I was glued to my screen this Thursday as Gold prices dropped by more than 4% in a matter of minutes. Reports say $3 trillions were wiped out from the Gold market, nearly equivalent to the entire market cap of crypto.

Take a second to let that sink in.

When a supposed safe-haven asset can drop 4% in minutes, it’s only natural to question: what even qualifies as a safe asset anymore? However, the market is gaining momentum again, and my personal thesis is that the rally is not over yet, not until we see signs of dollar strength, fewer global conflicts, or real estate stability in China.

But that is a discussion for another time. Today, we’re diving into something different.

The story of bringing capital formation mechanisms to the unbanked.

Where do we raise?

The financial incentives that drive crypto volumes have historically proven to be an excellent source of capital formation. Companies or ideas seeking to bootstrap their ventures can tap into global, frictionless capital across multiple platforms today.

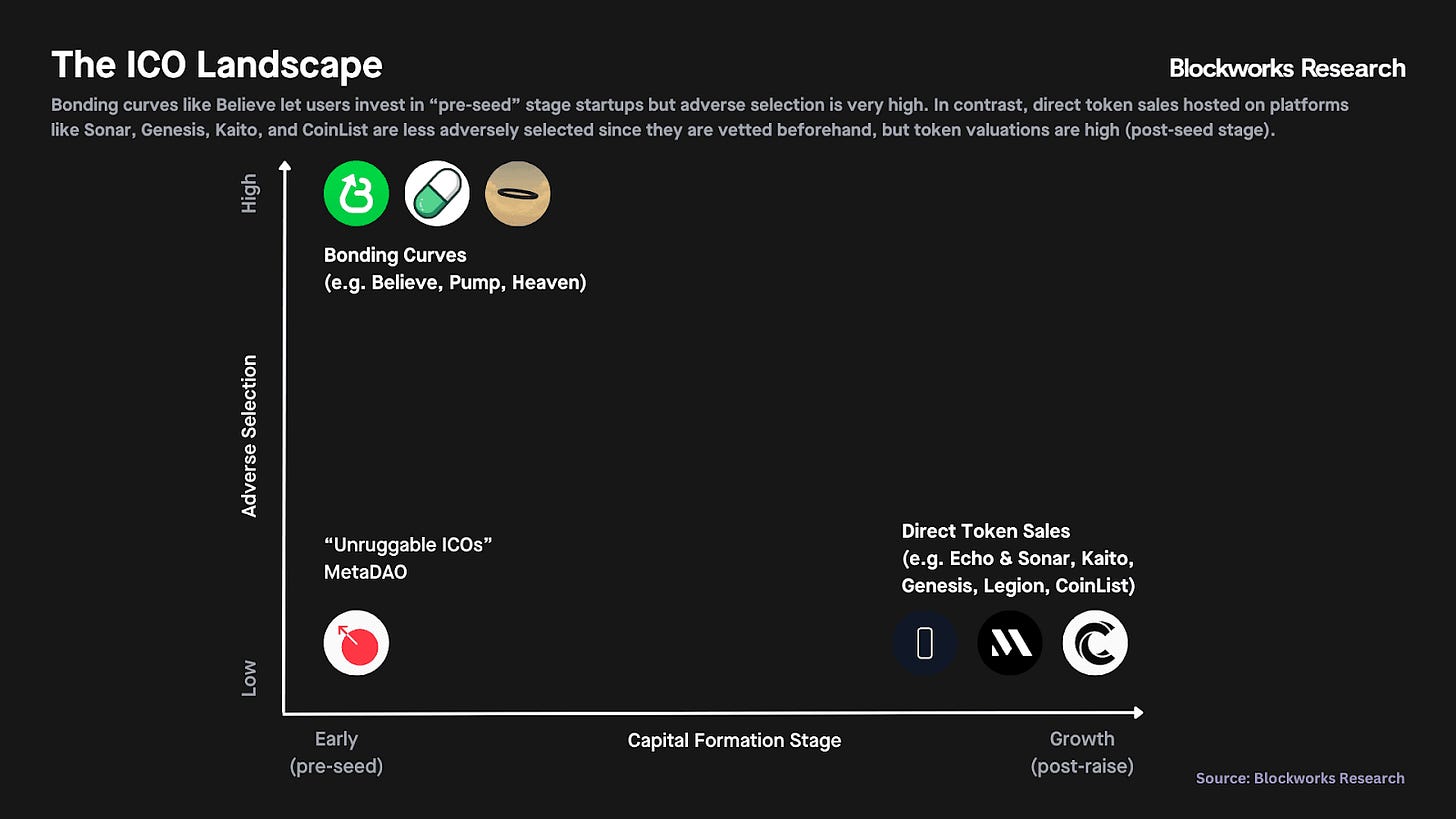

The distinction among these fundraising platforms lies in their selection mechanisms. We have both - permissionless launches for coins with no selection criteria - and platforms that allow ICOs by teams who have either proven their product or already gone through a previous round of funding.

While platforms like Echo, Kaito, and Buildpad are great products, they serve a different purpose than Pumpfun or Believe. Their goal is to help products with a proven track record raise capital and match them with investors looking to invest in established, post-raise teams.

However, one of crypto’s core principles is to bank the unbanked. To bring financial leverage to people around the world who can’t access it from traditional methods. Pumpfun, Believe and other permissionless capital formation platforms solve this problem. Anyone from a third-world country in Africa, or with little to no credibility to back them, can raise capital on Pumpfun or Believe today by launching a coin for their product; there’s no gating.

However, as we are well aware, there are little to no utility coins on these platforms themselves. They are either memecoins or are completely unrelated to the end product, making them hard to “Believe” in.

Believe, which caters to Web 2 native indie developers seeking small funds to build viral apps, clearly states in its terms of service that “Creator Tokens do not represent any ownership, equity, profit-sharing or entitlement to financial returns.” Founders on Believe structure tokens essentially as memecoins, offering no financial upside or equity to token holders.

While this limitation may be a result of existing laws, it creates a situation where founders on Believe are likely to be adversely selected, and they are launching there because they couldn’t be funded traditionally. Legally, tokens on Believe are really not much different from memecoins launched on Pump or Heaven.

For any serious early-stage founder looking to raise funds to build a product, the options are few. One of them is MetaDAO.

We’ve talked about MetaDAO multiple times on this newsletter, the most recent one by Prathik discussing the Ranger ICO, and another when I wrote about how MetaDAO helps curate the investors for ICO launches.

The project has been on our minds for some time now, but today we want to discuss where it’s going from here. A future vision we imagine for it.

But before that, a rundown for those new to MetaDAO.

Sweet sweet MetaDAO

MetaDAO adopts a novel approach towards its ICOs. Projects raising capital through MataDAO don’t actually receive the funds they raise. Instead, all capital sits in an on-chain treasury where conditional markets validate every expenditure. Teams must propose how they intend to spend, and tokenholders bet on whether those actions will create value. Only if the market agrees does the transaction go through. Its fundraising is rewritten as governance, a structure in which financial control is distributed and code replaces trust.

The investors also gain legal protection against revenue rugs. The founder assigns the intellectual property (IP) of the project (domain names, software, social media accounts, etc.) to a legal entity that recognizes the futarchy governance mechanism as the ultimate decider.

Serious founders looking for capital can benefit from this. Launching on MetaDAO sends a credible signal to markets that they are serious about building, and they can attract their first power users through incentive alignment. Additionally, tokens are designed from first principles and can be minted via futarchy proposals to fund value-accretive opportunities.

This means that serious founders, anywhere in the world, building a product worth investing in, can fundraise through MetaDAO, while giving ownership to investors in its IP. Investors can be more certain that their funds are not going to an unworthy product.

This was not possible until now. An early-stage founder lacked the two most important things required to fundraise - trust from its investors and curated investors who believe in their vision and won’t trade the product coin for quick profits.

The first problem is solved by the MetaDAO mechanism as we discussed. And well, the second one is a result of it.

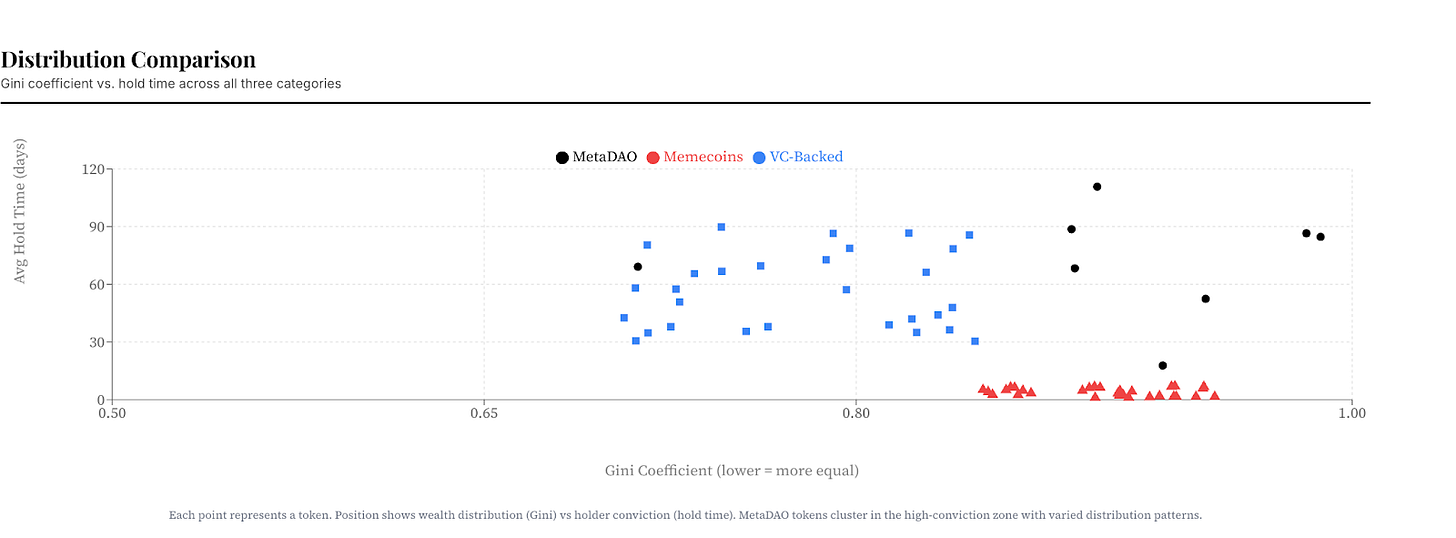

If you look closely at top VC-backed tokens and memecoins and compare them with MetaDAo coins, you will notice a very interesting detail.

The average hold time of a MetaDAO coin is 73 days, approximately a month higher than the average hold time for VC tokens and way higher than memecoins at 4 days.

This is what sets MetaDAO apart. The founders launching a token here can be assured that their investors will be long-term committed to their cause, a rare thing in crypto.

For the Future

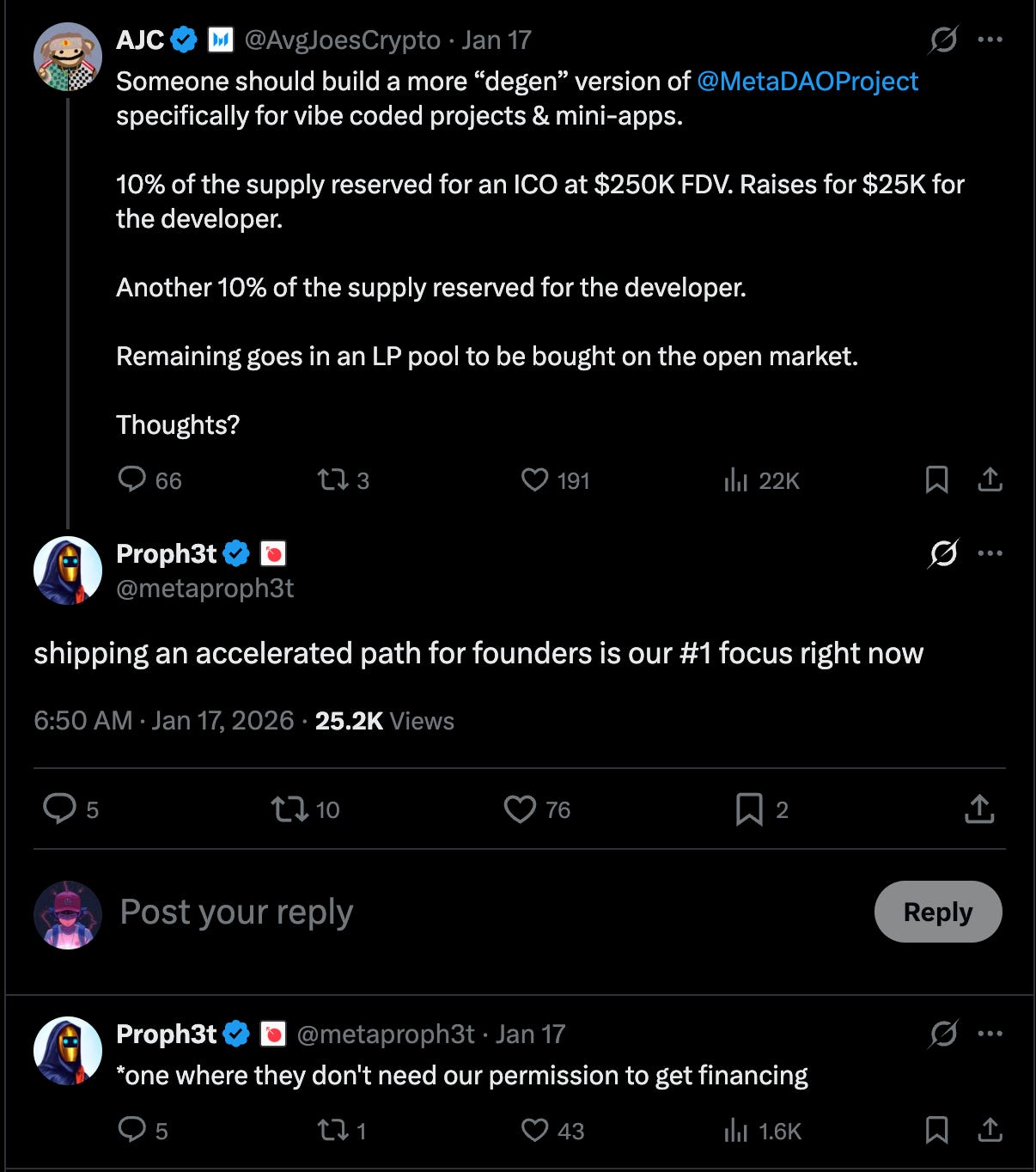

Now the caveat - MetaDAO as of today is permissioned and the process of vetting who can launch a coin is manually done by the team. They pick and choose amongst those who apply based on the quality of the project and the founder.

If the vision of empowering founders around the globe to fundraise easily is to be realised, the platform has to be permissionless. The additional friction can bring human biases and can make the system susceptible to past credibility, something we were trying to avoid all along.

The team understands this and plans to go permissionless soon.

In an era when anyone can build a fully functioning product using Claude, it will be insane to have the ability to raise and scale it up as easily as building it. We already saw a wave of Claude coins come and die within days on Pump. Some even touched $40-60M market cap.

While they were a failed experiment on Pump, they might be much more real on MetaDAO. The builders would get a chance to raise funds and scale their Claude project while the investors are ensured ownership and defensibility.

How much can these projects raise when there are a hundred of them daily, or how would a user differentiate between the good and the bad ones - these are a few questions that will be important to figure out before making the platform permissionless. It can make or break the system, because we don’t need another Pumpfun mechanism - one is enough - what we need is a way to make early-stage fundraisers credible and scalable to everyone in and outside crypto.

I believe we will get there.

Until then, keep an eye on the metals!

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Nice dissection of the trust paradox in early-stage funding. That 73-day hold time stat really caught my attention becuase it suggests the futarchy model naturally filters for aligned investors, not just speculative flips. Reminds me of working with a startup founder who spent more time vetting investors than actually pitching, turned out the wrong cap table caused way more problems then funding ever solved.