Hello!

Pump.fun is pumping up the creator economy with its most recent roll-out.

Check out our Wednesday edition to know more.

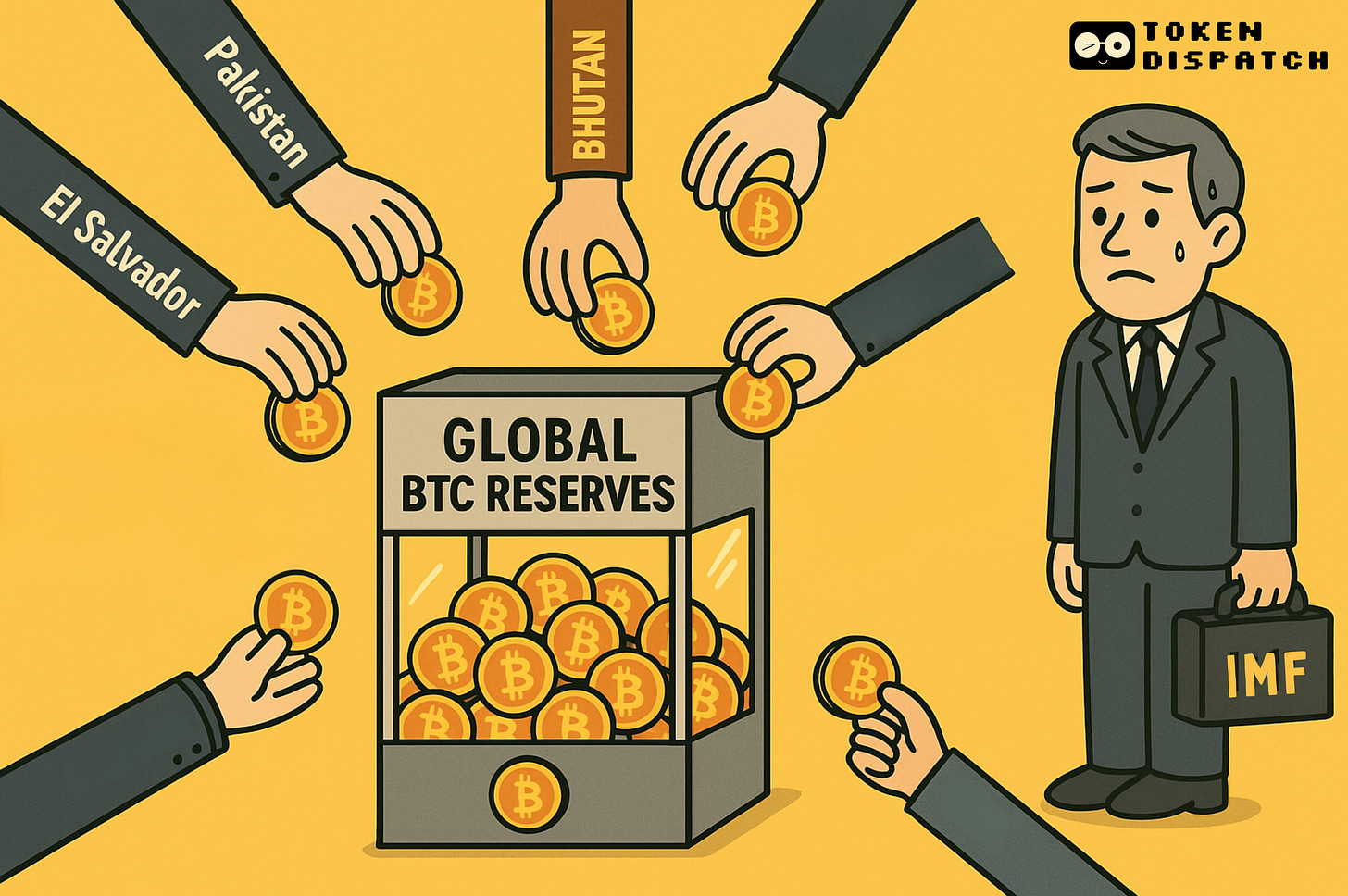

The International Monetary Fund (IMF) spent decades teaching nations to manage reserves prudently. Now those same nations are betting their treasuries on magic internet money – and the IMF is having a meltdown.

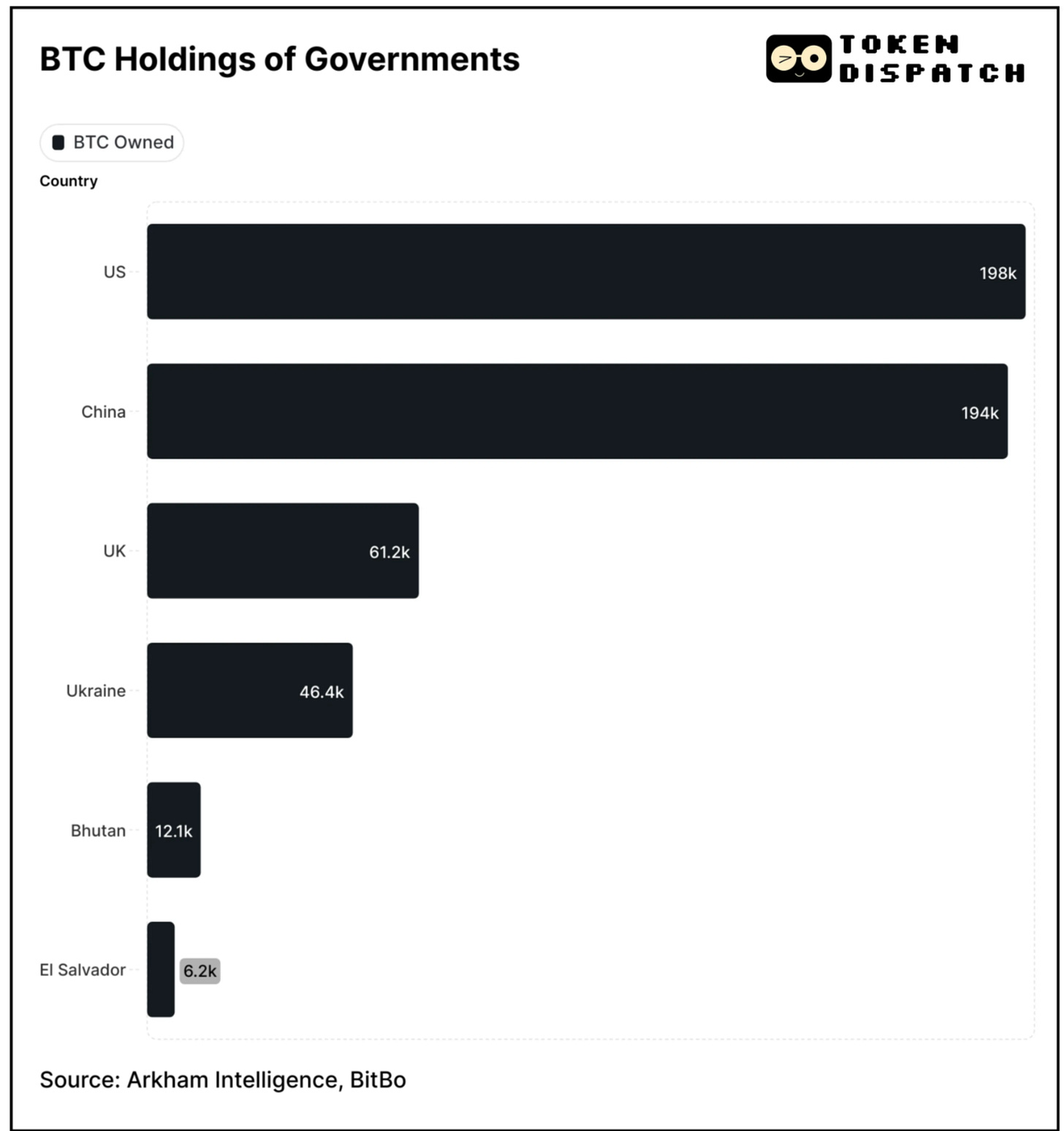

Last week, Pakistan's crypto minister met with US President Donald Trump's digital asset team at the White House to discuss their freshly announced Bitcoin reserve. They join El Salvador, which continues buying despite IMF warnings. Bhutan, a tiny Buddhist nation in the Himalayas, has also amassed over $1.2 billion worth. The US holds more than $21 billion worth of seized BTC.

This isn't a fringe movement anymore.

From zero sovereign Bitcoin holdings in 2020 to tens of billions of dollars worth today.

The movement has led to palpable tension as traditional finance guardians like the IMF scramble to maintain control while countries explore monetary independence through decentralised assets.

As countries race to stack sats, we're witnessing an interesting irony. Nations are using a trustless, borderless currency to escape the very institutions that were supposed to ensure global financial stability. All this while the IMF keeps having its reservations.

For the first time since 1944, countries have found a reserve asset that exists entirely outside the traditional monetary system. No central bank controls it. No international body governs it.

Got questions about a hot crypto topic? Reply to this email to send us your question for a chance to be featured with your name in next week's edition.

Q1: Why are nation states rushing to stack Bitcoin?

Three words: survival, sovereignty and energy.

For inflation-ravaged economies, Bitcoin comes across as a saviour.

It isn’t pegged to the dollar, tied to local economies, or subject to foreign sanctions. It’s a neutral, borderless asset — immune to currency collapse and geopolitical freeze.

Argentina until December last year saw triple-digit inflation. Pakistan's rupee lost ~50% in four years.

When the macro-economic variables are this unstable, Bitcoin's 30-day volatility — which has come down from 5% to 1.39% against US dollar — seems modest and stable.

The sovereignty play runs deeper. El Salvador’s move to make Bitcoin legal tender was about holding an asset that no foreign power could freeze.

Pakistan's 2,000 MW Bitcoin mining allocation transforms surplus electricity into hard money. Bhutan turned excess hydropower into a $1 billion treasury.

Read: Thunder Dragon's $1B Bitcoin Stack 🇧🇹

In digital age, this helps convert trapped energy into portable wealth.

Q2: Why is the IMF trying to stop the Bitcoin treasury trend?

The IMF's opposition is existential. Bitcoin undermines their core power: conditional lending, financial surveillance, and monetary control.

When El Salvador signed a $1.4 billion IMF loan in March, the deal required the “fiscal sector” to stop accumulating Bitcoin. The response? Pure bureaucratic genius. While the "fiscal sector" stopped buying, El Salvador's Bitcoin Office – conveniently outside that definition – kept stacking BTC.

The IMF’s meek response - "efforts will continue" to halt purchases.

Pakistan pulled the same move. While negotiating IMF loans, they simultaneously announced a Bitcoin reserve with Trump's crypto team. The timing wasn't subtle.

The pattern is global. Central African Republic scaled back Bitcoin laws under pressure but kept voluntary adoption.

Why can't the IMF enforce its will? Because desperation cuts both ways.

Countries like Argentina, Sri Lanka, and Pakistan have repeatedly turned to the IMF during debt crises — and the Fund steps in with bailouts, restructuring plans, and conditional loans.

But these lifelines come with strings attached: austerity measures, currency controls, and strict capital guidelines.

So when a country like El Salvador or Pakistan signals a pivot to Bitcoin — an asset that weakens IMF oversight — it threatens the playbook. Too many defections, and the IMF risks losing leverage, legitimacy, and its role as the gatekeeper of financial stability.

Q3: What happens when Bitcoin bets fail in fragile economies?

The math behind the Bitcoin bet could terrify any central banker.

Pakistan carries $131 billion in external debt while proposing to bet on an asset whose daily volatility is still high although on a downtrend in the past decade.

Credit rating agencies aren't amused. When El Salvador adopted Bitcoin, Fitch promptly downgraded its bonds, citing crypto exposure. For countries already dancing on the edge of default, these downgrades mean higher borrowing costs – a vicious cycle.

The volatility isn't theoretical.

When Bitcoin crashed from $69,000 to $15,000 in 2022, El Salvador's holdings lost 70% of their value. For a country with 85% debt-to-GDP ratio, such swings can push finances from precarious to catastrophic.

Then there's the custody nightmare.

One compromised private key, one insider threat, one hardware failure – and millions in national assets vanish forever. No Federal Reserve to call, no reversal mechanism, no insurance.

This vulnerability isn't just theoretical.

Between 2017 and 2025, North Korean hackers, notably the Lazarus Group, have stolen more than $5 billion in cryptocurrency through ~60 cyberattacks, according to a United Nations report. This includes $1.4-billion Bybit exploit - the largest crypto heist ever - that the group pulled off in February this year.

These illicit gains have been reportedly used to fund the country's nuclear weapons development, circumventing international sanctions.

Pakistan's energy gambit adds another layer of risk. Allocating 2,000 MW to Bitcoin mining in a country facing chronic power shortages seems optimistic at best.

The IMF has already demanded "urgent clarification" on how mining squares with Pakistan's energy crisis.

What happens when citizens face blackouts while Bitcoin miners hum along? It exposes the state’s misplaced priorities.

The question that looms is: where should national resources be directed? Investments in education and healthcare have demonstrable, long-term benefits. For instance, a World Bank document shows that each additional year of schooling can increase earnings by about 10%.

Pakistan spent 1.87% of GDP on education in 2023, second-lowest in the preceding decade. Redirecting funds towards these areas could offer more substantial and equitable benefits for the population.

Critics aren't pulling punches

"For a developing economy like Pakistan, where reserves can spell the difference between solvency and crisis, embracing such volatility isn't bold policy; it's reckless," Yousuf Nazar wrote in an opinion piece.

The counterargument from Bitcoin bulls – that long-term appreciation outweighs short-term volatility – requires a luxury these countries don't have: time. When your IMF loan comes due and Bitcoin is down 50%, philosophy won't pay the bills.

That's it for this week's News Rollups.

See ya, next Thursday.

Until then … stay curious,

Prathik

Don't forget to whitelist thetokendispatch+news-rollups@substack.com to ensure you’ve got me each week in your primary inbox.

Get 17% discount on our annual plans and access our weekly premium feature and subscribers only posts.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.