Worldcoin's New Trust Economy 🌎

Why Sam Altman wants to verify 8 billion humans with iris scans.

I’ve been thinking about trust lately. Not the abstract philosophical kind, the practical everyday kind. The kind where you pick up the phone and wonder if your mom’s voice is actually hers, or some AI-generated deepfake trying to scam you out of money. The kind where you scroll through Twitter and genuinely can’t tell which accounts are human and which are sophisticated bots farming engagement.

How do you know I’m human?

Right now, reading this, you’re assuming a person wrote these words. But what if I told you that over half of everything you interact with online isn’t human anymore? That 51% of internet traffic is bots? That when you argue with someone on Twitter, there’s a coin-flip chance you’re yelling at an algorithm?

Maybe I overthink it, but the internet designed to connect humans is now so polluted with bots that being human has become a feature, not a default. Sam Altman knows this.

He’s building the AI that’s creating the problem, and simultaneously, building the infrastructure he thinks will solve it.

Your Shortcut To Crypto’s Inner Circle

Introduction.com is a private, high-trust network designed for the most respected minds in GTM, BD, and leadership across crypto, tech, and finance.

Inside, members tap into a curated ecosystem where collaboration, dealmaking, and growth happen by default.

Cut through the noise. Reduce friction. Unlock the true value of executive connectivity.

Now accepting new applications.

👉Apply Today

I’m not joking about the bot problem, it’s real. According to the 2025 Imperva Bad Bot Report, bots now constitute 51% of all web traffic. This is the first time in a decade that automated traffic has surpassed human-generated activity. Malicious bots alone account for 37% of all internet traffic.

On blockchains, the problem compounds. Up to 80% of transactions are automated, and autonomous AI agents (not just human-directed trading bots) now dominate that automated activity, making their own decisions about what to buy, sell, and execute. During peak congestion periods, bot-driven trading can push gas fees to hundreds of dollars per transaction, effectively pricing out human users.

Deepfake fraud cases surged by 1,740% in North America between 2022 and 2023. Financial losses from AI-driven fraud exceeded $200 million in the first quarter of 2025 alone. The number of deepfake files is projected to explode from 500,000 in 2023 to 8 million in 2025.

Your voice, your face, your writing style, all of it can be cloned and weaponised. The verification systems we trusted? CAPTCHAs? Facial recognition? They’re failing. ChatGPT can solve your “I am not a robot” checks faster than you and I can.

Meet the Orb (Yes, Really)

A silver sphere the size of a basketball. It looks like something from a sci-fi movie. You lean forward, stare into its lens, and it scans your iris. The pattern of your eye — as unique as your fingerprint, but harder to fake — gets converted into a cryptographic hash. The raw image is deleted immediately, they promise.

Congratulations. You’re now a verified human. You have a World ID.

This is Sam Altman’s other big project. Worldcoin has verified 16.9 million people across 160 countries. The World App has 34 million users. The technology is legitimately impressive. Its False Match Rate is below 4.1 × 10⁻⁸, meaning it can distinguish between billions of people with near-perfect accuracy.

The WLD token, which was supposed to be the currency of this verified-human economy, is down 89% from its all-time high. Trading at $1.24 after hitting $11.74 in March 2024 still maintains a $2.65 billion market cap and ranks #59 on CoinGecko. But with monthly trading volume at 7.92 billion showing significant market activity.

So why is everyone suddenly excited again?

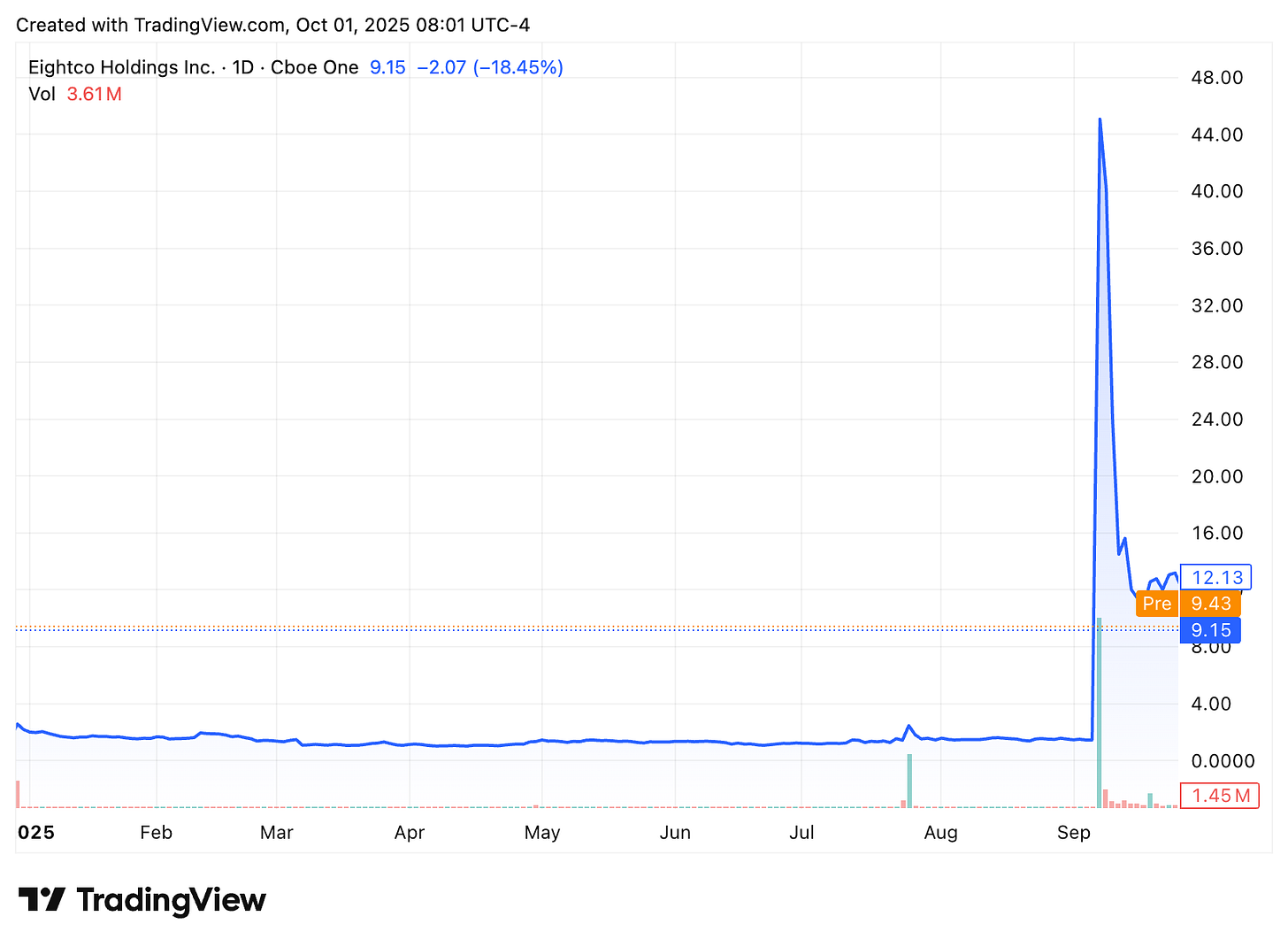

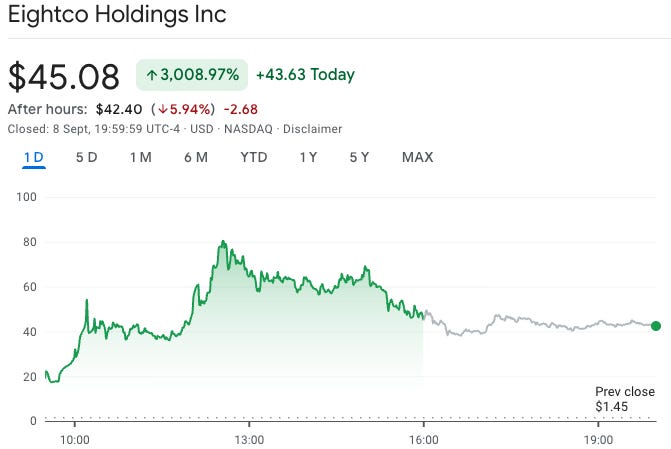

The reason is Eightco Holdings. A company that, until yesterday, managed e-commerce inventory. Nobody cared. Their stock traded at $1.45. Then they announced a $250 million Worldcoin purchase. Their entire strategy now revolves around accumulating WLD tokens and, implicitly, gaining access to verified human identities.

The stock exploded to $45.08. A 3,000% gain in one trading day on September 8.

BitMine Immersion Technologies, the largest corporate Ethereum holder, immediately invested $20 million for 13.7 million shares. Dan Ives from Wedbush Securities joined as chairman, calling this “the next step in the AI revolution around authentication.”

The playbook is familiar if you’ve been following the Digital Asset Treasury Company boom.

Read: The DATCO Machine 🔬

MicroStrategy accumulates Bitcoin. Its stock trades at a premium to its Bitcoin holdings. They issue more shares, buy more Bitcoin, repeat. A simple, yet effective, reflexive loop that created a $138 billion company.

Eightco is betting the same thing happens with verified human identities. As AI becomes indistinguishable from humans, proof-of-personhood becomes a critical digital asset. They accumulate WLD tokens. The stock trades at a premium. They issue more shares. They buy more tokens. The verified-human treasury strategy.

Except there’s a fundamental difference. Bitcoin is digital gold - inert, unseizable, finite. Worldcoin is a digital identity, which is personal, revocable, and tied to your eyeballs.

One is a commodity. The other is... you.

The regulatory skepticism looks more justified when you examine the Eightco deal closely. The 3000% surge is speculative mania, not organic adoption of proof-of-personhood infrastructure. Look at the drop:

If WLD drops further, Eightco’s entire thesis collapses. Countries are banning worldcoin and if the trend continues, the tokens become worthless. If the stock premium evaporates like it has for dozens of smaller crypto treasury companies, they can’t raise more capital without massive dilution.

Eightco is supposed to keep running its e-commerce inventory business while simultaneously managing a Worldcoin treasury. This dual mandate rarely works. You end up doing neither well.

Why Half the World Is Banning This Thing

Kenya doesn’t want Worldcoin. Neither does Spain. Or Brazil. Or Germany, Hong Kong, Portugal, Indonesia, or Colombia. The regulatory backlash has been swift and very aggressive, but why?

Kenya: Ruled it illegal, ordered all biometric data deleted, and cited paying people in crypto as coercive consent.

Spain: Banned from collecting data from minors without transparency or withdrawal mechanisms.

Brazil: Blanket ban with $8,800 daily fines. Crypto compensation compromises valid consent.

Germany: Ordered GDPR-compliant deletion of data collected “without sufficient legal basis.”

Hong Kong: Banned for excessive surveillance, especially considering plans to retain iris images for a decade.

Portugal: 90-day suspension due to insufficient information and consent issues.

Indonesia: Suspended for suspicious activity and registration violations.

Colombia: Under investigation, citizens warned to avoid participation.

Regulators see a company paying people, especially in developing countries, to scan their irises in exchange for tokens. They see permanent biometric data being collected without robust consent frameworks. They see a system that could become a surveillance tool in the wrong hands.

Some objections miss the technical nuances. Germany’s demand for “deletion” of iris codes doesn’t make cryptographic sense. The codes are mathematical hashes, not recoverable biometric data. Deleting them doesn’t “return” your iris pattern.

But Kenya’s objection? That one’s harder to dismiss. When you’re offering WLD tokens worth real money to someone living on $2 a day, is that “free consent”? Or is it economic coercion dressed up as innovation?

Where I Stand

I’m with Vitalik on this one.

Vitalik Buterin has been one of the most thoughtful critics of biometric proof-of-personhood systems. He acknowledges they address genuine problems that will intensify as AI capabilities advance, but he’s raised critical concerns about implementation.

His main worry is that one-ID-per-person systems risk eroding pseudonymity and exposing users to coercion. “In the real world, pseudonymity generally requires having multiple accounts,” he wrote. “If it’s common knowledge that everyone has only one identity, you can be coerced into revealing it.”

Vitalik proposes what he calls “pluralistic identity”: an ecosystem of overlapping, competing identity systems rather than a single dominant solution. This could be explicit, like social-graph-based verification, where trust comes from your community, or implicit, like the current patchwork of passports, social logins, and other credentials.

His argument resonates because it acknowledges the tension at the heart of World’s project. Yes, we need ways to verify humanness. Yes, bot dominance and AI-generated fraud are real problems. But the solution shouldn’t create new vectors for surveillance, coercion, and control.

The Orb requirement creates unavoidable centralisation. Despite all the talk about decentralisation and privacy-preserving cryptography, you still need to physically visit a proprietary hardware device controlled by a single company. That’s a chokepoint. That’s a honeypot of sensitive data, even if it’s encrypted and anonymised.

The global regulatory pushback is a legitimate response to the risks associated with concentrating biometric identity infrastructure in the hands of a private company, regardless of its intentions.

Yes, proof-of-personhood matters. The bot problem is real and getting worse. But World’s approach of universal biometric scanning with centralised hardware isn’t the only path forward, and probably isn’t the best one.

We need multiple competing systems. Social proof. Reputation systems. Economic stake combined with identity verification. Community-based trust networks. Decentralised identifiers that don’t require specialised hardware. A messy, pluralistic approach that resists capture by any single entity.

The risk with the world isn’t that it fails. The risk is that it succeeds too well, becomes too dominant, and we wake up in a world where accessing basic digital services requires surrendering your biometric data to a corporate identity layer. That’s not a future I want, even if it solves the bot problem.

The attention and capital flowing into World right now, the Eightco deal, the institutional backing, all of it reflects genuine demand for solutions to digital authenticity. But demand for a solution doesn’t mean this particular solution is the right one.

We’re at a fork in the road. One path leads to universal biometric identity controlled by a handful of companies. The other leads to pluralistic, user-controlled systems that preserve privacy while enabling verification. The choice we make now will shape digital identity for decades.

I’m betting on pluralism. I’m betting on multiple competing approaches. I’m betting that the messiness of diverse systems beats the efficiency of centralised control, every time.

Because once you hand over your iris scan, you can’t take it back. And in a world of AI agents and synthetic media, the one thing you can’t afford to lose is control over proving who you are.

That’s it for the day. See you next week with another one.

Until then … stay calm and DYOR,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Nice

👍