There’s a phenomenon that occurs when you add a suit to gambling. It raises the price.

If I let you bet on whether the Lakers will win tonight, that’s worth about $1.79 in regulatory scrutiny and a conversation with a state gaming commissioner.

But if I let you establish a long position on a binary outcome contract regarding the probabilistic resolution of a sporting event, that’s worth $100 million in venture capital and meetings with the CFTC.

Same concept. Different words. Wildly different treatment.

CEOs have built an entire theology around denying this. They’ve crafted sermons about “truth engines” and “information aggregation.” They have hired consultants to explain the difference between “event contracts” and “wagers.” They have also written white papers proving that what they are doing is fundamentally different from what DraftKings does, even though 60% of the volume on their platforms is people betting on sports.

The American Gambling Association put up a website and ran ads claiming this is just sports betting with a loophole. In response, the prediction market companies formed their own trade group, complete with a propaganda poll showing that Americans completely understand the difference and fully support these as “financial instruments, not gambling.”

The people using these platforms? They know what it is. We all know what it is. The only people pretending are those with a regulatory reason to do so.

The debate centers around whether insider trading is a feature or a bug (read it again, it’s not even a debate).

The debate is ongoing, and no one has definitively won, but Hyperliquid decided to stop caring about it. And that’s what we are talking about today.

Hyperliquid rolled out HIP-4, a proposal to add “Outcome Trading” to its platform. The HYPE token surged 10% on the news. And if you read the proposal, it definitely doesn’t talk about a fix.

Hyperliquid is not positioning these as journalism or crowdsourced wisdom. It’s packaging outcome risk as a financial primitive and plugging it directly into a derivatives trading engine.

Read: Hyperliquid: House of Finance 🏦 - by Prathik Desai

It might not be the best thing to happen to the world this week, but it’s one of the most honest things anyone has done with prediction markets in years.

Now, guess who said this:

“If your goal is to actually, for the 99% of people trying to get a signal about what’s going to happen in the world, like, is the Suez Canal going to be reopened or whatever? You actually want insider trading,”... “You want some admiral sitting on a ship in the Suez Canal, who has really good information, to be trading so you get better, higher quality signals out of them, right?

“Now, if you want to preserve the integrity of those markets, maybe you don’t want insider trading, right?”

The same guy is currently facing a $2.9 billion insider trading lawsuit filed in 2023. Yes, Coinbase’s Brian Armstrong. Let’s not even open the Coinbase gate issue, that’s for another day.

Let’s go back to what VoidZilla pointed out weeks ago. The “truth” these markets are supposed to reveal only comes from people leaking non-public information for profit. The gate we opened last week: Truth Comes Later - by Thejaswini M A - Token Dispatch

Time to enter Hyperliquid with HIP-4

The proposal introduces “Outcome Contracts” as a new financial primitive. These are fully collateralised, non-leveraged instruments that settle within a fixed price range. They can be used for prediction markets(binary yes/no events) or for options-style derivatives.

The key difference is that Hyperliquid isn’t building a standalone platform. It’s integrating outcome trading directly into its existing derivatives exchange. Same trading engine. Same margin system. Same stablecoin (USDH).

On Hyperliquid, an outcome contract sits in the same margin account as your perpetual futures on ETH, your tokenised exposure to gold, and your leveraged bet on Nasdaq futures. The system automatically offsets risks across all of them. If you’re long ETH perps and you buy an outcome contract that pays if ETH crashes, your margin requirement drops because the positions hedge each other.

This is what Hyperliquid calls “unified margin,” and it turns prediction markets from sentiment trackers into risk management tools.

The contracts are also fully collateralised, which means no leverage, no margin calls, no liquidations. You pay upfront for the maximum possible loss. If you buy a contract for $0.30 that pays $1 if your outcome hits, you’ve locked in your risk. The market can’t liquidate you. You can’t get blown out by a sudden price move.

This is a big deal because it removes the risk factor that makes leverage in prediction markets so dangerous: the cascade effect, where one person’s liquidation triggers another’s and suddenly the whole market is mispriced because forced sellers are dumbing positions.

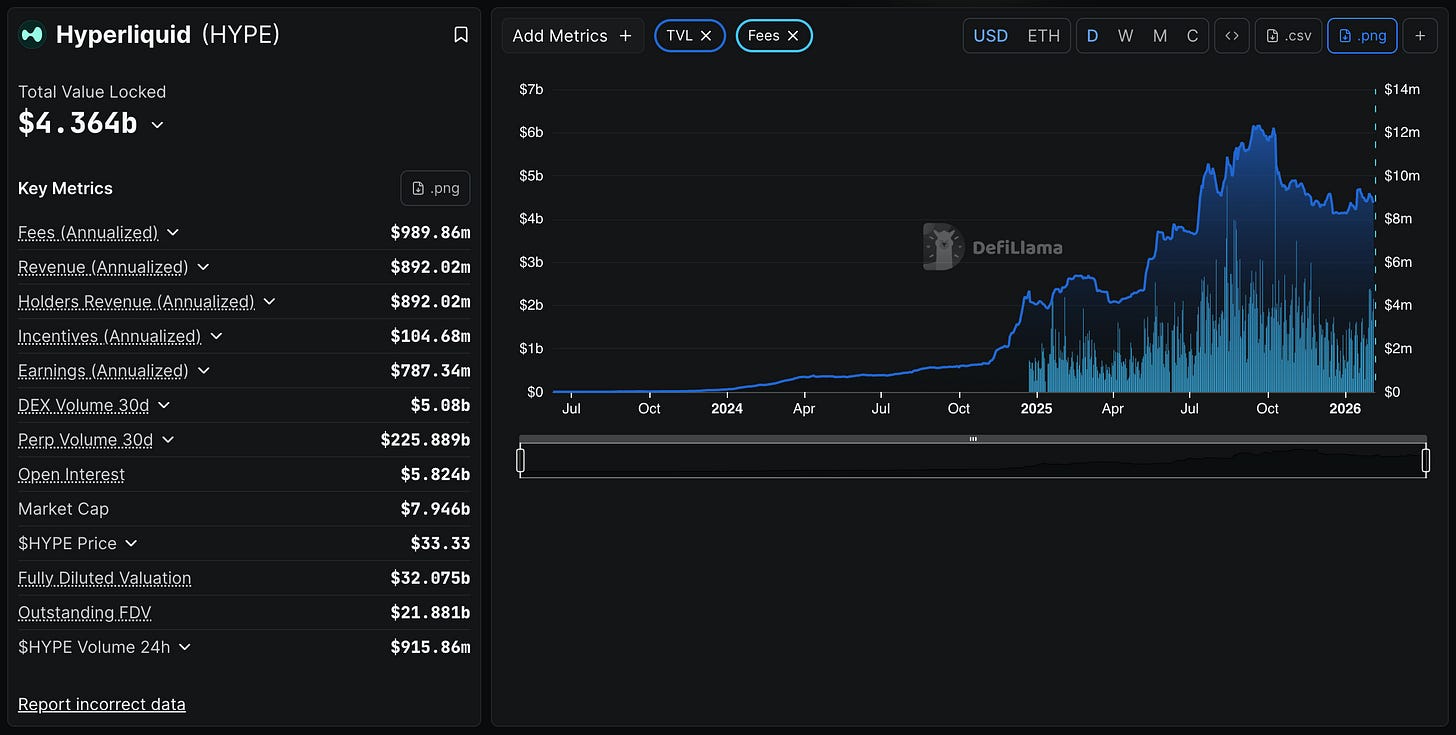

Hyperliquid is the crypto project performing absurdly well right now, which gives it room to experiment. HYPE was up 36% in the past week, while Bitcoin dropped 10% and Ethereum dropped 18%.

$4.5 billion in TVL. $887 million in annualised revenue. That’s 160x what dYdX (the previous leader in decentralised perps) generates.

Part of the hype is HIP-4. Part of it is HIP -3, which enables permissionless markets for real-world assets. Traders can now trade Nasdaq futures, gold, silver, and even pre-IPO exposure to SpaceX. Silver perps alone hit $1.2 billion in daily volume.

Hyperliquid is becoming more of a cross-asset trading venue that happens to run on a blockchain.

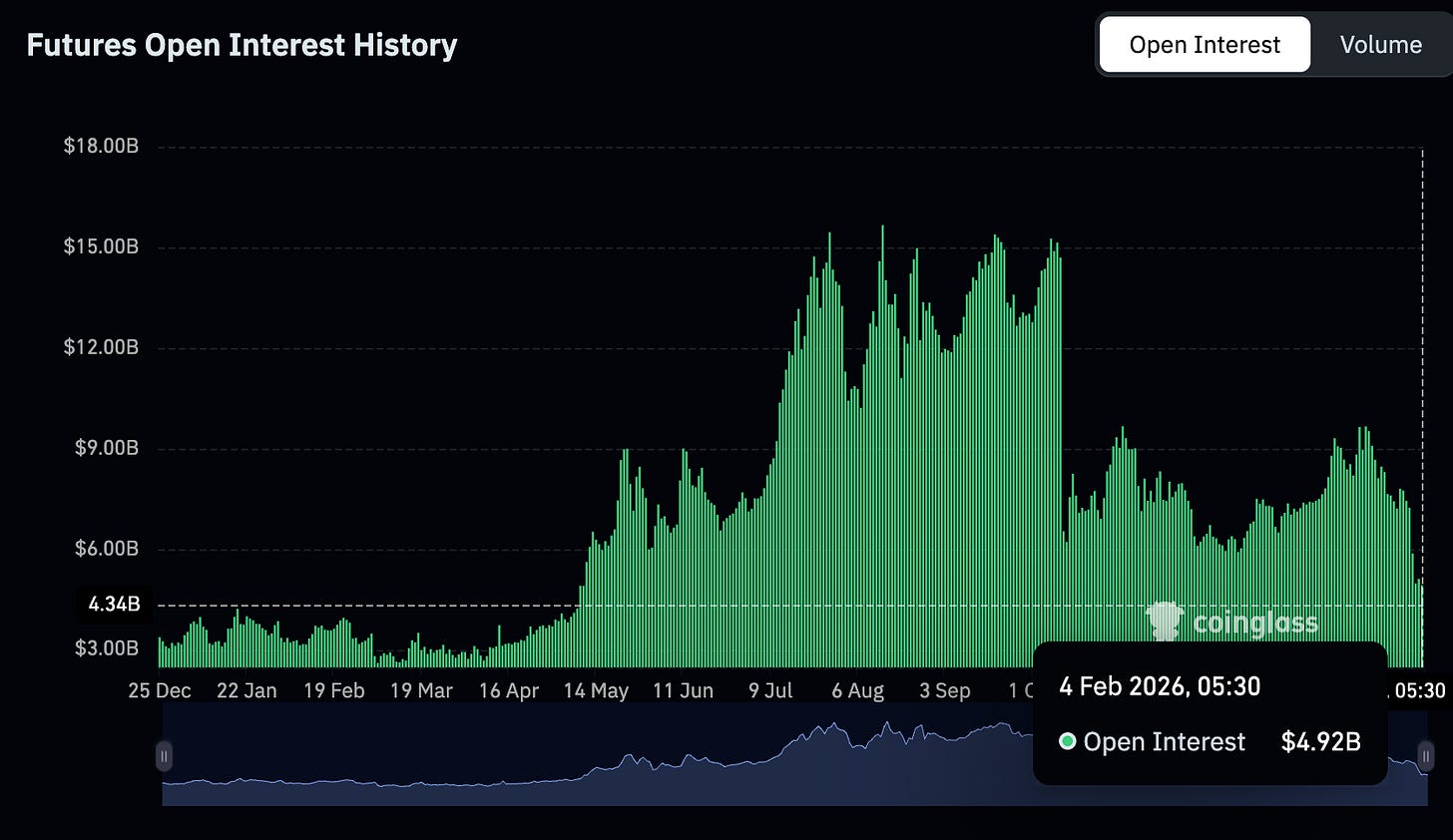

The prediction market sector is booming but also unstable.

Weekly volume peaked at $6 billion during the 2024 election. Polymarket dominated with a 60-70% share. But post-election, volume dropped hard. Without major events to bet on, users leave.

Open interest surged past $1 billion in late 2024, then collapsed. It’s been hovering around $200-400 million since.

Polymarket went from zero to 400,000 weekly users at its peak. Then users left when the election ended. And it’s clear that these are event-driven speculations, not integrated tools. People show up for big bets, and they leave when it resolves. Hyperliquid is betting that unified margin will change this. Instead of discrete bets, they become hedges. Instead of isolated positions, they become portfolio tools.

Regulation is pushing everything toward finance rather than journalism.

The CFTC, under Michael Selig, views prediction markets as commodity derivatives. They withdrew the rule that would have banned political and sports betting. They are helping Polymarket return to the US under full regulation.

Polymarket’s path back to acquiring QCEX, a CFTC-licensed exchange, cost $112 million. That bought them the infrastructure to operate as a compliant derivatives platform.

If you want institutional capital, US access, or scale, you need to look like a financial product. HIP-4 leans into this completely. It’s building bounded, collateralised contracts that fit into existing risk frameworks.

That’s it for today’s discussion. See you tomorrow with another one.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Excellent breakdown of the unified margin angle. The way Hyperliquid sidesteps the whole gambling debate by just integrating outcome contracts into their existing risk managment system is kinda genius. I've seen way too many prediction markets die between election cycles, so treating these as portfolio hedges instead of isolated bets makes alot more sense for sustained usage.