becoming the new banks. They see your paycheck, your savings, your investments, your spending patterns. They control execution, custody, and access. They mediate every transaction. The only differences are: the interface is prettier, the markets are 24/7, and they pay 50 basis points more on your deposits.

Either we’re democratising finance by making it accessible, instant, and frictionless. Or we’re just changing who gets to be the gatekeeper while keeping the gate.

Either way, the fragmentation era is over. We’ll spend the next few years discovering whether rebundling on open rails creates better outcomes than the bundled banks we tried to escape, or if we’ve just changed the logo on the lock-in.

That’s it for this week’s analysis. I’ll see you next week.

Until then, stay sharp,

Nishil

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.