Gold is strange.

It does nothing useful. It does not power machines. It does not generate flows. Its entire value rests on a shared belief that it will always be worth something tomorrow. It’s locked in high-security vaults.

Somehow, that belief has survived five thousand years.

Every generation thinks it has built something more sophisticated: Derivatives, fiat currencies, digital assets, algorithmic money. Yet, when trust thins out, when people return to element number 79 on the periodic table.

Not because it evolves. Because it doesn’t.

Today, that metal lives on-chain. Two companies control almost the entire digital version of it.

January 29, 2026. Bitcoin sat at $89,173. Ethereum at $2,941. On the same day, tether Gold touched $5,580. Paxos Gold hit $5,291. Combined trading volume between the two exceeded $1.6 billion in a single 24-hour window. Both gold tokens printed all-time highs while crypto markets were already beginning to crack.

What followed made the divergence impossible to ignore. Bitcoin fell from $89,000 to $67,000. Ethereum went from $2,941 to under $2,000. Over the same three-month window, Tether Gold rose 19.1%. Paxos Gold rose 19.6%. Opposite directions.

Tokenised gold broke to all-time highs.

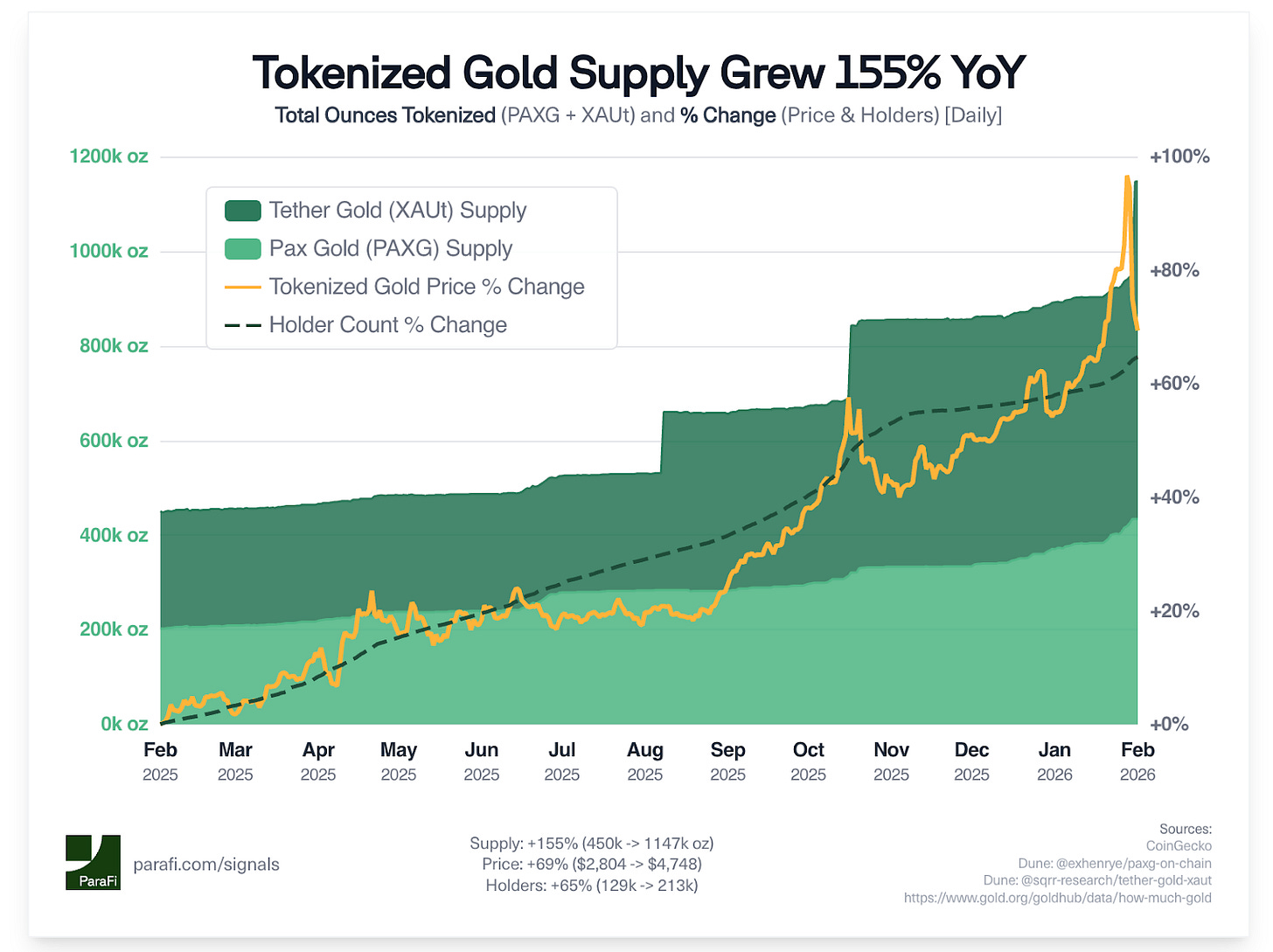

Not because of some complex on-chain dynamic. Not because capital was rotating through sophisticated DeFi strategies. But gold — the commodity — rallied. And the tokens did what they are designed to do: track it. Gold went from $2,600 to $5,600 in twelve months. The tokens followed, faithfully, within fractions of a percent.

One whale wallet, dormant for eight months, reactivated and moved $7 million into gold tokens. Not into Bitcoin on the dip, stablecoins. Into gold. The oldest hedge, on the newest rails.

The industry spent a decade trying to build new forms of money. The winning product turned out to be the oldest one?

That irony is worth sitting with for a moment, because the market it has created is no longer small.

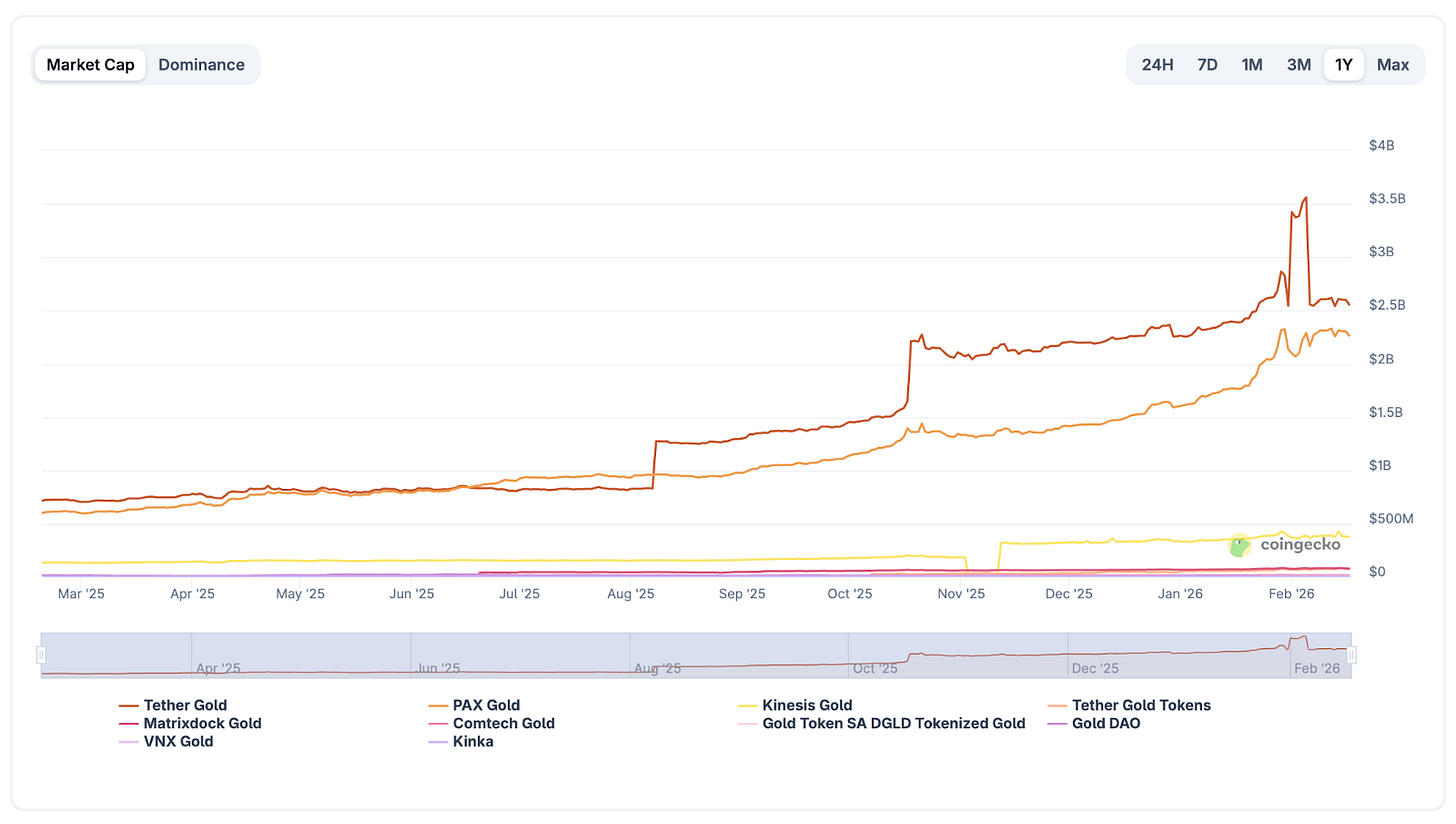

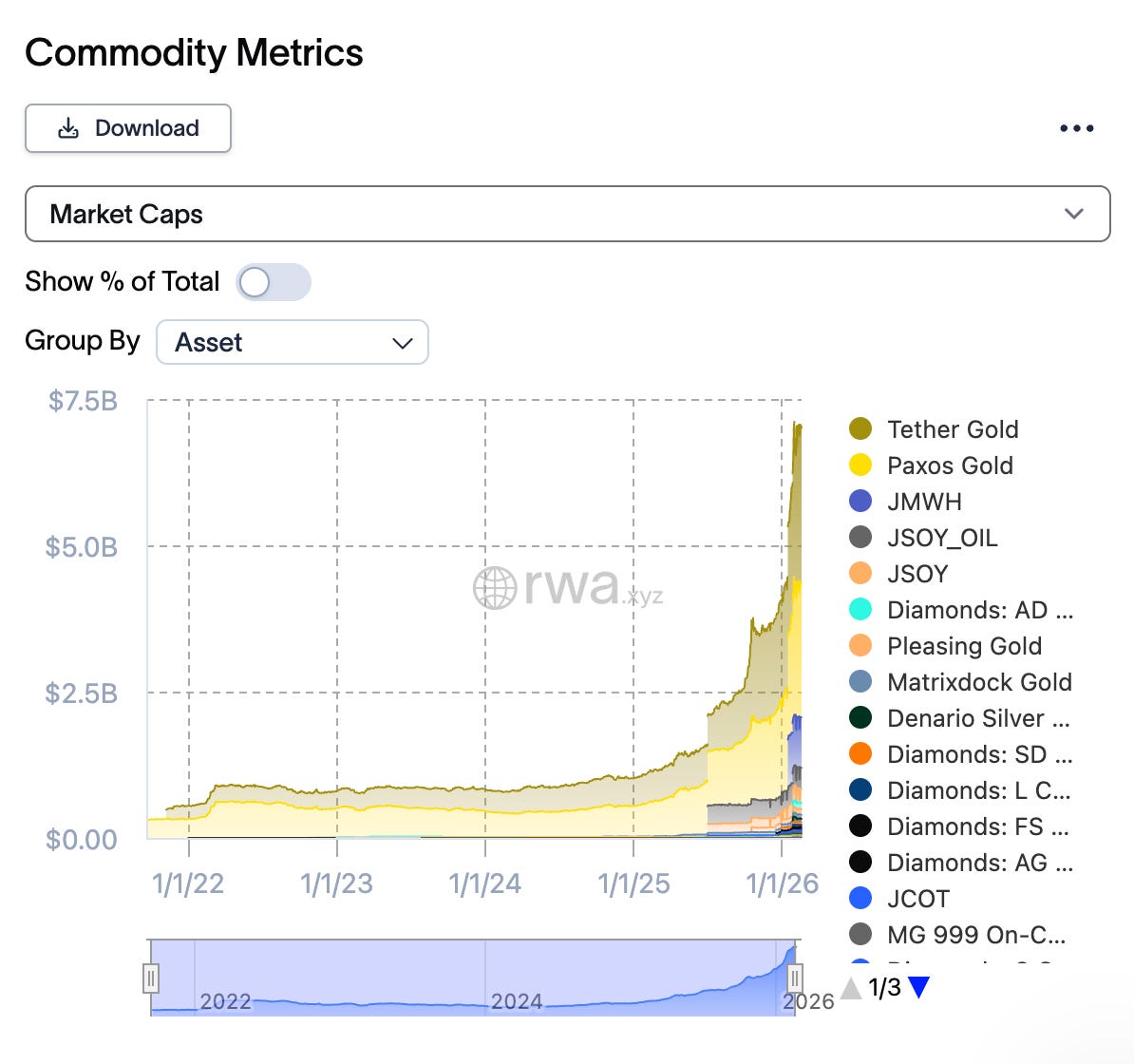

The tokenised gold market has crossed $6 billion. A year ago, it was $1.6 billin. Growth of roughly 275% in twelve months, making it one of the fastest-expanding segments in digital assets.

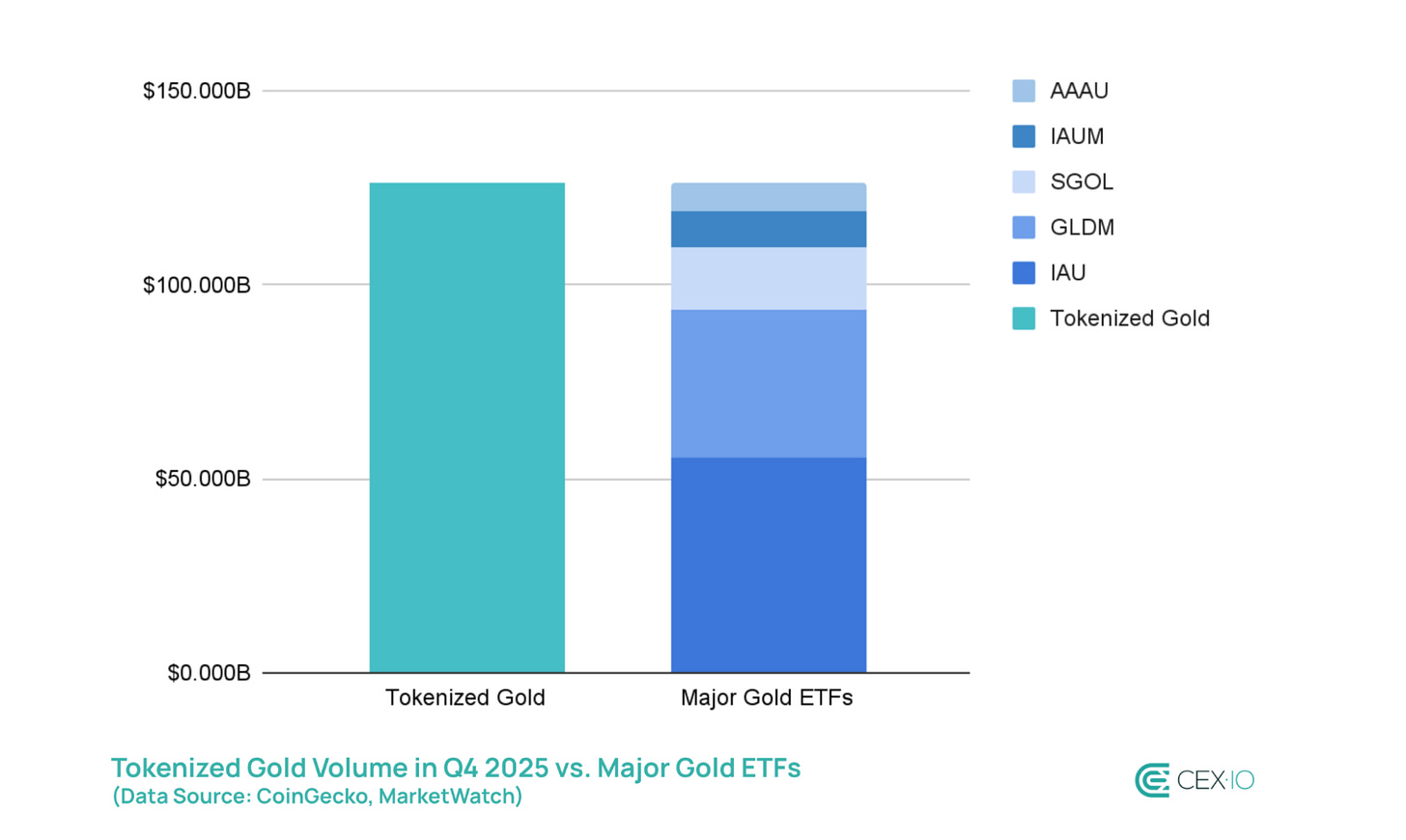

More than 1.2 million ounces of physical gold now sit in vaults backing these tokens. Annual trading volume reached $178 billion in 2025, making tokenised gold the second-largest gold investment product by volume globally, trailing only the SPDR Gold Shares ETF. In Q4 2025 alone, tokenised gold moved $126 billion. That is more volume than every other gold ETF in the world except GLD.

Virtually all of it runs through two tokens. Together, they account for roughly 97% of the entire tokenised gold market. There is no meaningful third player. A clear duopoly.

Tether

To understand what Tether is doing with gold, you have to stop thinking of it as a crypto company. It is easier to understand as a commodity accumulator that also issues stablecoins.

Tether Gold launched as a straightforward tokenised product - one token, one troy ounce, LBMA-certified bars in Swiss vaults, verifiable on-chain by serial number. The mechanics were unremarkable. What Tether has done since is not.

In Q4 2025, Tether added 27 metric tons of gold to its reserves. In a single quarter. That is more gold than most central banks purchase in a year. Tether’s acquisition pace has been outstripping sovereign buyers - Greece, Qatar, Australia. By January 2026, the company had accumulated roughly 140 tons of gold, worth approximately $23.3 billion.

Polish central bank, the most active buyer among reporting central banks, increased its reserves by +35 tonnes last quarter to 550 tonnes.

In 2025, Tether’s gold buying surpassed all but the 3 largest gold ETFs.

Read: Tether and the Dollar - by Thejaswini M A - Token Dispatch

Paolo Ardoino, Tether’s CEO, has stated the company plans to increase gold exposure to 10–15% of its total investment portfolio. It is a strategic reserve play. Tether is using profits from its stablecoin empire to accumulate hard assets at a pace that resembles state-level monetary policy more than corporate treasury management.

Then came Gold.com. Tether made a $150 million strategic investment in the precious metals platform, acquiring roughly 12% ownership. The plan is to integrate XAUT directly into Gold.com’s distribution network. The product is performing accordingly. XAUT’s total value locked (TVL) has gone parabolic, from effectively nothing before 2024 to $3.5 billion today.

XAUT operates under TG Commodities Limited, a Tether subsidiary regulated in El Salvador.

Not New York or London. Audits are quarterly, conducted by BDO Italia, providing what Tether describes as reasonable assurance opinions under ISAE 3000 standards. You can verify your gold bar allocation by wallet address. The mechanics are sound. The transparency is improving.

The trust model is still fundamentally: trust Tether.

Tether’s history of trust is not unblemished. The company paid $41 million in 2021 to settle charges from the CFTC related to misrepresenting USDT reserves. The New York Attorney General banned Tether from operating in the state after a separate investigation.

For the crypto-native trader who already holds USDT and wants seamless gold rotation during a downturn, XAUT is the obvious instrument. Liquid, cheap to move on Tron, integrated into the ecosystem they already inhabit. For the institutional allocator who needs to explain their counterparty risk to a compliance officer, the conversation becomes more complicated.

Tether is building something large. Whether the foundations are proportionate to the structure is the question that stays open.

Paxos

Paxos Gold is another philosophy.

PAXG is issued by Paxos Trust Company, a New York-chartered financial institution regulated by the New York State Department of Financial Services - the same body that oversees some of the most important banks in the world. Each token represents one fine troy ounce of physical gold stored in Brink’s LBMA-approved vaults in London. Each bar is allocated, serialised, and verifiable.

The audits are monthly. Not quarterly. Conducted by KPMG, one of the Big Four, providing third-party attestation that the gold in the vaults matches the tokens in circulation. This is as close to institutional-grade transparency as exists in tokenised commodities.

The custody structure is bankruptcy-remote. PAXG holders’ gold is legally segregated from Paxos’ own liabilities. If Paxos fails, the gold belongs to token holders, not creditors. That is a legal architecture that matters in a crisis - and it is one that XAUT’s framework does not explicitly replicate. Paxos has been in this market since 2019. It operates under a trust charter, not a BitLicense, not a money transmitter license - a trust charter, which carries fiduciary obligations. Paxos has a legal duty to act in the best interest of its customers. It is a regulatory requirement.

The trade-offs are real and worth stating plainly. PAXG lives primarily on Ethereum. No Tron, no TON, no multi-chain expansion. Higher gas fees. Less flexibility for frequent traders. Daily volume is slightly lower - roughly $235 million versus XAUT’s $249 million. Paxos generates zero in annualised fee revenue from PAXG because it sets transfer fees to zero. A choice that prioritises adoption over extraction.

Consider the holder numbers. PAXG has 98,619 holders. XAUT has 32,552.

Three times the holders with a smaller market cap. That means PAXG’s base is broader and more distributed - more retail participation, a wider foundation. XAUT’s is more concentrated - bigger wallets, fewer of them. Paxos owns the long tail. Tether owns the whales.

Paxos’ bet is patient and structural. When tokenised gold becomes large enough that serious institutional capital wants in, the first question will not be about liquidity or chain support. It will be: who regulates this? PAXG will be the only answer that satisfies the question without a footnote.

The Duopoly

Many markets have duopolies. These two companies represent fundamentally opposing theories on how to earn trust with the same underlying asset.

Tether maximises distribution. Multi-chain support. Deep integration with the USDT ecosystem. Aggressive expansion into emerging markets - XAUT is being integrated into Opera’s MiniPay wallet for African and Southeast Asian users. The strategy is present: be everywhere, move fast, let liquidity compound.

Paxos maximises assurance. One chain. One regulator. Monthly audits. Zero transfer fees. The strategy is patience. Be unimpeachable, and wait for the capital that cares about that to arrive.

Tether builds for speed. XAUT is designed for capital rotation during volatility. A trader holding USDT can swap into gold exposure in seconds, ride out a downturn, and rotate back. It functions as a digital commodity for active portfolio management.

Paxos builds for duration. PAXG is the token you buy and put in cold storage. The legal and custodial framework is designed to hold even if the issuer faces stress. Different products for different time horizons, wearing the same label.

The revenue structures reveal the philosophical split most clearly. XAUT generates $28 million a year from its 0.25% purchase and redemption fee. PAXG generates zero from transfer fees. One is extracting value from flow. The other is subsidising adoption to build a base. One is running a business today. The other is building a moat for tomorrow.

Paxos isn’t spotless. In August 2025, the company paid $48.5 million to settle NYDFS charges related to anti-money laundering failures stemming from its former partnership with Binance. $26.5 million in penalties plus $22 million in compliance upgrades. The issues were deficient transaction monitoring, weak KYC controls, and failure to independently verify Binance’s geofencing claims. $1.6 billion in illicit funds flowed through Binance between 2017 and 2022, and Paxos missed it.

And then there is the counterparty question, which neither side can fully resolve.

Both tokens ask you to trust that the gold is there. Tether asks you to trust their quarterly disclosures and BDO Italia audits. Paxos asks you to trust NYDFS oversight and monthly KPMG attestations. That distinction is nearly invisible when markets are calm. It becomes the only thing that matters when they are not.

Treating counterparty diversification as essential, not optional. Sophisticated capital already understands that in a market this concentrated, the risk is not which token fails. It is the duopoly that is the single point of failure.

What Tokenised Gold Is — and Is Not

Every analysis of tokenised gold eventually arrives at DeFi. Gold as collateral, as liquidity, as a building block. Technically possible. Practically, most tokenised gold just sits.

The reason is simple. DeFi thrives on yield-bearing collateral and assets that power lending loops. Treasuries pay interest. Gold pays nothing. It is a hedge, not an engine. And the biggest risk is not on-chain. It is custodial. Who owns the gold in the vault during insolvency? That question is resolved in courtrooms, not by smart contracts.

Tokenized gold’s real value is simpler to understand. Access, liquidity, portability. Gold at internet speed, fractional, borderless, without storage fees. That is enough.

If either company fails, the effect does not stay contained. There is no credible third option. The duopoly is the market.

The remaining 3% is fragmented across dozens of smaller tokens, none with meaningful liquidity or institutional backing. There is no credible third option waiting. If you want tokenised gold at scale today, you are choosing between Tether and Paxos. If you are being prudent, you are choosing both.

Wintermute launched institutional OTC trading for both tokens in February 2026. A sign that professional market makers recognise the same reality. The duopoly is the market. Hong Kong is exploring tokenised gold through its e-HKD+ and ASPIRe frameworks. But those are early-stage experiments. Today and for the foreseeable future, the market belongs to two companies with two very different ideas about what trust means.

Total above-ground gold exceeds $30 trillion. Tokenised gold is 0.02% penetration. Even 1% would be 50x from here. Central banks are accumulating at the fastest pace in decades. Gold rallied from $2,600 to $5,600 in twelve months. And in countries where currencies are collapsing — Argentina, Turkey, Nigeria — tokenised gold is the first time ordinary people can save in something that holds value without a bank account or a vault.

Gold is different. It’s no one’s liability. No government can print more of it. No central bank controls its supply. It’s survived every currency collapse, every regime change, every financial crisis in recorded history.

For someone in Lagos or Buenos Aires watching their savings evaporate in real time, tokenised gold is the first time they can hold a non-sovereign store of value (globally liquid, instantly transferable, accessible with just a phone) without needing to physically smuggle metal across borders or trust a local bank that might freeze their account tomorrow. It’s a different category of safety.

The addressable market is not the current crypto user base. It is everyone on earth who wants to hold gold and has never had a practical way to do so.

That is a very large number.

Two companies. Six billion dollars. One answer to El Salvador. The other to New York.

But is this duopoly the beginning of something open, or just the oldest power structure wearing new clothes?

Gold does not change. But the hands that hold it do.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.