Galaxy Builds Beyond BTC

A record year, a rough quarter and a billion-dollar pivot

Hello,

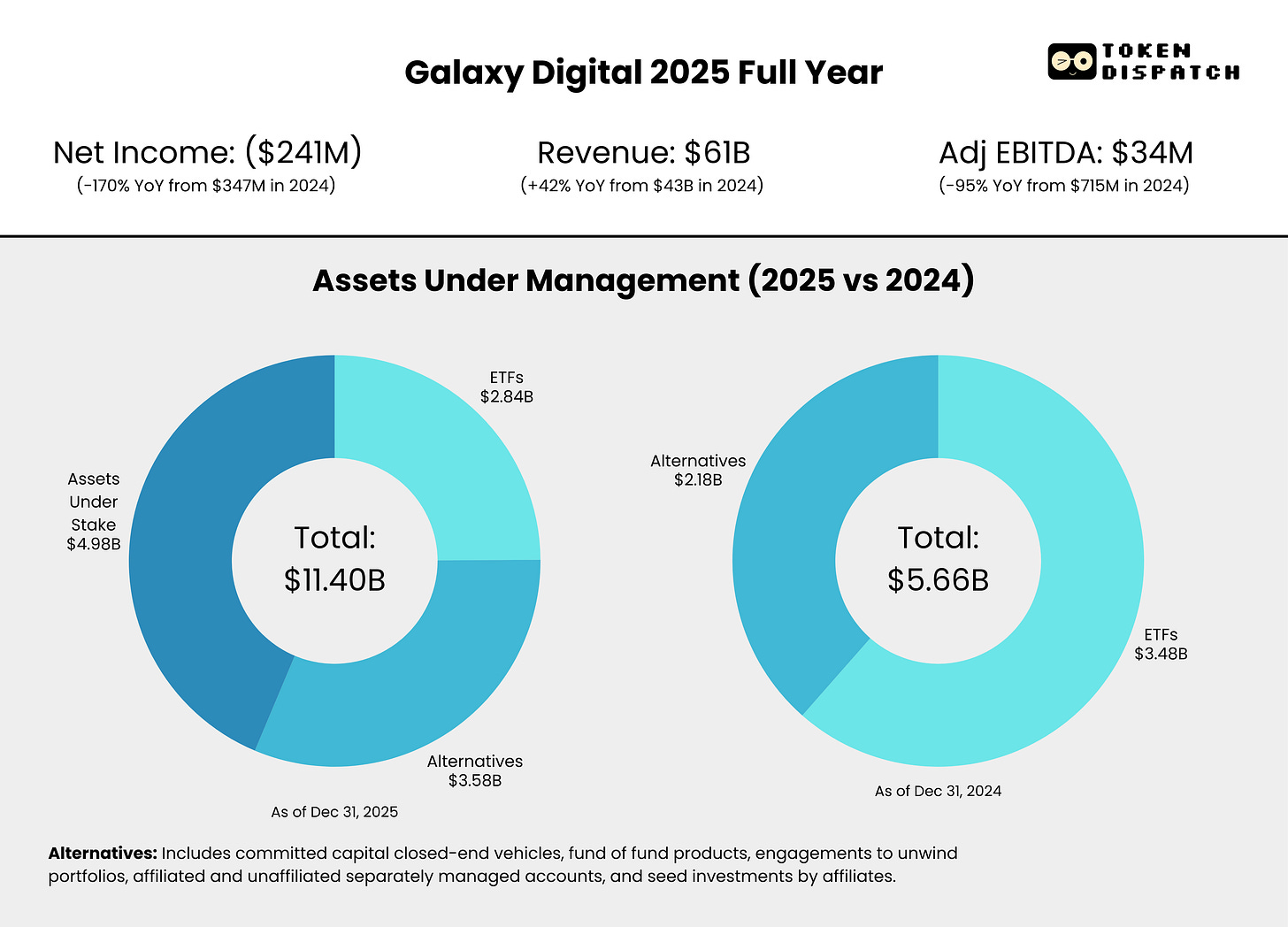

When I first looked at Galaxy Digital’s Q4 numbers, they seemed brutal. A $482 million loss in the final quarter of the year nearly erased the $505 million net income recorded in the previous quarter. Diluted earnings per share of negative $1.08 marked the firm’s worst quarter since the 2022 crypto winter for the asset-management and data centre solutions provider.At first glance, the figures look disastrous. But while numbers don’t lie, they are often misinterpreted.

As I dug deeper, Galaxy’s full-year results revealed nuances that are crucial to charting the company’s future trajectory. Behind this quarter’s net loss, which was solely driven by mark-to-market revaluations of digital assets, are events that most observers would miss unless they zoomed out.

Galaxy’s core operating business doubled its earnings for the full year. The firm also moved the Helios data centre project from blueprints and floor plans into brick-and-mortar construction.

While the market is pricing Galaxy for the quarter just ended, today’s analysis will help you value the company for what it is becoming.

Here we go.

TL;DR

Galaxy posts a $482 million net loss in Q4 2025, its worst quarter in over three years, as crypto market cap drops 24%

EBITDA in Digital Assets, its core operating segment, doubles to $247 million for the full year

Treasury & Corporate accounts for about 95% of Q4’s total adjusted EBITDA

Helios Phase 1 (133 MW) remains on track for H1 2026 delivery

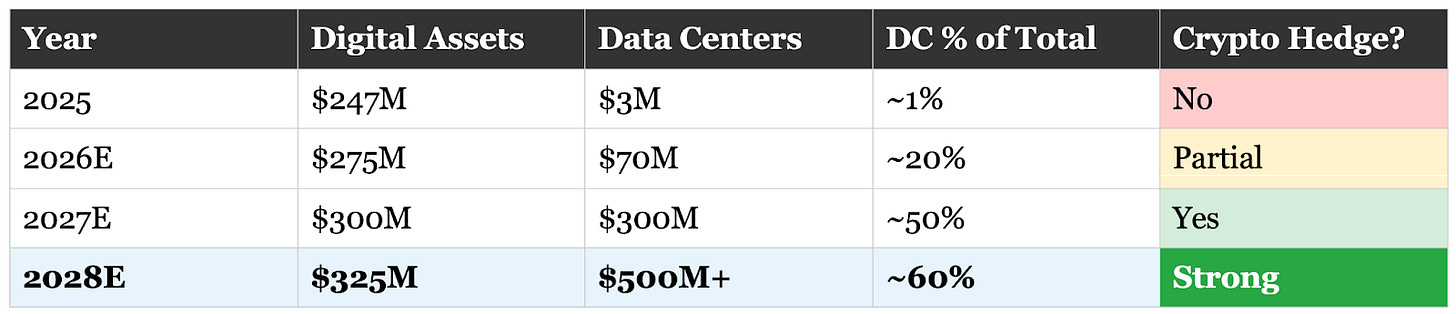

Two of three segments remain highly correlated with crypto; Data Centres may become the primary hedge beginning H2 2026

The Tale of Two Galaxies

Although Galaxy reported a $482 million net loss in Q4 2025, most of it came from one segment: Treasury & Corporate, where $1.68 billion in crypto holdings were marked down as the market fell by almost 25%. This segment maintains exposure to the digital asset ecosystem through a diversified allocation across spot positions, ETFs, equities, venture investments, private equity, and fund holdings.

To understand Galaxy’s trajectory, we must examine each segment separately.

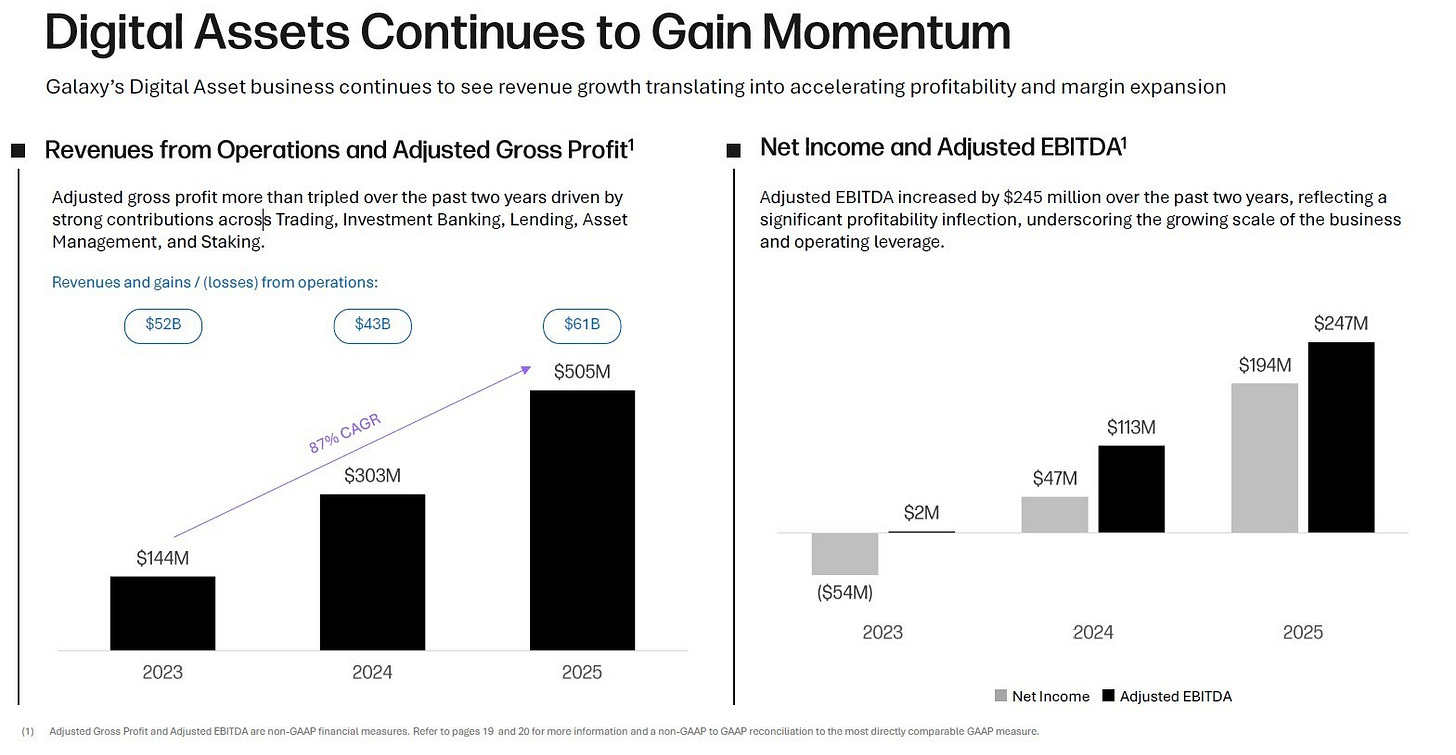

The Digital Assets division delivered its best year ever, posting $505 million in adjusted gross profit, up 67% from 2024. EBITDA more than doubled to $247 million from $113 million the prior year. Even amid Q4’s brutal conditions, when trading volumes fell 40% from Q3’s record-high levels, the segment recorded only a $29 million EBITDA loss.

The full-year numbers answer a question I asked in August: Can Galaxy build profitable layers around its thin-margin trading business?

Its loan book held steady at $1.8 billion despite falling asset prices. Trading counterparties rose to 1,620, up 6% quarter-on-quarter, even in a down market. The investment banking unit closed landmark transactions, including advising on one of the largest Bitcoin deals in history.

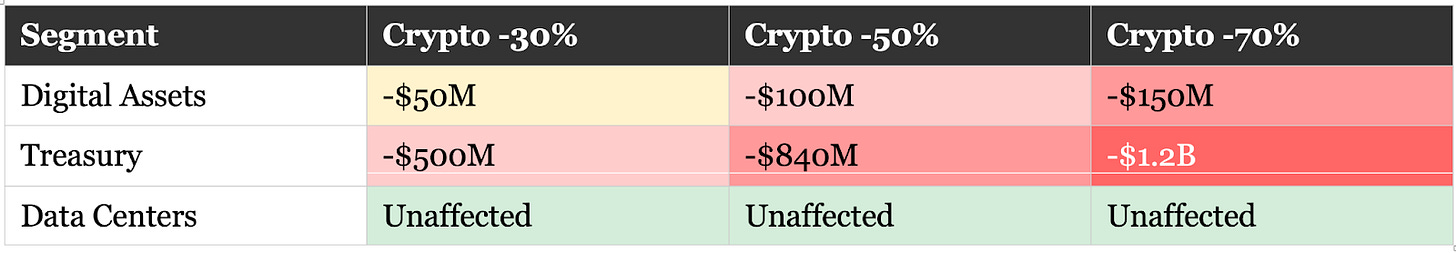

One concern remains amid these developments. Galaxy’s core business units are still highly correlated with crypto markets. A prolonged downturn could adversely affect its overall financial performance. At current asset levels, a 50% markdown in crypto prices could drive the earnings (EBITDA) of the Digital Assets segment approximately $100 million in the red.

This is where Galaxy’s work-in-progress data centre business becomes relevant. Its revenue-generating capacity is not dictated by BTC price swings or crypto narratives.

Turning Texas Real

When I last wrote about Galaxy in October, the Helios data centre site in Texas was largely theoretical. Financing had closed, contracts were signed, and bulldozers were warming up. Three months later, that paper reality has become more concrete, quite literally. Construction photos from January show a 345 kV substation, chiller yards, and a 125,000-square-foot data centre building taking shape.

In January, Galaxy doubled its total power capacity to 1.6 gigawatts (GW), with approval from the Electric Reliability Council of Texas (ERCOT) for an additional 830 MW.

This development is crucial because it provides the most compelling hedge against market cycles that could disrupt Galaxy’s other business segments — Digital Assets and Treasury & Corporate.

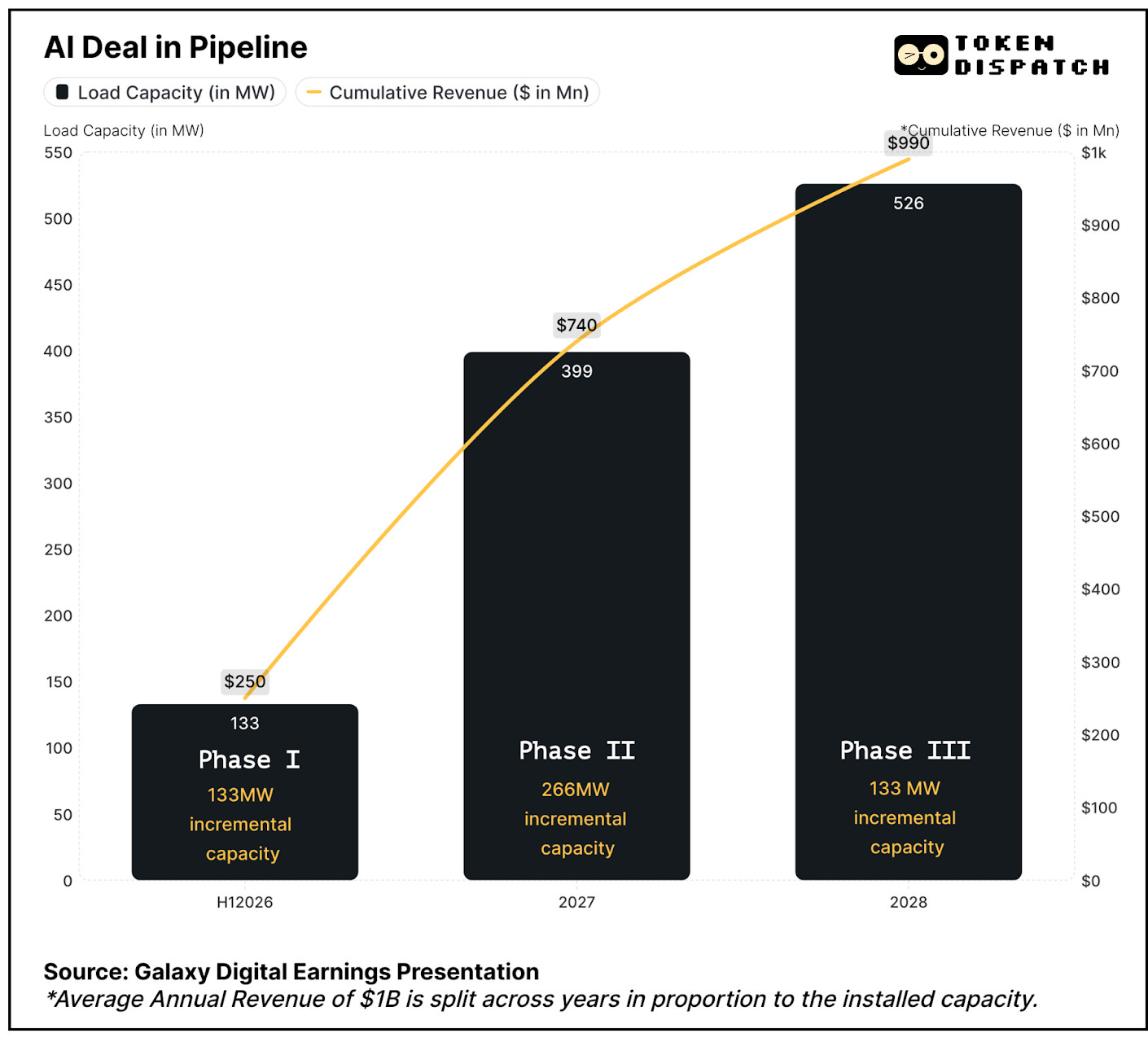

The economics behind the project are compelling: the 526 MW of capacity contracted to CoreWeave across three phases is projected to generate $1 billion in average annual revenue at a 90% EBITDA margin.

Although the second and third phases will require at least a couple more years to materialise, the prospective 2026 earnings alone could be a breakthrough for Galaxy’s business model.

Proportionate calculations indicate that revenue from full utilisation of data centres during Phase 1 is $250 million in H2 2026. But I don’t expect the site to be operational throughout the second half. Even by conservative estimates, if Phase 1 (133 MW) generates about $45-110 million in H2 2026, it will have laid a solid foundation for Galaxy to diversify its earnings and reliance.

In two years, assuming the Helios project progresses as planned, Data Centers could become Galaxy’s largest profit centre.

But can Galaxy survive long enough for Helio to matter? Especially if the current uncertainty and market conditions persist for longer periods of time?

Galaxy ended Q4 with $2.6 billion in cash and stablecoins. It also raised $325 million in equity and $1.3 billion in exchangeable notes. More importantly, Helios has $1.4 billion in project financing, non-recourse to other segments of the company. This signals that a robust bridge to diversification has been laid.

What does this mean for investors?

Today, GLXY’s fortune is closely tied to BTC and the larger crypto market. Its stock price has lost more than half its value over the past 20 days.

A 24% decline in crypto market cap led to a $482 million net loss, despite impressive operational performance. Such declines would still hurt in 2028, but they would also likely be offset by a more stable data centre revenue that could exceed $500 million.

The inflexion point will hedge Galaxy against losses from crypto market swings while allowing it to amplify gains during price rallies.

The Long View

For the past two quarters now, I have asked the same question: Is Galaxy successfully pivoting from volatility toward predictability? After tracking the business for three consecutive quarters, the direction is clearer than ever.

Its core business remains strong despite the volatile crypto cycles. Yet, I consider the data centre pivot a step in the right direction. That’s because Galaxy isn’t approaching the project as a back-up hedge option. Galaxy appears committed to making the Helios site its biggest profit centre. That’s evident from the fact that, once complete, the site will be the largest known 100% front-of-the-meter data centre and that Galaxy has already secured a 1.4-billion non-recourse project financing for it.

While the inflexion point remains at least two years away, GLXY’s fortress balance sheet, anchored by cash and stablecoin, should inspire confidence among long-term investors.

That’s it for today’s analysis. I will be back with another one soon.

Until then - stay curious

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.