Hello

I don’t know how I have managed to stay afloat lately. The barrage of financial statements I have surrounded myself with could have drowned me. I am now beginning to question my love for numbers. Not because it’s one analysis too many, but because each of the last half a dozen earnings analyses I wrote in the previous three weeks threw something we rarely see in corporate financial statements.

The financials of Digital Asset Treasuries (DATs) are intricately interwoven with DeFi strategies, making it challenging to analyse a company’s financial performance.

Upexi and SharpLink Gaming, which announced their quarterly earnings this week, were the latest ones whose financials I dug into.

On paper, they look like ordinary businesses: one sells consumer brands, and the other runs affiliate marketing for sports betting. Only when you dig deeper do you realise that what moves their valuations, dictates earnings, and forms their entire sense of identity is linked to crypto, not warehouses or e-commerce dashboards.

Upexi and SharpLink have entered a space that’s blurring the lines between corporate finance and crypto treasury management.

In today’s piece, I will take you through what I found interesting in their Ethereum and Solana treasuries, and what investors need to watch out for before getting exposure to crypto through these routes.

Ready?

Your Shortcut To Crypto’s Inner Circle

Introduction.com is a private, high-trust network designed for the most respected minds in GTM, BD, and leadership across crypto, tech, and finance.

Inside, members tap into a curated ecosystem where collaboration, dealmaking, and growth happen by default.

Cut through the noise. Reduce friction. Unlock the true value of executive connectivity.

Now accepting new applications.

SharpLink’s ETH Desk

Less than a year ago, I would have described SharpLink as a niche sports-affiliate business, the kind you forget about until the Super Bowl comes around. Its financials looked like every other mid-tier peer in the industry. It had a small revenue, seasonal swings based on sports calendars, and a P&L bottom line that was in the red more often than not.

Nothing hinted at a $3-billion balance sheet.

It all changed in June 2025, when the company rewired its identity with one decision: designate Ether as its primary treasury asset and become one of the leading corporations to hold ETH.

Read: ETH’s Treasury Turnaround 🏛️

It has since reorganised its operations around an ETH Management segment under the leadership of Joe Lubin. The cofounder of Ethereum and founder and CEO of Consensys had joined SharpLink in the end of May to chair its board.

In the past few months, SharpLink has deployed capital directly into native staking, liquid staking, and DeFi protocols to turn its business focus towards Ethereum. Three months later, the transformation is visible.

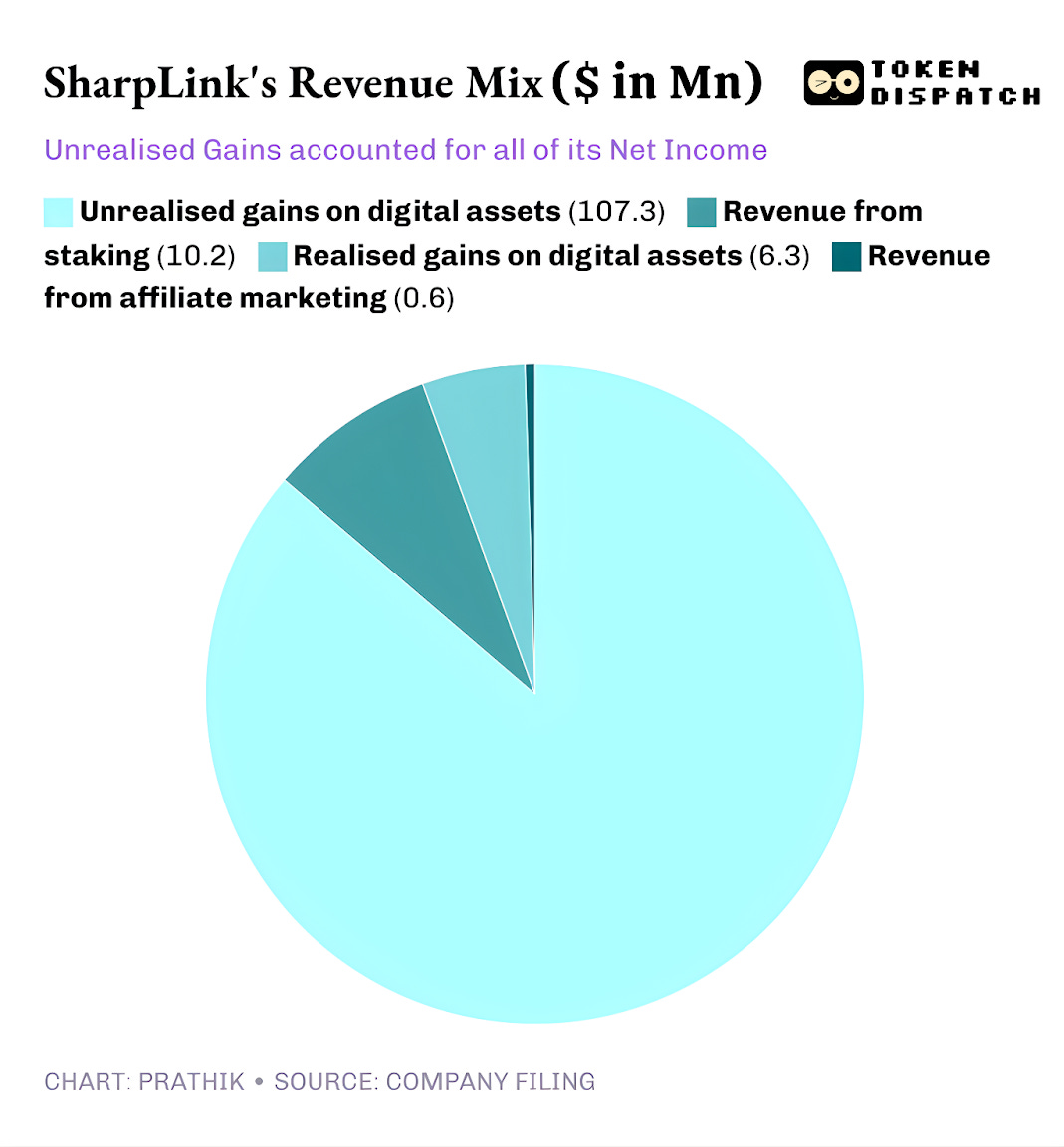

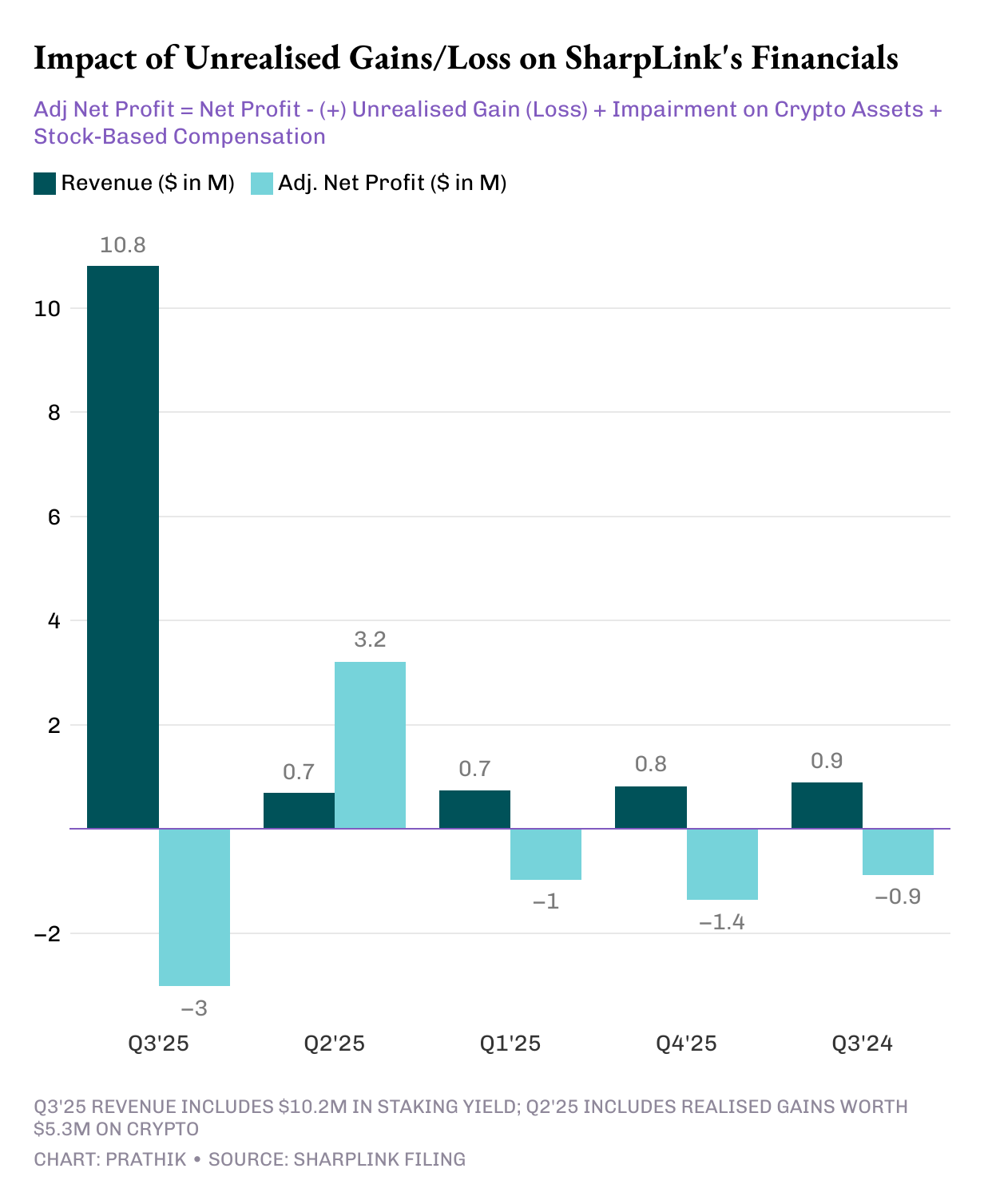

SharpLink reported a quarterly revenue of $10.8 million, an eleven-fold jump from $0.9 million in the same period a year ago. Of that, $10.2 million came from staking its ETH treasury, while only $0.6 million came from its legacy affiliate marketing business.

From $2.6 million in total assets as of December 31, 2024, SharpLink came a long way to hold assets worth $3 billion on its balance sheet as of September 30, 2025.

When the quarter ended, Sharplink held 817,747 ETH, which had grown to 861,251 ETH by early November. Today, it’s the second-largest corporate holder of ETH. This treasury was single-handedly responsible for the 11x jump in its income.

Almost 95% of all its revenue this quarter came from the yield it earned by staking its ETH. While its net income jumped 100x to $104.3 million, against a net loss of $0.9 million in Q3 2024, there’s a catch. Just as with the profit reported by most other DATs, SharpLink’s entire profit came from unrealised gains on the ETH it holds.

That’s because the US Generally Accepted Accounting Principles (GAAP) requires companies to mark the assets at fair value in the market as of the closing date of the accounting period. The affiliate arm contributed barely anything to the profit.

So, all these unrealised gains are non-cash in nature. Even the revenue SharpLink earns from staking rewards is paid in ETH and not periodically withdrawn in fiat. This is where my concerns arise.

Although the non-cash income is still income for accounting purposes, the company still burned $8.2 million in operating cash over nine months to pay salaries, legal and audit fees, and servers.

Where do these dollars come from?

Just like most other DATs, SharpLink financed its ETH additions by issuing fresh capital. The company raised $2.9 billion this year through equity issuance, then offset dilution with a $1.5-billion share buyback authorisation.

It’s a repeat of the DeFi flywheel that’s becoming common across DATs.

SharpLink issues equity and uses the proceeds to buy ETH. It stakes ETH to earn yield, books unrealised gains as the asset price rises, and reports higher accounting income, which gives it more capacity to issue additional shares. The circle then repeats.

The model, as I have said in each of the other DAT cases, works well in an upcycle. It could work fine even through a couple of bear cycles, as long as the corporate cash balance is strong enough to keep funding its cash expenses. A rising ETH lifts the balance sheet, treasury value increases faster than operating costs, and the market gets access to a liquid public proxy for Ethereum with a yield-enriched structure.

The fragility shows up when there are prolonged cycles of sideways price movement (nothing new for ETH holders), coupled with high corporate costs.

We saw a similar risk show up in the case of BTC treasury giant Strategy.

Read: Strategy & Marathon: Faith and Power ₿

And I expect these risks to occur in almost every DAT, irrespective of which cryptocurrency they bet on, unless they have a fat cash balance and healthy bottom-line figures to fund their DAT aspirations. But we don’t often see a profitable business go all out on a crypto treasury.

We saw that when Strategy chased BTC and SharpLink bet on ETH. It’s not very different in the case of Solana treasuries either.

Upexi’s Solana Factory

While SharpLink has almost entirely pivoted from being an affiliate gaming company to an ETH treasury, Upexi has adopted Solana even while it wears the old skin of a consumer-brands company.

I’ve followed Upexi for a while. Operationally, they have returned positive figures for most of the last five financial years. Their brand acquisitions and revenue growth were fine. So were their gross margins. Except that at an enterprise level, Upexi has registered a net loss in each of the last four financial years.

Probably, that pushed the company to include digital assets in its filings. In the last two quarters, the shift was mild but visible. This quarter, digital assets dominate the company’s financials.

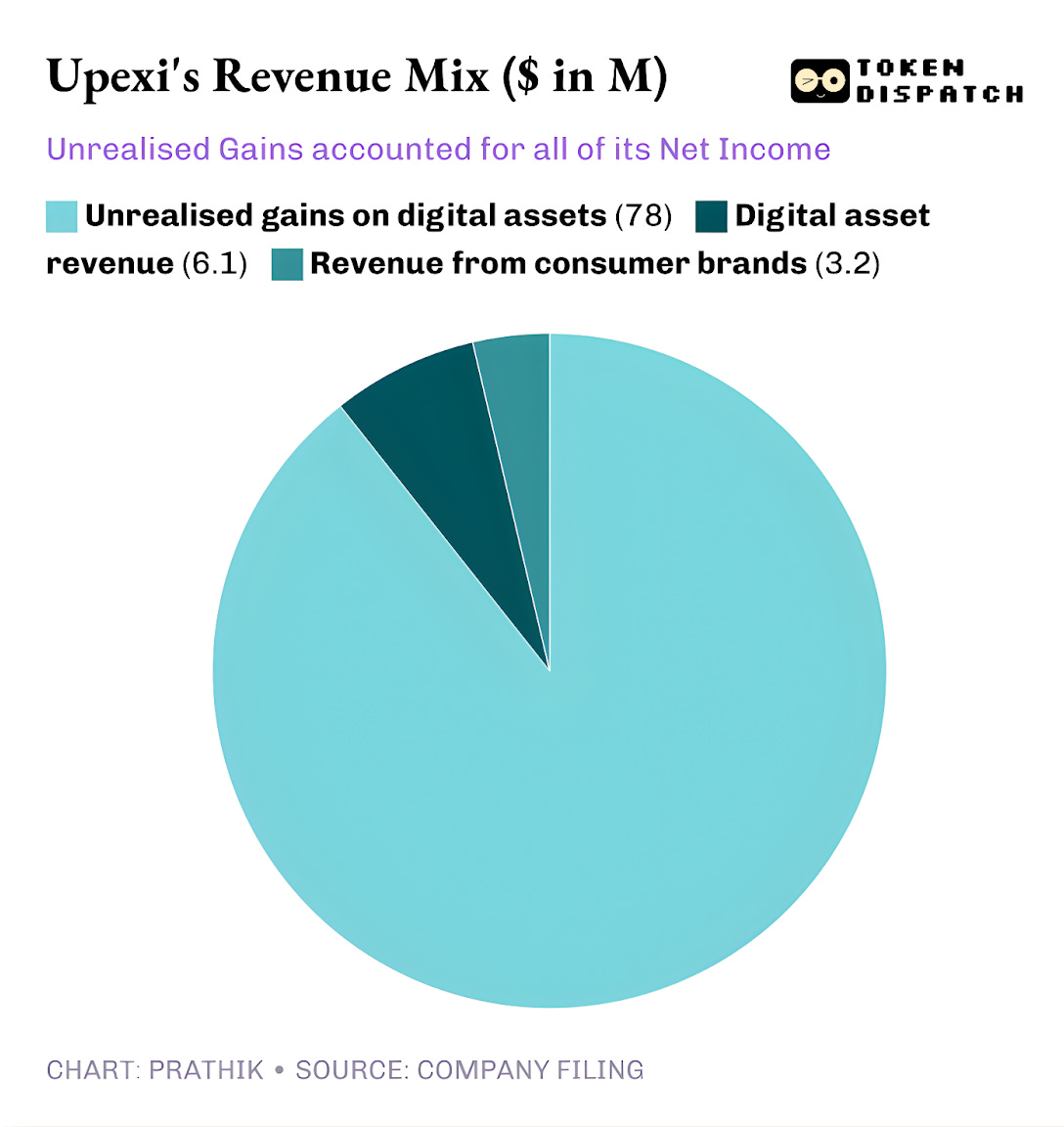

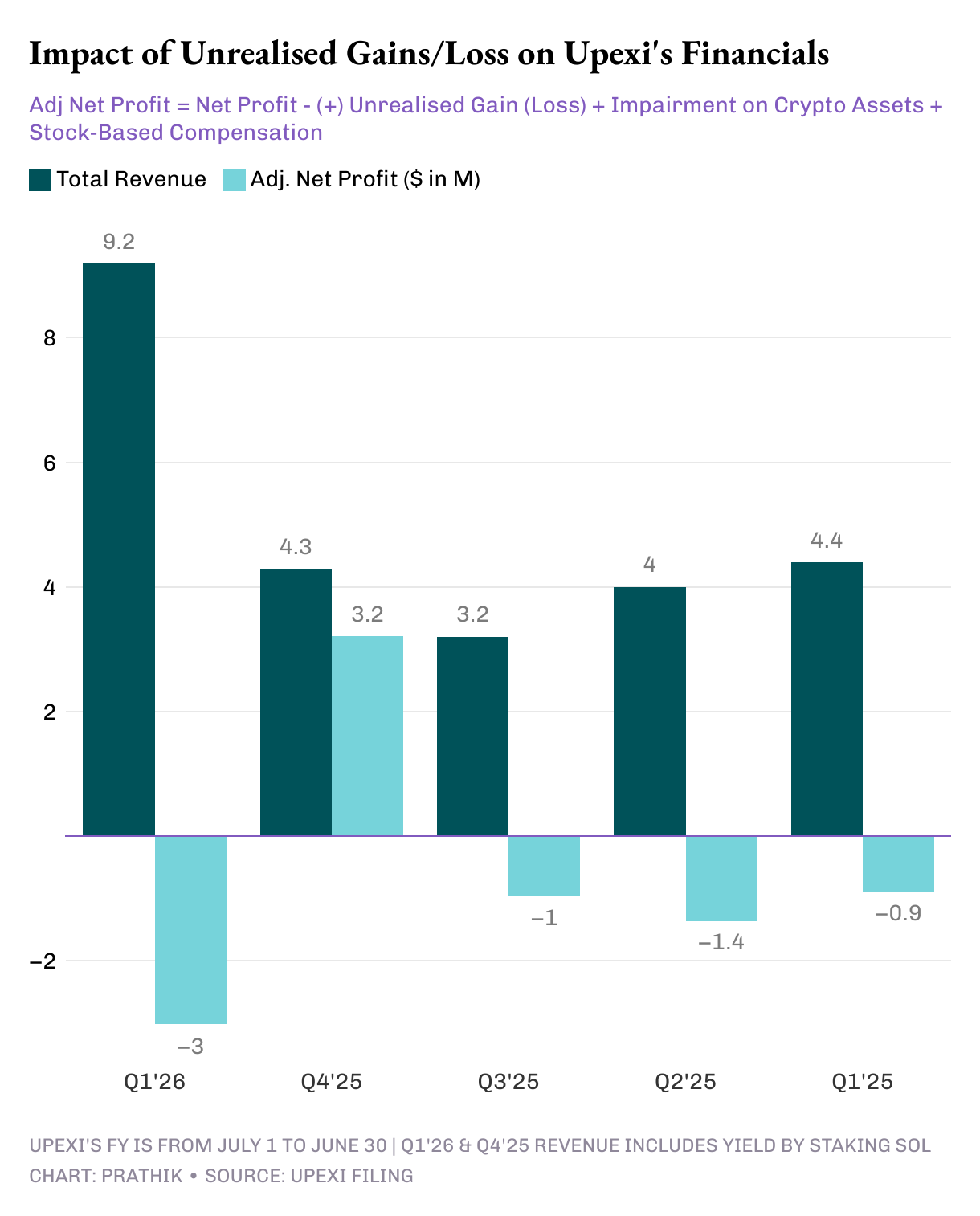

In Q3 2025, Upexi generated $9.2 million in revenue, out of which $6.1 million came from staking SOL. The remaining $3.1 million came from its consumer brands business. Earning two-thirds of its revenue from staking digital assets is a big leap for a consumer-products company that didn’t earn a single buck from crypto in the preceding quarter.

Upexi now holds 2.07 million SOL, worth over $400 million, with about 95% of it staked. They earned 31,347 SOL in staking rewards in this single quarter.

What sets Upexi apart from other DATs is its strategy of acquiring locked-SOL.

The company purchased roughly 1.05 million locked SOL at an average 14% discount to market, with unlocks stretching from 2026 to 2028.

Locked tokens can’t be sold yet and hence trade at a discount. As these locked SOLs unlock, their value will naturally rise to match normal SOL, letting Upexi earn both staking rewards and a built-in price appreciation on this SOL.

This kind of strategy is what one expects from a fund, not from an average DAT. But when you look at Upexi’s cash flow, the same concerns arise as with SharpLink.

Despite posting $66.7 million in net income, driven by $78 million in unrealised gains, Upexi recorded $9.8 million of operating cash outflow. Staking revenue in SOL remained non-cash because it wasn’t converted to fiat. So the company did what treasury-first DATs do: it raised money.

Upexi lined up $200 million through convertible notes and secured a $500 million equity line. It increased short-term debt from $20 million to $50 million.

The same flywheel, but with similar risks. What happens if SOL cools off for a year?

Both SharpLink and Upexi are building something clever. But that doesn’t automatically mean sustainable.

No Easy Answers

There’s a pattern here that I can’t unsee: both companies are running financial systems that make logical sense in favourable times. They have both built treasuries that scale with network activity; both of them have put in place yield structures that can complement revenue lines; and, in doing so, have become some of the top public proxies for two of the most critical Layer-1 blockchains in the world.

Yet both companies also derive almost all their profit from unrealised gains, earn token income that is not liquid, have shown no signs of liquidating their treasury holdings to book systematic profits, have reported negative operating cash, and use capital markets to pay their bills.

More than a criticism, this is a reality and a trade-off for every company that decides to adopt the DAT architecture.

For this model to survive, one of the following scenarios must occur. Either staking will have to become a corporate cash engine to keep funding digital asset purchases. Or the corporations will have to include planned selling of digital assets as a part of their DAT strategy to book systematic profits.

It is not impossible. Sharplink earned $10.3 million by staking ETH, while Upexi earned $6.08 million in SOL.

These are not trivial sums. Even if some portion of these is ploughed back into fiat to support operations, the math can change.

Until then, both Upexi and Sharplink walk the same tightrope: extraordinary innovation balanced on capital-market liquidity.

That’s it for today. I’ll see you with the next one.

Until then … stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

The locked SOL strategy from Upexi is really clever, getting that 14% discount while stil earning staking rewards. But youre right about the cash flow issue. These treasuries look strong on paper untill crypto moves sideways for a year. Would love to see more DATs actually converting some staking rewards to fiat periodically instread of just accumulating.