Vitalik Didn’t Blink 👾

A look at L2 concentration, liquidity, and what Vitalik is really saying.

Vitalik has always been a man of ethics. I don’t recall a time when he wasn’t.

There are countless reasons why he is my favourite person in the crypto space, but for a moment, let me keep sentiment out of this for a second. Strip away the admiration, the years of following his work, and the fact that he built the system I’ve spent nearly half a decade thinking about. Forget all of that.

He’s just been right. I said this yesterday and will say it again tomorrow.

Read: Vitalik Buterin: Ethereum’s Quiet Revolutionary 🧠

He was right in 2017 when he wrote “The Meaning of Decentralisation” and outlined the three key axes — architectural, political, and logical — that still define how we view blockchains today.

He was right in 2024 when he published “against choosing your political allegiances based on who is ‘pro-crypto’”

He was right to challenge the notion of ETH being just “ultrasound money” and to argue that we care more about Ethereum as a useful infrastructure than as a speculative trade. He was right when he refused to reduce decentralisation to a mere marketing term, insisting that it holds real significance.

And he is right now when he says the rollup-centric roadmap no longer makes sense.

He’s also right about AI and Ethereum, which we’ll get to, but that’s the part almost no one is paying attention to yet (though they might have to later).

I’m not a Vitalik maximalist (okay, maybe I am). But I have disagreed with him on execution, on timing, and whether Ethereum should have moved faster, or slower in various areas.. However, I trust his compass. I trust that when he says something publicly, it’s because he believes it to be true, not because it’s politically convenient or beneficial for the token price, or pleasing to his allies.

He doesn’t preach. He course-corrects and right now, Ethereum needs a course correction.

Let’s start with what changed.

Ethereum L1 is now doing what L2s were supposed to do.

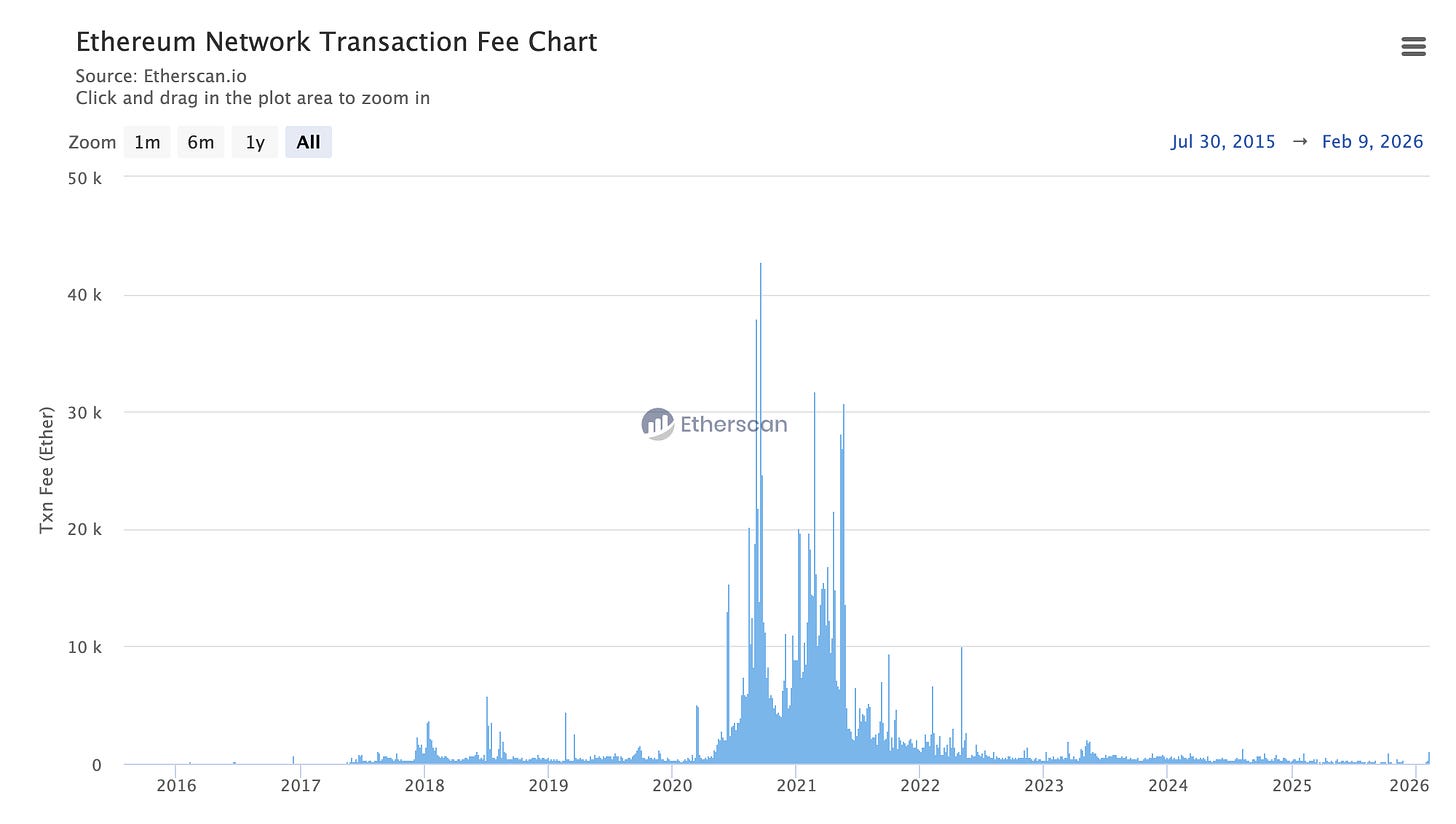

The rollup-centric roadmap emerged from a problem: Ethereum L1 couldn’t scale. Gas fees were spiking to $50, $100, and sometimes $200 per transaction during peak periods. The network was slow, expensive, and if Ethereum was to be the base layer for the crypto economy, something had to give.

The solution, starting in 2020, was rollups. Build execution layers on top of Ethereum that process transactions faster and cheaper, then settle the final state back on L1. Ethereum itself would remain decentralised and secure, with L2s handling the volume.

That was the plan. So, what happened?

L1 is scaling now.

Ethereum’s transaction fees are averaging under $1. Gas limits are projected to rise significantly by 2026. PeerDAS is live on the mainnet. ZK-EVM proofs are production-ready, and enshrined proving is on the roadmap.

The L1 we have today is a far cry from the L1 that justified the rollup-centric roadmap in 2020. It’s faster. It’s cheaper. And the technical path forward means it’s going to get substantially more capable.

The bottleneck that created the rollup thesis is disappearing. Which brings us to the next part.

L2s were meant to become Ethereum, but they didn’t.

Let’s look at the numbers.

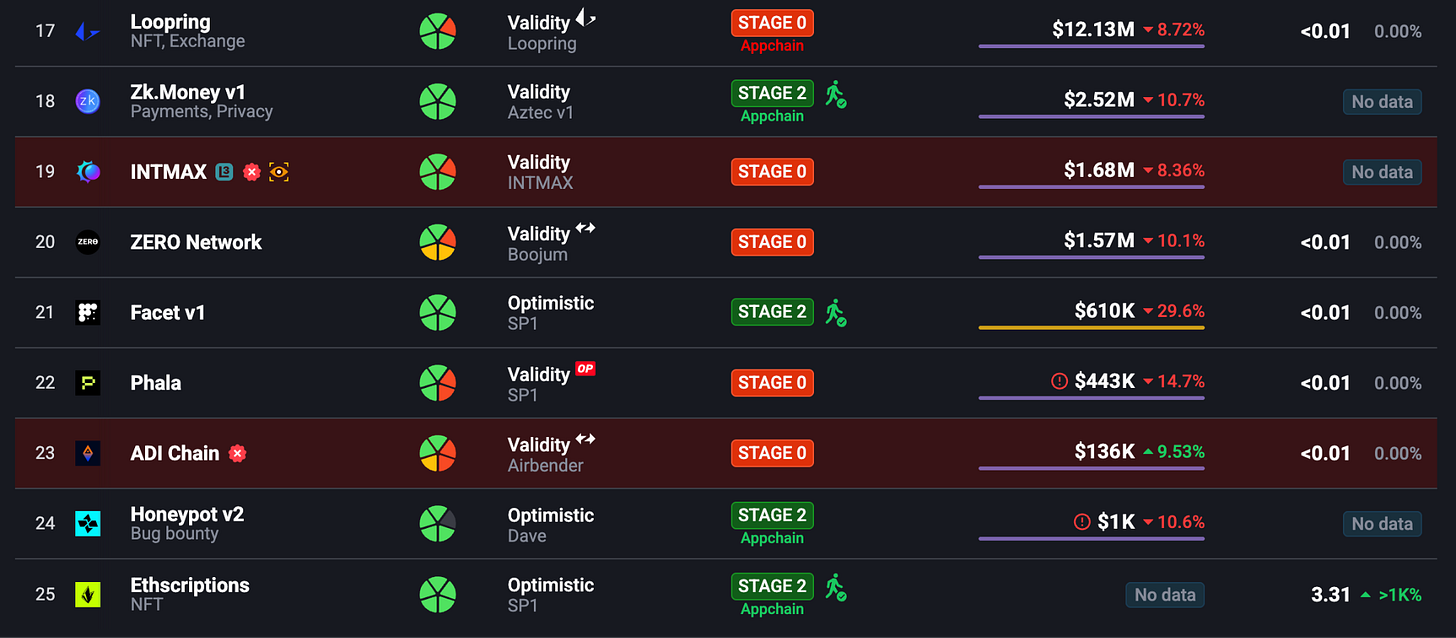

According to L2beat, there are 151 L2-adjacent projects tracked across rollups, validiums, and optimiums. Of those, 25 are classified as rollups, but only FOUR have reached stage 2, the point where an L2 is considered fully trustless and decentralised, with no security council to override withdrawals and no centralised sequencer to censor transactions.

Four. Out of 25 rollups. Out of 151 projects.

The rest are stage 0 or stage 1. Stage 0 means the chain is fully centralised with governance control that can change rules unilaterally. Stage 1: There’s a pathway to decentralisation, but ultimate control still rests with a security council or multisig.

L2s were meant to be extensions of Ethereum-branded shards offering the same security, the same trustlessness, the same guarantees, but faster and cheaper.

That didn’t happen.

Base, one of the most successful L2s in terms of user activity, only reached stage 1 in 2025. Arbitrum is at Stage 1. Optimism is at stage 1. Scroll is at stage 1. Starknet is at stage 0. Many smaller L2s launched in the past two years are still at stage 0 and will likely remain there.

Some teams have even said publicly they may never want to go beyond stable q because their corporate or regulatory customers require them to have ultimate control.

Which is fine. But it means they are not Ethereum. They’re something else.

Now, let’s talk about where the activity actually is.

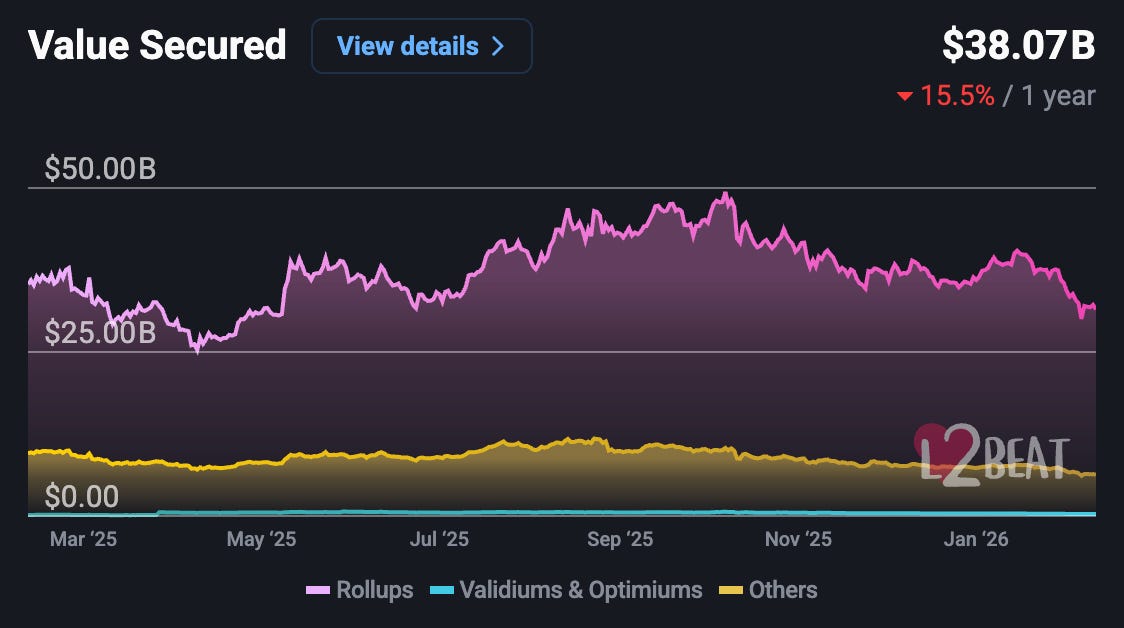

Total value locked (TVL) across all Ethereum L2s is $38.5 billion. Arbitrum holds $15.7 billion, and Base holds $10.4 billion. These two chains account for 68% of all L2 TVL.

The next tier, such as OP Mainnet, Lighter, Starknet, Ink, Linea, zkSybc Era accounts for about $6 billion combined. Everything else is a rounding error.

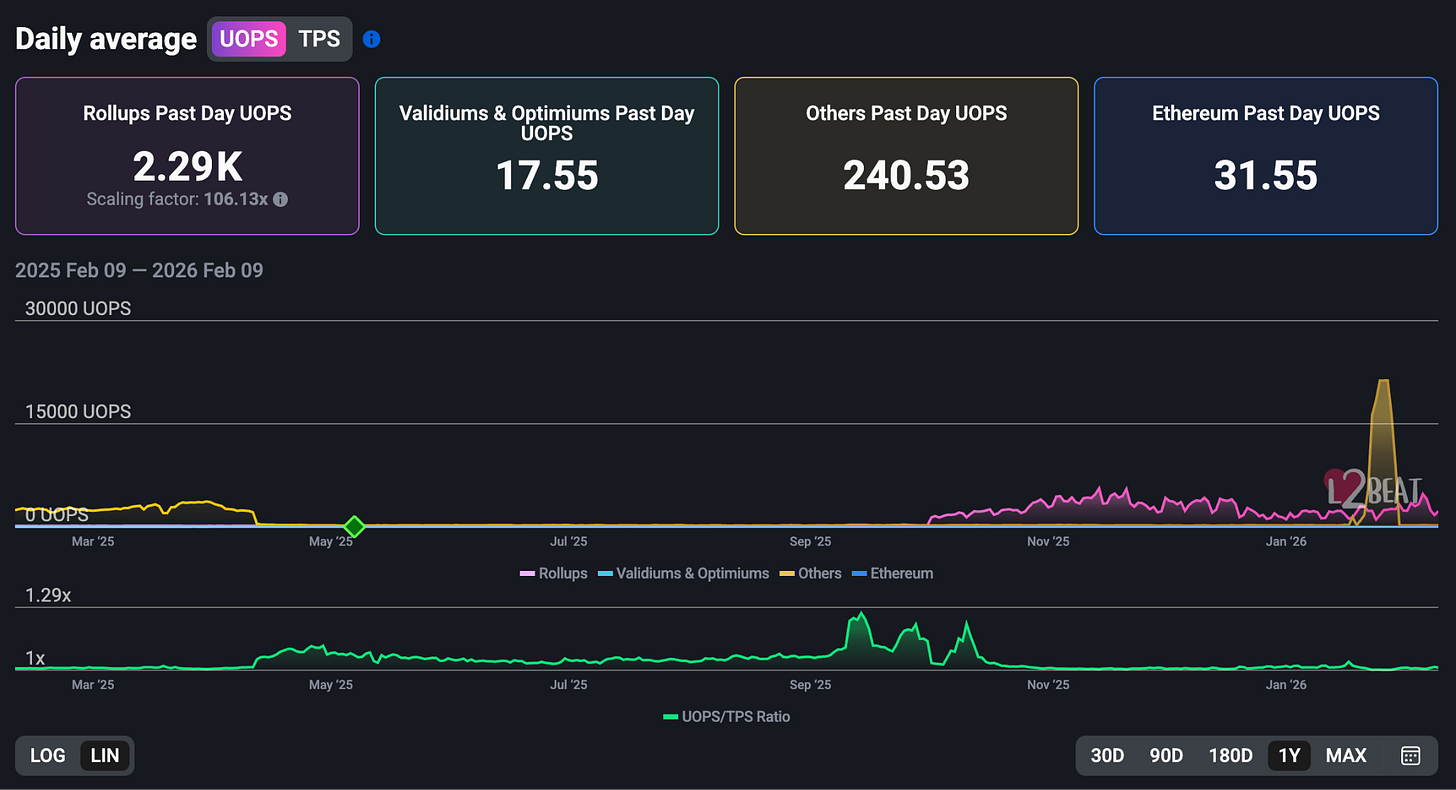

User activity follows the same pattern. Rolluspa averaged 2,290 operations per second over the past day, with a scaling factor of 106x compared to Ethereum’s 31.55 operation per second. But that activity is concentrated. Base and Arbitrum dominate. The long tail barely registers.

This is not what a thriving, interoperable rollup ecosystem looks like. This is an oligopoly. Two or three chains win. Everyone else fragments the user base, fragments liquidity, and fights for scraps.

The liquidity problem we have been screaming about.

Right now, if you want to use Ethereum, your ETH is on L1. Your stablecoins are on L1. Your DeFi positions are on L1. Everything in one place. Liquidity is deep. Composibility works. You can move between Aave, Uniswap, and Compound in a single transaction,

If you want to use L2s, none of that is true.

Your ETH might be on Arbitrum. Your USDC might be on Base. Your position might be on Optimism. You have to bridge between them. Every bridge costs time, money, and introduces risk. Users don’t know which bridges are trust-minimised and which aren’t. They shouldn’t have to.

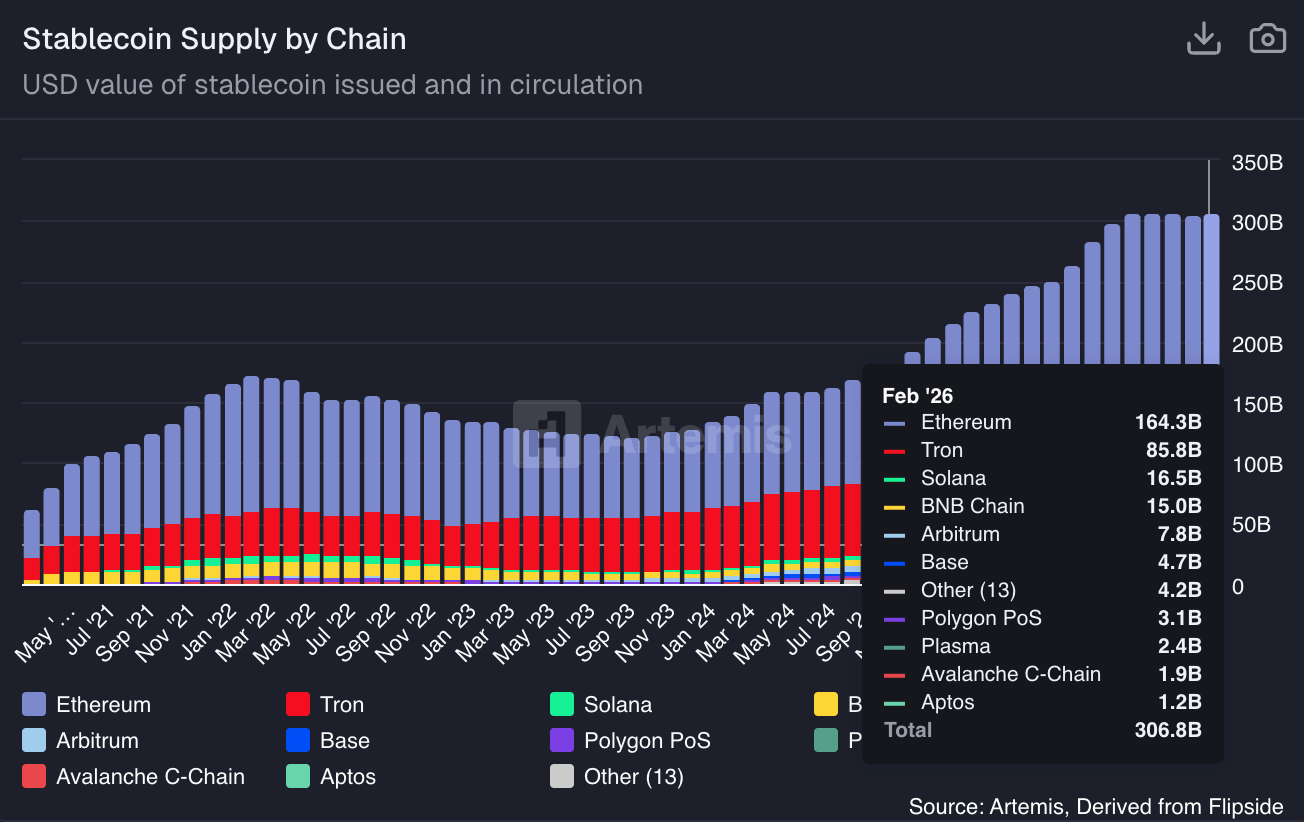

Stablecoin marketcap on Ethereum sits at $164 billion, but it’s split across L1 and dozens of L2s. DeFi TVL on Ethereum is $56.7 billion, but protocols on different L2s can’t compose with each other.

This is the opposite of what the rollup roadmap promised. The vision was shared liquidity, shared state, and one Ethereum with more block space. Instead, we got into a war of all against all, where L2 competes for users and liquidity, and none of them can deliver the network effects that made Ethereum valuable in the first place.

We built many shallow markets instead of one deep one. And users are paying the price.

So what’s the new path?

Vitalik’s proposal is not to kill L2s. It’s to stop pretending they’re something they’re not.

The old framing was: L2s exist to scale Ethereum.

The new framing is: L2 exist to let users choose their guarantees.

In this model, L2s stop trying to be Ethereum and start being explicit about what they actually offer. Some will offer speed, some will offer privacy, and some will offer app-specific execution or regulatory compliance.

Vitalik’s guidance is clear: Do something new. Don’t just copy the EVM and add a bridge. And make sure your public image reflects what you truly are.

Elephant in the room?

I think Ethereum’s next narrative is AI, not just DeFi. Specifically, the infrastructure that enables AI agents to interact economically, trustlessly, and at scale.

Vitalik recently explained: AI agents will need to transact with each other, not just coordinate. Actually, pay each other, post collateral, hire each other, build reputations, and settle disputes. They can’t do that with bank accounts. They can do it with crypto. But they need something cryptographically verifiable, where rules are enforced by code, not terms of service.

ERC-8004 is the first serious attempt to build this.

ERC-8004 is a standard for trustless agent identity and reputation. An AI agent gets an NFT-based identity tied to an on-chain registry. Every interaction, such as completing a task, getting rated, or making a payment, gets recorded on-chain.

Over time, the agent builds a verifiable reputation score. You can see: This agent completed 500 tasks, has a 98% success rate, and never defaulted. Zero-Knowledge proofs let agents verify credentials without exposing sensitive data. Identifying NFTs ensures an agent’s history follows everywhere.

Over 10,000 agents were registered on the testnet in just 5 months. The mainnet contracts went live in January 2026. Ethereum is positioning itself as the settlement layer for AI-to-AI commerce.

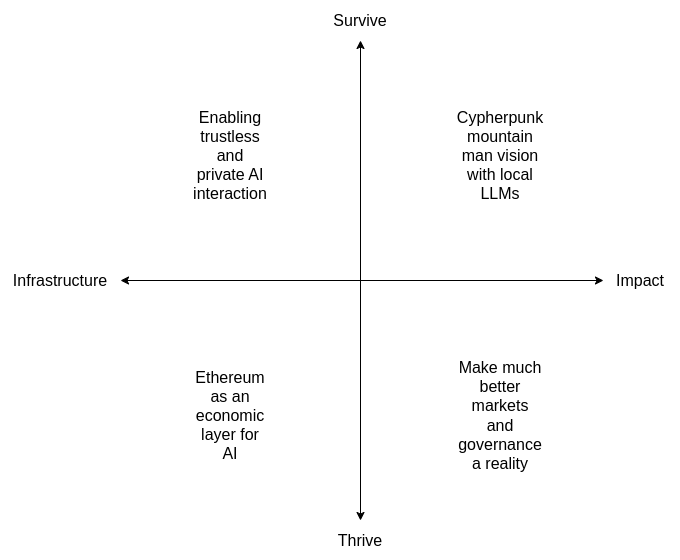

But Vitalik’s vision is broader. He sees Ethereum enabling four essential things for AI:

Trustless, private AI interaction. Local models. ZK payments for API calls. Client-side proof verification. Use AI without giving up privacy or control.

An economic layer for AI. Bots hiring bots. Security deposits. On-chain dispute resolution. ERC-8004 reputation. This makes decentralized AI architectures viable.

The cypherpunk vision is practical. LLMs can verify code, audit contracts, check transactions, and interpret proofs. The old dream of “don’t trust, verify” finally works because AI does the verification that humans couldn’t.

Better markets and governance. Prediction markets. Decentralised governance. Quadratic voting. AI removes the human attention constraint that made these beautiful in theory, but clunky in practice.

This is Ethereum’s d/acc moment. Not a race to build the biggest AI model, but using cryptography and decentralisation to ensure AI grows in a way that preserves freedom, and resists capture.

Where does this leave us?

Ethereum drifted. The rollup-centric roadmap consumed 5 years, billions in capital, and enormous talent. Some of it was necessary. Some was wasted. We fragmented liquidity. We diluted the brand. We let non-Ethereum chains call themselves Ethereum.

But Vitalik hasn’t drifted. He’s been consistent and intellectually honest. When the data changed, he said so.

The rollup-centric roadmap is over. Not because rollups failed, but because the premise(that L1 can’t scale) is no longer true. And the promise (that Ls would become Ethereum) never materialised.

L1 is scaling. L2s are diverging. Meanwhile, the opportunity is forming around AI. Ethereum has a chance to become the economic and identity layer for autonomous agents. ERC-8004 is live. The standards are being written. If Ethereum wins this, the rollup detour won’t matter.

It will just be a chapter in a much longer story.

And Vitalik has been right again.

Until next time… stay curious.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.