Hello, y'all. Happy Saturday.

Donald Trump signed an executive order on Monday directing the creation of an American sovereign wealth fund.

Bitcoin advocate Sen. Cynthia Lummis (R-WY) immediately replied by tweeting “This is a ₿ig deal”, leaving Bitcoin enthusiasts guessing if this would be a step to national Bitcoin adoption.

States aren't waiting for federal action.

Just 48 hours ago, Utah's Bitcoin reserve bill cleared the House vote and has headed to Senate - potentially making it the first state to establish a Bitcoin stockpile. Hours later, New Mexico joined 14 other states in the race, proposing to allocate 5% of public funds to Bitcoin.

From Utah's legislative moves to Florida's ambitious pension fund plans, state governments are racing to establish their own Bitcoin reserves in different forms and shapes.

Fifteen states have already proposed legislation, with Utah leading the race.

Will states pull off their Bitcoin reserves before the nation does?

We tell you how they can achieve this, in today’s Wormhole.

Roses Are Red, Security Is Key

Trezor has transformed crypto security from a complex puzzle to a user-friendly playground, so you can be the boss of your financial future?

This Valentine’s Day, help your audience give a gift that lasts. Get discounts of up to 50% on Trezor’s bundled best-selling hardware wallets.

The State Reserve Movement

Trump’s executive order to evaluate setting up a digital assets reserve instead of a Bitcoin-only reserve did upset some Bitcoin maxis. It even triggered a war of tweets between Bitcoin advocates and those supporting XRP’s candidature for a mixed reserve.

Read: Is XRP Crashing BTC's Stockpile Party? 🎈

Meanwhile, states are moving faster than most expected them to with their Bitcoin reserve plans.

The approaches vary significantly. Some states propose direct Bitcoin purchases, others favour ETF investments.

On January 27, Arizona became the first state in the nation whose finance committee passed a bill to create a 'Strategic Bitcoin Reserve'.

Their Senate Finance Committee approved the Strategic Bitcoin Reserve Act with a 5-2 vote, permitting up to 10% of public funds for Bitcoin investment. The bill now moves to the floor vote in the Senate.

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts.

The landscape shifts almost daily.

Utah's House voted on Thursday 8-1 to advance HB230, the Blockchain and Digital Innovation Amendments bill. New Mexico joined the race shortly with SB57, proposing a 5% allocation model.

Meanwhile, North Dakota's rejection (32-57 vote) on January 31 shows the proposal's mixed reception across state legislatures.

Pennsylvania, Texas, and Florida are in the queue.

Pennsylvania's proposal targets 10% allocation from their $16.7 billion combined funds. Texas aims to create a separate Bitcoin reserve fund.

Illinois mandates a 5-year minimum holding period. Wyoming suggests a conservative 3% allocation. Yet they share a common vision: positioning their states at the forefront of digital asset adoption.

State proposals are expanding beyond simple Bitcoin holdings.

Ohio's latest bill, SB57, introduced by Senator Sandra O'Brien, mandates a five-year minimum holding period and requires state agencies to accept cryptocurrency for tax payments and government transactions.

Why States Want Separate BTC Reserves?

Bitcoin reserve initiatives reflect broader strategic aims beyond simple investment returns.

Alabama State Auditor Andrew Sorrell frames it as a tech industry magnet: "The states that embrace new technologies will benefit most from their growth. The debate over whether crypto will succeed has ended. Now, the fight for which states will benefit from it has begun."

Florida plans to leverage its $185.7 billion pension fund - the nation's fourth largest - as an inflationary hedge.

"Just ONE percent allocation to Bitcoin would mean $1.857 billion in investment," explains Samuel Armes, head of the Florida Blockchain Business Association, a Bitcoin advocacy organisation.

The Speaker of the Florida House, Danny Perez, and the President of the Senate, Ben Albritton, had helped push the Anti-CBDC Bill in Florida, Armes added.

With them at the helm, Armes expects Florida to create a strategic Bitcoin reserve as early as this session itself starting in Q1 2025.

New Hampshire sees Bitcoin reserves as a matter of state sovereignty.

"The ethos in New Hampshire is 'Live Free or Die'. We're tied to the US dollar, whether we like it or not, but this would allow us to have the state invest in an uncorrelated, new asset class," says Representative Keith Ammon.

Wyoming’s Representative Jacob Wasserburger connects it to the state's history: "Wyoming has always been a pioneer—from women's suffrage to the first national park; from the invention of the LLC to the frontier of digital assets."

Beyond these, there are larger treasury and economic benefits states have.

Asset Diversification: "A well-balanced portfolio should include exposure to many different types of asset classes. Crypto is a $3 trillion asset class that states have zero exposure to, averaging 55% growth annually for 15 years," Sorrell argues.

States barely break even when they invest in traditional assets like Treasury bonds that yield 4.5% against 2.9% inflation.

Dollar Independence: What happens if the dollar ceases to be the reserve currency? What if inflation shoots up above 4%?

Exposure to Bitcoin's value could insulate states from dollar fluctuations.

Tech Ecosystem Development: States aim to create comprehensive blockchain environments. Utah's digital asset task force, operational since 2022, shares this long-term vision. Texas allows residents to donate Bitcoin to their reserve, building community engagement alongside state holdings.

Financial Innovation Hub: Pennsylvania's proposal, targeting 10% of its $16.7 billion combined funds, positions the state to attract financial innovation. The Pennsylvania Bitcoin Strategic Reserve Act could make the state a leader in digital asset management.

Regulatory Leadership: States like Wyoming leverage Bitcoin reserves to establish regulatory frameworks. Their Special Purpose Depository Institution (SPDI) model gains recognition in the digital asset space, attracting businesses seeking regulatory clarity.

Tax Base Expansion: As blockchain companies relocate to Bitcoin-friendly states, local tax revenues could see significant growth of investment and development.

The stakes extend beyond state treasuries.

Fidelity Digital Assets researchers predict in their 2025 outlook that "more nation-states, central banks, sovereign wealth funds, and government treasuries will look to establish strategic positions in bitcoin."

Why States May Win the Race

Utah's lightning-fast progress through legislative committees reveals a fundamental advantage states hold over federal initiatives. "Utah moves fast because we have a 45-day legislative calendar. It's sink or swim," explains Dennis Porter, CEO of Satoshi Action Fund. This urgency contrasts sharply with the federal government's methodical pace.

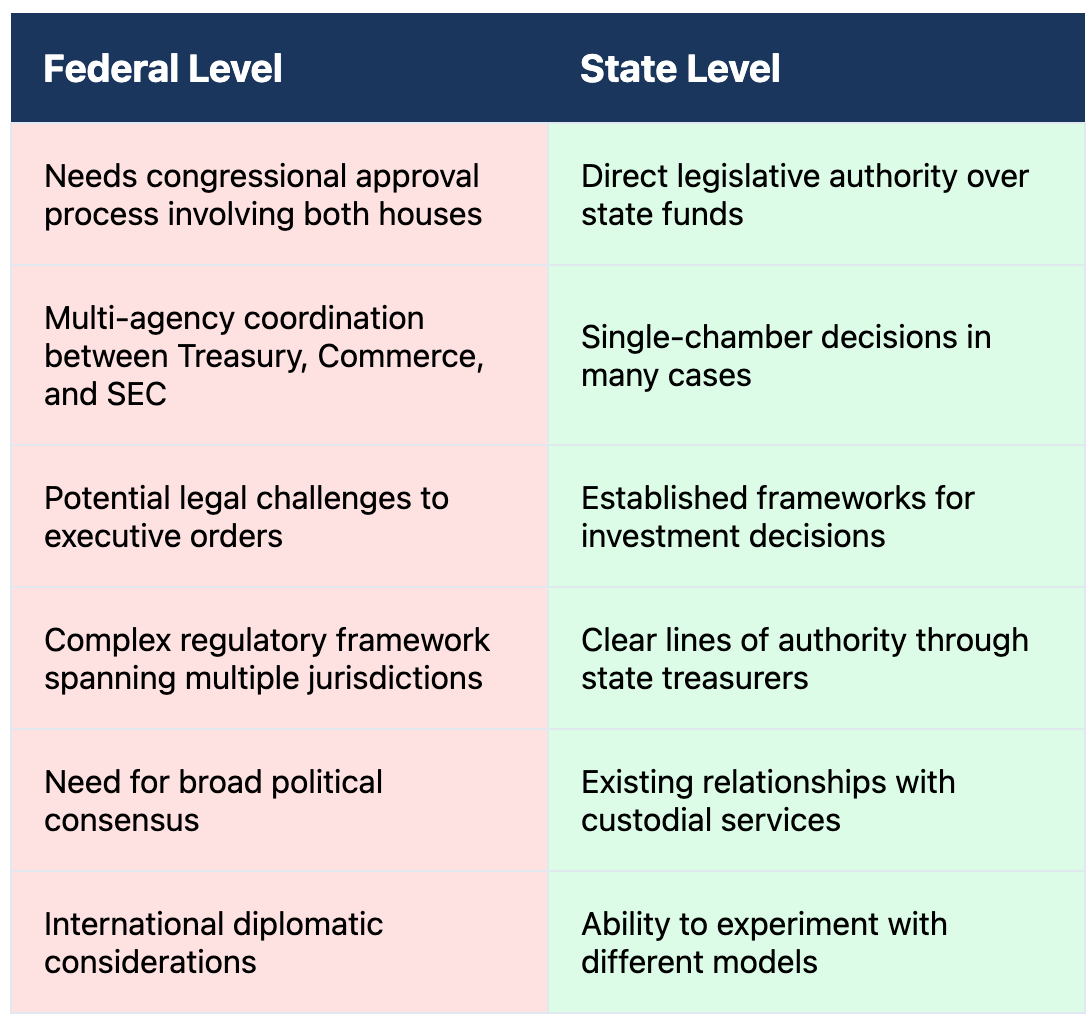

The federal path faces significant hurdles. Trump's sovereign wealth fund executive order requires coordination between Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, and multiple federal agencies. Even with pro-crypto leadership, the process could stretch beyond the promised 12-month timeline.

States operate with remarkable agility. Illinois's Bitcoin Reserve Act moved from proposal to committee approval in days. Arizona's Senate Finance Committee cleared their bill with a 5-2 vote, demonstrating how state legislatures can bypass the gridlock plaguing federal initiatives.

State vs Federal Implementation

Wyoming's approach illustrates this efficiency. The state leverages its Special Purpose Depository Institution (SPDI) framework - a regulatory innovation that took months, not years, to implement.

"This forward-thinking approach will benefit our state as we lead the nation in financial innovation,” explains Senator Cynthia Lummis.

Texas demonstrates another state advantage: community engagement.

Their proposal allows citizen donations to the Bitcoin reserve, creating public buy-in while avoiding taxpayer concerns. Unlikely to find direct community involvement proves at the federal level.

While the federal government must create comprehensive nationwide policies to adopt Bitcoin, states will have the flexibility to move quicker based on their customised needs.

States can contract directly with providers, implement specific security protocols, and adjust strategies based on local needs. The federal government must develop universal standards applicable across all agencies and situations.

"States aren't just competing with the federal government, they're competing with each other. This creates innovation and urgency that federal bureaucracy simply can't match," observes Porter.

Challenges for States

Despite state advantages in implementation speed, mandating robust custody solutions and strict security standards will be easier outlined than executed.

Security emerges as a primary concern. Beyond just storing Bitcoin, creating protocols that work within existing state treasury frameworks will remain a challenge. State treasuries will need systems to protect both private keys and public funds while maintaining transparent accounting.

Market volatility demands sophisticated risk management. Illinois addresses this through a mandatory 5-year holding period. Florida proposes gradual accumulation - "dollar-cost averaging over two years rather than large one-time purchases," according to FBBA's Samuel Armes. The challenge lies in balancing long-term vision against short-term price swings.

Public perception presents another hurdle. Texas tackles this through voluntary citizen donations rather than direct tax fund allocation.

"No taxpayer funds will be spent on buying Bitcoin to maximise the chances of the bill passing," states the Texas Blockchain Council.

Technical expertise gaps loom large. States need personnel who understand both traditional treasury operations and blockchain technology. Utah leverages its digital asset task force, operational since 2022, but most states lack similar resources.

"It takes education on the part of state officials," emphasises New Hampshire Representative Keith Ammon.

The sustainability question extends beyond market cycles.

Ongoing custody costs

Security system updates

Staff training requirements

Audit procedures

Compliance monitoring

Emergency liquidation protocols

Pennsylvania's approach acknowledges these challenges through phased implementation. Their proposal starts with 10% allocation but includes provisions for adjusting based on operational experience.

Political transitions pose another risk. While current administrations may support Bitcoin reserves, future leadership could reverse course.

States need structures resilient enough to survive electoral changes. Wyoming addresses this through legislative guardrails, requiring supermajority votes for major policy changes.

Asset concentration risk also requires attention. Arizona's bill limits cryptocurrency allocation to 10% of public funds, recognising the need for balanced portfolios.

Infrastructure dependencies create additional vulnerabilities.

Backup systems for key storage

Redundant security protocols

Multiple custody solutions

Alternative trading venues

Emergency response procedures

Token Dispatch View 🔎

The race between states and federal government to establish Bitcoin reserves illustrates a fundamental shift in American financial federalism. While Trump's sovereign wealth fund executive order captures headlines, the innovation is being led by the states.

More than who gets there first, this will be about effectiveness in execution.

States demonstrate that smaller, focused initiatives often succeed where larger federal programmes might stumble. Utah's 45-day legislative calendar exemplifies this efficiency, showing how constraints can drive innovation rather than hinder it.

The state-by-state approach offers unique advantages. Each state becomes a laboratory for different Bitcoin reserve models - from Florida's pension fund strategy to Texas's community-driven donations. These varied approaches provide valuable data points for other states and eventually, federal implementation.

Beyond states racing to build Bitcoin reserves, this is also their chance to build comprehensive digital asset ecosystems. Wyoming's SPDI framework, Utah's digital asset task force, and Florida's institutional approach each contribute to a broader financial evolution.

The challenges remain significant - from custody solutions to political transitions. Yet states' ability to move quickly, adapt strategies, and learn from each other suggests they're better positioned to overcome these hurdles than a single federal initiative.

Keith Ammon warns, "The state that is last to build Bitcoin reserves will lose."

The states are teaching us that in the race to embrace Bitcoin, speed and flexibility trump size and centralisation.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.