There’s a principle in behavioral economics about mental accounting. People treat money differently depending on where it sits. A hundred dollars in your checking account feels spendable. The same hundred dollars in a retirement account feels untouchable. Though the money is fungible, the context shapes how you think about it.

Sam Kazemian from Frax calls this the “net worth theory.” People prefer to keep their spending money where most of their wealth already lives. If your net worth sits in a Charles Schwab account with stocks and bonds, you keep dollars in a linked bank account because moving money between them is friction-free. If your net worth sits on-chain in Ethereum wallets and DeFi positions, you want dollars that can interact with that world just as easily.

For the first time, a meaningful number of people have most of their wealth stored on-chain. And they’re tired of constantly bridging back to traditional banks just to buy coffee.

Crypto neobanks are solving this by building infrastructure that consolidates everything into one place. With these platforms, you can save in yield-bearing stablecoins, spend with a Visa card, and never touch a traditional bank account.

The rapid growth of these platforms is a market response to the fact that crypto finally has enough real users with enough real money on-chain to make this worth building.

Stable: The Stablecoin Chain for the Real World

If you’re done juggling volatile tokens just to move value, Stable is your platform.

Pay fees in USDT – no extra tokens, no surprises.

Free peer-to-peer transfers, sub-second finality.

Native USDT settlement + enterprise-grade throughput (10,000+ TPS on roadmap).

EVM compatible so developers already familiar with Ethereum tooling can build faster.

Whether you’re a dev, business, or crypto user, Stable gives you rails that actually feel like digital dollars, not blocked rails.

For over a decade, crypto has promised to cut out intermediaries, reduce fees, give users more control. But there was always one problem: merchants didn’t accept crypto, and convincing them all to start simultaneously is impossible.

You can’t pay rent in USDC. Your employer won’t pay you in ETH. The grocery store doesn’t take stablecoins. Even if you hold all your wealth in crypto, you still need traditional bank accounts to function. Every conversion between crypto and fiat means fees, settlement delays, and friction.

This is why most crypto payments projects failed. BitPay tried to get merchants to accept Bitcoin directly. Lightning Network built peer-to-peer infrastructure but struggled with liquidity management and routing reliability. Neither achieved meaningful adoption because the switching costs were too high. Merchants needed certainty that customers would use the payment method. Customers needed certainty that merchants would accept it. Nobody wanted to move first.Neither achieved meaningful adoption because the switching costs were too high. Merchants needed certainty that customers would use the payment method. Customers needed certainty that merchants would accept it. Nobody wanted to move first.

Crypto neobanks make the coordination problem invisible. You spend stablecoins from your self-custody wallet. The neobank converts them to dollars and settles with the merchant through Visa or Mastercard. The coffee shop gets dollars in their bank account like always. They don’t know crypto was involved.

You don’t need to convince every merchant to accept crypto. You just need to abstract the conversion layer so users can spend crypto at any merchant that accepts normal debit cards, which is basically everywhere.

Three pieces of infrastructure matured simultaneously, making this possible now after years of failed attempts.

First, stablecoins became legitimate. The GENIUS Act, passed in July 2025, provided explicit legal frameworks for stablecoin issuance. Secretary Scott Bessent projects $3 trillion in payment stablecoin volume by 2030. That’s the U.S. Treasury Department saying stablecoins are now part of the financial system.

Second, card infrastructure commoditised. Companies like Bridge offer white-label APIs that let teams launch full neobank products in weeks. Stripe acquired Bridge for $1.1 billion. Teams no longer need to negotiate directly with card networks or build banking partnerships from scratch.

Third, people actually have wealth on-chain now. Earlier attempts at crypto payments failed because users didn’t hold significant net worth in crypto. Most savings sat in traditional brokerage accounts and 401ks. Crypto was speculation, not where you stored life savings.

That’s no longer true. Younger users and crypto-native people now hold meaningful wealth in Ethereum wallets, staking positions, and DeFi protocols. The mental accounting flipped. It’s easier to keep money on-chain and spend directly from there than to convert it back into bank deposits.

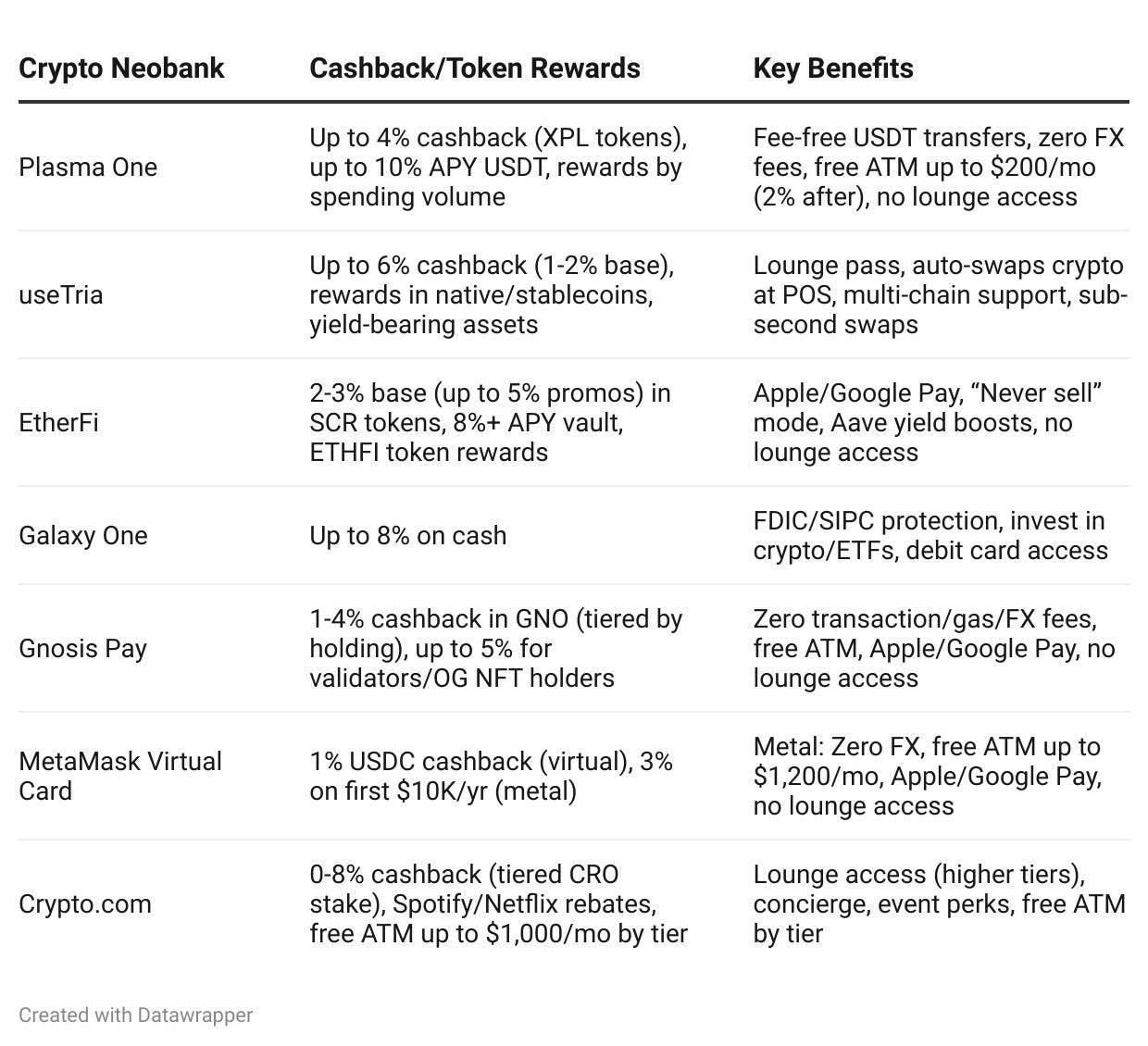

The Products and What They Offer

The differentiation among crypto neobanks comes down to yields, cashback rates, and regional focus. But they all solve the same core problem: letting people spend crypto holdings without forcing them to give up self-custody or constantly convert to bank deposits.

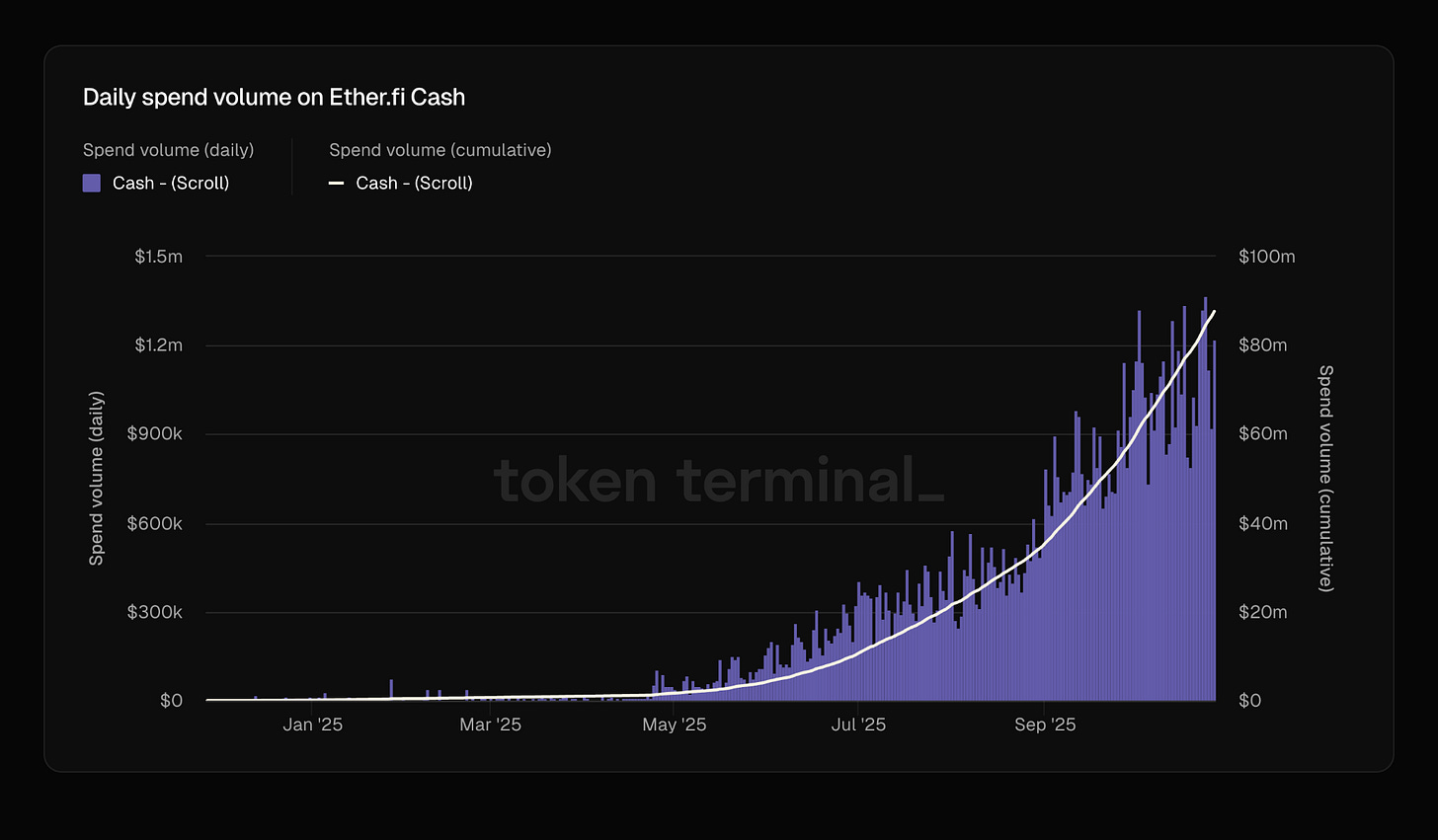

EtherFi processes over $1 million in daily card spending, with that volume doubling in the past two months. Similarly, Monerium’s EURe stablecoin has experienced significant growth in both issuance and burn rates.

This distinction matters because it shows that these platforms are facilitating real economic activity, not just crypto-to-crypto speculation. The money is leaving the crypto ecosystem and entering the broader economy.

That’s the bridge that was always missing.

The competitive landscape has exploded in the past year. Plasma One launched as the first stablecoin-native neobank, focusing on emerging markets with restricted access to dollars. Tria, built on Arbitrum, offers self-custodial wallets and gasless transactions. EtherFi has evolved from a liquid restaking protocol to a full neobank with $11 billion in TVL. UR by Mantle is targeting Asia with a Swiss regulation and compliance-first positioning.

Each platform takes a different approach, but they all solve the same problem: how do you let people spend their crypto without forcing them to constantly bridge to traditional banks?

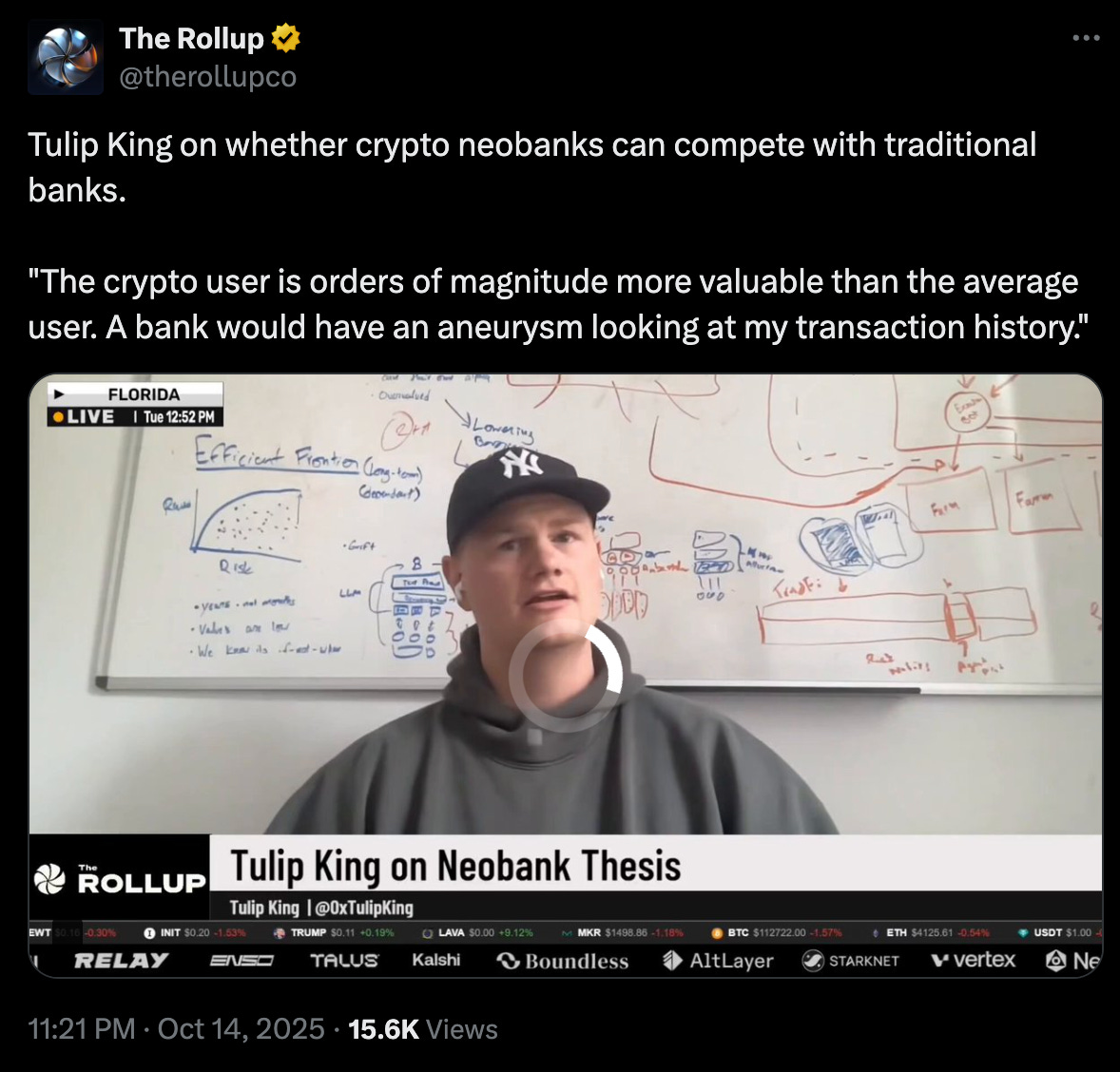

There’s another reason why crypto neobanks can compete despite their small scale: the users are fundamentally more valuable. The average American has around $8,000 in their checking account. Crypto-native users routinely move six and seven figures between protocols, chains, and platforms. They generate transaction volume that would take hundreds of traditional banking customers to match. This changes the unit economics completely. A crypto neobank doesn’t need millions of users to be profitable. It needs thousands of the right users. Traditional banks optimised for scale because each customer generates modest revenue. Crypto neobanks can build sustainable businesses with smaller user bases because each customer is worth 10x to 100x more in transaction fees, interchange revenue, and assets under management. The math just works differently when your average user isn’t depositing a $2,000 paycheck twice a month.

Every crypto neobank has independently arrived at the same architecture: separate spending and savings balances. Payment stablecoins like Frax’s FRAUSD optimise for universal acceptance with low-risk treasury backing that makes merchant integration straightforward. Yield-bearing stablecoins like Ethena’s sUSDe optimise for returns through sophisticated carry trades and DeFi strategies that generate 4-12% APY but require complexity merchants don’t want to evaluate. A few years ago, DeFi tried collapsing these categories, pushing everything to be yield-bearing by default, but discovered that combining the functions creates more friction than it solves. Traditional banks separated checking and savings for regulatory requirements. Crypto is rediscovering the same separation from first principles because you need a payment layer that maximises acceptance and a savings layer that maximises returns. Trying to optimise for both simultaneously compromises both.

Crypto neobanks can offer yields that traditional banks can’t match. They’re tapping into the same treasury bill returns that back the stablecoins, just routing the payments through an extra step to stay compliant. Traditional banks can’t compete on interest rates because their cost structures are fundamentally higher. Physical branches, legacy systems, compliance overhead. Neobanks cut all of that and pass the savings on to users.

Crypto has tried to build payment systems many times. What makes it different this time?

This time feels different because all three necessary conditions finally exist simultaneously. The regulatory framework is clear enough that banks are willing to engage. The infrastructure is mature enough that teams can ship products quickly. And most importantly, there are enough users with enough wealth on-chain to make the market viable.

The mental accounting has shifted. People used to keep wealth in traditional accounts and speculate with crypto. Now people keep wealth in crypto and only convert to fiat when they need to spend. The neobanks are building infrastructure to match where user behaviour has already moved.

Money has always been a story we tell ourselves about value. For centuries, that story required intermediaries to verify the telling - banks to hold the ledger, governments to back the currency, card networks to route transactions. Crypto promised to rewrite the story without intermediaries, but it turned out we still needed someone to translate between the old narrative and the new one. The neobanks could be that translator. What’s fascinating is that in building the bridge between two monetary systems, they’re not creating something entirely novel. They’re rediscovering patterns that emerged a century ago because those patterns reflect something fundamental about how humans relate to money. The technology changes, but the stories we tell ourselves about what money is and where it should live remain surprisingly constant. Maybe that’s the real lesson: we thought we were disrupting finance, but we were simply moving wealth to match where the story was already being told.

That’s all for today. See you soon with another one.

Until then … DYOR,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Really enjoyed your analysis of crypto neobanks. From my perspective, the shift of wealth on-chain and the rise of stablecoin payment rails show that user behaviour is finally driving product adoption, not speculation alone. Curious what you think about how traditional banks might respond if this trend continues and starts capturing significant consumer transaction volume?

Very detailed analysis into the great shift in financial stage.