Hello

ICOs are back, and launchpads are flocking in to take a part of the pie.

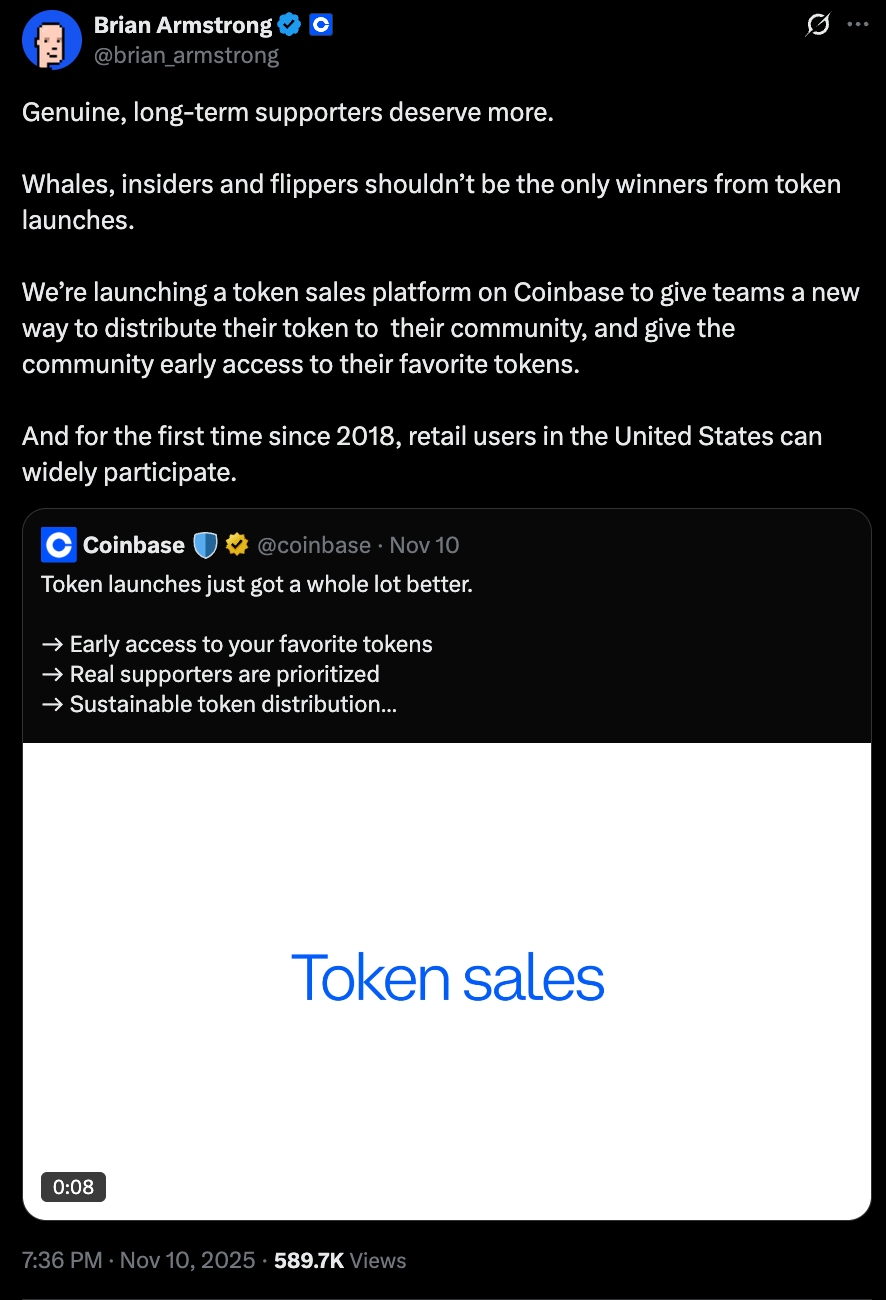

In October, Coinbase acquired Echo and launched its token-sale platform earlier this month, while in September Kraken teamed up with Legion. Meanwhile, Binance is cosy with Buidlpad, and PumpFun is trying its hand at utility-coin launches through Spotlight.

The developments come at a time when investor interest and trust in ICOs are rebounding.

Umbra Privacy pulled in $156 million on MetaDAO for a $750,000-ask, while Yieldbasis was oversubscribed 98 times in under a day on Legion. Aria Protocol on Buidlpad was oversubscribed by 20x with 30,000+ users piling in.

As ICOs start pulling in capital at multiples of the ask, it’s important to filter the noise.

In our November 9 edition, Saurabh explained how capital formation is evolving in the crypto space. He discussed how new fundraising architectures, such as Fyiling Tulip’s investment model and MetaDAO’s ICOs, are trying to resolve the underlying tension among teams, investors, and users. Each new model claims to balance these interests better.

While the success of those models is still up for testing, we are seeing launchpads trying to address the investor-user-team tension in different ways. They are architecting cap table curation by allowing teams to choose the investors for their public token sales.

In today’s piece, I take you through why and how investor curation is happening.

Nishil

GigaStar: Creator Economy Meets Investment

Creators now can offer a share of their future revenue to their fans and investors. GigaStar makes it possible!

Build your creator brand, raise funds, retain your IP

Investors gain access to “Channel Revenue Tokens (CRTs)” that represent revenue share rights

Record-breaking results: multi-million dollar channels raised, thousands of investors joined

Whether you’re a creator or an investor looking to get ahead of the creator economy boom, GigaStar is the bridge.

Discover GigaStar!

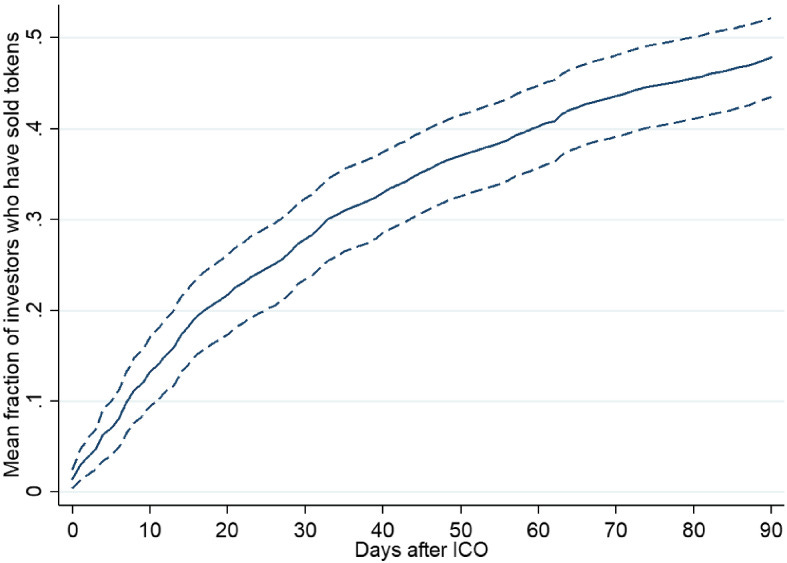

Between 2017-2019, ICO investing was mostly first-come, first-served, where investors flocked to participate and get in at a lower valuation, generally to make a quick buck at launch. Data from research on 300+ ICO launches shows that 30% of investors exited the ICO in the first month.

While quick returns will always tempt investors, projects aren’t obligated to accept every wallet that waves capital at them. Serious teams should be able to choose their ICO participants to filter for investors committed to long-term outcomes.

Here’s Eigencloud’s Ditto discussing a shift from FCFS sales towards a community-focused sales system.

The problem with this ICO cycle was that it ended up facing a lemon market problem. Too many ICOs were launched, many of them rugs or scams, making it hard to distinguish good projects from bad ones.

Launchpads could not carefully vet all that were launched, leading to low investor trust in ICOs. Eventually, it led to an abundance of ICOs, but not enough capital was willing to back them.

The tides seem to be shifting again, now.

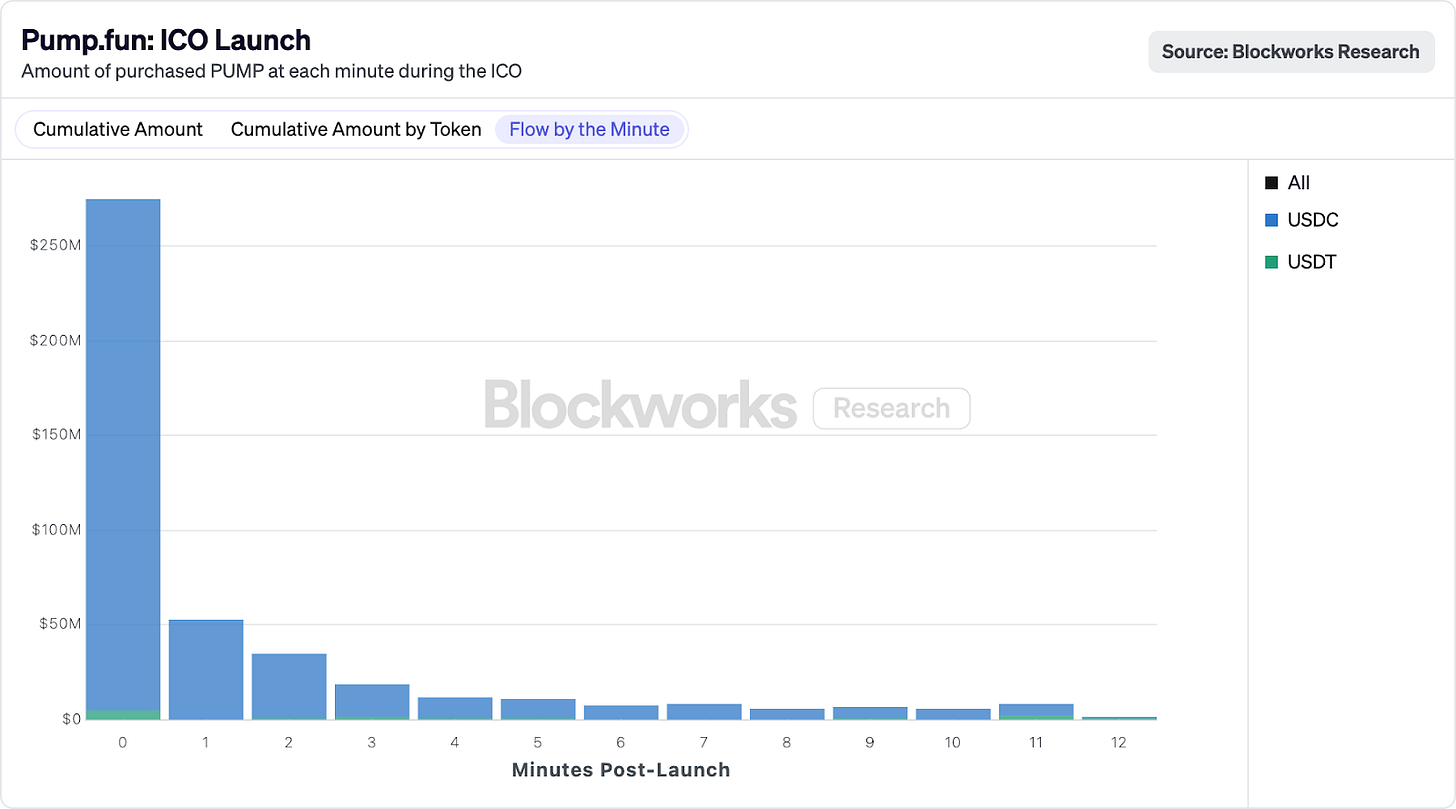

Echo, the fundraising platform by Cobie, has raised $200 million across 300+ supported projects since its launch. Meanwhile, at independent fundraisers, we’ve seen millions being raised in a matter of minutes. Pump.fun led a successful ICO, raising $500 million in under 12 minutes, and Plasma collected $373 million for a $50 million ask in their public XPL sale.

This shift is seen not just among token launches but also among launchpads. Newer ones like Legion, Umbra and Echo promise better transparency, clearer mechanisms, and more thoughtful structures for both founders and investors. They are removing information asymmetry, allowing investors to see peaches from lemons. The investors now have clear knowledge of the valuation, the raise amount, and details about the project they are betting on, with better protection against rug pulls.

This has brought back capital into ICO investments, with projects getting oversubscribed, way above their ask.

New launchpads are also focusing on curating an investment community aligned with the long-term vision of the project.

After Coinbase acquired Echo, they announced their own token sales platform with a sharp focus on vetting users based on their alignment. Currently, they do this by tracking users’ token-selling patterns. Participants who sell within 30 days of the sale get a lower allocation, with more alignment metrics to be announced soon.

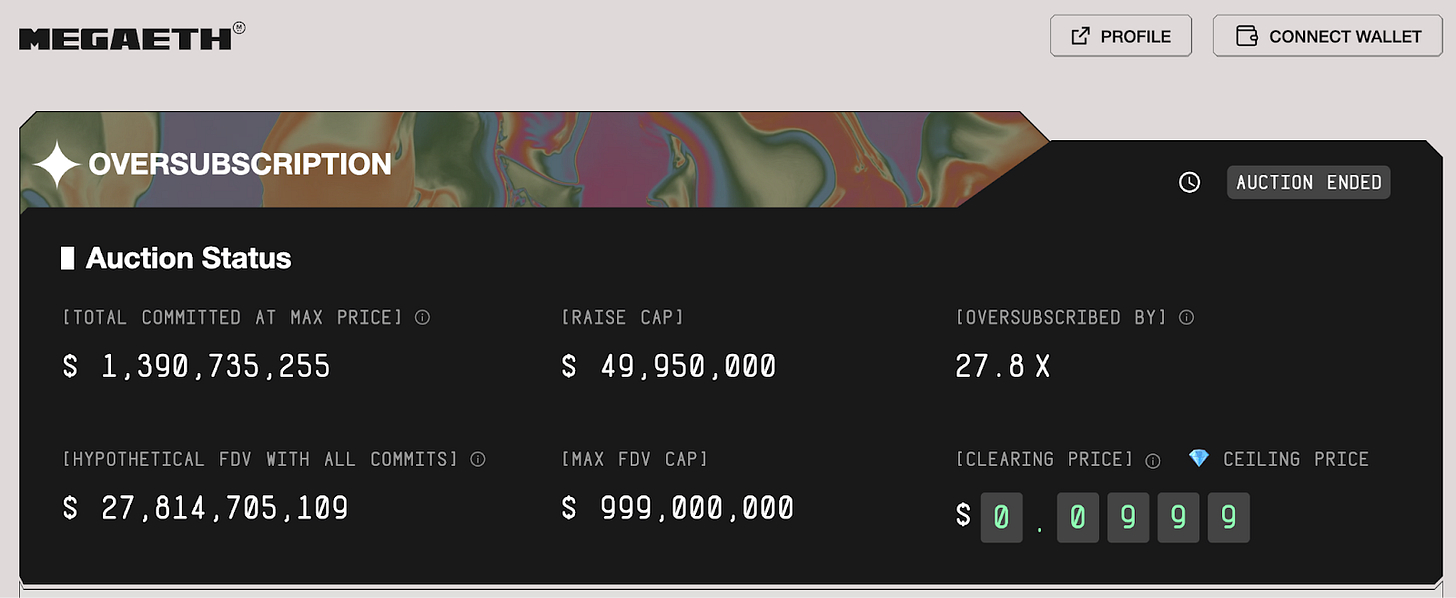

This shift in community-centric vision in token allocations is evident in how selectively Monad’s airdrop was designed and in MegaETH’s ICO allocations that focused on community members.

Read: Speed without Shortcuts

MegaETH was oversubscribed ~28 times. It had asked users to link their social profiles and wallets with on-chain history to curate a list of token holders who they believe are best aligned with the project.

This is the shift we are seeing: when capital to participate in ICOs is abundant again, projects need to choose whom to allocate to. The new launchpads solve for that.

Next Gen Launchpads

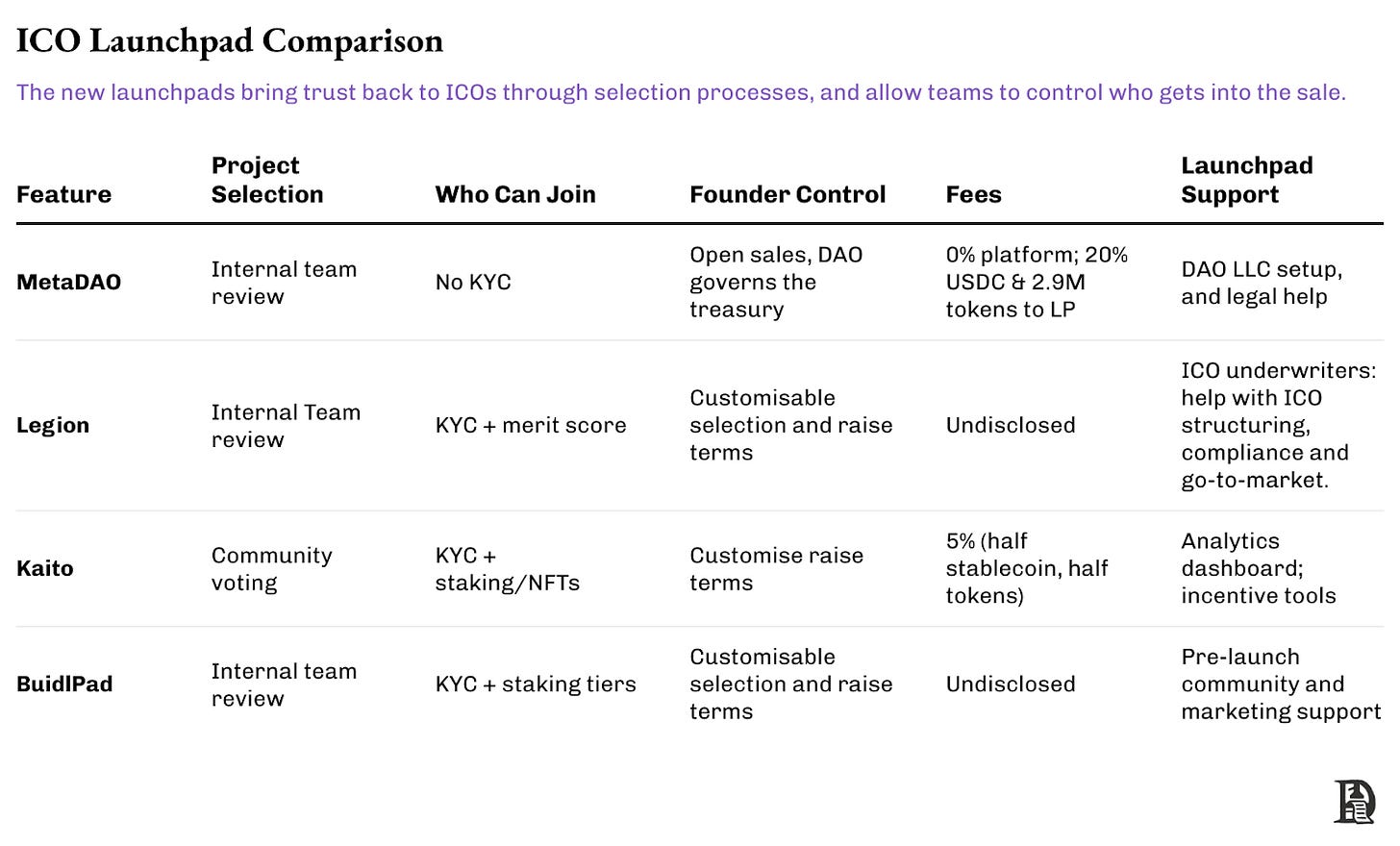

We now have Legion, Buidlpad, MetaDAO and Kaito emerging as new launchpad models. While the first step is to vet the ICO projects to ensure investor trust in the launchpad, the next step is to vet the participating investors to ensure allocation is curated according to the project’s criteria.

With a focus on merit-based allocations, Legion provides the most comprehensive system to rank a community member. The launchpad has completed 17 token launches, with the highest oversubscription rate of ~100X for a recent token launch.

To ensure tokens reach the right hands in an oversubscribed sale, each participant is assigned a Legion Score that accounts for their on-chain history and activity across protocols, developer credentials (such as GitHub contributions), social influence, network reach, and qualitative statements about their intended contribution to the project.

Founders launching on Legion get to choose the allocation metrics, be it developer engagement, social reach, KOL (Key Opinion Leader) participation, or community education, and assign weights accordingly.

Kaito offers a more focused approach by providing allocation to ‘yappers’, active participants in Twitter discussions. Participation is weighted and dependent on the user’s voting reputation and yap influence, staked $KAITO amounts and genesis NFT rarity. Founders can choose from these preferred supporter profiles.

Kaito’s model allows projects to secure influential social media participants as early investors. This strategy can be useful for projects where early-stage visibility matters.

With Buidlpad, the core focus has been towards capital-based allocation. The more a user stakes to participate in a token sale, the more tokens they are allocated. However, this leaves participation open to the wallets with capital.

To balance this capital-based system, Buidlpad introduced a “Squad System,” which rewards community participation and qualitative contributions. Activities like content creation, education, and social outreach earn leaderboard points and bonus rewards.

The most unique among these four launchpads is MetaDAO. The treasuries built through the MetaDAO ICOs are governed through a market-based governance system called Futarchy. Futarchy is futures trading of the underlying token, but based on governance decisions instead of price.

All raised capital sits in an on-chain treasury where conditional markets validate every expenditure. Teams must propose how they intend to spend, and token holders bet on whether those actions will create value. Only if the market agrees does the transaction go through.

Investor participation in the MetaDAO ICOs is permissionless and open, and everyone gets an allocation based on their capital contributed. However, the community and alignment curation for token holders happens after the ICO. Each proposal is a market in Futarchy, which allows traders to either sell the token if the proposal passes or buy more. Hence, it enables a token-holder base to form based on the decisions being made.

While curated allocation is what I focused on in this piece, from a founder’s perspective, there are many more factors to consider before you make your ICO launch decision, such as project selection criteria, founder flexibility, platform fees and post-launch support. Here’s a comparison table to help you understand all of them at a glance.

Web3 can bring together users, traders and contributors through incentives distributed based on verifiable reputation systems. Without the mechanisms to weed out bad actors or onboard the right ones, much of the community token sales will remain jejune, filled with a mix of both believers and non-believers. The current launchpads give teams a shot at improving their token economies and starting right.

Projects need tools that can identify the right users in their ecosystem and reward them for real contributions. That includes users with influence and an active community behind them. It also includes founders or builders who create useful applications and experiences for others. These are examples of profiles that play a role in moving the ecosystem forward and should be incentivised to stay for a longer term.

If the current momentum holds, the next generation of launchpads might help address community bootstrapping issues in crypto, a problem that airdrops have not been able to solve.

That’s it for this week, see you with the next one.

Until then, stay curious,

Nishil

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.