Happy Thursday, Dispatchers! Welcome to this week's News Rollups.

It was just another week at work for the Trump and Co. First slammed the reports claiming Trump Media was raising funds to buy Bitcoin, only to go back on its statement by … err .. actually announcing the fund raise to stack the sats.

In today's News Rollups edition, we answer:

How Trump Media went from insulting journos to confirming a Bitcoin fund

Why Sui validators are voting to forcibly override hacker wallets

How Coinbase shareholders are suing over "artificially inflated" stock prices

What happens once all 100% BTC is mined

Got questions about a hot crypto topic that you want help understanding? Ask your question using the form and our crypto experts may answer it along with a shoutout to your name in our weekly News Rollups.

Secure your Bitcoin with Hardware Wallets

Trezor has transformed crypto security from a complex puzzle to a user-friendly playground, so you can be the boss of your financial future.

Securely store, manage, and protect your coins with Trezor hardware wallets, app & backup solutions.

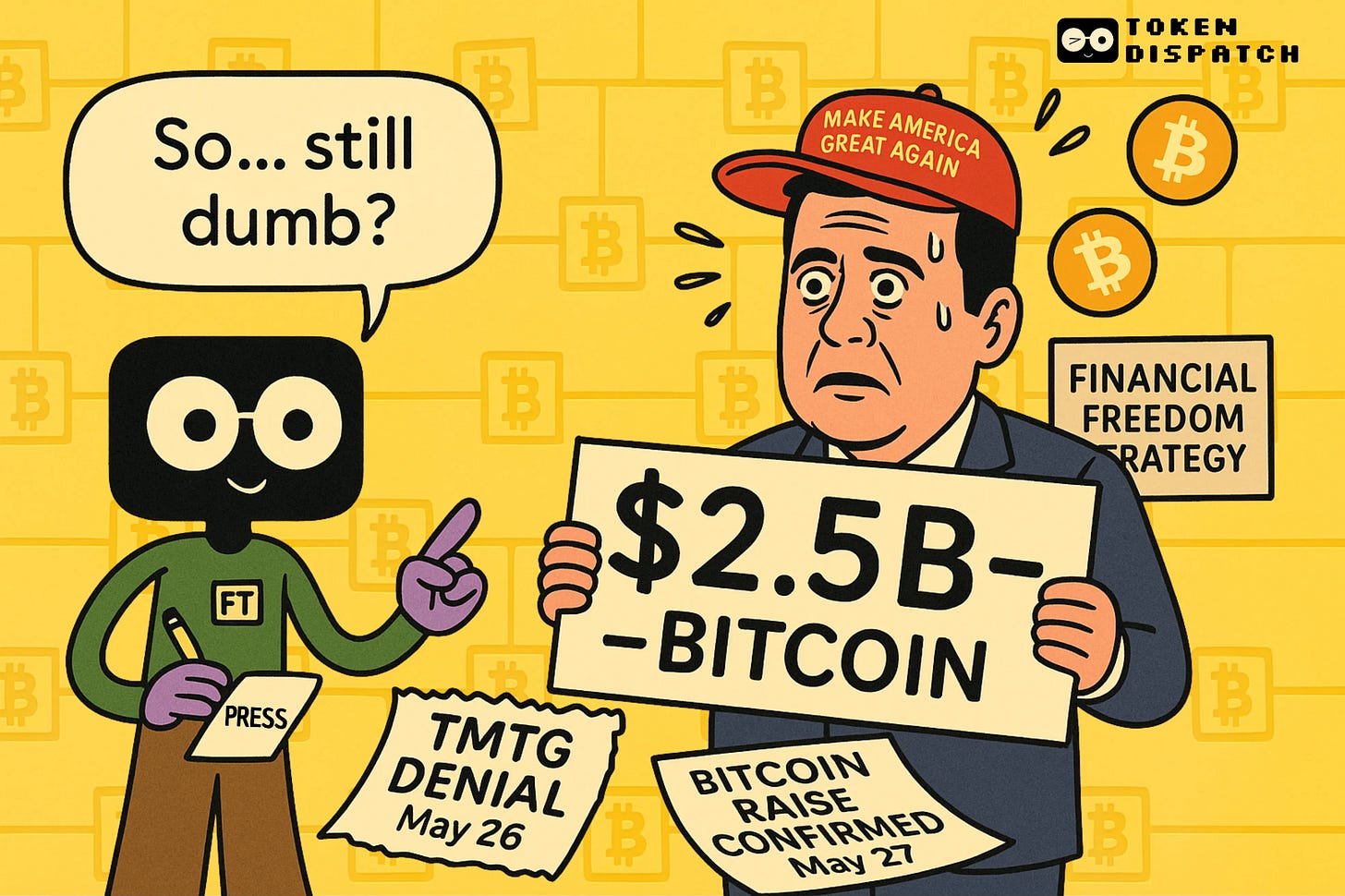

Q: How did Trump Media go from "dumb writers" to "yes, we're buying Bitcoin"?

In a corporate messaging whiplash, Trump Media and Technology Group (TMTG) — a firm US President Donald Trump has a majority ownership in — went from calling Financial Times reporters "dumb writers listening to even dumber sources" to confirming a $2.5 billion Bitcoin capital raise within 24 hours.

Here's how the drama unfolded:

May 26: FT reports TMTG’s plans to raise $3 billion to buy Bitcoin, citing six sources

TMTG's response to FT: "…apparently the Financial Times has dumb writers listening to even dumber sources"

May 27: TMTG announces $2.5 billion capital raise for Bitcoin purchases

The confirmed deal comprises $1.5 billion in stock sales and $1 billion in convertible bonds (with a 0% coupon rate).

CEO Devin Nunes positioned it as financial freedom strategy, saying Bitcoin would help "defend our Company against harassment and discrimination by financial institutions."

Why the initial denial? TMTG likely wanted to control the narrative timing. The original FT report suggested the announcement would come at Bitcoin 2025 in Las Vegas, but the company may have preferred managing the news cycle on their own terms.

Market reaction? Not great. TMTG shares fell over ~20% following the announcement.

Why? Perhaps the investors were spooked by the dilution from new share issuance, despite the Bitcoin treasury strategy that's worked well for companies like Strategy.

Also, this comes right after a persistent wing of Democrats questioned Trump’s unending love-affair with crypto and resulting conflicts of interest.

The irony? The "dumb writers" turned out to be pretty accurate – they just had their numbers slightly off — by $500 million.

Q: Is Sui actually voting to steal back stolen crypto?

That's exactly what they're trying to do – and it's working so far.

After freezing $162 million of the hacker's funds following the $223 million Cetus exploit, Sui network’s major participants — validators and SUI stakers — are now voting on a protocol upgrade. The vote comes after crypto community accused the 114 Sui validators of taking a unanimous and centralised decision to freeze funds.

Read: SUI Dilemma: Decentralised vs Safety?

The vote, if passed, would forcibly override the attacker's wallet control and transfer the frozen funds to a multisig controlled by Cetus, OtterSec, and the Sui Foundation.

The voting mechanics

Requires 50%+ participation and majority approval

Currently at 83.6% "yes" votes with 14.5% yet to vote

Can close early if the result becomes mathematically decisive after 48 hours

Vote officially ends June 3

The bailout package: Sui Foundation is providing an emergency loan to Cetus while separately committing $10 million for ecosystem-wide security upgrades (enhanced audits, bigger bug bounties, formal verification tools).

It's reactive damage control disguised as proactive planning – fixing the barn door after the horse bolted, then buying a better lock for next time.

The math: Cetus claims 100% user recovery by combining frozen funds + treasury + Sui Foundation emergency loan. Insurance that actually pays out – rare in crypto.

The debate: 114 validators overriding wallet control equals a neighbourhood watch with nuclear weapons, and not decentralisation.

The precedent: Ethereum faced this with the DAO hack in 2016, forked the chain, and the community still argues about it.

The irony: Same team that negotiated with hackers at Crema Finance ($9M loss) now says "we're taking it back" for a 25x bigger hack.

Bottom line: Vote passes = "code is law" has exceptions. Vote fails = Sui joins the "sorry for your loss" club. Either way, the pragmatism vs purity battle will give us a winner and set a precedent.

Get 17% discount on our annual plans and access our weekly premium features (Mempool, Game On, News Rollups, HashedIn, Wormhole and Rabbit hole) and subscribers only posts. Also, show us some love on Twitter and Telegram.

Q: Why are Coinbase shareholders suing over a data breach that didn't steal crypto?

Because the stock tanked when the truth came out.

Investor Brady Nessler filed a class-action lawsuit claiming Coinbase's delayed disclosure of the December 2024 data breach caused "significant losses" when shares dropped 7.2% on May 15. The suit argues Coinbase sat on material information for months while investors bought shares at "artificially inflated prices."

The timing makes it worse.

Coinbase just joined the S&P 500 and closed a $2.9 billion Deribit acquisition while knowing about security failures that would cost $180-400 million in remediation.

Now they're facing multiple class-action suits with CEO Brian Armstrong and CFO Alesia Haas named as defendants. The message from investors: when you're playing in the big leagues, sitting on bad news while your stock trades higher isn't poor judgment – it's potentially securities fraud.

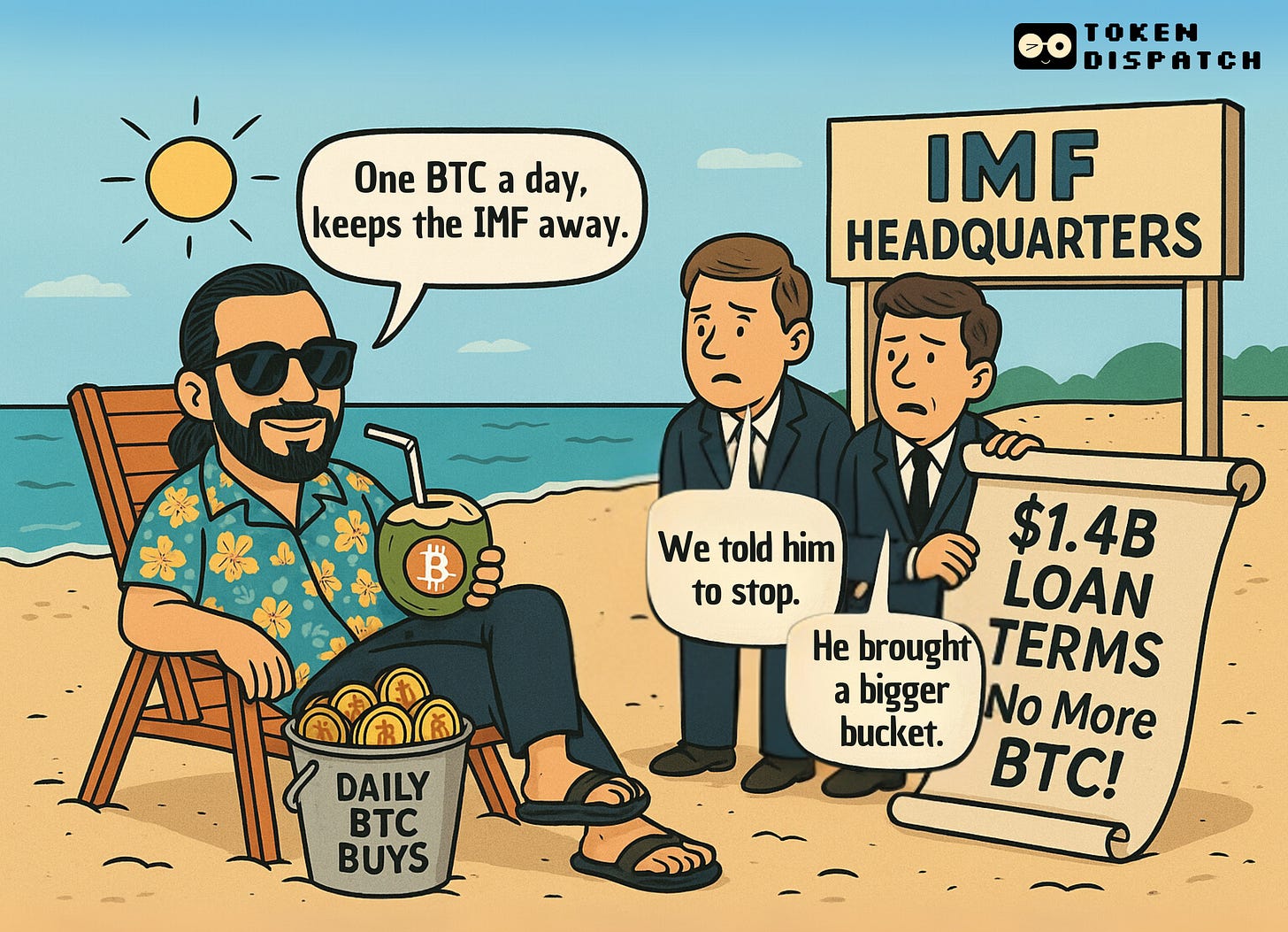

The Crypto Comic 🎭

The IMF said it will "efforts will continue to ensure that the total amount of Bitcoin held across all government-owned wallets remains unchanged" as part of a $1.4B loan deal. Hours later, the country bought more BTC. Again.

Dispatch Decoder 👨🏽🏫

93% of BTC is mined. What happens after 100%?

Bitcoin's supply mechanics create a fascinating scarcity dynamic that most people miss. With 19.6 million of the 21 million (93%) total BTC already mined, we're witnessing the effects of an exponential issuance schedule that front-loaded most coins into the early years.

The halving schedule is the key driver.

Starting at 50 BTC per block in 2009, rewards have halved every four years to now reach 3.125 BTC per block. The remaining 6.7% will trickle out until 2140, creating an asymptotic supply curve that approaches but never quite reaches 21 million.

What happens once we hit 100% mining?

There’s a wild card here: the lost Bitcoin — which makes the effective circulating supply much lower than what’s on paper. Conservative estimates suggest about 3 million BTC (~15% of total) is permanently lost through forgotten keys, destroyed wallets, and dormant addresses like Satoshi's 1.1 million coins.

Unlike gold, which can be recycled indefinitely, lost Bitcoin makes what’s scarce scarcer. This gives us a supply that shrinks over time rather than just stopping growth.

When block rewards eventually approach zero, Bitcoin's difficulty adjustment mechanism ensures network security doesn't collapse. If mining becomes unprofitable, hashrate drops, difficulty adjusts downward, and margins restore themselves.

This self-correcting feedback loop was stress-tested during China's 2021 mining ban when hashrate dropped 50% yet the network continued functioning seamlessly.

Under the Radar 🔎

Circle's IPO gets BlackRock backing

USDC issuer Circle is targeting a $5.4 billion valuation in its NYSE debut, as per its amended SEC filing, with BlackRock reportedly planning to buy 10% of the IPO shares. The USDC issuer aims to raise $600 million at $24-26 per share, with ARK Investment also indicating interest in $150 million worth of shares.

Existing shareholders are selling more stock (14.4 million shares) than Circle itself (9.6 million) – unusual for tech IPOs but common when insiders want liquidity.

The timing is strategic.

Circle rejected acquisition bids from Coinbase and Ripple "for at least $5 billion" earlier this month, choosing to go public instead.

Read: Coinbase v Ripple: The Battle for Circle🥊

Meanwhile, JPMorgan, Bank of America, Citigroup, and Wells Fargo are plotting their own joint stablecoin venture through co-owned payment companies, eyeing Circle and Tether's $245 billion market.

The irony: BlackRock already manages Circle's reserve fund and built integrations with USDC, while simultaneously the traditional banking giants that once dismissed crypto are now scrambling to compete with the very companies they ignored. Circle's public listing could be the last hurrah before TradFi brings trillion-dollar balance sheets into the stablecoin wars.

That's it for this week's News Rollups.

See ya, next Thursday.

Until then … stay curious.

Don't forget to whitelist thetokendispatch+news-rollups@substack.com to ensure you’ve got me each week in your primary inbox.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.